Yesterday we were the first to point out that beneath the hawkish veneer of the FOMC minutes, there was an ultra dovish message which most missed in their initial read, yet which may have been the Hail Mary for so many bulls who have been trampled by the Fed's hawkish rhetoric in recent weeks: referring to the Fed's cut of its 2023 and 2024 PCE estimates, we said that "it would imply the next expected three half-point rate hikes would be the end of the current tightening cycle and set the stage for a major risk rally into second half of 2022" which incidentally aligns with what Atlanta Fed president Bostic recently hinted at.

Picking up this morning on this theme, Nomura's Charlie McElligott writes that there is a gradual but tangible pivot in sentiment as the Fed’s aggressively “front-loaded” tightening "is helping with outcomes they have desired", to wit: FCI is tightening, but not in totally “unruly” fashion in either Credit or Equities; Housing / Labor / Survey data is rapidly slowing off peaks; and Inflation Breakevens are plummeting.

Critically, McElligott notes, the market is adjusting to key transition as we now see a “near” equilibrium between Fed and Market regarding forward expectations, "a critical pivot in the sequencing of this cycle."

The Nomura strategist quotes his Econ Team which "said it best last night":

“…markets appear to have recently begun to more completely accept the implications of the Fed’s stated commitment to bringing inflation under control, even at the expense of growth. With markets now pricing in this commitment, the near-term urgency to escalate the Fed’s hawkish pivot has faded.”

Accordingly, the Nomura Econ team has adjusted their near-term Fed outlook from two 75bps to three consecutive 50bps moves (Jun / Jul / Sep), but it is also important to note that their above-consensus “hawkish” Terminal Rate forecast (3.75%-4.0% by Jun 2023) remains unchanged. Also, looming at medium-term risks going-forward, two important observations / expectations from the Economics team note (available to pro subs) which swings back to Charlie's earlier comments on “no pause,” as the Fed’s lack of visibility beyond fresh monthly data essentially kills “forward guidance” beyond ‘1 month at a time’…yet while too believing that tightening will continue in smaller increments until inflationary pressure is contained, which will then require the market to re-adjust Terminal Rate expectations higher as further risk looking-out in coming months:

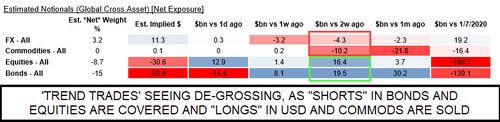

As a result, the Nomura desk has already seen a de-grossing of the recent “trend trade” winners YTD (“Short Bonds and Equities, Long Commods and USD”), but this near-term “pivot” with the market coalescing to the Fed’s “commitment” to fighting inflation is now providing a window of calm which drive further unwind of these trades.

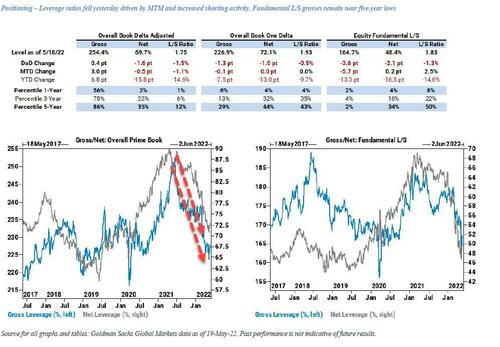

And amid the near-record consensus Equities under-positioning among - particularly with “un-emotional” Vol sensitive “first mover” systematics, but also hedge funds who at last check were in a sub-10%ile of net exposure according to Goldman Prime...

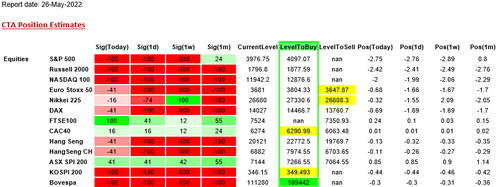

... there is a flow catalyst to drive further Equities “squeeze” in the coming-days and weeks ahead across CTA Trend, Risk Parity and most notably, Vol Control with some very large $ re-allocation flows. Indeed, a quick look at CTA positioning shows that we are approaching massive short squeeze risk. Of note, S&P CTAs, which are -100 net short, would reverse and start buying at 4,097 so there's your short-term bogey (which is fast aprpoaching).

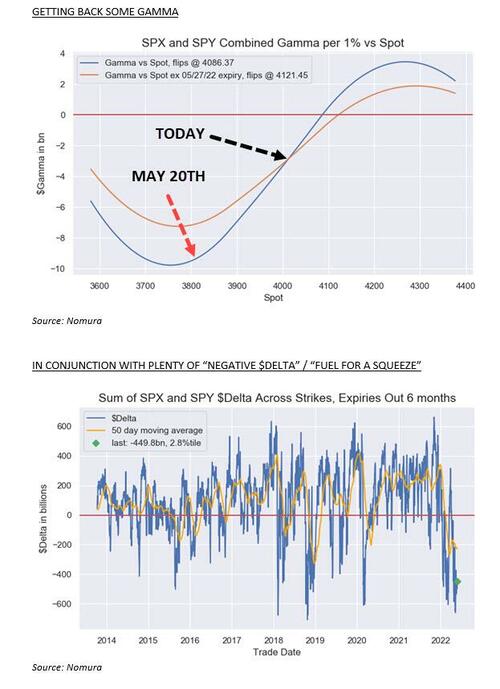

Additionally, McElligott adds that Options Positioning is increasingly “more stable” from a Dealer Gamma profile, "with substantial Negative $ Delta as fuel for a squeeze and even some pockets of upside “Short Gamma” which could exacerbate a rally."

There has also been some big thematic relief this morning, because despite last night’s software/chip cloud earnings gong-show (NVDA, SNOW and NTNX), today we get major sentiment relief from M (+14%) and DG (+11%) beats and raises in consumer retail, along with BABA’s beat.

Finally, Charlie believes that the massive rally in Credit yesterday can continue to act as a macro-factor “tailwind” for higher Equities and “easier” FCI, while also super tactically, there is big relief this morning from Earnings, particularly in Retailer beats / raises (DG, DLTR, WSM, M). Some more comments on this from the Nomura credit desk:

Relatively massive move in HYG yesterday, with the high yield bond ETF trading up 1.5%, its biggest one day up move since 5/18/2020 when the ETF was up 1.8% (with SPX +3.2%). Particularly interesting is how much HYG outperformed the move in SPX (only +0.9%). Per our back testing, a day that puts HYG up 1.5%, should have seen SPX up +2.1%. I think this speaks a fair bit to investors demand to get back into the upper tranches of high yield credit and the extreme short gamma in the credit vol space. Yesterday, we saw paper lift 100,000 Jul 80 c for .255 (64mm in dollar gamma, 900k of Vega) these calls went out last night at around $.46. I think a lot of dealers got lifted on a fair bit of HYG upside in the past couple weeks and that helped to cause the absolute VOL explosion we saw in the space with HYG VOLs trading up about a 1.25 vols at the one month maturity, as realized vol spiked higher.

Ultimately, however, before the bulls go all-out on a buying spree (which they appear to be doing today), the Nomura x-asset strategist believes "there remains one final potential for a medium-term / Summer re-adjustment to a more “hawkish” message from the Fed, as the anticipated softening expected in this week’s PCE Deflator MoM should likely then reverse the two prints thereafter" in conjunction with the Core CPI release (May) coming June 10th, setting the stage for a potentially “hawkish” messaging from Chair Powell into “peak August illiquidity” at Jackson Hole.

It is possible then that Powell would need to push markets on moving September FOMC expectations from 25bps back up to 50bps (especially if stocks surge by then), and also with strong potential that they have to communicate “no pause” (vs expectations within the Equities after our note yesterday)...

... all of which risks reintroducing turbulence to markets, in the words of our Econ Team "…will likely underscore the scale of the problem policymakers face."

Much more in the full note available to ZH professional subscribers.

Yesterday we were the first to point out that beneath the hawkish veneer of the FOMC minutes, there was an ultra dovish message which most missed in their initial read, yet which may have been the Hail Mary for so many bulls who have been trampled by the Fed’s hawkish rhetoric in recent weeks: referring to the Fed’s cut of its 2023 and 2024 PCE estimates, we said that “it would imply the next expected three half-point rate hikes would be the end of the current tightening cycle and set the stage for a major risk rally into second half of 2022″ which incidentally aligns with what Atlanta Fed president Bostic recently hinted at.

Picking up this morning on this theme, Nomura’s Charlie McElligott writes that there is a gradual but tangible pivot in sentiment as the Fed’s aggressively “front-loaded” tightening “is helping with outcomes they have desired”, to wit: FCI is tightening, but not in totally “unruly” fashion in either Credit or Equities; Housing / Labor / Survey data is rapidly slowing off peaks; and Inflation Breakevens are plummeting.

Critically, McElligott notes, the market is adjusting to key transition as we now see a “near” equilibrium between Fed and Market regarding forward expectations, “a critical pivot in the sequencing of this cycle.”

The Nomura strategist quotes his Econ Team which “said it best last night”:

“…markets appear to have recently begun to more completely accept the implications of the Fed’s stated commitment to bringing inflation under control, even at the expense of growth. With markets now pricing in this commitment, the near-term urgency to escalate the Fed’s hawkish pivot has faded.”

Accordingly, the Nomura Econ team has adjusted their near-term Fed outlook from two 75bps to three consecutive 50bps moves (Jun / Jul / Sep), but it is also important to note that their above-consensus “hawkish” Terminal Rate forecast (3.75%-4.0% by Jun 2023) remains unchanged. Also, looming at medium-term risks going-forward, two important observations / expectations from the Economics team note (available to pro subs) which swings back to Charlie’s earlier comments on “no pause,” as the Fed’s lack of visibility beyond fresh monthly data essentially kills “forward guidance” beyond ‘1 month at a time’…yet while too believing that tightening will continue in smaller increments until inflationary pressure is contained, which will then require the market to re-adjust Terminal Rate expectations higher as further risk looking-out in coming months:

As a result, the Nomura desk has already seen a de-grossing of the recent “trend trade” winners YTD (“Short Bonds and Equities, Long Commods and USD”), but this near-term “pivot” with the market coalescing to the Fed’s “commitment” to fighting inflation is now providing a window of calm which drive further unwind of these trades.

And amid the near-record consensus Equities under-positioning among – particularly with “un-emotional” Vol sensitive “first mover” systematics, but also hedge funds who at last check were in a sub-10%ile of net exposure according to Goldman Prime…

… there is a flow catalyst to drive further Equities “squeeze” in the coming-days and weeks ahead across CTA Trend, Risk Parity and most notably, Vol Control with some very large $ re-allocation flows. Indeed, a quick look at CTA positioning shows that we are approaching massive short squeeze risk. Of note, S&P CTAs, which are -100 net short, would reverse and start buying at 4,097 so there’s your short-term bogey (which is fast aprpoaching).

Additionally, McElligott adds that Options Positioning is increasingly “more stable” from a Dealer Gamma profile, “with substantial Negative $ Delta as fuel for a squeeze and even some pockets of upside “Short Gamma” which could exacerbate a rally.”

There has also been some big thematic relief this morning, because despite last night’s software/chip cloud earnings gong-show (NVDA, SNOW and NTNX), today we get major sentiment relief from M (+14%) and DG (+11%) beats and raises in consumer retail, along with BABA’s beat.

Finally, Charlie believes that the massive rally in Credit yesterday can continue to act as a macro-factor “tailwind” for higher Equities and “easier” FCI, while also super tactically, there is big relief this morning from Earnings, particularly in Retailer beats / raises (DG, DLTR, WSM, M). Some more comments on this from the Nomura credit desk:

Relatively massive move in HYG yesterday, with the high yield bond ETF trading up 1.5%, its biggest one day up move since 5/18/2020 when the ETF was up 1.8% (with SPX +3.2%). Particularly interesting is how much HYG outperformed the move in SPX (only +0.9%). Per our back testing, a day that puts HYG up 1.5%, should have seen SPX up +2.1%. I think this speaks a fair bit to investors demand to get back into the upper tranches of high yield credit and the extreme short gamma in the credit vol space. Yesterday, we saw paper lift 100,000 Jul 80 c for .255 (64mm in dollar gamma, 900k of Vega) these calls went out last night at around $.46. I think a lot of dealers got lifted on a fair bit of HYG upside in the past couple weeks and that helped to cause the absolute VOL explosion we saw in the space with HYG VOLs trading up about a 1.25 vols at the one month maturity, as realized vol spiked higher.

Ultimately, however, before the bulls go all-out on a buying spree (which they appear to be doing today), the Nomura x-asset strategist believes “there remains one final potential for a medium-term / Summer re-adjustment to a more “hawkish” message from the Fed, as the anticipated softening expected in this week’s PCE Deflator MoM should likely then reverse the two prints thereafter” in conjunction with the Core CPI release (May) coming June 10th, setting the stage for a potentially “hawkish” messaging from Chair Powell into “peak August illiquidity” at Jackson Hole.

It is possible then that Powell would need to push markets on moving September FOMC expectations from 25bps back up to 50bps (especially if stocks surge by then), and also with strong potential that they have to communicate “no pause” (vs expectations within the Equities after our note yesterday)…

… all of which risks reintroducing turbulence to markets, in the words of our Econ Team “…will likely underscore the scale of the problem policymakers face.”

Much more in the full note available to ZH professional subscribers.