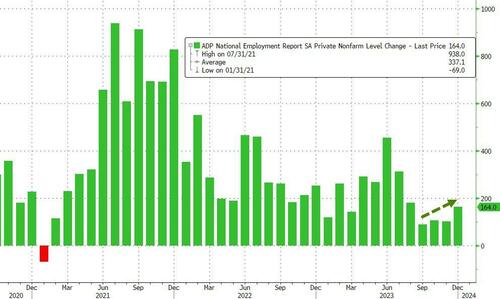

After four straight months of disappointments, ADP Employment Report printed +164k jobs in December, better than the +125k expected, up from a revised +101k gain in November.

Source: Bloomberg

That is the largest monthly job gain since August with Services jobs dominating once again (+155k Services vs +9k Goods-producing).

The advance was led by services sectors including leisure and hospitality and education and health services, while Manufacturing and mining saw job declines.

Wage growth continued to slow:

-

Job-changers wage growth dropped to 8.0% from 8.3%, lowest since May 2021

-

Job-stayers wage growth dropped to 5.4% from 5.6%, lowest since August 2021

"We're returning to a labor market that's very much aligned with pre-pandemic hiring," said Nela Richardson, chief economist, ADP.

"While wages didn't drive the recent bout of inflation, now that pay growth has retreated, any risk of a wage-price spiral has all but disappeared."

The MidWest and South saw job declines of 21k and 7k respectively while The West and Northeast saw job gains soar (+109k and +94k respectively)

Finally, we note that ADP has under-estimated the print for BLS for the last three months...

So, if BLS beats this, will the market still 'believe' in a soft landing and six rate-cuts?

After four straight months of disappointments, ADP Employment Report printed +164k jobs in December, better than the +125k expected, up from a revised +101k gain in November.

Source: Bloomberg

That is the largest monthly job gain since August with Services jobs dominating once again (+155k Services vs +9k Goods-producing).

The advance was led by services sectors including leisure and hospitality and education and health services, while Manufacturing and mining saw job declines.

Wage growth continued to slow:

-

Job-changers wage growth dropped to 8.0% from 8.3%, lowest since May 2021

-

Job-stayers wage growth dropped to 5.4% from 5.6%, lowest since August 2021

“We’re returning to a labor market that’s very much aligned with pre-pandemic hiring,” said Nela Richardson, chief economist, ADP.

“While wages didn’t drive the recent bout of inflation, now that pay growth has retreated, any risk of a wage-price spiral has all but disappeared.”

The MidWest and South saw job declines of 21k and 7k respectively while The West and Northeast saw job gains soar (+109k and +94k respectively)

Finally, we note that ADP has under-estimated the print for BLS for the last three months…

So, if BLS beats this, will the market still ‘believe’ in a soft landing and six rate-cuts?

Loading…