Unlike yesterday, where opinions what MSFT and GOOGL would report was split down the middle between outspoken bulls and just as fervent bears (the bulls ended up getting the upper hand), today's results by META after the close should be a more subdued affair, because as JPM trader Jack Atherton writes in his preview, META is "probably the least controversial name of the tech group into earnings" and positioning reflects that: "top line accelerating, cost driven upgrade story, valuation support, etc."

As Atheron adds, investors are starting to discuss the growth sustainability story into 2024 as the next leg of upside – many hope to get more clarity on that (Reels monetization, AI ad tools, click to message, etc).

Buyside looking for Q1 revenue ~2.5% FXN (guide -5% to +4%) and Q2 guide ~3.5% FXN (midpoint). Investors are mixed on whether mgmt update the cost outlook again but there is definitely a cohort expecting another small trim to the guide (especially on $30-33b capex outlook).

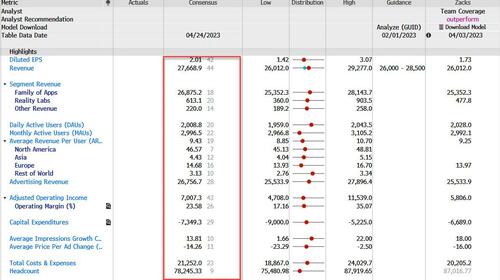

Below is a snapshot of what consensus expects today courtesy of Bloomberg:

In terms of the advertising environment, the JPM trader says that it "is in a better place than 3ms ago at Q4 earnings, suggesting there could be upside risk to Q1 ests." As such, META "remains our top pick of the group; we recently raised PT to $270 with note focused on the multiple drivers of a revenue growth acceleration (AI/ad tech, Reels, Click-to-Message, easing H2 comps).

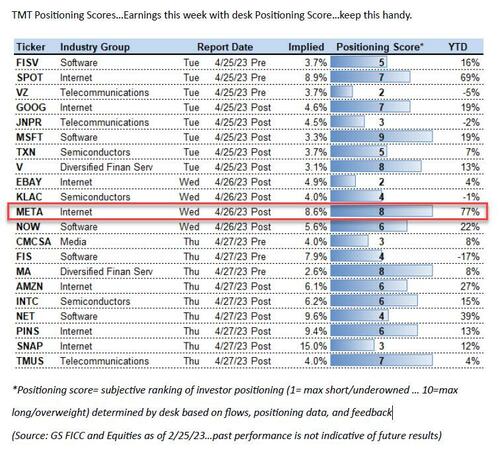

Finally, while META expectations are broadly optimistic, so is positioning which is one of the most long/overweight as the following chart of TMT positioning from Goldman shows (the positioning score= subjective ranking of investor positioning (1= max short/underowned … 10=max long/overweight) as determined by desk based on flows, positioning data, and feedback).

Unlike yesterday, where opinions what MSFT and GOOGL would report was split down the middle between outspoken bulls and just as fervent bears (the bulls ended up getting the upper hand), today’s results by META after the close should be a more subdued affair, because as JPM trader Jack Atherton writes in his preview, META is “probably the least controversial name of the tech group into earnings” and positioning reflects that: “top line accelerating, cost driven upgrade story, valuation support, etc.”

As Atheron adds, investors are starting to discuss the growth sustainability story into 2024 as the next leg of upside – many hope to get more clarity on that (Reels monetization, AI ad tools, click to message, etc).

Buyside looking for Q1 revenue ~2.5% FXN (guide -5% to +4%) and Q2 guide ~3.5% FXN (midpoint). Investors are mixed on whether mgmt update the cost outlook again but there is definitely a cohort expecting another small trim to the guide (especially on $30-33b capex outlook).

Below is a snapshot of what consensus expects today courtesy of Bloomberg:

In terms of the advertising environment, the JPM trader says that it “is in a better place than 3ms ago at Q4 earnings, suggesting there could be upside risk to Q1 ests.” As such, META “remains our top pick of the group; we recently raised PT to $270 with note focused on the multiple drivers of a revenue growth acceleration (AI/ad tech, Reels, Click-to-Message, easing H2 comps).

Finally, while META expectations are broadly optimistic, so is positioning which is one of the most long/overweight as the following chart of TMT positioning from Goldman shows (the positioning score= subjective ranking of investor positioning (1= max short/underowned … 10=max long/overweight) as determined by desk based on flows, positioning data, and feedback).

Loading…