Somebody knows something...

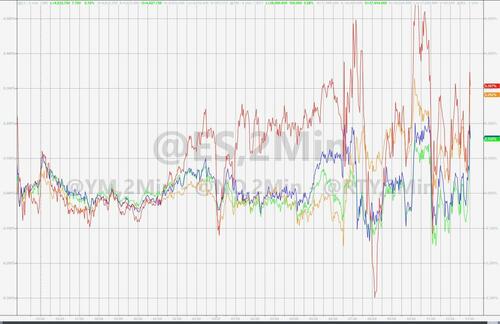

Dollar pukefest, Swiss Franc panic-bid, bond yields plunge-gasm, gold surge-plosion, Crypto spike-a-thon... and stocks UNCH.

Looking at stocks today you could be forgiven for thinking that today was a typical 'meh' mid-week between Xmas and NYE day with all the US majors hovering around unchanged (until the last second idiocy from algos)...

BUT, It was far from it in every other asset class as the dollar dumped while gold, bonds, swiss franc, and crypto all ripped higher as Magnificent 7 stocks were liquidated shortly after 10amET.

Source: Bloomberg

Notably, 0-DTE call-covering was very heavy as the Magnificent 7 was sold around 10am (after 0-DTE call-buying dominated at the open)...

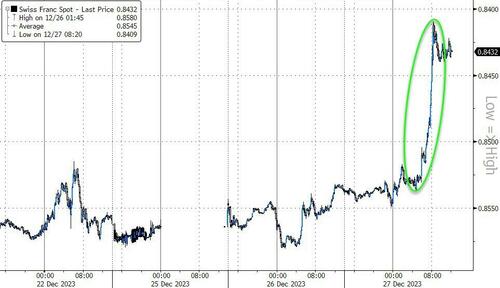

The Swiss Franc soared today by over 1% against the USD - the second biggest 'ultimate safe-haven' gain of the year outside of FOMC/ECB days...

Source: Bloomberg

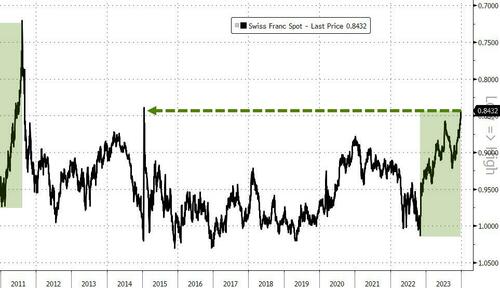

That lifted Swissy to its strongest since the SNB intervention in Jan 2015. 2023 has seen the Swiss Franc's strongest annual gains against the dollar since 2010...

Source: Bloomberg

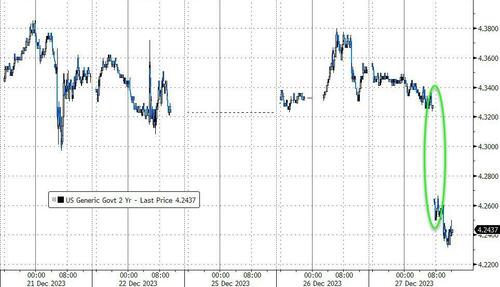

2Y yields crashed today, gapping down by 8bps this morning as a wave of safe-haven buying hit multiple asset-classes.

Source: Bloomberg

But the entire curve was lower in yield on the day (down 10-11bps) thanks to a strong 5Y auction also...

Source: Bloomberg

The bond rally today snapped the 30Y yield down to unchanged for 2023 (the rest of the curve is all lower in yield for 2023 already)...

Source: Bloomberg

Put another way, Fed Funds are up 100bps on the year and the rest of the curve is flat or lower in yield...

Source: Bloomberg

The S&P 500 surged on the strong 5Y auction (as yields declined) but reversed all that back to unchanged. The market then exploded higher in the last 2 minutes of the day on the back an almost $3BN MoC sell imbalance...

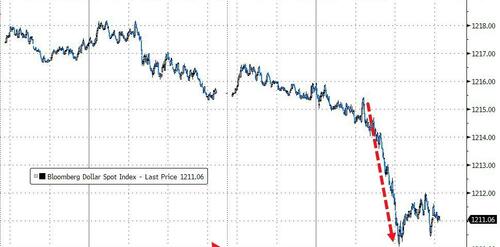

The dollar plunged at around 7am after drifting lower all night...

Source: Bloomberg

That smashed the greenback to its lowest since July...

Source: Bloomberg

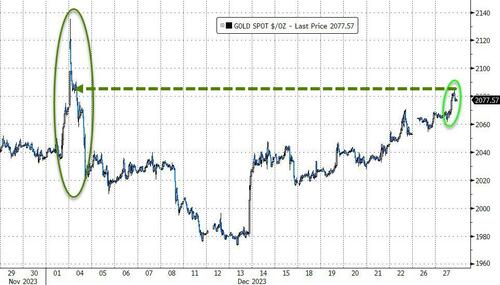

Dollar's loss was Gold's gain as the precious metal jumped to

Source: Bloomberg

And closed at a new record closing high...

Source: Bloomberg

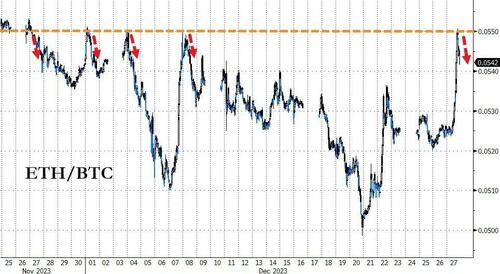

Elsewhere it was a big day in crypto with Ethereum dramatically outperforming (as Solana faded)...

Source: Bloomberg

Today saw $29 million in ETH short liquidations - the most since early December...

That pushed ETH/BTC up to recent key resistance, where it stalled again (for now)...

Source: Bloomberg

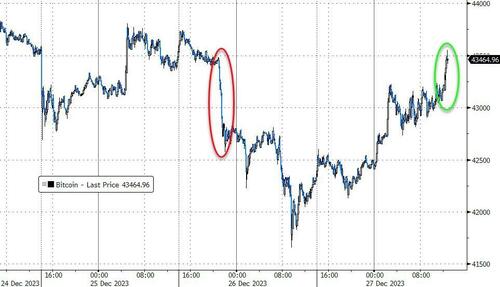

...as Bitcoin extended its roundtrip rebound back up to $43,500...

Source: Bloomberg

Despite the dollar weakness, oil prices fell today, erasing most of yesterday's spike gains ahead of tonight's API inventory data...

Source: Bloomberg

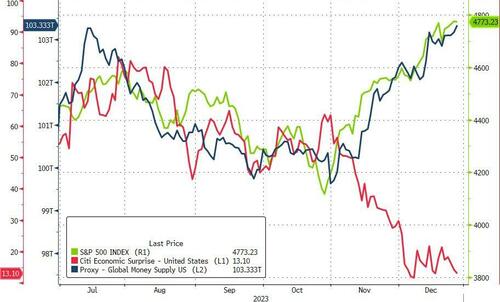

Finally, in case you wondered, only one thing matters still - global liquidity. As macro funny-mentals have deteriorated, stocks have soared in line with global liquidity....

Source: Bloomberg

And, while the last two months have seen real yields declining as P/Es rise, they remain dramatically decoupled from their prior regime...

Source: Bloomberg

This level of S&P 500 forward valuation implies a negative real-yield... is it any wonder that gold and crypto are rallying too?

Somebody knows something…

Dollar pukefest, Swiss Franc panic-bid, bond yields plunge-gasm, gold surge-plosion, Crypto spike-a-thon… and stocks UNCH.

Looking at stocks today you could be forgiven for thinking that today was a typical ‘meh’ mid-week between Xmas and NYE day with all the US majors hovering around unchanged (until the last second idiocy from algos)…

BUT, It was far from it in every other asset class as the dollar dumped while gold, bonds, swiss franc, and crypto all ripped higher as Magnificent 7 stocks were liquidated shortly after 10amET.

Source: Bloomberg

Notably, 0-DTE call-covering was very heavy as the Magnificent 7 was sold around 10am (after 0-DTE call-buying dominated at the open)…

The Swiss Franc soared today by over 1% against the USD – the second biggest ‘ultimate safe-haven’ gain of the year outside of FOMC/ECB days…

Source: Bloomberg

That lifted Swissy to its strongest since the SNB intervention in Jan 2015. 2023 has seen the Swiss Franc’s strongest annual gains against the dollar since 2010…

Source: Bloomberg

2Y yields crashed today, gapping down by 8bps this morning as a wave of safe-haven buying hit multiple asset-classes.

Source: Bloomberg

But the entire curve was lower in yield on the day (down 10-11bps) thanks to a strong 5Y auction also…

Source: Bloomberg

The bond rally today snapped the 30Y yield down to unchanged for 2023 (the rest of the curve is all lower in yield for 2023 already)…

Source: Bloomberg

Put another way, Fed Funds are up 100bps on the year and the rest of the curve is flat or lower in yield…

Source: Bloomberg

The S&P 500 surged on the strong 5Y auction (as yields declined) but reversed all that back to unchanged. The market then exploded higher in the last 2 minutes of the day on the back an almost $3BN MoC sell imbalance…

The dollar plunged at around 7am after drifting lower all night…

Source: Bloomberg

That smashed the greenback to its lowest since July…

Source: Bloomberg

Dollar’s loss was Gold’s gain as the precious metal jumped to

Source: Bloomberg

And closed at a new record closing high…

Source: Bloomberg

Elsewhere it was a big day in crypto with Ethereum dramatically outperforming (as Solana faded)…

Source: Bloomberg

Today saw $29 million in ETH short liquidations – the most since early December…

That pushed ETH/BTC up to recent key resistance, where it stalled again (for now)…

Source: Bloomberg

…as Bitcoin extended its roundtrip rebound back up to $43,500…

Source: Bloomberg

Despite the dollar weakness, oil prices fell today, erasing most of yesterday’s spike gains ahead of tonight’s API inventory data…

Source: Bloomberg

Finally, in case you wondered, only one thing matters still – global liquidity. As macro funny-mentals have deteriorated, stocks have soared in line with global liquidity….

Source: Bloomberg

And, while the last two months have seen real yields declining as P/Es rise, they remain dramatically decoupled from their prior regime…

Source: Bloomberg

This level of S&P 500 forward valuation implies a negative real-yield… is it any wonder that gold and crypto are rallying too?

Loading…