The United Arab Emirates is set to attract the most millionaires in 2024, while China and the UK are expected to lose the largest number of high-net-worth individuals (HNWIs).

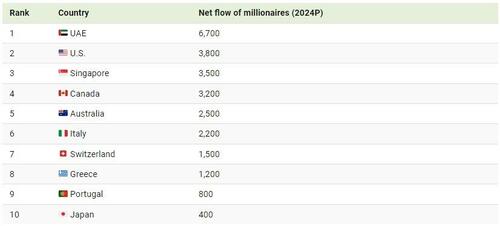

This graphic, via Visual Capitalist's Marcus Lu, shows the top 10 countries projected to have the highest net inflows or net outflows of HNWIs in 2024. HNWIs have a liquid investable wealth of $1 million or more. All figures come from the Henley Private Wealth Migration Report 2024.

Why is Attracting Millionaires Important?

According to Henley & Partners, 20% of HWNIs are entrepreneurs (rising to 60% for centi-millionaires and billionaires). As a result, countries that attract HWNIs from other parts of the world may see powerful benefits like job creation and investment.

Countries Attracting the Most Millionaires in 2024

The UAE’s strategic focus on economic diversification and government investment has positioned it as a global economic powerhouse.

The country has seen significant investments in tourism, real estate, logistics, financial services, and technology markets.

In addition, the adoption of international standards in regulatory and market frameworks, coupled with attractive tax initiatives, has drawn young entrepreneurs worldwide to the country.

According to Warwick Legal Network, the UAE accounts for over 30% of foreign direct investment inflow to the MENA region.

Countries Losing the Most Millionaires in 2024

Meanwhile, uncertainty over China’s economic trajectory and geopolitical tensions have led millionaires to leave the country. China saw the world’s biggest outflow of high-net-worth individuals last year and is expected to see a record exodus of 15,200 in 2024.

Similarly, the UK is expected to lose 9,500 millionaires this year, on top of the 16,500 millionaires it lost in the six-year period following Brexit.

This is an interesting and noteworthy reversal in fortune, since historically, the UK has drawn wealthy families from Europe, Africa, Asia, and the Middle East.

The United Arab Emirates is set to attract the most millionaires in 2024, while China and the UK are expected to lose the largest number of high-net-worth individuals (HNWIs).

This graphic, via Visual Capitalist’s Marcus Lu, shows the top 10 countries projected to have the highest net inflows or net outflows of HNWIs in 2024. HNWIs have a liquid investable wealth of $1 million or more. All figures come from the Henley Private Wealth Migration Report 2024.

Why is Attracting Millionaires Important?

According to Henley & Partners, 20% of HWNIs are entrepreneurs (rising to 60% for centi-millionaires and billionaires). As a result, countries that attract HWNIs from other parts of the world may see powerful benefits like job creation and investment.

Countries Attracting the Most Millionaires in 2024

The UAE’s strategic focus on economic diversification and government investment has positioned it as a global economic powerhouse.

The country has seen significant investments in tourism, real estate, logistics, financial services, and technology markets.

In addition, the adoption of international standards in regulatory and market frameworks, coupled with attractive tax initiatives, has drawn young entrepreneurs worldwide to the country.

According to Warwick Legal Network, the UAE accounts for over 30% of foreign direct investment inflow to the MENA region.

Countries Losing the Most Millionaires in 2024

Meanwhile, uncertainty over China’s economic trajectory and geopolitical tensions have led millionaires to leave the country. China saw the world’s biggest outflow of high-net-worth individuals last year and is expected to see a record exodus of 15,200 in 2024.

Similarly, the UK is expected to lose 9,500 millionaires this year, on top of the 16,500 millionaires it lost in the six-year period following Brexit.

This is an interesting and noteworthy reversal in fortune, since historically, the UK has drawn wealthy families from Europe, Africa, Asia, and the Middle East.

Loading…