By Ye Xie, Bloomberg Markets Live commentator and reporter

1. China’s mortgage-boycott problem is still growing. More homebuyers halted payments on unfinished apartments, affecting at least 319 projects, up from 235 a week ago, according to Capital Economics. By all accounts, the situation is still manageable. Most economists estimate that the affected loans make up about 1%-2% of China’s $5.8 trillion in mortgages.

But the problem is that Beijing has yet to break the vicious circle in the housing market. The boycotts undermine confidence of new homebuyers, which reduces the cash flow of troubled developers and causes more of the type of construction delays that motivated the boycotts in the first place.

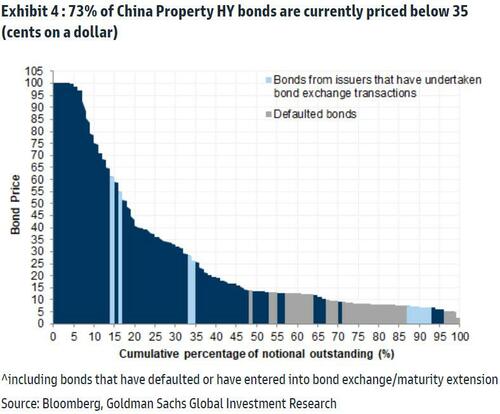

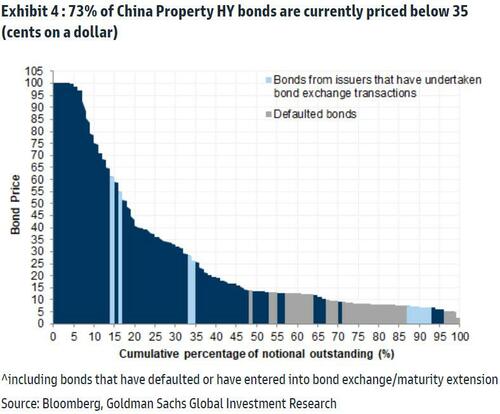

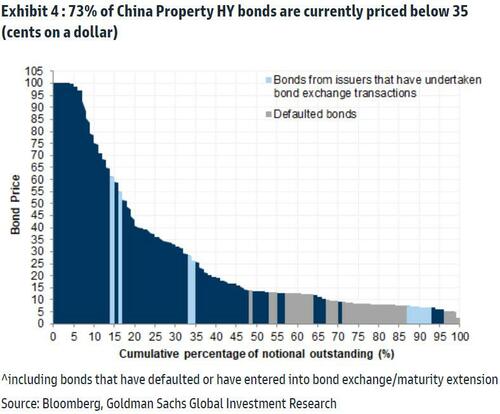

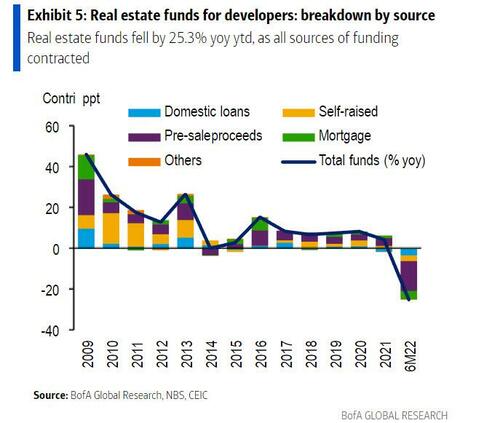

Already, the top 100 private developers, which account for more than a third of the projects under construction, are experiencing liquidity risks, according to Goldman Sachs. Reflecting this risk, about 73% of China’s high-yield property bonds are trading below 35 cents on the dollar, a level deemed as distressed by Goldman’s analysts. Left unsolved, it could quickly create problems in the banking system.

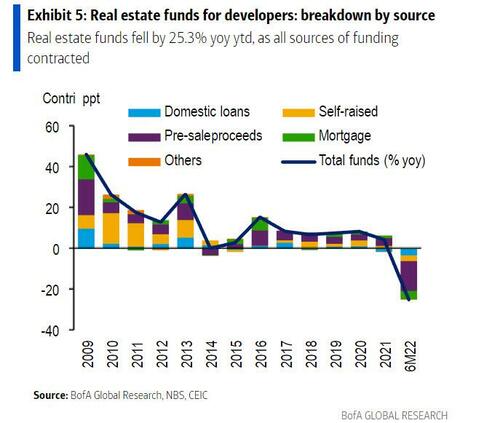

What’s the solution? Policy makers are considering remedies, including allowing a grace period for mortgage payments of affected homeowners. Bank of America’s economists led by Helen Qiao expect local governments and state-owned enterprises to step in to complete the unfinished projects. But they also warn that it may take time to resolve the issue, and governments of lower-tier cities may not have sufficient funds to come to the rescue.

2. The housing troubles and sporadic Covid outbreaks took momentum out of the economic rebound. The consensus 2022 GDP forecast in a Bloomberg survey has declined to 4%, and a number of economists, including at Bloomberg Economics, only see a growth rate of 3%. The outperformance of Chinese stocks since last month also has faded.

In response to the latest housing drama, the PBOC kept liquidity abundant, with interbank borrowing costs dropping below 1.5% for the first time since December 2020. Meanwhile, traders took advantage of the cheap funding to build leverage in the bond market, sending the overnight repo trading volume to records almost on a daily basis.

3. Recession risks keep rising as central banks tighten monetary policy. A survey of purchasing managers by S&P Global on Friday showed activities in both the euro zone and US contracted. The ECB ended eight years of negative interest rates with a 50bp hike last week. The Fed is expected to raise rates by 75 bps this week for a second consecutive meeting. But traders are betting that the Fed will slow down the rate increases afterward and wrap the tightening campaign by December.

By Ye Xie, Bloomberg Markets Live commentator and reporter

1. China’s mortgage-boycott problem is still growing. More homebuyers halted payments on unfinished apartments, affecting at least 319 projects, up from 235 a week ago, according to Capital Economics. By all accounts, the situation is still manageable. Most economists estimate that the affected loans make up about 1%-2% of China’s $5.8 trillion in mortgages.

But the problem is that Beijing has yet to break the vicious circle in the housing market. The boycotts undermine confidence of new homebuyers, which reduces the cash flow of troubled developers and causes more of the type of construction delays that motivated the boycotts in the first place.

Already, the top 100 private developers, which account for more than a third of the projects under construction, are experiencing liquidity risks, according to Goldman Sachs. Reflecting this risk, about 73% of China’s high-yield property bonds are trading below 35 cents on the dollar, a level deemed as distressed by Goldman’s analysts. Left unsolved, it could quickly create problems in the banking system.

What’s the solution? Policy makers are considering remedies, including allowing a grace period for mortgage payments of affected homeowners. Bank of America’s economists led by Helen Qiao expect local governments and state-owned enterprises to step in to complete the unfinished projects. But they also warn that it may take time to resolve the issue, and governments of lower-tier cities may not have sufficient funds to come to the rescue.

2. The housing troubles and sporadic Covid outbreaks took momentum out of the economic rebound. The consensus 2022 GDP forecast in a Bloomberg survey has declined to 4%, and a number of economists, including at Bloomberg Economics, only see a growth rate of 3%. The outperformance of Chinese stocks since last month also has faded.

In response to the latest housing drama, the PBOC kept liquidity abundant, with interbank borrowing costs dropping below 1.5% for the first time since December 2020. Meanwhile, traders took advantage of the cheap funding to build leverage in the bond market, sending the overnight repo trading volume to records almost on a daily basis.

3. Recession risks keep rising as central banks tighten monetary policy. A survey of purchasing managers by S&P Global on Friday showed activities in both the euro zone and US contracted. The ECB ended eight years of negative interest rates with a 50bp hike last week. The Fed is expected to raise rates by 75 bps this week for a second consecutive meeting. But traders are betting that the Fed will slow down the rate increases afterward and wrap the tightening campaign by December.