Diesel supplies are very scarce across the Northeast and in the Southeast. Supplies are at the lowest seasonal level for this time of year, and the US only has 25 days left of the industrial fuel in storage. The crisis gripping the diesel market appears to be getting out of hand as one fuel supply logistics company initiated emergency protocols this week.

"Because conditions are rapidly devolving and market economics are changing significantly each day, Mansfield is moving to Alert Level 4 to address market volatility. Mansfield is also moving the Southeast to Code Red, requesting 72-hour notice for deliveries when possible to ensure fuel and freight can be secured at economical levels," Mansfield Energy wrote in an update to customers on Tuesday. The trucking firm has a fleet of tankers that delivers refined fuel products to more than 8,000 customers nationwide.

Mansfield said in many areas on the East Coast, diesel fuel prices are "30-80 cents higher than the posted market average, because supply is tight."

"At times, carriers are having to visit multiple terminals to find supply, which delays deliveries and strains local trucking capacity," the notice continued.

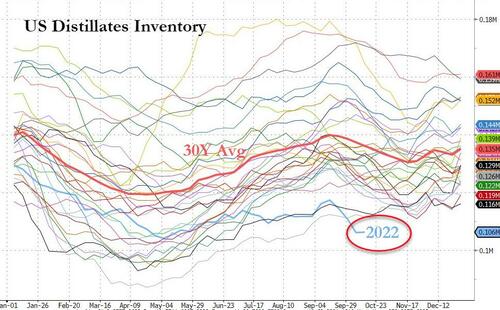

This could mean that the US diesel market is so tight that supplies are running very low in certain areas. The crisis has sent supplies of the industrial fuel that power the economy, from trucks to vans to generators to freight trains to tractors, to the lowest level ever for this time of year.

The latest EIA data shows there are only 25 days of diesel supply, the lowest since 2008; and while inventories are record low, the four-week rolling average of distillates supplied - a proxy for demand - rose to its highest seasonal level since 2007.

Mansfield's is a warning sign that the record low storage levels is beginning to impact fuel supply networks.

None of this should be surprising, as we've warned diesel markets have been in crisis for much of 2022. Our latest note titled "Forget Oil, The Real Crisis Is Diesel Inventories: The US Has Just 25 Days Left" outlines the severity of the crisis but also points out underinvestment in the nation's fuel-making capacity, refinery closures and disruptions, strong domestic demand, soaring exports for the fuel, and embargo on Russian energy products have all helped to deplete inventories and the price surge.

Historically low diesel inventories have put a fuel trucking company on high alert for possible disruptions in the Southeast.

Diesel supplies are very scarce across the Northeast and in the Southeast. Supplies are at the lowest seasonal level for this time of year, and the US only has 25 days left of the industrial fuel in storage. The crisis gripping the diesel market appears to be getting out of hand as one fuel supply logistics company initiated emergency protocols this week.

“Because conditions are rapidly devolving and market economics are changing significantly each day, Mansfield is moving to Alert Level 4 to address market volatility. Mansfield is also moving the Southeast to Code Red, requesting 72-hour notice for deliveries when possible to ensure fuel and freight can be secured at economical levels,” Mansfield Energy wrote in an update to customers on Tuesday. The trucking firm has a fleet of tankers that delivers refined fuel products to more than 8,000 customers nationwide.

Mansfield said in many areas on the East Coast, diesel fuel prices are “30-80 cents higher than the posted market average, because supply is tight.”

“At times, carriers are having to visit multiple terminals to find supply, which delays deliveries and strains local trucking capacity,” the notice continued.

This could mean that the US diesel market is so tight that supplies are running very low in certain areas. The crisis has sent supplies of the industrial fuel that power the economy, from trucks to vans to generators to freight trains to tractors, to the lowest level ever for this time of year.

The latest EIA data shows there are only 25 days of diesel supply, the lowest since 2008; and while inventories are record low, the four-week rolling average of distillates supplied – a proxy for demand – rose to its highest seasonal level since 2007.

Mansfield’s is a warning sign that the record low storage levels is beginning to impact fuel supply networks.

None of this should be surprising, as we’ve warned diesel markets have been in crisis for much of 2022. Our latest note titled “Forget Oil, The Real Crisis Is Diesel Inventories: The US Has Just 25 Days Left” outlines the severity of the crisis but also points out underinvestment in the nation’s fuel-making capacity, refinery closures and disruptions, strong domestic demand, soaring exports for the fuel, and embargo on Russian energy products have all helped to deplete inventories and the price surge.

Historically low diesel inventories have put a fuel trucking company on high alert for possible disruptions in the Southeast.