By Vishwanath Tirupattur of Morgan Stanley

Our 2023 Outlook – What We Debated

This has been our outlook week. We published our year-ahead global economics and strategy outlooks last Sunday, and the more detailed asset class and country-specific outlooks have been streaming out during the week, with more to follow. At Morgan Stanley Research, the outlooks are the culmination of a process involving much deliberation and spirited debate among economists and strategists across all the regions and asset classes we cover. In a highly interconnected world with myriad uncertainties, we are convinced that this collaborative exercise in which we challenge each other’s views is critically important. In last week’s Sunday Start, my colleague Andrew Sheets summarized the outcome of the process – our outlook for 2023 across markets and economies. This week, I will focus on some of the key debates we engaged in during the process.

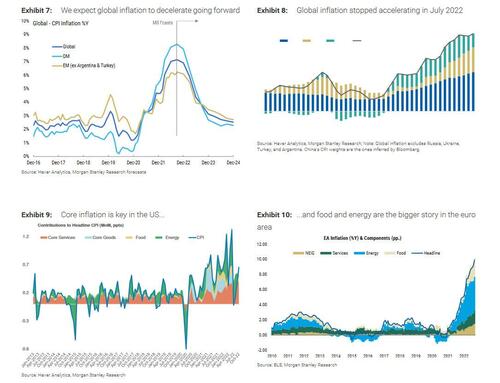

Unsurprisingly, we spent a lot of time on inflation. Given the many upside surprises to inflation through much of the year, there was understandable skepticism around our forecast that US inflation will show a steady decline. Our economists acknowledged the uncertainty but took some comfort in base effects, normalizing supply chains, and weaker labor markets. They also saw deflation (not just disinflation) in certain core goods such as autos and a reset in medical services prices exerting a steady drag on core inflation. To be clear, our US inflation forecast takes into account that while shelter inflation will slow, it will remain a persistent driver of above-target inflation for a few more quarters.

Our FX strategists changed their bullish stance on USD to neutral, a notably out-of-consensus call. With our outlook debates taking place against the background of a hawkish-sounding post-FOMC press conference at which the Fed chair signaled the policy rate peaking higher than previously thought, this change was vigorously debated. Our strategists argued that a decline in inflation as our economists forecast would limit upside potential for US rates. Furthermore, monetary policy in the US is now in restrictive territory, implying that we will see more downside surprises in individual data points. Also, the outlook for China, while still challenging, appears to be shifting, with a decent chance that the authorities take steps toward ending the Covid-zero policy. This would help to bring greater balance to the global economy, with less upward pressure on the dollar.

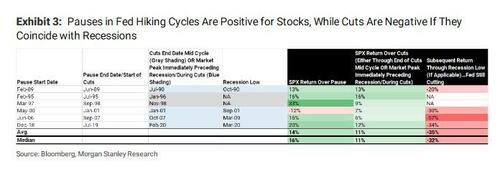

Our economists’ base case expectation that the Fed will stop hiking in January led to a discussion of how markets would behave following the end of a hiking cycle. In some cases, the end of a hiking cycle was good for markets over the following 12 months (February 1995) but not in others (May 2000). We noted that the key to the outcome for markets seems to be whether a recession follows the end of a hiking cycle.

While our forecast for the US is a 'soft landing' (no recession), our economists pointed out that the landing won’t feel all that soft and the margin for error is small. This makes the risk/reward for US stocks challenging. It is worth highlighting that in both 1995 and 2000 the 10-year US Treasury yield rallied, consistent with what our rates strategists expect by the end of 2023.

There was debate around why we only see high yield default rates rising to 'long-term average' levels (4-4.5%), given slower growth and higher borrowing costs. Our credit strategists contended that the modest maturity walls over the next two years, cash on balance sheets, and healthy coverage and leverage ratios will mitigate near-term default pressures. However, they did note the potential for a longer default cycle, as maturities start to matter more in 2024.

Another topic of discussion was our housing strategists’ view that US housing will experience a significant decline in activity (sales, starts, and permits) comparable to the steep declines seen in the aftermath of the GFC, yet only a modest drop in home prices, unlike what we saw post-GFC. The divergence in activity and prices is rooted in the prospect of much lower forced sales through foreclosures due to tight mortgage lending standards post-GFC, the substantial equity in many existing homes, and the lock-in effect of existing mortgages.

The future of the Fed’s quantitative tightening (QT) was also much debated, particularly when it might end and its sequencing with a rate cut. History is really no guide here since we only have one data point to go by. As our chief global economist Seth Carpenter noted, the Fed sees the two policy tools as independent, and stopping QT depends on money market conditions and bank demand for reserves. Thus, QT could end before or after December 2023, when we anticipate gradual rate normalization to start. That said, QT could stop abruptly for two reasons:

- A recession that forces the Fed to contemplate rate cuts of 100bp or more; or

- Dysfunctional markets along the lines of March 2020 or the recent episode in the gilt market.

More in the full note available to pro subscribers.

By Vishwanath Tirupattur of Morgan Stanley

Our 2023 Outlook – What We Debated

This has been our outlook week. We published our year-ahead global economics and strategy outlooks last Sunday, and the more detailed asset class and country-specific outlooks have been streaming out during the week, with more to follow. At Morgan Stanley Research, the outlooks are the culmination of a process involving much deliberation and spirited debate among economists and strategists across all the regions and asset classes we cover. In a highly interconnected world with myriad uncertainties, we are convinced that this collaborative exercise in which we challenge each other’s views is critically important. In last week’s Sunday Start, my colleague Andrew Sheets summarized the outcome of the process – our outlook for 2023 across markets and economies. This week, I will focus on some of the key debates we engaged in during the process.

Unsurprisingly, we spent a lot of time on inflation. Given the many upside surprises to inflation through much of the year, there was understandable skepticism around our forecast that US inflation will show a steady decline. Our economists acknowledged the uncertainty but took some comfort in base effects, normalizing supply chains, and weaker labor markets. They also saw deflation (not just disinflation) in certain core goods such as autos and a reset in medical services prices exerting a steady drag on core inflation. To be clear, our US inflation forecast takes into account that while shelter inflation will slow, it will remain a persistent driver of above-target inflation for a few more quarters.

Our FX strategists changed their bullish stance on USD to neutral, a notably out-of-consensus call. With our outlook debates taking place against the background of a hawkish-sounding post-FOMC press conference at which the Fed chair signaled the policy rate peaking higher than previously thought, this change was vigorously debated. Our strategists argued that a decline in inflation as our economists forecast would limit upside potential for US rates. Furthermore, monetary policy in the US is now in restrictive territory, implying that we will see more downside surprises in individual data points. Also, the outlook for China, while still challenging, appears to be shifting, with a decent chance that the authorities take steps toward ending the Covid-zero policy. This would help to bring greater balance to the global economy, with less upward pressure on the dollar.

Our economists’ base case expectation that the Fed will stop hiking in January led to a discussion of how markets would behave following the end of a hiking cycle. In some cases, the end of a hiking cycle was good for markets over the following 12 months (February 1995) but not in others (May 2000). We noted that the key to the outcome for markets seems to be whether a recession follows the end of a hiking cycle.

While our forecast for the US is a ‘soft landing’ (no recession), our economists pointed out that the landing won’t feel all that soft and the margin for error is small. This makes the risk/reward for US stocks challenging. It is worth highlighting that in both 1995 and 2000 the 10-year US Treasury yield rallied, consistent with what our rates strategists expect by the end of 2023.

There was debate around why we only see high yield default rates rising to ‘long-term average’ levels (4-4.5%), given slower growth and higher borrowing costs. Our credit strategists contended that the modest maturity walls over the next two years, cash on balance sheets, and healthy coverage and leverage ratios will mitigate near-term default pressures. However, they did note the potential for a longer default cycle, as maturities start to matter more in 2024.

Another topic of discussion was our housing strategists’ view that US housing will experience a significant decline in activity (sales, starts, and permits) comparable to the steep declines seen in the aftermath of the GFC, yet only a modest drop in home prices, unlike what we saw post-GFC. The divergence in activity and prices is rooted in the prospect of much lower forced sales through foreclosures due to tight mortgage lending standards post-GFC, the substantial equity in many existing homes, and the lock-in effect of existing mortgages.

The future of the Fed’s quantitative tightening (QT) was also much debated, particularly when it might end and its sequencing with a rate cut. History is really no guide here since we only have one data point to go by. As our chief global economist Seth Carpenter noted, the Fed sees the two policy tools as independent, and stopping QT depends on money market conditions and bank demand for reserves. Thus, QT could end before or after December 2023, when we anticipate gradual rate normalization to start. That said, QT could stop abruptly for two reasons:

- A recession that forces the Fed to contemplate rate cuts of 100bp or more; or

- Dysfunctional markets along the lines of March 2020 or the recent episode in the gilt market.

More in the full note available to pro subscribers.