US Macro data surprised to the upside this week (the biggest weekly jump in the macro surprise index since August 2022) helping lift global macro notably higher, sparking hopes for a 'soft landing' (or no landing?)...

Source: Bloomberg

Digging into the data, it is very much the Labor market that is holding up the macro data, as 'soft' survey data slumps... (so let's hope all these mass layoffs don't ever show up in the official data)...

Source: Bloomberg

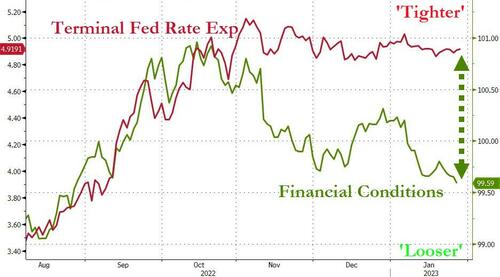

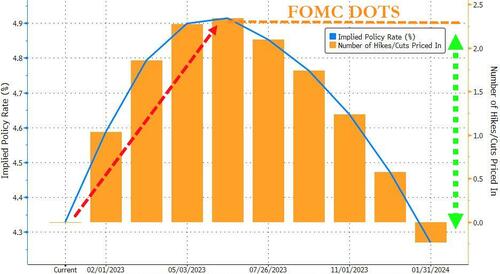

However, the 'soft landing' narrative pushed Fed rate trajectory expectations hawkishly firmer... Translation - the market has removed 10bps of expected easing from the second half of 2023 in the last week or so....

Source: Bloomberg

But the markets ignored all that and pushed financial conditions to their loosest level since August (dramatically pulling forward expectations for The Fed to pivot to cuts)...

Source: Bloomberg

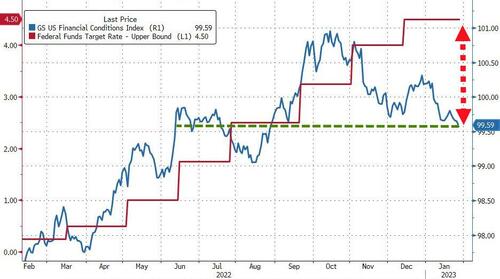

For context, financial conditions are as loose as they were in June of last year, 100s of bps of Fed Funds rate lower...

Source: Bloomberg

And financial conditions eased thanks in large part to soaring stocks this week. Led by Nasdaq (up 4 weeks in a row) which rallied over 5% (its best week since early Nov)

There was some aggressive selling into the close today which left The Dow almost unchanged (Nasdaq still managed a 1% gain)...

The meltup of the last couple of days was heavily influenced by 0DTE gamma squeezes and good old-fashioned short-squeezes. Today saw 'most shorted' stocks soar almost 7% - the biggest short-squeeze day since Nov 10th (3rd biggest short-squeeze day in 18 months)

Source: Bloomberg

For context, unprofitable tech stocks ripped 13% off their lows on Wednesday morning (and are up 30% YTD)...

Source: Bloomberg

The S&P is getting close to a golden cross (50DMA crossing above its 200DMA)...

Nasdaq closed above its 200DMA (at its highest since September)...

TSLA has been up for 6 straight days, rallying over 40% - its biggest such move since July 2020...

VIX was crushed this week to an 18 handle, but we do note that demand for downside protection has picked up as skews have started to accelerate...

Source: Bloomberg

Treasuries were mixed on the week with the long-end outperforming and the belly of the curve weakest (5Y +6bps, 30Y -3bps). Yields tumbled as stocks rallied today however during the US day session...

Source: Bloomberg

The dollar ended the week marginally lower (finding support at the May 2022 lows). NOTE that every day this week the dollar was dumped around the European close...

Source: Bloomberg

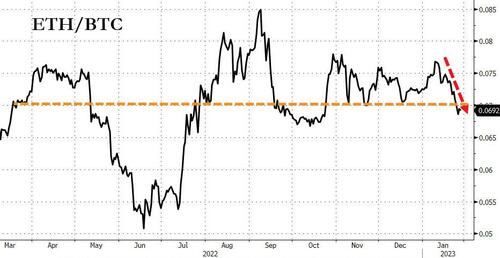

Cryptos were mixed this week with Bitcoin outperforming, up around 5% holding above $23,000...

Source: Bloomberg

Ethereum notably underperformed on the week (down around 2-3%), but has been lagging bitcoin significantly for two weeks...

Source: Bloomberg

Gold managed very modest gains this week, the 6th straight weekly gain for the precious metal...

Oil prices fell on the week with WTI back below $80...

NatGas fell for the 6th straight week, with Henry Hub trading at its lowest since April 2021 (bouncing off $3)...

Finally, we wonder do traders really think Jay Powell wants to see LUCID and all the worst stocks of last year (BZFD?) exploding blindly higher on the back of frontrunning The Fed's potential for a pivot to a cut (not just a pause)...

Source: Bloomberg

Do traders really think The Fed will do that kind of pivot in the face of just a 'soft landing'?

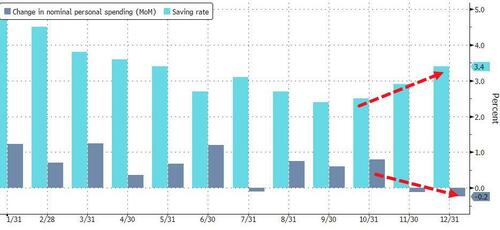

In fact, as Bloomberg pointed out today, the landing could be a lot harder. Analysts have pointed to diminishing pandemic stimulus cash cushions and a declining saving rate as reasons US consumers could ultimately pull back and tip the economy into recession.

Source: Bloomberg

Spending data show households did indeed cut back on purchases in the last two months of 2022. And at the same time, they started socking away more money throughout the fourth quarter, suggesting Americans may be preparing for tougher times ahead.

And the equity market is definitely not pricing in a harder-landing for the economy (no matter how quickly one believes the pivot would come).

US Macro data surprised to the upside this week (the biggest weekly jump in the macro surprise index since August 2022) helping lift global macro notably higher, sparking hopes for a ‘soft landing‘ (or no landing?)…

Source: Bloomberg

Digging into the data, it is very much the Labor market that is holding up the macro data, as ‘soft’ survey data slumps… (so let’s hope all these mass layoffs don’t ever show up in the official data)…

Source: Bloomberg

However, the ‘soft landing’ narrative pushed Fed rate trajectory expectations hawkishly firmer… Translation – the market has removed 10bps of expected easing from the second half of 2023 in the last week or so….

Source: Bloomberg

But the markets ignored all that and pushed financial conditions to their loosest level since August (dramatically pulling forward expectations for The Fed to pivot to cuts)…

Source: Bloomberg

For context, financial conditions are as loose as they were in June of last year, 100s of bps of Fed Funds rate lower…

Source: Bloomberg

And financial conditions eased thanks in large part to soaring stocks this week. Led by Nasdaq (up 4 weeks in a row) which rallied over 5% (its best week since early Nov)

There was some aggressive selling into the close today which left The Dow almost unchanged (Nasdaq still managed a 1% gain)…

The meltup of the last couple of days was heavily influenced by 0DTE gamma squeezes and good old-fashioned short-squeezes. Today saw ‘most shorted’ stocks soar almost 7% – the biggest short-squeeze day since Nov 10th (3rd biggest short-squeeze day in 18 months)

Source: Bloomberg

For context, unprofitable tech stocks ripped 13% off their lows on Wednesday morning (and are up 30% YTD)…

Source: Bloomberg

The S&P is getting close to a golden cross (50DMA crossing above its 200DMA)…

Nasdaq closed above its 200DMA (at its highest since September)…

TSLA has been up for 6 straight days, rallying over 40% – its biggest such move since July 2020…

VIX was crushed this week to an 18 handle, but we do note that demand for downside protection has picked up as skews have started to accelerate…

Source: Bloomberg

Treasuries were mixed on the week with the long-end outperforming and the belly of the curve weakest (5Y +6bps, 30Y -3bps). Yields tumbled as stocks rallied today however during the US day session…

Source: Bloomberg

The dollar ended the week marginally lower (finding support at the May 2022 lows). NOTE that every day this week the dollar was dumped around the European close…

Source: Bloomberg

Cryptos were mixed this week with Bitcoin outperforming, up around 5% holding above $23,000…

Source: Bloomberg

Ethereum notably underperformed on the week (down around 2-3%), but has been lagging bitcoin significantly for two weeks…

Source: Bloomberg

Gold managed very modest gains this week, the 6th straight weekly gain for the precious metal…

Oil prices fell on the week with WTI back below $80…

NatGas fell for the 6th straight week, with Henry Hub trading at its lowest since April 2021 (bouncing off $3)…

Finally, we wonder do traders really think Jay Powell wants to see LUCID and all the worst stocks of last year (BZFD?) exploding blindly higher on the back of frontrunning The Fed’s potential for a pivot to a cut (not just a pause)…

Source: Bloomberg

Do traders really think The Fed will do that kind of pivot in the face of just a ‘soft landing’?

In fact, as Bloomberg pointed out today, the landing could be a lot harder. Analysts have pointed to diminishing pandemic stimulus cash cushions and a declining saving rate as reasons US consumers could ultimately pull back and tip the economy into recession.

Source: Bloomberg

Spending data show households did indeed cut back on purchases in the last two months of 2022. And at the same time, they started socking away more money throughout the fourth quarter, suggesting Americans may be preparing for tougher times ahead.

And the equity market is definitely not pricing in a harder-landing for the economy (no matter how quickly one believes the pivot would come).

Loading…