Authored by Alasdair Macleod via SchiffGold.com,

This article concludes that the current downturn in bond yields is part of a continuing market manipulation by central banks in order to restore confidence in the global economic outlook.

There is a long history of government intervention in markets. In the nineteenth century, it was by legal regulation, the most notable of which was the 1844 Bank Charter Act, which had to be suspended in 1847, 1857, and 1866.

From the early 1920s, the emphasis on intervention changed under Benjamin Strong, the first Fed Chairman, who started to deliberately expand central bank credit to stimulate the economy. Coupled with the expansion phase of the commercial bank credit cycle, this led to the Roaring Twenties, the stock market boom, and its collapse.

Presidents Hoover and Roosevelt compounded the errors with economic interventions which only succeeded in prolonging the 1930’s depression. It was the start of modern government economic and monetary manipulation, which took on a new urgency under the fiat dollar in the 1970s.

While they create problems through their interventions, governments have perfected the art of managing markets to restore failing confidence in credit values. This was dramatically proved in the wake of the Lehman failure.

But if government intervention is behind the current decline in bond yields and interest rate expectations, it is only a temporary solution to G7 government debt traps, the squeeze on bank credit, and a deteriorating economic outlook. These are problems deferred, not resolved.

Introduction

You have to hand it to the authorities. While they are motivated against free markets and can’t stop interfering in our day-to-day affairs when the crisis that they themselves created finally hits markets and the economy, they prove adept at resolving it. That the fiat dollar has survived a repeated cycle of crises since the early 1970s is a testament to the fact.

Unbeknown to most of us, much of the time they work behind the scenes to neutralize threats to the financial and economic status quo. This was the original purpose of the US’s Exchange Stabilisation Fund, founded as part of the Gold Stabilisation Act of 1934. The US Treasury website says the following:

The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury (“the Secretary”).

The Secretary is responsible for the formulation and implementation of U.S. international monetary and financial policy, including exchange market intervention policy. The ESF helps the Secretary to carry out these responsibilities. By law, the Secretary has considerable discretion in the use of ESF resources.

The Bank of England manages the UK’s Exchange Equalization Account with similar objectives. But the US’s ESF is not the only means at its disposal for steering markets. The Fed is widely recognized to use JPMorgan Chase as its main conduit into the US banking system, and it is suspected (bank confidentiality conveniently hides the truth) that JPM and other major banks front market operations on behalf of the Treasury, the ESF off-balance sheet, and the Fed itself.

Another area of intervention that steers our expectations is statistics. At some time in the future, economists and commentators might look back with incredulity on how markets are moved by government statistics as if they were the whole truth when clearly, they prove anything but the truth. And the most shameless manipulation in full public view is of consumer inflation numbers.

In the UK, index-linked gilts use the retail price index as the basis of inflation compensation, which has tracked higher than other indices, such as the CPI. The government has managed to remove the costly RPI from many other forms of inflation compensation, but so far steps to change the compensation basis for index-linked gilts are a work in progress, changing RPI to CPIH from 2030, which, the Debt Management Office estimates could save the government billions of pounds in future.

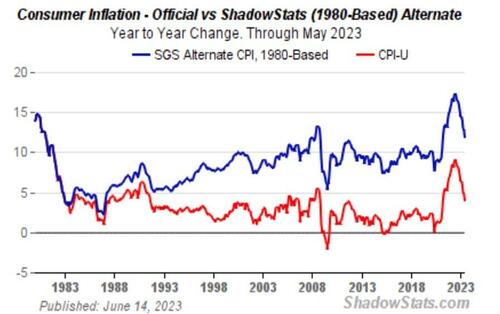

In the US, tinkering with inflation estimates has created an alternative business for John Williams at Shadowstats.com, who calculates inflation on the 1980 basis before government statisticians began tinkering in earnest to reduce the cost of inflation compensation to hapless citizens. The chart below is from Williams’ website and says it all.[i]

Taking the 1980 methodology, Williams estimates that consumer prices are rising at a rate of about 12%, compared with government estimates of less than 5%. What gives government statisticians flexibility in calculation is that changes in the general level of prices are an unmeasurable concept, allowing statisticians to make any assumptions they please. Yet despite this fraud, nearly everyone in the financial sector accepts the government’s inflation myth as gospel, drowning out dissenting voices such as Williams’. Another example is unemployment statistics, which Williams currently estimates to be about 25%, including long-term discouraged workers, “who were defined out of official existence in 1994”.

Surprise, surprise, that every change governments make to statistics either reduces their costs, window dresses them favorably, or both. The accumulating result is an unreality, which at some stage brings their inexactitudes crashing back to earth. But perhaps we shouldn’t worry about that, because of the authorities’ unblemished track record of saving us all from their follies.

Continual intervention and market management are with us today. Interest rates and bond yields which reflect the true loss of purchasing power for the dollar would be considerably higher if the truth behind them was driving financial asset values. Instead, the yield on the 10-year US Treasury Note has fallen from 5% to 4.37% in a month, and the dollar’s trade-weighted index has fallen by about 3% — not a lot but enough coupled with the fall in US Treasury yields to take pressure off foreign bonds and equity markets, alleviating a growing sense of crisis.

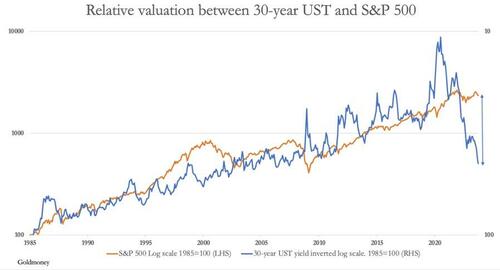

The chart below shows why this move was necessary.

The chart compares the negative correlation between the S&P 500 Index and the yield on the long bond both rebased to 1985 with the latter inverted. The theory behind it is that equity markets refer their values inversely to bond yields: in other words, a rising bond yield undermines equity markets, while falling yields lead to rising equity values. It is one of the planks supporting official interest rate policies, on the basis that healthy equity markets encourage overall economic confidence. It was clearly stated to be a consideration for the Fed by Alan Greenspan when he was Chairman.

To illustrate the point, the chart shows the valuation disparity between rising bond yields and the S&P 500 Index, which other than when the yield was suppressed to as low as 1.2% during Covid, it is the greatest valuation disparity in modern times — possibly ever. If Treasury bond yields had not declined, the equity market faced a bloodbath potentially taking it back to post-Lehman crisis levels with the S&P falling towards 1000.

Dealing with the banking system

The root cause of the economic errors of modern interventionism was the 1930s depression, and the root cause of the depression in turn was errors in dealing with the bank credit cycle, which still leads to periodic financial crises to this day.

The boom that fuelled the 1930s bust was the first major foray into monetary manipulation by the Fed under chairman Benjamin Strong. Strong was an advocate of credit stimulation, and his input further leveraged the effects of commercial bank credit expansion which together fuelled the Roaring Twenties. And the Roaring Twenties fuelled stock market speculation, the bubble bursting to collapse Wall Street and in the wake of it, some 9,000 banks failed.

Unfortunately for America, the hands-off President Coolidge (who, incidentally, seemed blissfully unaware of what was happening at the Fed — but then Silent Cal was not a money man) was followed by Herbert Hoover, of whom Coolidge said, “That man has given me nothing but advice, and all of it bad.” Hoover, followed by Roosevelt stuck his oar into everything trying to make it better, only succeeding in making things worse. But Roosevelt came up with his New Deal, which caught the public’s imagination though it simply prolonged the depression due to his intervention policies, for which free markets wrongly got the blame.

It fired the imagination of statist economists, such as Irving Fisher and John Keynes to recommend using credit to stimulate the economy when free markets failed — no lessons had been learned from Benjamin Strong’s calamitous credit policies. It wasn’t free markets failing, it was the expansion of the Fed’s credit turbocharging the expansion of commercial bank credit, which magnified the bubble and the following crisis. Without that intervention, the bank credit cycle would not have been so destructive. Keynes et al clearly didn’t understand credit, so for the benefit of his followers and their defective analysis, we must rewrite the history of credit and its various crises in an attempt to fathom whether the current decline in bond yields is being engineered by the authorities.

Currency versus Banking Schools

State intervention has a long history. But in the nineteenth century, it wasn’t direct meddling with the economy but mistakes in setting the legal framework for the means of payment.

There has been a long-running debate about whether money should be controlled by a rules-based approach, or whether banks should be free to make loans in accordance with the demands of trade. The former approach is of the currency school, which refers back to David Ricardo, who in 1823 wrote a paper entitled Plan for the Establishment of a National Bank which was published the following year after his death. In that paper, Ricardo wrote:

The Bank of England performs two operations of banking, which are quite distinct, and have no necessary connection with each other: it issues a paper currency as a substitute for a metallic one; and it advances money in the way of loan, to merchants and others. That these two operations of banking have no necessary connection, will appear obvious from this – that they might be carried on by two separate bodies, without the slightest loss of advantage, either to the country, or to the merchants who receive accommodation from such loans.

Ricardo’s approach rhymed with the later Chicago Plan of 1933, which sought to strictly limit the process of loan creation. To this day, currency school precepts find support from economists of the Austrian school as well as monetarists. Ricardo’s quantity theory of money, the basis of his approach lives on.

The banking school’s approach was more flexible with regard to loan creation, arguing in favor of a more evolutionary, less static approach, whereby banks should be free to respond to market conditions and the opportunities they presented. The problem with this approach was it did nothing to address the cyclicality of bank credit expansion which periodically led to bank failures and economic downturns.

The most important banking legislation of the nineteenth century was the 1844 Bank Charter Act, which set the terms under which the Bank of England’s charter to act as the government’s bank was renewed. The Act was a triumph for the currency school, splitting the Bank into two separate functions, an issue department and a banking department as advocated by Ricardo in 1823.

As the banking school predicted, the Bank Charter Act had to be suspended on three occasions: in 1847 only three years after it became law, in 1857, and in 1866 when the Overend Gurney failure occurred. It is the remedy to those failures which concern us here.

In October 1847, the Bank tried to halt a financial crisis by making large amounts of credit available to commercial banks in London, to the point where its ability to support the entire financial system became exhausted. Earlier that year, there had been a drain on the gold reserves which severely limited the Bank’s room for maneuver, because the Act required the bank to maintain gold cover for any banknotes issued after the Act on a one-for-one basis. For fear of the banking crisis bringing the entire system down, the government temporarily authorised the Bank to issue bank notes at discretion disregarding the requirements of the Act. The financial panic immediately subsided, and the panicky demand for banknotes and gold sovereigns simply disappeared.

Problem solved. In November 1857 there was a run on the Bank of England itself when its gold reserves stood at only £274,000 against liabilities of £5,460,000, a condition which would have stopped a commercial bank from trading. There was also a full-blown banking crisis in America. Again, the government was forced to authorize the Bank to issue notes at discretion, but it also required the Bank to increase its discount rate to not less than 10%. The day after this permission, the panic eased. And in 1866, the Overend Gurney failure which was the worst of the three by far cited here was resolved by the government again authorizing the Bank to proceed in similar terms to those given to subdue the 1857 panic.

Our reason for dragging up the failures of the currency school approach is not so much to resuscitate the debate of the early nineteenth century but to point out that a strict rules-based approach does not guarantee banking stability, and to add that in the context of dealing with periodic banking crises they can only be resolved by abandoning the rules. But there is a further lesson, and that is a banking crisis does not require a fall in interest rates to be resolved. The solution is found in ensuring that sufficient liquidity is available and that the level of interest rates should be set by the issue department alone in order to ensure there are adequate gold reserves to back the currency.

The theories of the currency school have little credence today, ironically replaced by an increasingly regulated banking school approach. But even that has not prevented crises from emerging. In this era of fiat currencies, the most notable case was the stock market collapse in late 1974. The S&P 500 index had roughly halved since January 1973, but the UK’s FT30 had collapsed to 146 on 6 January 1975, 73% down from its 1972 high. The entire commercial property sector had become more or less valueless, a result of the earlier crash in November 1973 which bankrupted a number of secondary banks. Joint stock banks were rumored to be also bankrupt and market sentiment was at the lowest possible ebb.

It was at that point that behind closed doors The Bank of England instructed major pension funds and insurance companies which had accumulated significant levels of short-term liquidity to buy equities indiscriminately.[ii] Consequently, the market soared on the mother-of-all bear squeezes, and investor confidence rapidly returned. Talk of joint stock banks in trouble was forgotten as collateral values recovered.

Even though The Bank of England had had all restrictions on its currency and credit creation removed in accordance with the theories of the banking school, not only did a cycle of credit crises continue but they were resolved in a similar way as the earlier suspensions of the Bank Charter Act simply by a judicious turning of sentiment. This was also the case when the Lehman crisis exploded in our faces in 2008 when the Fed and other central banks quickly acted to stop faith in the credit system from imploding.

The lesson for us today is that central banks have learned how to quickly restore confidence in a credit crisis. As was the case in 2007 before Lehman failed, it was becoming obvious that the conditions for a crisis were snowballing but yet to be reflected in a loss of confidence in the enormous global structure of unbacked credit. The question that now arises is whether the authorities are already intervening to prevent the looming crisis by kicking the can down the road just one more time.

The background to today’s evolving crisis

Since the 1970s when dollar credit was detached from gold’s value, the need for behind-the-scenes management of market expectations has increased. It commenced with unsuccessful attempts by the US Treasury to suppress the gold price by selling gold into the market. Anti-gold propaganda continued unsuccessfully until Chairman of the Fed Paul Volcker raised interest rates in the early 1980s sufficiently to turn the tide in favor of the dollar. That the Fed Funds rate had to be raised to over 19% indicated the failure of the 1970s anti-gold propaganda effort, but it paved the way towards its resolution.

Today, those who understand that gold is money and all else is credit are a vanishingly small proportion of economists and investment professionals. As the principal reserve currency, the dollar is now believed to have completely superseded gold as the sheet anchor for global credit. Nevertheless, the dollar is inherently unstable. Therefore, a more determined effort at continual management of expectations was called for, and this arrived with the financialization of G7 economies in the mid-eighties.

The advantage of financialization is that it gives a central bank greater control over economic outcomes, compared with an economy dependent on manufacturing. Central banks and their regulators set the agenda for how credit is used in a way that is impossible for manufacturing. Big bang in London led to the Glass Stegall Act in America being eventually rescinded, but more immediately it redirected global capital otherwise earmarked for manufacturing into financial markets. The expansion of derivative markets soaked up speculative demand for commodities, including gold, and coupled with statistical manipulation became an important part of suppressing inflation.

The expansion of credit aimed at financial markets worked particularly well until the turn of the century. It led to the dot-com bubble, its collapse, and the Fed Fund rate being reduced to a record low of 1%. Eventually, word was put out that recovery was on its way and there was a gathering momentum, reflected in residential property markets. We will probably never know whether this recovery was initiated by the Fed, in the way the Bank of England did in January 1975, but Alan Greenspan did understand markets, their sentiment, and their timing.

However, the inflationary consequences led to the 2007‑2009 crisis and the Fed having to bail out the entire financial system.

The constituents of an evolving crisis today are in plain sight, many factors being similar to crises in the past. The commercial banking system is caught flat-footed by the upturn in price inflation and interest rates, which they are exacerbating by restricting credit. With the banking system’s difficulty in contracting its aggregate liabilities, it is shuffling its assets towards lower-risk assets such as short-term Treasury bills. Furthermore, commercial banks are presided over by central banks whose balance sheets have been destroyed by a combination of earlier quantitative easing, higher interest rates, and collapsing balance sheet asset values.

With sentiment in bond markets being at a low ebb, the conditions for setting off a bear squeeze in bond markets are now in place, with banks and investment funds having increased their near-cash assets.

Why now?

For the central banks such as the Fed, there are two major problems looming. The first is how to fund escalating government budget deficits, when interest costs already account for the largest component of spending commitments, and the second is the strains put on the G7 monetary system by a strong dollar. Conveniently, it appears that CPI inflation is easing sufficiently to rule out further interest rate rises and that they may even fall sooner than previously expected. This creates the opportunity for steering market expectations away from the evolving crisis and hopefully to buy a few years’ time.

There is little doubt that growing confidence in these conditions in government circles justified the UK Chancellor’s tax cuts announced in the Autumn Statement this week. The Ukraine war is in a lull, and apart from demonstrations supporting the Palestinians, a general policy from America and her allies of non-military intervention over Gaza has relieved geopolitical tensions in bond markets. Consequently, the yield on the 10-year US treasury Note has declined from 5% to 4.37% and the dollar’s trade-weighted index has declined from 107 to 103.9, taking pressure off other bond markets, most notably the Japanese where the 10-year JGB yield has declined from 0.96% to 0.7%.

As the sense of crisis diminishes, perhaps US Treasury yields will decline further. It will be needed to avoid a significant fall in equity markets, and it should also trigger a backwash out of short-term Treasury Bills and the like into longer-term bonds, hopefully allowing the US Government to progress with its funding.

How long will it work?

The growing evidence that the authorities are deploying their acute sense of market timing to steer markets away from a funding crisis and to foster confidence in wider financial assets should not be confused with dealing with a cyclical banking crisis per se. At best, it is a temporary patch over a gaping wound. At the heart of it is a debt funding crisis that is not going away on the back of an orchestrated bear squeeze in bond markets.

Today’s is a very different situation from the 1970s with which these times of resurging price inflation can be best compared. Between 1971 and 1980, the sum of budget deficits for the US Government over the ten years was $421,823 million, 15% of 1980’s GDP. By way of contrast, the total budget deficit for the last ten years totaled $12,918 billion, 47% of 2023 GDP. Furthermore, US debt to GDP in 1970 was 34%, while today it is 122%.

In other words, there is a US government debt crisis that will only get worse and won’t be resolved by a sixty basis point fall in long bond yields. Furthermore, overleveraged banks still face mounting private sector non-performing loans going into an economic downturn, discouraging them from resuming the expansion of their balance sheets. Credit will still be tight and borrowing rates elevated.

The fact remains that for the banks there are very few buyers of collateral held against loans. The chart above of the valuation gap between bond yields and equity markets also applies to other assets, most notably commercial real estate. Bank executives are bound to look through this dip in bond yields and will almost certainly conclude that the economic outlook and how it affects credit margins relative to risk is still unfavorable.

Foreign investors are heavily overweight in dollars already, and far from seeing falling Treasury yields as an opportunity to buy, they are likely to remain on the sidelines, or even take the opportunity to sell with more of an eye on the dollar’s declining exchange rate.

There is a further problem when it comes to the US Treasury’s dependency on foreign investors buying its debt, and that is the relationship between the trade deficit and the balance of payments. The trade deficit is roughly balanced between the budget deficit and changes in the savings rate. The simplest explanation for this accounting identity is that a budget deficit leads to a direct expansion of credit into the economy, leading in turn to an imbalance between domestic production and consumer demand. If consumers fail to increase their savings, it leads to the importation of goods and services in excess of national exports — in other words, a deficit in the balance of trade.

The balance of payments differs from the balance of trade by the extent to which foreigners supplying products into the economy dispose of or retain the currency. By ensuring that the dollar is the international reserve currency in which international trade is valued and settled, foreign exporters into the US market have accumulated large quantities of dollars in preference to their own and other currencies. And those balances either accumulate as bank deposits, or they are invested which is why foreigners buy US treasuries. But in the current fiscal year, we can be certain that the US Federal deficit will rise above last fiscal year’s $2 trillion, which was 7.2% of GDP.

The budget deficit this year will be far higher. It is the run-up to a presidential election next November, so spending almost certainly won’t be restricted on that account. Furthermore, we know that the global and US economies are heading into recession, likely to be very deep if the initial contraction of the money supply is any indication. Ex-interest, it seems unlikely that with declining tax revenues and increasing welfare costs, the deficit will turn out to be less than $2 trillion, to which interest costs must be added. They are already running at over $1 trillion annually, and with the rise in interest rates impacting funding of the budget deficit and some $7.6 trillion of debt being rolled over at significantly higher interest rates, the cost of funding could well approach $1.5 trillion, assuming interest rates go no higher.

Adding together these funding costs and the deficit ex-interest gives us a likely outturn approaching $3.5 trillion. Unless the domestic private sector increases its savings rate, then the trade deficit will increase to match this $3.5 trillion.

In the UK, the Chancellor has decided the outlook is sufficiently improved for some minor tax cuts. The relevant figures are a budget deficit of £123.9bn in the current fiscal year to next April, with debt interest of £116.2bn. In other words, if it was not for debt interest, the budget would be approximately balanced. Part of the debt interest is due to the cost of maturing debt being rolled over, and the increase in interest payments on index-linked gilts. While Britain is not in such a deep debt trap as the US, budget arithmetic appears to be too optimistic for a number of reasons:

-

According to the government’s own estimates, GDP growth measured by consumption will be greater in the public sector than in the private sector. The private sector is expected to stagnate at just 0.5% real, with inflation falling to 3.6%. Expectations for 2024/25 will almost certainly prove to be optimistic, with the global economic outlook being for a significant recession. Instead, the Office for Budget Responsibility forecasts continuing economic growth in the coming years.

-

The revenue forecasts are bound to be too optimistic given the global recession outlook, with welfare costs increasing more as well. Ex-interest costs, the borrowing requirement is sure to widen. Interest costs are bound to move in line with dollar rates which due to the factors above are almost certainly going to rise, not decline.

-

Inflation assumptions (CPI) assume that there will be a return to 2% in 2025. The prospects for monetary inflation in the G7 countries make that outcome extremely unlikely.

While the UK’s figures are materially better than those of the US, relative to the dollar sterling has a credibility problem. As the dollar’s purchasing power declines, sterling is likely to do so as well, possibly at an even faster rate.

Conclusion

The current decline in US bond yields and the dollar’s trade-weighted index take enormous pressure off both financial markets and global currencies. Unless geopolitical events upset this newfound confidence, it could have further to go. But its origin would appear to be skilled timing by the authorities to inject needed confidence back into the markets, and thus into the US and other economies.

We can only surmise that this is the case. But by tracing the histories and backgrounds to interventions designed to restore confidence in markets, this article shows that there is strong circumstantial evidence that the current decline in interest rates bears the hallmark of a degree of market manipulation.

Consequently, the underlying problems remain. Government funding problems, the continuing downturn in the bank credit cycle, and the economic outlook apply not only to the US, but to all overindebted G7 governments. The conditions which have led to the general instability of credit values have not been addressed, so in time all the problems which might appear to be receding will return with renewed vengeance

Authored by Alasdair Macleod via SchiffGold.com,

This article concludes that the current downturn in bond yields is part of a continuing market manipulation by central banks in order to restore confidence in the global economic outlook.

There is a long history of government intervention in markets. In the nineteenth century, it was by legal regulation, the most notable of which was the 1844 Bank Charter Act, which had to be suspended in 1847, 1857, and 1866.

From the early 1920s, the emphasis on intervention changed under Benjamin Strong, the first Fed Chairman, who started to deliberately expand central bank credit to stimulate the economy. Coupled with the expansion phase of the commercial bank credit cycle, this led to the Roaring Twenties, the stock market boom, and its collapse.

Presidents Hoover and Roosevelt compounded the errors with economic interventions which only succeeded in prolonging the 1930’s depression. It was the start of modern government economic and monetary manipulation, which took on a new urgency under the fiat dollar in the 1970s.

While they create problems through their interventions, governments have perfected the art of managing markets to restore failing confidence in credit values. This was dramatically proved in the wake of the Lehman failure.

But if government intervention is behind the current decline in bond yields and interest rate expectations, it is only a temporary solution to G7 government debt traps, the squeeze on bank credit, and a deteriorating economic outlook. These are problems deferred, not resolved.

Introduction

You have to hand it to the authorities. While they are motivated against free markets and can’t stop interfering in our day-to-day affairs when the crisis that they themselves created finally hits markets and the economy, they prove adept at resolving it. That the fiat dollar has survived a repeated cycle of crises since the early 1970s is a testament to the fact.

Unbeknown to most of us, much of the time they work behind the scenes to neutralize threats to the financial and economic status quo. This was the original purpose of the US’s Exchange Stabilisation Fund, founded as part of the Gold Stabilisation Act of 1934. The US Treasury website says the following:

The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury (“the Secretary”).

The Secretary is responsible for the formulation and implementation of U.S. international monetary and financial policy, including exchange market intervention policy. The ESF helps the Secretary to carry out these responsibilities. By law, the Secretary has considerable discretion in the use of ESF resources.

The Bank of England manages the UK’s Exchange Equalization Account with similar objectives. But the US’s ESF is not the only means at its disposal for steering markets. The Fed is widely recognized to use JPMorgan Chase as its main conduit into the US banking system, and it is suspected (bank confidentiality conveniently hides the truth) that JPM and other major banks front market operations on behalf of the Treasury, the ESF off-balance sheet, and the Fed itself.

Another area of intervention that steers our expectations is statistics. At some time in the future, economists and commentators might look back with incredulity on how markets are moved by government statistics as if they were the whole truth when clearly, they prove anything but the truth. And the most shameless manipulation in full public view is of consumer inflation numbers.

In the UK, index-linked gilts use the retail price index as the basis of inflation compensation, which has tracked higher than other indices, such as the CPI. The government has managed to remove the costly RPI from many other forms of inflation compensation, but so far steps to change the compensation basis for index-linked gilts are a work in progress, changing RPI to CPIH from 2030, which, the Debt Management Office estimates could save the government billions of pounds in future.

In the US, tinkering with inflation estimates has created an alternative business for John Williams at Shadowstats.com, who calculates inflation on the 1980 basis before government statisticians began tinkering in earnest to reduce the cost of inflation compensation to hapless citizens. The chart below is from Williams’ website and says it all.[i]

Taking the 1980 methodology, Williams estimates that consumer prices are rising at a rate of about 12%, compared with government estimates of less than 5%. What gives government statisticians flexibility in calculation is that changes in the general level of prices are an unmeasurable concept, allowing statisticians to make any assumptions they please. Yet despite this fraud, nearly everyone in the financial sector accepts the government’s inflation myth as gospel, drowning out dissenting voices such as Williams’. Another example is unemployment statistics, which Williams currently estimates to be about 25%, including long-term discouraged workers, “who were defined out of official existence in 1994”.

Surprise, surprise, that every change governments make to statistics either reduces their costs, window dresses them favorably, or both. The accumulating result is an unreality, which at some stage brings their inexactitudes crashing back to earth. But perhaps we shouldn’t worry about that, because of the authorities’ unblemished track record of saving us all from their follies.

Continual intervention and market management are with us today. Interest rates and bond yields which reflect the true loss of purchasing power for the dollar would be considerably higher if the truth behind them was driving financial asset values. Instead, the yield on the 10-year US Treasury Note has fallen from 5% to 4.37% in a month, and the dollar’s trade-weighted index has fallen by about 3% — not a lot but enough coupled with the fall in US Treasury yields to take pressure off foreign bonds and equity markets, alleviating a growing sense of crisis.

The chart below shows why this move was necessary.

The chart compares the negative correlation between the S&P 500 Index and the yield on the long bond both rebased to 1985 with the latter inverted. The theory behind it is that equity markets refer their values inversely to bond yields: in other words, a rising bond yield undermines equity markets, while falling yields lead to rising equity values. It is one of the planks supporting official interest rate policies, on the basis that healthy equity markets encourage overall economic confidence. It was clearly stated to be a consideration for the Fed by Alan Greenspan when he was Chairman.

To illustrate the point, the chart shows the valuation disparity between rising bond yields and the S&P 500 Index, which other than when the yield was suppressed to as low as 1.2% during Covid, it is the greatest valuation disparity in modern times — possibly ever. If Treasury bond yields had not declined, the equity market faced a bloodbath potentially taking it back to post-Lehman crisis levels with the S&P falling towards 1000.

Dealing with the banking system

The root cause of the economic errors of modern interventionism was the 1930s depression, and the root cause of the depression in turn was errors in dealing with the bank credit cycle, which still leads to periodic financial crises to this day.

The boom that fuelled the 1930s bust was the first major foray into monetary manipulation by the Fed under chairman Benjamin Strong. Strong was an advocate of credit stimulation, and his input further leveraged the effects of commercial bank credit expansion which together fuelled the Roaring Twenties. And the Roaring Twenties fuelled stock market speculation, the bubble bursting to collapse Wall Street and in the wake of it, some 9,000 banks failed.

Unfortunately for America, the hands-off President Coolidge (who, incidentally, seemed blissfully unaware of what was happening at the Fed — but then Silent Cal was not a money man) was followed by Herbert Hoover, of whom Coolidge said, “That man has given me nothing but advice, and all of it bad.” Hoover, followed by Roosevelt stuck his oar into everything trying to make it better, only succeeding in making things worse. But Roosevelt came up with his New Deal, which caught the public’s imagination though it simply prolonged the depression due to his intervention policies, for which free markets wrongly got the blame.

It fired the imagination of statist economists, such as Irving Fisher and John Keynes to recommend using credit to stimulate the economy when free markets failed — no lessons had been learned from Benjamin Strong’s calamitous credit policies. It wasn’t free markets failing, it was the expansion of the Fed’s credit turbocharging the expansion of commercial bank credit, which magnified the bubble and the following crisis. Without that intervention, the bank credit cycle would not have been so destructive. Keynes et al clearly didn’t understand credit, so for the benefit of his followers and their defective analysis, we must rewrite the history of credit and its various crises in an attempt to fathom whether the current decline in bond yields is being engineered by the authorities.

Currency versus Banking Schools

State intervention has a long history. But in the nineteenth century, it wasn’t direct meddling with the economy but mistakes in setting the legal framework for the means of payment.

There has been a long-running debate about whether money should be controlled by a rules-based approach, or whether banks should be free to make loans in accordance with the demands of trade. The former approach is of the currency school, which refers back to David Ricardo, who in 1823 wrote a paper entitled Plan for the Establishment of a National Bank which was published the following year after his death. In that paper, Ricardo wrote:

The Bank of England performs two operations of banking, which are quite distinct, and have no necessary connection with each other: it issues a paper currency as a substitute for a metallic one; and it advances money in the way of loan, to merchants and others. That these two operations of banking have no necessary connection, will appear obvious from this – that they might be carried on by two separate bodies, without the slightest loss of advantage, either to the country, or to the merchants who receive accommodation from such loans.

Ricardo’s approach rhymed with the later Chicago Plan of 1933, which sought to strictly limit the process of loan creation. To this day, currency school precepts find support from economists of the Austrian school as well as monetarists. Ricardo’s quantity theory of money, the basis of his approach lives on.

The banking school’s approach was more flexible with regard to loan creation, arguing in favor of a more evolutionary, less static approach, whereby banks should be free to respond to market conditions and the opportunities they presented. The problem with this approach was it did nothing to address the cyclicality of bank credit expansion which periodically led to bank failures and economic downturns.

The most important banking legislation of the nineteenth century was the 1844 Bank Charter Act, which set the terms under which the Bank of England’s charter to act as the government’s bank was renewed. The Act was a triumph for the currency school, splitting the Bank into two separate functions, an issue department and a banking department as advocated by Ricardo in 1823.

As the banking school predicted, the Bank Charter Act had to be suspended on three occasions: in 1847 only three years after it became law, in 1857, and in 1866 when the Overend Gurney failure occurred. It is the remedy to those failures which concern us here.

In October 1847, the Bank tried to halt a financial crisis by making large amounts of credit available to commercial banks in London, to the point where its ability to support the entire financial system became exhausted. Earlier that year, there had been a drain on the gold reserves which severely limited the Bank’s room for maneuver, because the Act required the bank to maintain gold cover for any banknotes issued after the Act on a one-for-one basis. For fear of the banking crisis bringing the entire system down, the government temporarily authorised the Bank to issue bank notes at discretion disregarding the requirements of the Act. The financial panic immediately subsided, and the panicky demand for banknotes and gold sovereigns simply disappeared.

Problem solved. In November 1857 there was a run on the Bank of England itself when its gold reserves stood at only £274,000 against liabilities of £5,460,000, a condition which would have stopped a commercial bank from trading. There was also a full-blown banking crisis in America. Again, the government was forced to authorize the Bank to issue notes at discretion, but it also required the Bank to increase its discount rate to not less than 10%. The day after this permission, the panic eased. And in 1866, the Overend Gurney failure which was the worst of the three by far cited here was resolved by the government again authorizing the Bank to proceed in similar terms to those given to subdue the 1857 panic.

Our reason for dragging up the failures of the currency school approach is not so much to resuscitate the debate of the early nineteenth century but to point out that a strict rules-based approach does not guarantee banking stability, and to add that in the context of dealing with periodic banking crises they can only be resolved by abandoning the rules. But there is a further lesson, and that is a banking crisis does not require a fall in interest rates to be resolved. The solution is found in ensuring that sufficient liquidity is available and that the level of interest rates should be set by the issue department alone in order to ensure there are adequate gold reserves to back the currency.

The theories of the currency school have little credence today, ironically replaced by an increasingly regulated banking school approach. But even that has not prevented crises from emerging. In this era of fiat currencies, the most notable case was the stock market collapse in late 1974. The S&P 500 index had roughly halved since January 1973, but the UK’s FT30 had collapsed to 146 on 6 January 1975, 73% down from its 1972 high. The entire commercial property sector had become more or less valueless, a result of the earlier crash in November 1973 which bankrupted a number of secondary banks. Joint stock banks were rumored to be also bankrupt and market sentiment was at the lowest possible ebb.

It was at that point that behind closed doors The Bank of England instructed major pension funds and insurance companies which had accumulated significant levels of short-term liquidity to buy equities indiscriminately.[ii] Consequently, the market soared on the mother-of-all bear squeezes, and investor confidence rapidly returned. Talk of joint stock banks in trouble was forgotten as collateral values recovered.

Even though The Bank of England had had all restrictions on its currency and credit creation removed in accordance with the theories of the banking school, not only did a cycle of credit crises continue but they were resolved in a similar way as the earlier suspensions of the Bank Charter Act simply by a judicious turning of sentiment. This was also the case when the Lehman crisis exploded in our faces in 2008 when the Fed and other central banks quickly acted to stop faith in the credit system from imploding.

The lesson for us today is that central banks have learned how to quickly restore confidence in a credit crisis. As was the case in 2007 before Lehman failed, it was becoming obvious that the conditions for a crisis were snowballing but yet to be reflected in a loss of confidence in the enormous global structure of unbacked credit. The question that now arises is whether the authorities are already intervening to prevent the looming crisis by kicking the can down the road just one more time.

The background to today’s evolving crisis

Since the 1970s when dollar credit was detached from gold’s value, the need for behind-the-scenes management of market expectations has increased. It commenced with unsuccessful attempts by the US Treasury to suppress the gold price by selling gold into the market. Anti-gold propaganda continued unsuccessfully until Chairman of the Fed Paul Volcker raised interest rates in the early 1980s sufficiently to turn the tide in favor of the dollar. That the Fed Funds rate had to be raised to over 19% indicated the failure of the 1970s anti-gold propaganda effort, but it paved the way towards its resolution.

Today, those who understand that gold is money and all else is credit are a vanishingly small proportion of economists and investment professionals. As the principal reserve currency, the dollar is now believed to have completely superseded gold as the sheet anchor for global credit. Nevertheless, the dollar is inherently unstable. Therefore, a more determined effort at continual management of expectations was called for, and this arrived with the financialization of G7 economies in the mid-eighties.

The advantage of financialization is that it gives a central bank greater control over economic outcomes, compared with an economy dependent on manufacturing. Central banks and their regulators set the agenda for how credit is used in a way that is impossible for manufacturing. Big bang in London led to the Glass Stegall Act in America being eventually rescinded, but more immediately it redirected global capital otherwise earmarked for manufacturing into financial markets. The expansion of derivative markets soaked up speculative demand for commodities, including gold, and coupled with statistical manipulation became an important part of suppressing inflation.

The expansion of credit aimed at financial markets worked particularly well until the turn of the century. It led to the dot-com bubble, its collapse, and the Fed Fund rate being reduced to a record low of 1%. Eventually, word was put out that recovery was on its way and there was a gathering momentum, reflected in residential property markets. We will probably never know whether this recovery was initiated by the Fed, in the way the Bank of England did in January 1975, but Alan Greenspan did understand markets, their sentiment, and their timing.

However, the inflationary consequences led to the 2007‑2009 crisis and the Fed having to bail out the entire financial system.

The constituents of an evolving crisis today are in plain sight, many factors being similar to crises in the past. The commercial banking system is caught flat-footed by the upturn in price inflation and interest rates, which they are exacerbating by restricting credit. With the banking system’s difficulty in contracting its aggregate liabilities, it is shuffling its assets towards lower-risk assets such as short-term Treasury bills. Furthermore, commercial banks are presided over by central banks whose balance sheets have been destroyed by a combination of earlier quantitative easing, higher interest rates, and collapsing balance sheet asset values.

With sentiment in bond markets being at a low ebb, the conditions for setting off a bear squeeze in bond markets are now in place, with banks and investment funds having increased their near-cash assets.

Why now?

For the central banks such as the Fed, there are two major problems looming. The first is how to fund escalating government budget deficits, when interest costs already account for the largest component of spending commitments, and the second is the strains put on the G7 monetary system by a strong dollar. Conveniently, it appears that CPI inflation is easing sufficiently to rule out further interest rate rises and that they may even fall sooner than previously expected. This creates the opportunity for steering market expectations away from the evolving crisis and hopefully to buy a few years’ time.

There is little doubt that growing confidence in these conditions in government circles justified the UK Chancellor’s tax cuts announced in the Autumn Statement this week. The Ukraine war is in a lull, and apart from demonstrations supporting the Palestinians, a general policy from America and her allies of non-military intervention over Gaza has relieved geopolitical tensions in bond markets. Consequently, the yield on the 10-year US treasury Note has declined from 5% to 4.37% and the dollar’s trade-weighted index has declined from 107 to 103.9, taking pressure off other bond markets, most notably the Japanese where the 10-year JGB yield has declined from 0.96% to 0.7%.

As the sense of crisis diminishes, perhaps US Treasury yields will decline further. It will be needed to avoid a significant fall in equity markets, and it should also trigger a backwash out of short-term Treasury Bills and the like into longer-term bonds, hopefully allowing the US Government to progress with its funding.

How long will it work?

The growing evidence that the authorities are deploying their acute sense of market timing to steer markets away from a funding crisis and to foster confidence in wider financial assets should not be confused with dealing with a cyclical banking crisis per se. At best, it is a temporary patch over a gaping wound. At the heart of it is a debt funding crisis that is not going away on the back of an orchestrated bear squeeze in bond markets.

Today’s is a very different situation from the 1970s with which these times of resurging price inflation can be best compared. Between 1971 and 1980, the sum of budget deficits for the US Government over the ten years was $421,823 million, 15% of 1980’s GDP. By way of contrast, the total budget deficit for the last ten years totaled $12,918 billion, 47% of 2023 GDP. Furthermore, US debt to GDP in 1970 was 34%, while today it is 122%.

In other words, there is a US government debt crisis that will only get worse and won’t be resolved by a sixty basis point fall in long bond yields. Furthermore, overleveraged banks still face mounting private sector non-performing loans going into an economic downturn, discouraging them from resuming the expansion of their balance sheets. Credit will still be tight and borrowing rates elevated.

The fact remains that for the banks there are very few buyers of collateral held against loans. The chart above of the valuation gap between bond yields and equity markets also applies to other assets, most notably commercial real estate. Bank executives are bound to look through this dip in bond yields and will almost certainly conclude that the economic outlook and how it affects credit margins relative to risk is still unfavorable.

Foreign investors are heavily overweight in dollars already, and far from seeing falling Treasury yields as an opportunity to buy, they are likely to remain on the sidelines, or even take the opportunity to sell with more of an eye on the dollar’s declining exchange rate.

There is a further problem when it comes to the US Treasury’s dependency on foreign investors buying its debt, and that is the relationship between the trade deficit and the balance of payments. The trade deficit is roughly balanced between the budget deficit and changes in the savings rate. The simplest explanation for this accounting identity is that a budget deficit leads to a direct expansion of credit into the economy, leading in turn to an imbalance between domestic production and consumer demand. If consumers fail to increase their savings, it leads to the importation of goods and services in excess of national exports — in other words, a deficit in the balance of trade.

The balance of payments differs from the balance of trade by the extent to which foreigners supplying products into the economy dispose of or retain the currency. By ensuring that the dollar is the international reserve currency in which international trade is valued and settled, foreign exporters into the US market have accumulated large quantities of dollars in preference to their own and other currencies. And those balances either accumulate as bank deposits, or they are invested which is why foreigners buy US treasuries. But in the current fiscal year, we can be certain that the US Federal deficit will rise above last fiscal year’s $2 trillion, which was 7.2% of GDP.

The budget deficit this year will be far higher. It is the run-up to a presidential election next November, so spending almost certainly won’t be restricted on that account. Furthermore, we know that the global and US economies are heading into recession, likely to be very deep if the initial contraction of the money supply is any indication. Ex-interest, it seems unlikely that with declining tax revenues and increasing welfare costs, the deficit will turn out to be less than $2 trillion, to which interest costs must be added. They are already running at over $1 trillion annually, and with the rise in interest rates impacting funding of the budget deficit and some $7.6 trillion of debt being rolled over at significantly higher interest rates, the cost of funding could well approach $1.5 trillion, assuming interest rates go no higher.

Adding together these funding costs and the deficit ex-interest gives us a likely outturn approaching $3.5 trillion. Unless the domestic private sector increases its savings rate, then the trade deficit will increase to match this $3.5 trillion.

In the UK, the Chancellor has decided the outlook is sufficiently improved for some minor tax cuts. The relevant figures are a budget deficit of £123.9bn in the current fiscal year to next April, with debt interest of £116.2bn. In other words, if it was not for debt interest, the budget would be approximately balanced. Part of the debt interest is due to the cost of maturing debt being rolled over, and the increase in interest payments on index-linked gilts. While Britain is not in such a deep debt trap as the US, budget arithmetic appears to be too optimistic for a number of reasons:

-

According to the government’s own estimates, GDP growth measured by consumption will be greater in the public sector than in the private sector. The private sector is expected to stagnate at just 0.5% real, with inflation falling to 3.6%. Expectations for 2024/25 will almost certainly prove to be optimistic, with the global economic outlook being for a significant recession. Instead, the Office for Budget Responsibility forecasts continuing economic growth in the coming years.

-

The revenue forecasts are bound to be too optimistic given the global recession outlook, with welfare costs increasing more as well. Ex-interest costs, the borrowing requirement is sure to widen. Interest costs are bound to move in line with dollar rates which due to the factors above are almost certainly going to rise, not decline.

-

Inflation assumptions (CPI) assume that there will be a return to 2% in 2025. The prospects for monetary inflation in the G7 countries make that outcome extremely unlikely.

While the UK’s figures are materially better than those of the US, relative to the dollar sterling has a credibility problem. As the dollar’s purchasing power declines, sterling is likely to do so as well, possibly at an even faster rate.

Conclusion

The current decline in US bond yields and the dollar’s trade-weighted index take enormous pressure off both financial markets and global currencies. Unless geopolitical events upset this newfound confidence, it could have further to go. But its origin would appear to be skilled timing by the authorities to inject needed confidence back into the markets, and thus into the US and other economies.

We can only surmise that this is the case. But by tracing the histories and backgrounds to interventions designed to restore confidence in markets, this article shows that there is strong circumstantial evidence that the current decline in interest rates bears the hallmark of a degree of market manipulation.

Consequently, the underlying problems remain. Government funding problems, the continuing downturn in the bank credit cycle, and the economic outlook apply not only to the US, but to all overindebted G7 governments. The conditions which have led to the general instability of credit values have not been addressed, so in time all the problems which might appear to be receding will return with renewed vengeance

Loading…