Ahead of the payrolls report, we commented that with both of the two largest banks - Goldman and JPMorgan - expecting a miss, it was only logical to expect a big beat...

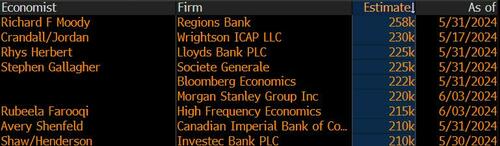

Goldman (165K) and JPM (150k) are below the median NPF estimate of 180k.

— zerohedge (@zerohedge) June 7, 2024

It will beat. pic.twitter.com/v2UxP2TBky

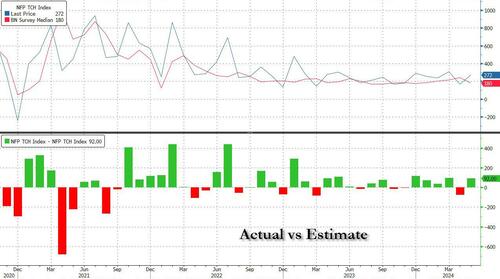

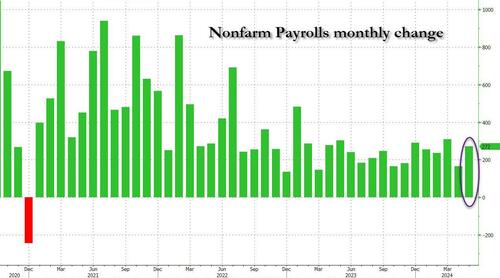

... and sure enough moments ago the BLS reported that in May, the US added a whopping 272K jobs...

... up sharply from the (downward revised of course) April print of 165K (from 175), and not only a 4-sigma beat to the 180K median estimate..

... but also above the highest Wall street estimate which was 258K courtesy of Regions Bank, and which was 14K below the actual print.

Not surprisingly historical data was - as always - revised lower: March was revised down by 5,000, from +315,000 to +310,000, and the change for April was revised down by 10,000, from +175,000 to +165,000. With these revisions, employment in March and April combined is 15,000 lower than previously reported.

developing.

Ahead of the payrolls report, we commented that with both of the two largest banks – Goldman and JPMorgan – expecting a miss, it was only logical to expect a big beat…

Goldman (165K) and JPM (150k) are below the median NPF estimate of 180k.

It will beat. pic.twitter.com/v2UxP2TBky

— zerohedge (@zerohedge) June 7, 2024

… and sure enough moments ago the BLS reported that in May, the US added a whopping 272K jobs…

… up sharply from the (downward revised of course) April print of 165K (from 175), and not only 92K…

… or 4-sigma beat to the 180K median estimate..

… but also above the highest Wall street estimate which was 258K courtesy of Regions Bank, and which was 14K below the actual print.

Not surprisingly historical data was – as always – revised lower: March was revised down by 5,000, from +315,000 to +310,000, and the change for April was revised down by 10,000, from +175,000 to +165,000. With these revisions, employment in March and April combined is 15,000 lower than previously reported.

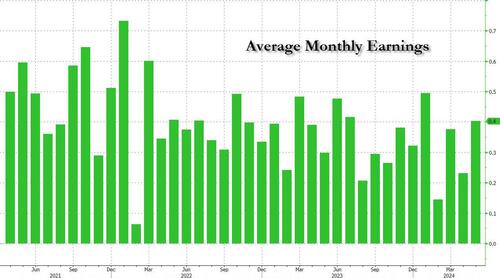

It wasn’t just the jobs that came in red hot: wages did too: in May, average hourly earnings increased by 14 cents, or 0.4 percent, to $34.91, double the April increase of 0.2% and more than the 0.3% estimate.

The increase meant that after declining every month since January, in May hourly wages actually rose on an annual basis, increasing 4.1% from the upward revised 4.0% in April, and above the 3.9% estimate. Separately, in May, average hourly earnings of private-sector production and nonsupervisory employees increased by 14 cents, or 0.5%, to $29.99.

The average workweek for all employees on private nonfarm payrolls remained at 34.3 hours in May. In manufacturing, the average workweek was unchanged at 40.1 hours, while overtime edged up to 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged up by 0.1 hour to 33.8 hours.

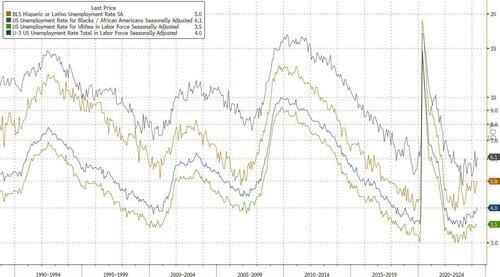

Yet not all was great: indeed, the umemployment rate unexpectedly rose to 4.0%, from 3.9% (amid expectations of an unchanged print). Among the major worker groups, the unemployment rates for adult men (3.8 percent), adult women (3.4 percent), teenagers (12.3 percent), Whites (3.5 percent), Blacks (6.1 percent), Asians (3.1 percent), and Hispanics (5.0 percent) showed little or no change in May.

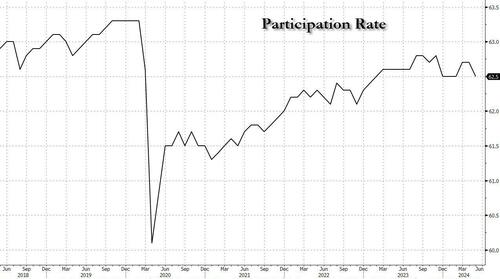

Not only that, but after recovering almost all covid-losses, the participation rate unexpectedly slumped back to 62.5% from 62.7%.

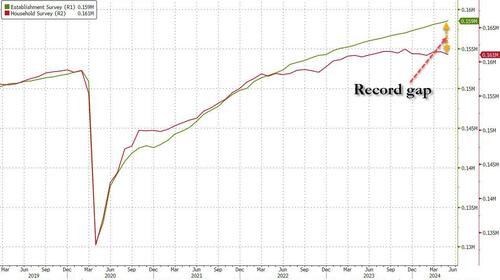

Why the increase in the unemployment rate? Because while the Establishment survey reported a red hot print, the Household Survey which is far more accurate and used to measure the unemp. rate, actually reported that the number of working Americans tumbled by a whopping 408K!

… which means that the gap between the always upward sloping (and market moving) Establishment Survey and the flatlined Household Survey, which hasnt made a new high since late 2023 and is back to where it was last summer, is now the biggest on record!

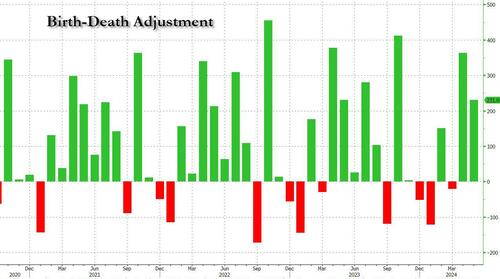

For those asking how much of the 272K number was fabricated, here is the answer: according to the BLS, Birth/Death adjustment (i.e., new business creation) added 231K jobs. These are jobs that were not actually counter but were imputed and plugged in some spreadsheet.

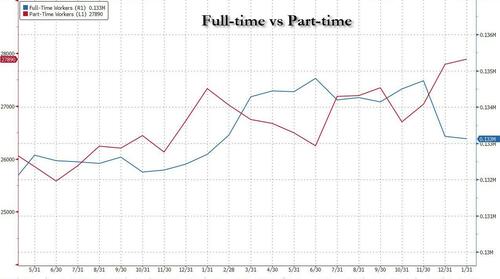

We’ll have more to say about this stunning gap shortly, but here is the punchline: in May, the number of full-time workers plunged by 625K to 133.3 million, the lowest since February 2023, while part-time workers surged by 286K to 28 million, the highest on record (more on this shortly).

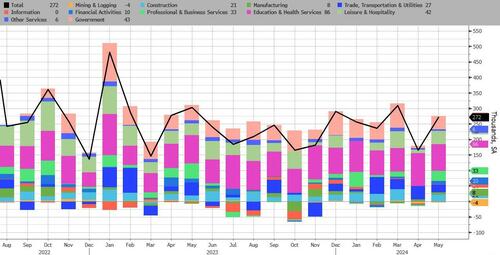

While the bulk of the jobs report was literally made up, this is how the BLS broke down the new job additions in May:

- Health care added 68,000 jobs in May, in line with the average monthly gain of 64,000 over the prior 12 months. In May, employment growth continued in ambulatory health care services (+43,000), hospitals (+15,000), and nursing and residential care facilities (+11,000).

- Government employment continued to trend up in May (+43,000), in line with the average monthly growth over the prior 12 months (+52,000).

- Employment in leisure and hospitality continued to trend up in May (+42,000), similar to the average monthly gain over the prior 12 months (+35,000). Employment in food services and drinking places continued to trend up over the month (+25,000).

- Professional, scientific, and technical services added 32,000 jobs in May, higher than the average monthly gain of 19,000 over the prior 12 months. Over the month, employment increased in management, scientific, and technical consulting services (+14,000) and in architectural, engineering, and related services (+10,000). Specialized design services lost 3,000 jobs.

- Social assistance employment continued to trend up in May (+15,000), primarily in individual and family services (+11,000).

- In May, employment in retail trade continued to trend up (+13,000), about in line with the average monthly gain over the prior 12 months (+8,000). Building material and garden equipment and supplies dealers added 12,000 jobs in May, while job losses occurred in department stores (-5,000) and furniture and home furnishings retailers (-4,000).

- Employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; transportation and warehousing; information; financial activities; and other services.

And visually:

What to make of the data? Well, we will shortly show that once again the number was brutally massaged by BLS low-level buraucrats to make Bidenomics look better than it was, but for the market’s kneejerk reaction purposes, the jobs report was too hot for comfort and with the market no longer pricing in a full rate cut before December, yields and the dollar surged, and stock, bitcoin and gold all tumbled. As Fitch economist Brian Coulton put it, “Payrolls expanding at a monthly average rate of 250k over the last 3 months does not point to much of a slowdown in labor demand. At the same time the household survey tells us that the participation rate and the labor force declined on the month. That is not the mix of news on labor supply and demand that the Fed wanted to see in order to corroborate its assessment that labor market imbalances are easing.”

Yet we would look for a reversal.

As Bloomberg notes, “the direction of travel in a weakening labor market is best indicated by the higher unemployment rate, not the payroll print. That should keep September interest rate cut squarely on the table. The higher unemployment rate, now 0.6% above the cycle low, and downward revisions to prior months’ payroll numbers tell a story of deteriorating labor market.” Indeed, the incorrectly named Sahm Rule (named after pro-Biden socialist Claudia Sahm who stole “her rule” from a Goldman economist), and which is used to calculate recession signals from an uptick in unemployment, says an increase of 0.5% in the previous 12 months gets you there. Like last month, we are now at 0.37%, dangerously close. And outside of the initial pandemic shock, the highest levels since May 2010.

Morgan Stanley, which is sticking with three Fed rate cuts for 2024, starting in September, agrees: “We think the Fed will see the rise in the unemployment rate as sign of further slackening.”

And here is Bloomberg’s Anna Wong, who four months after us, observed that the monthly jobs print is about to be revised dramatically lower:

“May’s jobs report presented contradictory views of the labor market, as we expected. The establishment survey shows robust gains in nonfarm payrolls — yet the unemployment rate rose to 4.0%. We believe the latter currently offers a closer approximation of reality than payrolls, as BLS’ model for estimating business births and deaths – which added 231,000 jobs to the nonfarm-payrolls print in May – is lagging the reality of surging establishment closures and falling business formation. We think the underlying pace of current job gains is likely less than 100,000 per month.”

Since we have been pounding the table on this for the past year, we clearly agree. And to that point, expect another analysis here shortly, showing just how ugly today’s jobs print truly was.

Loading…