Authored by Jeffrey Tucker via The Epoch Times,

A major intellectual revelation from my youth came from reading Murray Rothbard’s “What Has Government Done to Our Money?” (1963). He includes a passing opinion that private markets are perfectly capable of producing money with no help from government. Under a sweeping monetary reform, private mints could compete in offering this good with full associated services. There is no need for any government intervention here.

It was the kind of claim that, at some point in one’s life, causes the jaw to hit the floor. Investigating this assertion more, I came to see that there was a large literature on the topic. Historically, money originated in the market economy itself, a naturally evolving institution that met the needs of trade. Whatever good was generally valued by everyone, and was as capable of being divided into consistent units with a stable value, could be deployed as money, with no need for government to do anything but watch.

But of course history has not panned out that way. Every government has a strong incentive to monopolize the good called money because this is how they can tax their citizens, reward the most compliant industries, cultivate close relationships with bankers, and inflate the currency at will through a variety of methods depending on the technology of the time.

We can of course imagine primitive tribes or pre-colonial native populations using rocks and shells, but is there a modern case where private coinage became normalized? In a major but often overlooked work of historical scholarship, economist George Selgin has written the most extensive treatment of the private coinage industry in the UK at the dawn of the Industrial Revolution.

His book “Good Money” is beautifully produced with color photographs of some of the most alluring coins you will ever see. The historical narrative is endlessly fascinating. At the dawn of the factory system, the Royal Mint didn’t care in the slightest bit about small denomination coins of silver and copper to enable small businessmen to pay their workers. The Royal Mint only produced large denominations in gold for big business doing big trade deals.

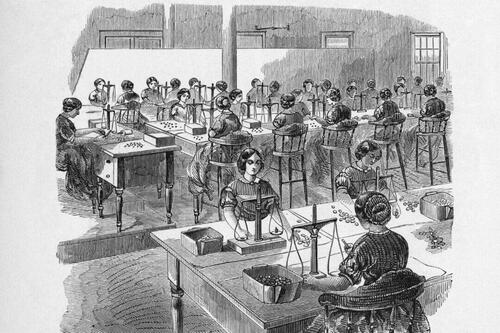

Frustrated with the inability to pay workers, the entire period from 1700 through 1813 saw the evolution of a sophisticated industry focused on coinage. Old button factories were converted to producing coins of various weights and sizes based on copper and silver. They were used to pay workers and accepted widely by merchants.

The system worked just fine and it could have continued forever. The new industry alleviated the coin shortage and yielded healthy competition among many producers of new money. It was all made to be inflation resistant and verifiable according to standard weights and measures. This was a full industry of private coinage, in operation in one of the most advanced and industrious societies in the world at the time.

Sadly, the Royal Mint eventually became upset about this. Driven by the eternal need of government to control the money in its realm, Parliament passed a series of acts in 1812–1813 to cartelize the function of the mint and make the Royal Mint the only legal producer. The entire industry was destroyed very quickly. So from this one case, we can see that the monopolization of money is not an outgrowth of market forces but imposed by government. It has always been this way.

The digital age birthed new attempts to privatize money, stemming from a very real problem of financial verification (revealed in the 2008 financial crisis) and using money without the need for intermediaries. The result was Bitcoin, which was born in January 2010. It grew in sophistication and value over the course of the year. In the following seven years, adoption exploded and incentivized the creation of new private methods of settling transactions and accepting credit cards. It was a solid competitor to nationalized money.

As in 1813, governments did not much like it. The code of Bitcoin itself was deliberately throttled to prevent the new private money from scaling, prompting a fork in the transaction chain and the birth of general chaos in the industry, even as Bitcoin itself kept growing in value. Government responded by taking control of the on-ramps, the off-ramps, all exchanges, and then put heavy taxation and reporting requirements on all dealings. Right now, the crackdown is full-on, with websites and wallets being shut down and top investors investigated and even subject to criminal trials.

As in 19th century Britain, we see here another tragic case of government intervention strangling a wonderful new industry in the interest of maintaining a monopoly on power, the first condition of which is always to control the money of the realm.

I think back to my own shock at the discovery that free enterprise was fully capable of managing money as a good. It had never occurred to me because it had always been otherwise. And yet, if you think about it, there are all sorts of conditions in which market forces invent money as a method of moving beyond primitive barter arrangements.

Every prison has its own form of money. It used to be cigarettes but now is more commonly canned fish or some other valued good. The only reason this is not common in society at large is that governments do not want it this way.

A feature of government management in modern times has been periodic reforms that always end in making the system worse. We had a government-backed gold standard in the late 19th century that was compromised by a fixed price relationship between gold and silver that was unsustainable. Then we got the Federal Reserve in 1913, with the promise that it would control inflation even as it took off soon after the Fed accommodated the need for war funding.

In 1933, we got another reform that devalued the currency from the center, changing the definition of a dollar from 1/20 an ounce of gold to 1/35 an ounce. That massive devaluation was accompanied by a nationwide gold confiscation that included criminal penalties and jail time for noncompliance. At the close of World War II, a new system called Bretton Woods forbid domestic conversion and only allowed gold for international exchange. This was completely unsustainable because every nation has different fiscal and monetary policies so of course the value of money could not be frozen in place. This led to the end of the gold standard completely in 1971–73, resulting in a disastrous inflation bout.

No question that the next great monetary reform will be to globalize a central bank digital currency with track-and-trace capability and the power to turn money on and off on political whim. In order to make this possible, government now needs to eliminate all the competition, just as they did in 1813.

None of this mucking around with the money is in the public interest. It is in the government’s interest and also its industrial partners in banking and finance. A full denationalization of money is the fix for the whole problem but getting there from here will require dislodging the government of its penchant for controlling the economic forces of the whole realm. It’s an age-old problem and perhaps the greatest challenge of all ages.

Authored by Jeffrey Tucker via The Epoch Times,

A major intellectual revelation from my youth came from reading Murray Rothbard’s “What Has Government Done to Our Money?” (1963). He includes a passing opinion that private markets are perfectly capable of producing money with no help from government. Under a sweeping monetary reform, private mints could compete in offering this good with full associated services. There is no need for any government intervention here.

It was the kind of claim that, at some point in one’s life, causes the jaw to hit the floor. Investigating this assertion more, I came to see that there was a large literature on the topic. Historically, money originated in the market economy itself, a naturally evolving institution that met the needs of trade. Whatever good was generally valued by everyone, and was as capable of being divided into consistent units with a stable value, could be deployed as money, with no need for government to do anything but watch.

But of course history has not panned out that way. Every government has a strong incentive to monopolize the good called money because this is how they can tax their citizens, reward the most compliant industries, cultivate close relationships with bankers, and inflate the currency at will through a variety of methods depending on the technology of the time.

We can of course imagine primitive tribes or pre-colonial native populations using rocks and shells, but is there a modern case where private coinage became normalized? In a major but often overlooked work of historical scholarship, economist George Selgin has written the most extensive treatment of the private coinage industry in the UK at the dawn of the Industrial Revolution.

His book “Good Money” is beautifully produced with color photographs of some of the most alluring coins you will ever see. The historical narrative is endlessly fascinating. At the dawn of the factory system, the Royal Mint didn’t care in the slightest bit about small denomination coins of silver and copper to enable small businessmen to pay their workers. The Royal Mint only produced large denominations in gold for big business doing big trade deals.

Frustrated with the inability to pay workers, the entire period from 1700 through 1813 saw the evolution of a sophisticated industry focused on coinage. Old button factories were converted to producing coins of various weights and sizes based on copper and silver. They were used to pay workers and accepted widely by merchants.

The system worked just fine and it could have continued forever. The new industry alleviated the coin shortage and yielded healthy competition among many producers of new money. It was all made to be inflation resistant and verifiable according to standard weights and measures. This was a full industry of private coinage, in operation in one of the most advanced and industrious societies in the world at the time.

Sadly, the Royal Mint eventually became upset about this. Driven by the eternal need of government to control the money in its realm, Parliament passed a series of acts in 1812–1813 to cartelize the function of the mint and make the Royal Mint the only legal producer. The entire industry was destroyed very quickly. So from this one case, we can see that the monopolization of money is not an outgrowth of market forces but imposed by government. It has always been this way.

The digital age birthed new attempts to privatize money, stemming from a very real problem of financial verification (revealed in the 2008 financial crisis) and using money without the need for intermediaries. The result was Bitcoin, which was born in January 2010. It grew in sophistication and value over the course of the year. In the following seven years, adoption exploded and incentivized the creation of new private methods of settling transactions and accepting credit cards. It was a solid competitor to nationalized money.

As in 1813, governments did not much like it. The code of Bitcoin itself was deliberately throttled to prevent the new private money from scaling, prompting a fork in the transaction chain and the birth of general chaos in the industry, even as Bitcoin itself kept growing in value. Government responded by taking control of the on-ramps, the off-ramps, all exchanges, and then put heavy taxation and reporting requirements on all dealings. Right now, the crackdown is full-on, with websites and wallets being shut down and top investors investigated and even subject to criminal trials.

As in 19th century Britain, we see here another tragic case of government intervention strangling a wonderful new industry in the interest of maintaining a monopoly on power, the first condition of which is always to control the money of the realm.

I think back to my own shock at the discovery that free enterprise was fully capable of managing money as a good. It had never occurred to me because it had always been otherwise. And yet, if you think about it, there are all sorts of conditions in which market forces invent money as a method of moving beyond primitive barter arrangements.

Every prison has its own form of money. It used to be cigarettes but now is more commonly canned fish or some other valued good. The only reason this is not common in society at large is that governments do not want it this way.

A feature of government management in modern times has been periodic reforms that always end in making the system worse. We had a government-backed gold standard in the late 19th century that was compromised by a fixed price relationship between gold and silver that was unsustainable. Then we got the Federal Reserve in 1913, with the promise that it would control inflation even as it took off soon after the Fed accommodated the need for war funding.

In 1933, we got another reform that devalued the currency from the center, changing the definition of a dollar from 1/20 an ounce of gold to 1/35 an ounce. That massive devaluation was accompanied by a nationwide gold confiscation that included criminal penalties and jail time for noncompliance. At the close of World War II, a new system called Bretton Woods forbid domestic conversion and only allowed gold for international exchange. This was completely unsustainable because every nation has different fiscal and monetary policies so of course the value of money could not be frozen in place. This led to the end of the gold standard completely in 1971–73, resulting in a disastrous inflation bout.

No question that the next great monetary reform will be to globalize a central bank digital currency with track-and-trace capability and the power to turn money on and off on political whim. In order to make this possible, government now needs to eliminate all the competition, just as they did in 1813.

None of this mucking around with the money is in the public interest. It is in the government’s interest and also its industrial partners in banking and finance. A full denationalization of money is the fix for the whole problem but getting there from here will require dislodging the government of its penchant for controlling the economic forces of the whole realm. It’s an age-old problem and perhaps the greatest challenge of all ages.

Loading…