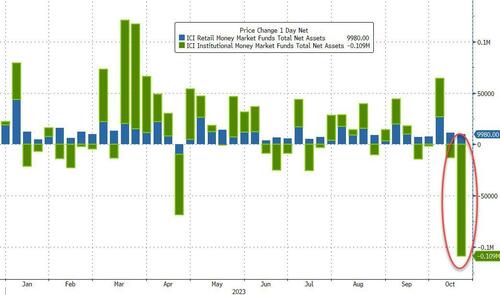

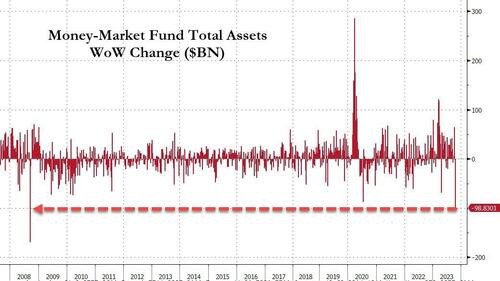

Money-market funds saw the largest weekly outflow since Lehman (Q3 2008), plunging $99BN...

Source: Bloomberg

The outflows were all from institutional funds (retail funds saw another inflow)...

Source: Bloomberg

Presumably this was driven by tax-extension deadline payments - or else something serious is happening.

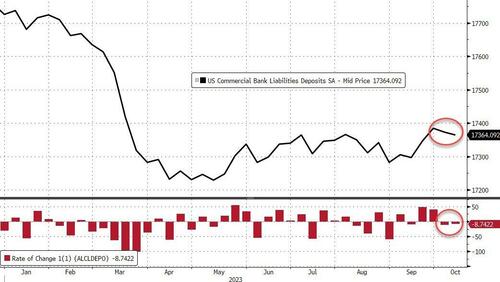

Total bank deposits - on a seasonally-adjusted basis - dropped for the second week in a row (-$$8.7BN)...

Source: Bloomberg

Non-seasonally-adjusted, total deposits saw inflows for the 3rd week in a row (+$20.6BN)...

Source: Bloomberg

Is this the start of a major reversal... or just the one-off tax flows?

Source: Bloomberg

Domestically, excluding foreign banks, there were deposit inflows on both an SA and NSA basis...

Source: Bloomberg

Which has narrowed the delta between SA and NSA deposit outflows since SVB to just $38BN (the outflows are still over $200BN total)...

Source: Bloomberg

On the other side of the ledger, bans increased their lending volumes modestly last week - after 2 weeks of shrinkage - op around $9BN...

Source: Bloomberg

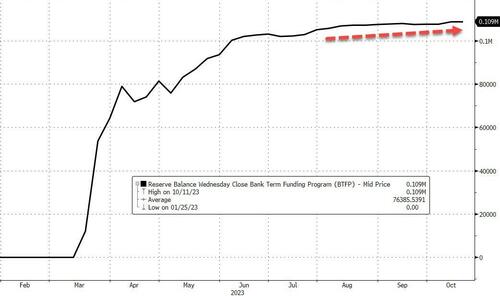

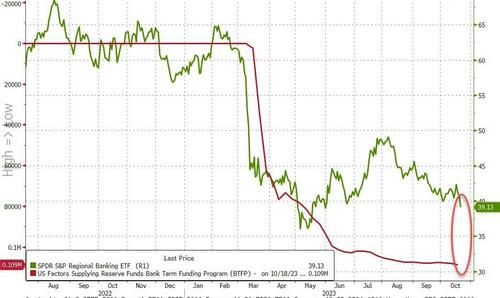

The Fed's balance sheet shrank by around $19BN last week, but usage of its emergency funding facility for banks remained at record highs around $109BN...

Source: Bloomberg

Bank reserves at The Fed and US equity market appear to be converging back together...

Source: Bloomberg

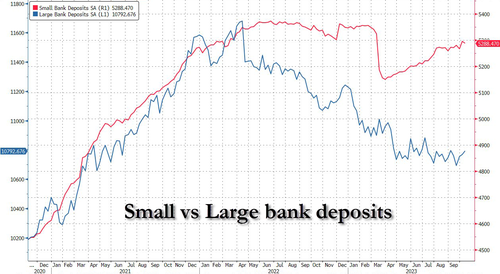

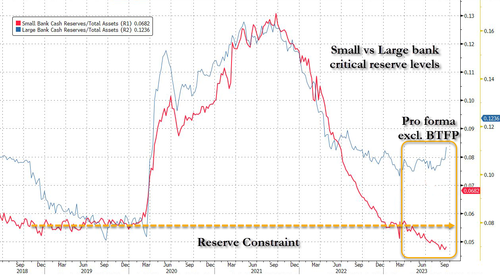

The key warning sign continues to trend lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now).

Source: Bloomberg

Notably above, Large bank cash is surging (as those money-market fund outflows move?) - is it time to sacrifice another small bank for the greater good?

Source: Bloomberg

Finally, if you're wondering why regional banks were clubbed like a baby seal this week... wonder no more...

Source: Bloomberg

They have a $109BN (at least) hole in their balance sheets that needs to be filled by March-ish...

...(and with rates going higher, good luck!)

Tl;dr:...

- QT is shrinking Fed BS.

— zerohedge (@zerohedge) October 20, 2023

- Shrinking Fed BS means commercial bank deposits have to drop.

- Since deposits (especially at small banks) refuse to drop (normally they would be reallocated to risk but high rates make that unattractive), small bank deposits will be forced to drop. pic.twitter.com/OpWwQs4x5t

Money-market funds saw the largest weekly outflow since Lehman (Q3 2008), plunging $99BN…

Source: Bloomberg

The outflows were all from institutional funds (retail funds saw another inflow)…

Source: Bloomberg

Presumably this was driven by tax-extension deadline payments – or else something serious is happening.

Total bank deposits – on a seasonally-adjusted basis – dropped for the second week in a row (-$$8.7BN)…

Source: Bloomberg

Non-seasonally-adjusted, total deposits saw inflows for the 3rd week in a row (+$20.6BN)…

Source: Bloomberg

Is this the start of a major reversal… or just the one-off tax flows?

Source: Bloomberg

Domestically, excluding foreign banks, there were deposit inflows on both an SA and NSA basis…

Source: Bloomberg

Which has narrowed the delta between SA and NSA deposit outflows since SVB to just $38BN (the outflows are still over $200BN total)…

Source: Bloomberg

On the other side of the ledger, bans increased their lending volumes modestly last week – after 2 weeks of shrinkage – op around $9BN…

Source: Bloomberg

The Fed’s balance sheet shrank by around $19BN last week, but usage of its emergency funding facility for banks remained at record highs around $109BN…

Source: Bloomberg

Bank reserves at The Fed and US equity market appear to be converging back together…

Source: Bloomberg

The key warning sign continues to trend lower (Small Banks’ reserve constraint), supported above the critical level by The Fed’s emergency funds (for now).

Source: Bloomberg

Notably above, Large bank cash is surging (as those money-market fund outflows move?) – is it time to sacrifice another small bank for the greater good?

Source: Bloomberg

Finally, if you’re wondering why regional banks were clubbed like a baby seal this week… wonder no more…

Source: Bloomberg

They have a $109BN (at least) hole in their balance sheets that needs to be filled by March-ish…

…(and with rates going higher, good luck!)

Tl;dr:…

– QT is shrinking Fed BS.

– Shrinking Fed BS means commercial bank deposits have to drop.

– Since deposits (especially at small banks) refuse to drop (normally they would be reallocated to risk but high rates make that unattractive), small bank deposits will be forced to drop. pic.twitter.com/OpWwQs4x5t— zerohedge (@zerohedge) October 20, 2023

Loading…