The US and China have been locked in a five-year trade war. Lawmakers in Washington have been touting the economic "decoupling" of the world's two biggest economies, but that has not yet happened.

It's unclear if a full decoupling is even achievable. Western countries urge corporations to rejigger supply chains from China to other "friendlier" countries like India, Indonesia, Thailand, and Mexico.

However, there's one problem: even if firms relocate their manufacturing base to other countries, components are still sourced from China. The reality of achieving full decoupling appears more challenging and complex than once thought (and costlier).

Morgan Stanley's global director of research Katy Huberty told clients earlier this week that a complete "re-wiring" of the EV battery supply chain out of China would require a $7 trillion investment by the West through 2040.

In a separate Morgan Stanley report earlier this month, a team of strategists revealed:

The reality is that a complete decoupling of the US economy from China is neither possible nor desirable. It will take many years to shift the supply chain, and the US will remain dependent on China in many areas. However, investing in the technology sector now requires a change in thinking to navigate the economic implications of multi-polarization. Investors need to consider the broad investment themes associated with geopolitical risks rather than just taking a bottom-up view.

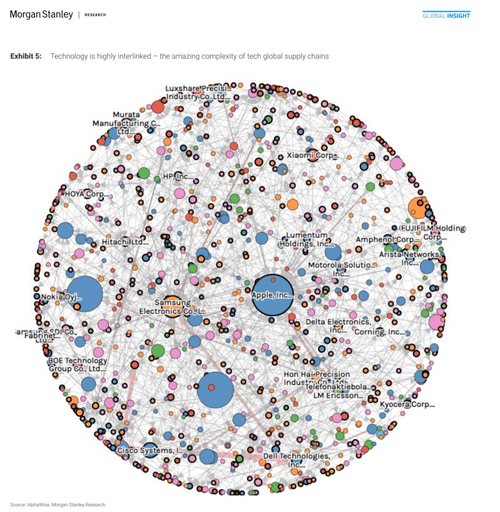

With that understanding, the analysts provided a breathtaking view of how the world's technology companies are interlinked. A full decoupling of China and the US is only possible if a war over Taiwan occurs. If that happens, global supply chains will crash overnight, essentially a reset.

More recently, Jay Shambaugh, Treasury Undersecretary for International Affairs, told Bloomberg Television the US isn't seeking to decouple its economy from China or limit the country's growth:

"We occasionally have issues with different economic policies in China and we will always defend US economic interests as well — but we will not in any way be trying to separate these two economies entirely.

Even though relations between US and China have deteriorated sharply in recent years, a full decoupling is impossible at the moment, and if the West were to friendshore and reshore supply chains, it would take decades and trillions of dollars.

So the whole decoupling narrative in the near term is unrealistic, given the chart we shared above. The only thing the West can do is reduce reliance on China and hope Beijing doesn't invade Taiwan anytime soon.

The US and China have been locked in a five-year trade war. Lawmakers in Washington have been touting the economic “decoupling” of the world’s two biggest economies, but that has not yet happened.

It’s unclear if a full decoupling is even achievable. Western countries urge corporations to rejigger supply chains from China to other “friendlier” countries like India, Indonesia, Thailand, and Mexico.

However, there’s one problem: even if firms relocate their manufacturing base to other countries, components are still sourced from China. The reality of achieving full decoupling appears more challenging and complex than once thought (and costlier).

Morgan Stanley’s global director of research Katy Huberty told clients earlier this week that a complete “re-wiring” of the EV battery supply chain out of China would require a $7 trillion investment by the West through 2040.

In a separate Morgan Stanley report earlier this month, a team of strategists revealed:

The reality is that a complete decoupling of the US economy from China is neither possible nor desirable. It will take many years to shift the supply chain, and the US will remain dependent on China in many areas. However, investing in the technology sector now requires a change in thinking to navigate the economic implications of multi-polarization. Investors need to consider the broad investment themes associated with geopolitical risks rather than just taking a bottom-up view.

With that understanding, the analysts provided a breathtaking view of how the world’s technology companies are interlinked. A full decoupling of China and the US is only possible if a war over Taiwan occurs. If that happens, global supply chains will crash overnight, essentially a reset.

More recently, Jay Shambaugh, Treasury Undersecretary for International Affairs, told Bloomberg Television the US isn’t seeking to decouple its economy from China or limit the country’s growth:

“We occasionally have issues with different economic policies in China and we will always defend US economic interests as well — but we will not in any way be trying to separate these two economies entirely.

Even though relations between US and China have deteriorated sharply in recent years, a full decoupling is impossible at the moment, and if the West were to friendshore and reshore supply chains, it would take decades and trillions of dollars.

So the whole decoupling narrative in the near term is unrealistic, given the chart we shared above. The only thing the West can do is reduce reliance on China and hope Beijing doesn’t invade Taiwan anytime soon.

Loading…