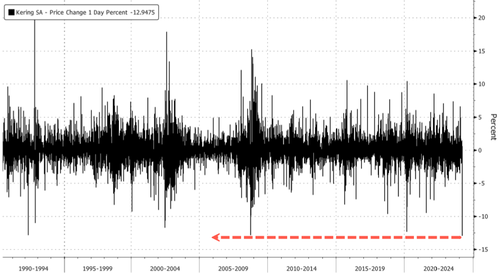

Shares of French luxury group Kering tumbled as much as 15% on Wednesday—the largest drop in more than three decades. The luxury goods company issued a profit warning, expecting sales at Gucci, its biggest brand, to plunge 20% year-on-year in the first quarter, notably because of slumping demand across the Asia-Pacific region.

"In a first half that Kering expected to be challenging, current trends lead the Group to estimate that its consolidated revenue in the first quarter of 2024 should decline by approximately 10% on a comparable basis, from last year's first quarter," Kering said in a statement.

The statement continued, "This performance primarily reflects a steeper sales drop at Gucci, notably in the Asia-Pacific region. Gucci comparable revenues in the first quarter are expected to be down by nearly 20% year on year."

The luxury slowdown originates in Asia, mainly China, whose economic downturn has spooked consumers.

Shares of Kering in Paris plunged as much as 15%, the most significant drop since 1992.

Analysts at Jefferies, led by James Grzinic, told clients:

"Kering's warning largely reflects a sharp deterioration of Gucci's resonance in Asia Pacific, and China in particular. This comes at a time when the transition to the De Sarno signature remains in its early stages. While a mixed Chinese yuan backdrop may have added an extra challenge, the news suggests a deeper trough."

Vital Knowledge analysts said:

"Gucci has been encountering some company-specific problems for a few quarters, but this update will raise further worries about consumer spending and China's economy."

Here's what other Wall Street analysts are saying (list courtesy of Bloomberg):

AlphaValue (add)

- Analyst Jie Zhang will lower her earnings expectations for 2024 on the back of the group's unexpected trading update

- Gucci's recovery "will need some time to achieve, and the continued higher investment will weigh on the brand's profitability throughout the year," Zhang writes in a note

Citi (buy)

- "Gucci suffered significantly from being in the midst of a major design and management transition, with weak performance of carryover items and limited penetration from early products," analyst Thomas Chauvet writes

- While consensus earnings estimates had been slashed by high- single digits just over a month ago on the heels of the company's forecast for a y/y decline in operating income, expects company fiscal 2024 Ebit/EPS estimates to be reduced by ~15% "solely due to Gucci, with the likelihood of slower-than- expected brand turnaround"

- Implications for the sector include "downside" risk for 1H 2024 sales

RBC (outperform)

- Analyst Piral Dadhania says "patience still required," with Gucci in early stages of a turnaround

- Revenue guidance is much worse than expected, especially in APAC region

- Gucci's potential continues to be unfulfilled, but with right strategic initiatives in areas such as China and brand elevation, rebuilding its product offer especially in handbags, and change in creative and executive leadership, the growth profile can improve over time

Morgan Stanley (equal-weight)

- Luxury brands/groups performance likely to have polarized further in 1Q vs 2023, and with Kering guiding for first-quarter comparable revenue to decline by about 10% it will be "in the bottom of the pack," according to analyst Edouard Aubin

- Kering didn't provide indications for its other brands, but implies that non-Gucci businesses saw organic sales growth as flat to slightly down y/y

Jefferies (hold)

- "Whilst a mixed CNY backdrop may have added an extra challenge, the news suggests a deeper trough and material" estimate cuts, analyst James Grzinic writes

- Says legacy Gucci product is not resonating with consumers, while transition to De Sarno signature product is in "early stages"

- Thinks flattish 1Q sales for non-Gucci brands points to market share losses

- Investors likely weigh whether Kering's "M&A ambitions" in the near term are affected

Bloomberg Intelligence

- "Preliminary 1Q guidance for a 10% comparable sales downturn flags a 20% drop at Gucci (vs. consensus' 6.5% decline) on Asia softness," Analyst Deborah Aitken writes

- Says possible 2024 EPS estimates may be cut by 6%-8%, even with the other 50% of the portfolio flat and better than expected

- "Gucci matters most to operating and cash flow contribution (33% margin in 2023 vs. 24% for Kering)," she says

Kering's profit warning is an ominous sign for luxury stocks.

MSCI Europe Textiles Apparel & Luxury Goods has peaked.

"European stock investors have become more upbeat on economic growth and the earnings backdrop. Yet cyclical sectors such as luxury and autos are affected by China's sluggish rebound. That sets up luxury, a key European growth sector, for a disappointing 1Q reporting season, and a crack in bullish sentiment for the region's stocks," Bloomberg's Heather Burke noted.

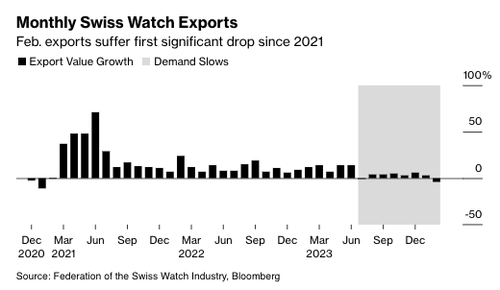

Separately, Swiss watch exports recorded the first decline in three years, primarily due to a slowdown in shipments to China and Hong Kong.

China has been the engine of global growth, but its deflationary pressures and other mounting economic troubles are spreading beyond the world's second-largest economy to Europe.

Shares of French luxury group Kering tumbled as much as 15% on Wednesday—the largest drop in more than three decades. The luxury goods company issued a profit warning, expecting sales at Gucci, its biggest brand, to plunge 20% year-on-year in the first quarter, notably because of slumping demand across the Asia-Pacific region.

“In a first half that Kering expected to be challenging, current trends lead the Group to estimate that its consolidated revenue in the first quarter of 2024 should decline by approximately 10% on a comparable basis, from last year’s first quarter,” Kering said in a statement.

The statement continued, “This performance primarily reflects a steeper sales drop at Gucci, notably in the Asia-Pacific region. Gucci comparable revenues in the first quarter are expected to be down by nearly 20% year on year.”

The luxury slowdown originates in Asia, mainly China, whose economic downturn has spooked consumers.

Shares of Kering in Paris plunged as much as 15%, the most significant drop since 1992.

Analysts at Jefferies, led by James Grzinic, told clients:

“Kering’s warning largely reflects a sharp deterioration of Gucci’s resonance in Asia Pacific, and China in particular. This comes at a time when the transition to the De Sarno signature remains in its early stages. While a mixed Chinese yuan backdrop may have added an extra challenge, the news suggests a deeper trough.”

Vital Knowledge analysts said:

“Gucci has been encountering some company-specific problems for a few quarters, but this update will raise further worries about consumer spending and China’s economy.”

Here’s what other Wall Street analysts are saying (list courtesy of Bloomberg):

AlphaValue (add)

- Analyst Jie Zhang will lower her earnings expectations for 2024 on the back of the group’s unexpected trading update

- Gucci’s recovery “will need some time to achieve, and the continued higher investment will weigh on the brand’s profitability throughout the year,” Zhang writes in a note

Citi (buy)

- “Gucci suffered significantly from being in the midst of a major design and management transition, with weak performance of carryover items and limited penetration from early products,” analyst Thomas Chauvet writes

- While consensus earnings estimates had been slashed by high- single digits just over a month ago on the heels of the company’s forecast for a y/y decline in operating income, expects company fiscal 2024 Ebit/EPS estimates to be reduced by ~15% “solely due to Gucci, with the likelihood of slower-than- expected brand turnaround”

- Implications for the sector include “downside” risk for 1H 2024 sales

RBC (outperform)

- Analyst Piral Dadhania says “patience still required,” with Gucci in early stages of a turnaround

- Revenue guidance is much worse than expected, especially in APAC region

- Gucci’s potential continues to be unfulfilled, but with right strategic initiatives in areas such as China and brand elevation, rebuilding its product offer especially in handbags, and change in creative and executive leadership, the growth profile can improve over time

Morgan Stanley (equal-weight)

- Luxury brands/groups performance likely to have polarized further in 1Q vs 2023, and with Kering guiding for first-quarter comparable revenue to decline by about 10% it will be “in the bottom of the pack,” according to analyst Edouard Aubin

- Kering didn’t provide indications for its other brands, but implies that non-Gucci businesses saw organic sales growth as flat to slightly down y/y

Jefferies (hold)

- “Whilst a mixed CNY backdrop may have added an extra challenge, the news suggests a deeper trough and material” estimate cuts, analyst James Grzinic writes

- Says legacy Gucci product is not resonating with consumers, while transition to De Sarno signature product is in “early stages”

- Thinks flattish 1Q sales for non-Gucci brands points to market share losses

- Investors likely weigh whether Kering’s “M&A ambitions” in the near term are affected

Bloomberg Intelligence

- “Preliminary 1Q guidance for a 10% comparable sales downturn flags a 20% drop at Gucci (vs. consensus’ 6.5% decline) on Asia softness,” Analyst Deborah Aitken writes

- Says possible 2024 EPS estimates may be cut by 6%-8%, even with the other 50% of the portfolio flat and better than expected

- “Gucci matters most to operating and cash flow contribution (33% margin in 2023 vs. 24% for Kering),” she says

Kering’s profit warning is an ominous sign for luxury stocks.

MSCI Europe Textiles Apparel & Luxury Goods has peaked.

“European stock investors have become more upbeat on economic growth and the earnings backdrop. Yet cyclical sectors such as luxury and autos are affected by China’s sluggish rebound. That sets up luxury, a key European growth sector, for a disappointing 1Q reporting season, and a crack in bullish sentiment for the region’s stocks,” Bloomberg’s Heather Burke noted.

Separately, Swiss watch exports recorded the first decline in three years, primarily due to a slowdown in shipments to China and Hong Kong.

China has been the engine of global growth, but its deflationary pressures and other mounting economic troubles are spreading beyond the world’s second-largest economy to Europe.

Loading…