As the market looks to scrutinize companies far more closely, thanks to the worsening macroeconomic environment, Morgan Stanley was out with a new note last week discussing the valuation impact of stock based compensation and which companies had the most exposure.

The note asks whether or not stock based compensation should be treated as a "real" cash expense due to companies potentially needing to issue more stock and equity grants as a way to retain talent.

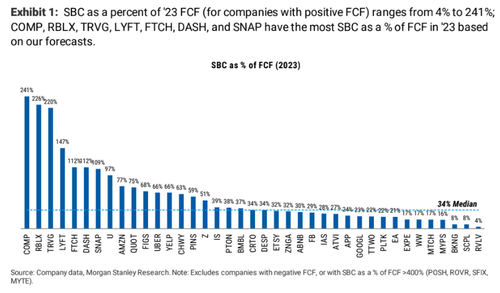

To better help clients understand the issue, the bank provided several analyses looking at the theoretical impact of treating SBC as real cash. The note first pointed out that, on average, SBC represents about 34% of industry FCF for positive FCF companies.

The note shows annual SBC as a percentage of 2023 FCF across 39 companies, to show who is most reliant on the practice and where the risk may lie. Topping the list is COMP, RBLX, REVG and LYFT:

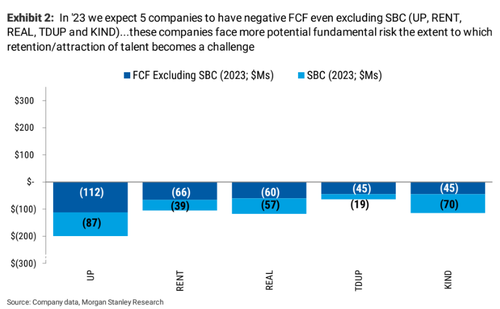

Additionally, the note points out that five names it examined were expected to have negative FCF even excluding SBC:

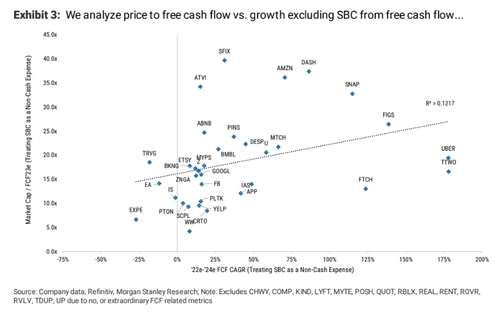

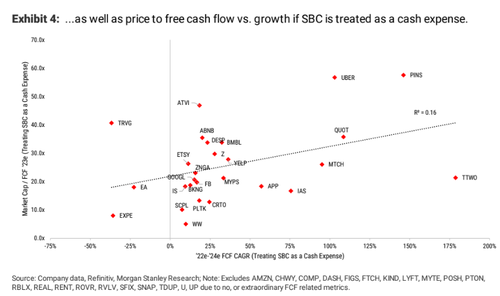

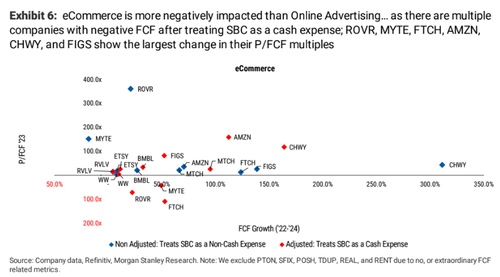

It also looked at each company's current price to FCF excluding SBC and treating it as a cash expensive. Names like AMZN, CHWY, FIGS, PINS, QUOT, ATVI, TRVG and DESP were all impacted.

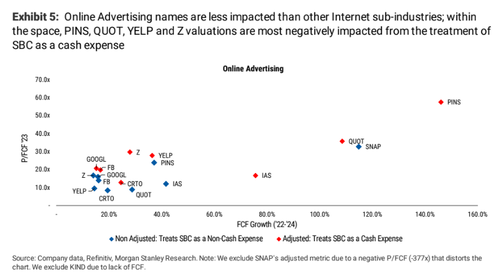

The note found that online advertising and eCommerce were both negatively impacted:

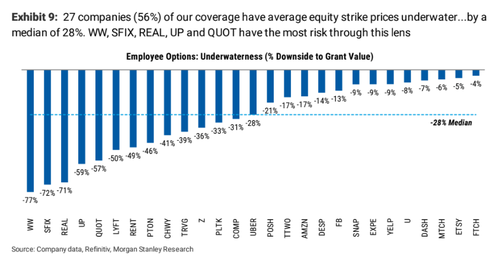

And finally, it identified which company had the most underwater non-cash equity based awards. MS found that 27 companies it tracks have average equity strike prices underwater by a median of 28%. Names like PTON, LYFT, CHWY, Z and UBER were all at the median, or below it.

"Market volatility/talent competition are raising concerns whether SBC should be viewed as cash," the note, published late last week, said.

"Part of this is likely cyclical (see prior cycles) but we're not dismissive. We analyze where FCF and valuation would be most impacted with SBC as cash and which companies' grants are most under-water."

While the note says that these concerns are likely just heightened and temporary, it says that "many investors only focus this much on SBC as a cash expense on the way down".

As the market looks to scrutinize companies far more closely, thanks to the worsening macroeconomic environment, Morgan Stanley was out with a new note last week discussing the valuation impact of stock based compensation and which companies had the most exposure.

The note asks whether or not stock based compensation should be treated as a “real” cash expense due to companies potentially needing to issue more stock and equity grants as a way to retain talent.

To better help clients understand the issue, the bank provided several analyses looking at the theoretical impact of treating SBC as real cash. The note first pointed out that, on average, SBC represents about 34% of industry FCF for positive FCF companies.

The note shows annual SBC as a percentage of 2023 FCF across 39 companies, to show who is most reliant on the practice and where the risk may lie. Topping the list is COMP, RBLX, REVG and LYFT:

Additionally, the note points out that five names it examined were expected to have negative FCF even excluding SBC:

It also looked at each company’s current price to FCF excluding SBC and treating it as a cash expensive. Names like AMZN, CHWY, FIGS, PINS, QUOT, ATVI, TRVG and DESP were all impacted.

The note found that online advertising and eCommerce were both negatively impacted:

And finally, it identified which company had the most underwater non-cash equity based awards. MS found that 27 companies it tracks have average equity strike prices underwater by a median of 28%. Names like PTON, LYFT, CHWY, Z and UBER were all at the median, or below it.

“Market volatility/talent competition are raising concerns whether SBC should be viewed as cash,” the note, published late last week, said.

“Part of this is likely cyclical (see prior cycles) but we’re not dismissive. We analyze where FCF and valuation would be most impacted with SBC as cash and which companies’ grants are most under-water.”

While the note says that these concerns are likely just heightened and temporary, it says that “many investors only focus this much on SBC as a cash expense on the way down”.