Authored by Ven Ram, Bloomberg cross-asset strategist,

Perhaps few other data points generate as much discussion in the run-up to their release as the non-farm payrolls.

But the report for May is unlikely to mark the start of a new tactical trading point for the markets.

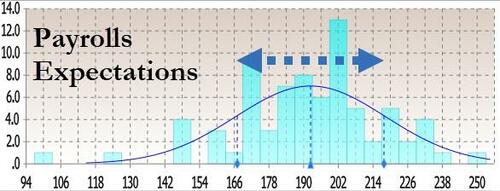

US employers expanded their payrolls by 195k, according to the median forecast, but what is perhaps more remarkable is that the scatter of opinion is the smallest we have seen since the markets convulsed in March 2020.

The low standard deviation of 25.6k perhaps defines the current narrative: conviction is high that we are still in an economy where the labor market continues to remain hot. Too hot even, from the Federal Reserve’s perspective, considering that the jobless rate is still running as low as any policymaker could wish for in the post-Bretton Woods era. We are at 3.4%, but the FOMC reckons the labor market won’t snap back into balance unless the number is higher. Higher by more than a full percentage point, and therefore this print may be far more important.

Looked against that backdrop, it would make little difference if the payrolls addition shows 100k — the lowest estimate — or even matches the most optimistic expectation of 252k.

Either of those numbers or any in between wouldn’t really tell the Fed something new.

The more important data point for the Fed would be the inflation prints for May, which are due as the central bank begins its deliberations later this month. Considering that headline inflation has slowed for 10 months on a trot, yet another reading that shows disinflation is still the theme du jour would give the Fed little incentive to raise rates.

And just Thursday, we heard from Fed St Louis President James Bullard, who remarked that “monetary policy is now at the low end of what is arguably sufficiently restrictive given current macroeconomic conditions.”

Which brings us back to non-farm payrolls data. Unless you get a shocking read-out, the Fed will go rather quietly into its quiet period that begins Saturday - and Treasury trading will reflect this.

Authored by Ven Ram, Bloomberg cross-asset strategist,

Perhaps few other data points generate as much discussion in the run-up to their release as the non-farm payrolls.

But the report for May is unlikely to mark the start of a new tactical trading point for the markets.

US employers expanded their payrolls by 195k, according to the median forecast, but what is perhaps more remarkable is that the scatter of opinion is the smallest we have seen since the markets convulsed in March 2020.

The low standard deviation of 25.6k perhaps defines the current narrative: conviction is high that we are still in an economy where the labor market continues to remain hot. Too hot even, from the Federal Reserve’s perspective, considering that the jobless rate is still running as low as any policymaker could wish for in the post-Bretton Woods era. We are at 3.4%, but the FOMC reckons the labor market won’t snap back into balance unless the number is higher. Higher by more than a full percentage point, and therefore this print may be far more important.

Looked against that backdrop, it would make little difference if the payrolls addition shows 100k — the lowest estimate — or even matches the most optimistic expectation of 252k.

Either of those numbers or any in between wouldn’t really tell the Fed something new.

The more important data point for the Fed would be the inflation prints for May, which are due as the central bank begins its deliberations later this month. Considering that headline inflation has slowed for 10 months on a trot, yet another reading that shows disinflation is still the theme du jour would give the Fed little incentive to raise rates.

And just Thursday, we heard from Fed St Louis President James Bullard, who remarked that “monetary policy is now at the low end of what is arguably sufficiently restrictive given current macroeconomic conditions.”

Which brings us back to non-farm payrolls data. Unless you get a shocking read-out, the Fed will go rather quietly into its quiet period that begins Saturday – and Treasury trading will reflect this.

Loading…