Just like everyone else, High Net Worth Individuals (HNWIs) traveled less than usual during the pandemic, and as a result their migration numbers trended downwards.

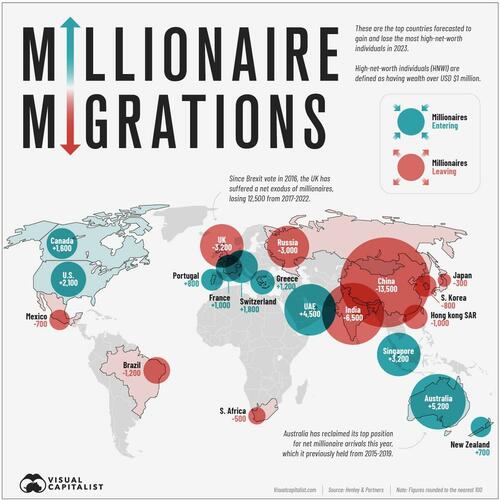

But, as Visual Capitalist's Avery Koops details below, millionaires and billionaires are on the move again and it is anticipated that 122,000 HNWIs will move to a new country by the end of the year.

Henley & Partners’ Private Wealth Migration Report has tracked the countries HNWIs have moved from and to over the last 10 years; this map showcases the 2023 forecasts.

In this context, HNWIs are defined as individuals with a net worth of at least $1 million USD.

The Countries Welcoming New Millionaires

The top 10 countries which are likely to become home to the highest number of millionaires and billionaires in 2023 are scattered across the globe, with Australia reclaiming its top spot this year from the UAE.

Here’s a closer look at the data:

Only two Asian countries make the top 10, with the rest spread across Europe, North America, and Oceania.

Despite historic economic challenges, Greece is projected to gain 1,200 High Net Worth Individuals this year. One reason could be the country’s golden visa program, wherein wealthy individuals can easily obtain residence and eventually EU passports for the right price—currently a minimum real estate investment cost of 250,000 euros is all that’s required.

Many of the leading millionaire destinations are attractive for wealthy individuals because of higher levels of economic freedom, allowing for laxer tax burdens or ease of investment. Singapore, which expects to gain 3,200 millionaires, is the most economically free market in the world.

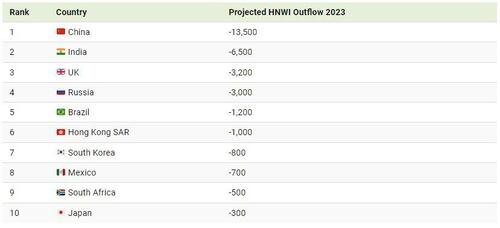

The Countries Losing the Most Millionaires

China is anticipated to lose 13,500 High Net Worth Individuals this year, more than double as many as the second place country, India (6,500).

Here’s a closer look at the bottom 10:

In a number of these countries, strict regulatory bodies and corrupt governments can hinder the ease with which HNWIs can manage their own money.

In Russia, many wealthy individuals are facing personal tariffs and trade restrictions from Western countries due to the war in Ukraine. China’s crackdowns on Hong Kong have made it a less attractive place for business. And finally, the UK’s exit from the EU has caused many businesses and individuals to lose the easy movement of labor, finances, and investment that made operations across European borders seamless.

Some of these countries may still be adding homegrown millionaires and billionaires, but losing thousands of HNWIs to net migration does have a considerable economic impact.

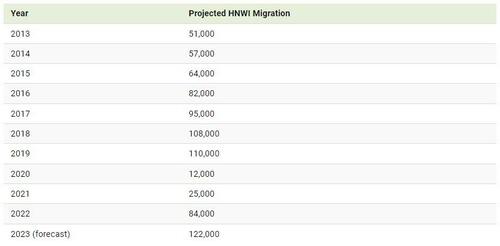

Overall, millionaires are increasingly on the move. In the 10 years of reporting—despite a dip during the pandemic—the number of HNWIs moving away from their countries of origin has been growing every year.

Here’s a look at the numbers:

In a geopolitically fragile but more connected world, it’s no surprise to see millionaires voting with their feet. As a result, governments are increasingly in competition to win the hearts and minds of the world’s economic elite to their side.

Just like everyone else, High Net Worth Individuals (HNWIs) traveled less than usual during the pandemic, and as a result their migration numbers trended downwards.

But, as Visual Capitalist’s Avery Koops details below, millionaires and billionaires are on the move again and it is anticipated that 122,000 HNWIs will move to a new country by the end of the year.

Henley & Partners’ Private Wealth Migration Report has tracked the countries HNWIs have moved from and to over the last 10 years; this map showcases the 2023 forecasts.

In this context, HNWIs are defined as individuals with a net worth of at least $1 million USD.

The Countries Welcoming New Millionaires

The top 10 countries which are likely to become home to the highest number of millionaires and billionaires in 2023 are scattered across the globe, with Australia reclaiming its top spot this year from the UAE.

Here’s a closer look at the data:

Only two Asian countries make the top 10, with the rest spread across Europe, North America, and Oceania.

Despite historic economic challenges, Greece is projected to gain 1,200 High Net Worth Individuals this year. One reason could be the country’s golden visa program, wherein wealthy individuals can easily obtain residence and eventually EU passports for the right price—currently a minimum real estate investment cost of 250,000 euros is all that’s required.

Many of the leading millionaire destinations are attractive for wealthy individuals because of higher levels of economic freedom, allowing for laxer tax burdens or ease of investment. Singapore, which expects to gain 3,200 millionaires, is the most economically free market in the world.

The Countries Losing the Most Millionaires

China is anticipated to lose 13,500 High Net Worth Individuals this year, more than double as many as the second place country, India (6,500).

Here’s a closer look at the bottom 10:

In a number of these countries, strict regulatory bodies and corrupt governments can hinder the ease with which HNWIs can manage their own money.

In Russia, many wealthy individuals are facing personal tariffs and trade restrictions from Western countries due to the war in Ukraine. China’s crackdowns on Hong Kong have made it a less attractive place for business. And finally, the UK’s exit from the EU has caused many businesses and individuals to lose the easy movement of labor, finances, and investment that made operations across European borders seamless.

Some of these countries may still be adding homegrown millionaires and billionaires, but losing thousands of HNWIs to net migration does have a considerable economic impact.

Overall, millionaires are increasingly on the move. In the 10 years of reporting—despite a dip during the pandemic—the number of HNWIs moving away from their countries of origin has been growing every year.

Here’s a look at the numbers:

In a geopolitically fragile but more connected world, it’s no surprise to see millionaires voting with their feet. As a result, governments are increasingly in competition to win the hearts and minds of the world’s economic elite to their side.

Loading…