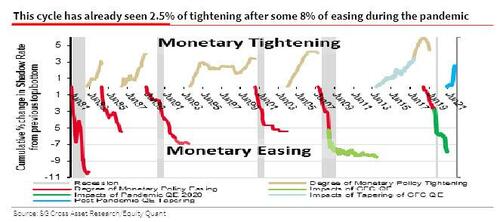

One month ago, we cited from a stunning report by Nomura quant Solomon Tadesse, who calculated that the peak of the Fed Funds in the current tightening cycle would be just below 1.0% - or just 1 more rate hike away - before the Fed is forced to reverse, as the Fed has already unleashed some 2.5% of implicit tightening in the current cycle after tightening 8% during the pandemic:

Needless to say with market consensus expecting rates to rise as high as 3% before the Fed starts cutting around the next recession, if Solomon is right that the Fed will struggle to raise FFR to 1% or above, this is a huge divergence with consensus. One can see clearly in Solomon’s chart below how the recent 250bp Shadow FFR hike compares to the cumulative easing and tightening in previous Fed cycles:

Fast forward to today when in a Medium essay by Minneapolis Fed Neel Kashkari titled "Policy Has Tightened a Lot. Is It Enough?", the former PIMCO and Goldman reaches a conclusion, which while not nearly as aggressive as Tadesse, is still notable: according to Kashkari the Neutral rate is 2% (we actually agree with this), which means that the Fed has at most a little over 1% in hikes left in the tank before it has to reverse. To wit:

"We cannot observe the neutral funds rate directly; we can only estimate it. My own estimate of the nominal neutral funds rate is 2.0 percent, and the range of estimates in the most recent SEP among FOMC participants is from 2.0 percent to 3.0 percent."

Considering that consensus among rates traders is for another 12 or so rate hikes, and some analysts on Wall Street have suggested that the Fed will have to keep hiking until it hits 5% (or even 8% in some idiotic predictions), Kashkari's dovish forecast was enough to put in a low to stocks for the day.

One month ago, we cited from a stunning report by Nomura quant Solomon Tadesse, who calculated that the peak of the Fed Funds in the current tightening cycle would be just below 1.0% – or just 1 more rate hike away – before the Fed is forced to reverse, as the Fed has already unleashed some 2.5% of implicit tightening in the current cycle after tightening 8% during the pandemic:

Needless to say with market consensus expecting rates to rise as high as 3% before the Fed starts cutting around the next recession, if Solomon is right that the Fed will struggle to raise FFR to 1% or above, this is a huge divergence with consensus. One can see clearly in Solomon’s chart below how the recent 250bp Shadow FFR hike compares to the cumulative easing and tightening in previous Fed cycles:

Fast forward to today when in a Medium essay by Minneapolis Fed Neel Kashkari titled “Policy Has Tightened a Lot. Is It Enough?”, the former PIMCO and Goldman reaches a conclusion, which while not nearly as aggressive as Tadesse, is still notable: according to Kashkari the Neutral rate is 2% (we actually agree with this), which means that the Fed has at most a little over 1% in hikes left in the tank before it has to reverse. To wit:

“We cannot observe the neutral funds rate directly; we can only estimate it. My own estimate of the nominal neutral funds rate is 2.0 percent, and the range of estimates in the most recent SEP among FOMC participants is from 2.0 percent to 3.0 percent.”

Considering that consensus among rates traders is for another 12 or so rate hikes, and some analysts on Wall Street have suggested that the Fed will have to keep hiking until it hits 5% (or even 8% in some idiotic predictions), Kashkari’s dovish forecast was enough to put in a low to stocks for the day.