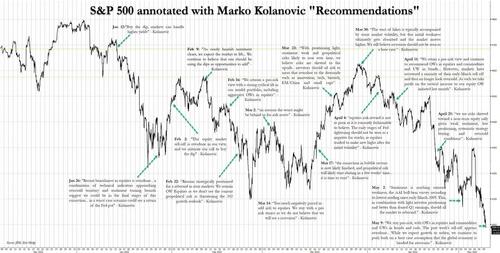

Heading into August, we had over 7 full months where every. single. week, JPM's equivalent of Goldman's Abby Joseph Cohen, the resident in-house permabull (and one time value-added quant) Marko Kolanovic, would tell the bank's sellside clients to just keep buying stocks no matter how much the market crashed the day, week or month before... or was about to crash. We even charted it two months ago, showing his weekly invocations to what was left of JPM clients with actual disposable income, to buy stocks.

And yet, try as hard as he might to influence market sentiment - an ability he lost long ago when he traded in the bloomberg for the corner office - Marko's weekly sermons from the latest market dip failed to have any impact. In fact, some joked that for stocks to turn higher, Marko would have to finally turn bearish.

Kolanovic says go underweight corporate bonds over equities.

— zerohedge (@zerohedge) July 11, 2022

The crash will not end until he turns bearish

All joking aside though, stocks are finally screeching higher and - guess what - Marko, or mARKo as he is also known, has just turned ever so slightly bearish.

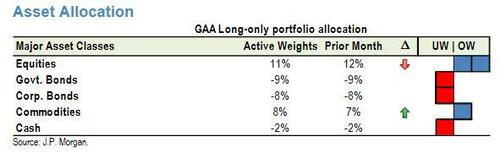

In a note published on Monday, Kolanovic - while still a bull - has become less bullish writing that "given diminishing risks of a more negative shift in behaviour, low positioning in risky assets and widespread negativity in sentiment, as well as robust nominal GDP and revenue growth, risky assets have seen a recovery" and as a result "with commodities lagging other risky assets, we shift some of our risk allocation from equities to commodities."

As a result, the team’s overall overweight recommendation on risky assets stays the same. They also remain underweight fixed income and cash.

As Bloomberg notes, "telling clients to cut back on stocks is a notable shift for Kolanovic, voted the No. 1 equity-linked strategist in last year’s Institutional Investor survey." Well sure, just look at the top chart where every green arrow indicates a time when Marko said to buy, buy the dip, or buy the rip. Far from having any market timing skills, the Croatian's strategy is to hope he is like the broken clock and be right at least twice in 2022... supposedly that will offset all those other times he was wrong.

Then said, since Marko is if not genetically then certainly contractually incapable of being openly bearish, his gentle shift away from raging permabull, doesn’t mean that he expects stocks will actually fall. Far from it: the JPMorgan strategist - as always - sees equities rising through year-end, bolstered by robust corporate earnings. Yet with commodities weakening of late, the strategists view it as a chance to pounce. Oh and it's really a CYA type of note, one where if stocks surge Marko can say "i told you so", and if stocks plunge Marko can say "I told you to rotate out of stocks." He'll just never tell you when to sell ahead of the next bear market.

Heading into August, we had over 7 full months where every. single. week, JPM’s equivalent of Goldman’s Abby Joseph Cohen, the resident in-house permabull (and one time value-added quant) Marko Kolanovic, would tell the bank’s sellside clients to just keep buying stocks no matter how much the market crashed the day, week or month before… or was about to crash. We even charted it two months ago, showing his weekly invocations to what was left of JPM clients with actual disposable income, to buy stocks.

And yet, try as hard as he might to influence market sentiment – an ability he lost long ago when he traded in the bloomberg for the corner office – Marko’s weekly sermons from the latest market dip failed to have any impact. In fact, some joked that for stocks to turn higher, Marko would have to finally turn bearish.

Kolanovic says go underweight corporate bonds over equities.

The crash will not end until he turns bearish

— zerohedge (@zerohedge) July 11, 2022

All joking aside though, stocks are finally screeching higher and – guess what – Marko, or mARKo as he is also known, has just turned ever so slightly bearish.

In a note published on Monday, Kolanovic – while still a bull – has become less bullish writing that “given diminishing risks of a more negative shift in behaviour, low positioning in risky assets and widespread negativity in sentiment, as well as robust nominal GDP and revenue growth, risky assets have seen a recovery” and as a result “with commodities lagging other risky assets, we shift some of our risk allocation from equities to commodities.“

As a result, the team’s overall overweight recommendation on risky assets stays the same. They also remain underweight fixed income and cash.

As Bloomberg notes, “telling clients to cut back on stocks is a notable shift for Kolanovic, voted the No. 1 equity-linked strategist in last year’s Institutional Investor survey.” Well sure, just look at the top chart where every green arrow indicates a time when Marko said to buy, buy the dip, or buy the rip. Far from having any market timing skills, the Croatian’s strategy is to hope he is like the broken clock and be right at least twice in 2022… supposedly that will offset all those other times he was wrong.

Then said, since Marko is if not genetically then certainly contractually incapable of being openly bearish, his gentle shift away from raging permabull, doesn’t mean that he expects stocks will actually fall. Far from it: the JPMorgan strategist – as always – sees equities rising through year-end, bolstered by robust corporate earnings. Yet with commodities weakening of late, the strategists view it as a chance to pounce. Oh and it’s really a CYA type of note, one where if stocks surge Marko can say “i told you so“, and if stocks plunge Marko can say “I told you to rotate out of stocks.” He’ll just never tell you when to sell ahead of the next bear market.