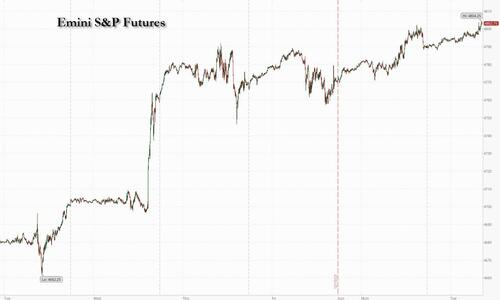

S&P futures continue their seasonal year-end meltup following 0.3% gain in Estoxx 50 where utilities and industrials outperform and a surge in Japanese stocks where the BOJ "shocked" market by doing nothing at all. As of 8:00am ET, S&P and Nasdaq 100 futures were up 0.2%, set for a third consecutive record high. Europe's Stoxx 600 index rose 0.3%, with Switzerland’s UBS AG rising as much as 2.8% after Cevian Capital AB took a €1.2 billion ($1.3 billion) stake. The yen plunged as much as 1.5% to a one-week low against the dollar, while the Nikkei 225 equity index rallied after the BOJ held its policy rate at -0.10% denying laughable speculation of an imminent rate hike. 10-year yields slipped about two basis points, the dollar slipped and bitcoin gained, while WTI futures were little change on the day despite growing paralysis of Red Sea transit.

In premarket trading, cryptocurrency-exposed stocks rise as Bitcoin extends gains into a second session, rising above the $43,000 level. Here are some other notable movers:

- Accenture falls 1.7% after the consulting firm issued a weaker-than-expected revenue outlook for the current quarter. .

- American International Group rises 1.4% after BMO Capital Markets raises its recommendation to outperform from market perform, as lower protection limits and more reinsurance protection lift worries over reserves, analyst Michael Zaremski writes in a report.

- Chewy rises 3.8% while Bark falls 1.4% as Jefferies initiated coverage of US pet stocks, rating Chewy and PetIQ at buy, with Freshpet, Bark, and Petco at hold.

- Kenvue rises 5.1% after a court ruled in favor of the company in a class action lawsuit involving Tylenol. However, Bloomberg Intelligence notes that the company’s legal risk wouldn’t be completely gone with this update.

The big news overnight was the "shocking" lack of action by the BOJ which had ginned up tons of excitement through media leaks and jawboning that it was about to hike rates. It didn't, and as a result the yen tumbled as much as 1.5% after policymakers did not unveil any groundwork to move away from sub-zero rates, while BOJ governor Kazuo Ueda pushed back against expectations on policy tightening as soon as January.

The BOJ has been an outlier, having failed to even start tightening policy, even as peers in the US and Europe appear set to wind down their rate-hike cycles. Its meeting follows an apparently dovish pivot from the Federal Reserve last week, which got markets wagering US and European rate cuts will start next year.

“The BOJ stance encouraged speculators to sell the yen, and there’s relief that yields in Japan aren’t likely to to to jump higher,” said Lee Hardman, a strategist at MUFG Bank Ltd. “That takes some of downside risk away for other major global bond markets as well.”

Expectation about policy easing by the FED are making investors the most optimistic since the beginning of 2022, according to a Bank of America Corp. survey. Still, several policymakers in Europe and the US have tried to push back against such bets. Chicago Fed President Austan Goolsbee and the Cleveland Fed’s Loretta Mester suggested on Monday, the expectations were premature. Atlanta Fed President Raphael Bostic will speak later Tuesday. While Treasury markets had paused Monday after the Fed officials’ comments, Hardman said “ultimately the market is looking through those comments because they only really have credibility if the data backs them up.”

Whether equities and bonds continue their rallies might be determined by near-term data readouts including durable goods orders, personal consumption expenditures — the Fed’s preferred measure of inflation — and the final third quarter gross domestic product estimate.

European stocks edged higher, with the Stoxx 600 adding 0.3%. The travel & leisure and basic resources the best-performing sub-indexes on the regional Stoxx 600 benchmark, while the automotive sector underperforms. UBS rose as much as 2.8% after activitst investor Cevian Capital AB took a €1.2 billion ($1.3 billion) stake, making it a top 10 stakeholder. Shares in shipping companies such A.P Moller-Maersk A/S and Hapag-Lloyd AG eased after surging for four sessions in a row as US Defense Secretary Lloyd Austin announced the creation of a task force to protect commercial vessels traveling through the area. Here are the biggest movers Tuesday:

- Stora Enso rises as much as 3.6% as DNB Markets upgrades its rating on the Finnish paper and packaging company to buy from hold and says it sees “good reason” to become more positive

- UBS shares climb as much as 2.7%, on track for the highest closing level since 2008, after activist investor Cevian took a €1.2 billion stake in the Swiss bank

- Thyssenkrupp Nucera rises as much as 16%, extending gains into a fourth session, as investors continued to digest the news from yesterday’s annual results, the first since its IPO

- TomTom gains as much as 5.7% after the Dutch navigation device maker announced a partnership with Microsoft to bring the benefits of generative AI to the automotive industry

- Barco rises as much as 5.2%, the most since February, after the Belgian technology company announced a program to repurchase a maximum of 2 million shares

- Duerr gains as much as 2.6% after losing its only negative analyst rating as BNP Paribas Exane upgrades the machine maker to neutral from underperform due to limited downside from here

- Superdry shares slump as much as 33%, hitting a record low, after the apparel retailer said its FY24 trading has been hit by a tough environment, with Peel Hunt slashing its price target

- Bachem falls as much as 8.6% after Citi warned its checks suggest the expansion of the firm’s Building K manufacturing facility is potentially delayed, posing a risk to consensus forecasts

- Hipgnosis Songs Fund falls as much as 3.3% delayed publishing its interim results. Jefferies said this is a setback for shareholders in attempting to resolve the fund’s “myriad of issues”

- Richemont falls as much as 1.4%, with Barclays saying the termination of the Farfetch deal, causing a €218 million writedown, may add to negative sentiment

Earlier in the session, Asian stocks were mixed, with Hong Kong-listed shares a drag while Japanese names climbed after the domestic central bank kept interest rates unchanged at its last policy meeting for 2023. The MSCI Asia Pacific Index swung between a 0.2% gain and a loss of 0.3%, with Meituan and TSMC among the main laggards. Japanese benchmarks moved sharply higher after the Bank of Japan stuck with the world’s last negative interest rate Tuesday, and left forward guidance unchanged.

“Export stocks, especially in the auto sector, which had recently been sold off, are likely to be repurchased for the time being,” said Rina Oshimo, senior strategist at Okasan Securities. Still, “there is no change in the perception that the BOJ is preparing for a modification of the easing policy,” she added. By contrast, gauges in Hong Kong were among the worst performers in the region as investors sold property shares on continued worries about the health of the sector into the next year. Country Garden Services hit a record low after it said it set aside some funds as impairment.

- Hang Seng and Shanghai Comp were softer throughout the session with the former dragged lower once again by its property sector, whilst the latter saw its losses cushioned by another sizeable liquidity injection via 7-day and 14-day reverse repos.

- Japan's Nikkei 225 was subdued at the start of the session but later shot higher on its return from lunch break after the BoJ opted to keep all settings unchanged unanimously in what was a straightforward meeting to round off the year.

- ASX 200 was supported from the start by its Gold and Energy sectors, whilst no major move was seen on the release of the RBA minutes.

- Indian stocks rose again, resuming a rally that saw stocks climb to a new high last week, led by gains in the nation’s largest company Reliance Industries and Nestle India. The S&P BSE Sensex rose 0.2% to 71,437.19 in Mumbai, while NSE Nifty 50 Index advanced by a similar measure. Out of 30 shares in the Sensex, 15 rose, and the rest fell. Reliance Industries contributed the most to the index gain, increasing 1.5%. Zee Entertainment shares declined after Sony Pictures Networks India said it hasn’t yet agreed to the former’s request for deadline extension to close a merger

In FX, the Japanese yen was lower after the Bank of Japan stuck with negative rates and Governor Ueda played down the likelihood of any imminent policy tightening. USD/JPY rose 1.4% to ~144.80. The pound is one of the best performing G-10 currencies, rising 0.4% versus the greenback ahead of UK inflation data on Wednesday. The euro is up 0.2% after euro area CPI was confirmed at 2.4% in November.

In rates, treasuries rose alongside Japanese government bonds and bunds after Germany’s bond-sale plans for 2024 of €248b broadly meet estimates. €291b was sold this year. Treasury yields are richer by 1bp to 2bp across the curve with spreads slightly flatter, although broadly within one basis point of Monday session close; 10-year yields around 3.915% with bunds outperforming by 2bp in the sector following wider gains seen in In Asia. Treasuries were underpinned by JGBs after Bank of Japan kept monetary policy steady and Governor Kazuo Ueda said it’s difficult to lay out an exit plan from sub-zero rates. US session focus includes housing data and three Fed speakers scheduled.

In commodities, oil prices decline, with WTI falling 0.4% to trade near $72.20, just shy of the highest price in two weeks as more companies shunned the Red Sea after a spike in vessel attacks along the key shipping conduit. Bitcoin is a touch firmer and resides around the $43k mark, specifics light since Monday's Grayscale update.

Looking to the day ahead now, and data releases include US housing starts and building permits for November, along with Canada’s CPI for November. Central bank speakers include the Fed’s Bostic and Goolsbee, the ECB’s Simkus, Kazimir and Vujcic, and BoE Deputy Governor Breeden.

Market Snapshot

- S&P 500 futures little changed at 4,797.25

- STOXX Europe 600 up 0.2% to 476.37

- MXAP down 0.1% to 164.01

- MXAPJ little changed at 513.35

- Nikkei up 1.4% to 33,219.39

- Topix up 0.7% to 2,333.81

- Hang Seng Index down 0.7% to 16,505.00

- Shanghai Composite little changed at 2,932.39

- Sensex up 0.2% to 71,436.49

- Australia S&P/ASX 200 up 0.8% to 7,489.07

- Kospi little changed at 2,568.55

- German 10Y yield little changed at 2.03%

- Euro up 0.2% to $1.0944

- Brent Futures down 0.2% to $77.81/bbl

- Gold spot down 0.0% to $2,026.47

- U.S. Dollar Index little changed at 102.51

Top Overnight News From Bloomberg

- The Japanese currency extended losses as the BOJ kept its short-term rate at -0.1% and maintained its yield curve control parameters along with its forward guidance on policy. Ueda’s ‘exit’ comments were made in a press conference after the decision

- Dollar-yen jumped as leveraged funds exited their short positions placed before the BOJ decision, according to an Asia-based FX trader

- The yields on 10-year US Treasuries fell 3 bps to 3.90%

- “The JPY reaction shows that there is some disappointment in the market that Ueda did not lay down the groundwork for a specific exit policy,” said Jane Foley, head of FX strategy at Rabobank. “There is scope for USD/JPY to edge higher near-term, but we will likely see the JPY strengthen again on rate hike hopes into the January policy meeting,” Foley added

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed after a subdued start to the session with news flow light and the BoJ failing to induce any macro price action. ASX 200 was supported from the start by its Gold and Energy sectors, whilst no major move was seen on the release of the RBA minutes. Nikkei 225 was subdued at the start of the session but later shot higher on its return from lunch break after the BoJ opted to keep all settings unchanged unanimously in what was a straightforward meeting to round off the year. Hang Seng and Shanghai Comp were softer throughout the session with the former dragged lower once again by its property sector, whilst the latter saw its losses cushioned by another sizeable liquidity injection via 7-day and 14-day reverse repos.

Top Asian News

- Japan to set FY 2024 draft budget of more than JPY 110tln, according to Asahi.

- Japan's Economy Minister Shindo attended today's BoJ policy meeting, according to Reuters citing the government.

- PBoC injected CNY 119bln through 7-day reverse repos at 1.80% and CNY 182bln via 14-day reverse repos at 1.95%; both rates maintained.

- China state planner spokesperson expects CPI to rise mildly next year, according to Reuters.

- China state planner said they approved 144 fixed-asset investment projects worth a total of CNY 1.28tln in January-November, according to Reuters.

- At least 118 people died after a 6.2 magnitude earthquake struck northwestern China, according to state media.

European bourses are marginally firmer with dovish BoJ not having much sway on the broader tape; Stoxx 600 +0.3%. Sectors have a slight positive bias, but with Energy names lagging as benchmarks have spent much of the morning pressured after Monday's upside. US futures are marginally firmer but the ES is sub-4800 and yesterday's best of 4802.25; ahead of a handful of Fed speakers and data points.

Top European News

- The EU is to suspend until the end of March 2025 retaliatory tariffs against the US regarding the steel/aluminium tariff dispute, according to an EU official journal cited by Reuters.

- German Finance Ministry says that in 2024 the government intends to issue a total of EUR 440bln in Federal securities; plans to raise a total of EUR 247.5bln vs exp. 240-250bln (prev. 291bln) on capital markets via auction.

FX

- DXY has largely been swayed by JPY fluctuations, with USD/JPY the standout outperformer after the BoJ and in reach of 145.00 at best.

- The DXY itself remains within Monday's parameters and for the most part has been fluctuating the 102.50 mark, EUR bid but capped by 1.0950.

- GBP firmer and inching above 1.27 with specifics light ahead of potential remarks from BoE's Breeden.

- Antipodeans are once again the best performers with the AUD benefitting from the December RBA Minutes and NZD on trade data; climbing further above 0.67 and 0.62 respectively.

- PBoC set USD/CNY mid-point at 7.0982 vs exp. 7.1347 (prev. 7.0933)

Fixed Income

- JGBs outperform post-BoJ, lifting EGBs and USTs in tandem with specifics generally light thus far.

- Bunds and Gilts remain within Monday's range, EGBs unreactive to the German 2024 issuance remit while Gilts experienced some fleeting pressure after the last DMO outing of 2023.

- USTs moving in tandem with the above and after remarks from Fed's Daly on Monday; US yields bull-flattening currently.

- Japan's MOF is to reportedly front-load reduction of 20-year bonds by JPY 200bln from January, reflecting waning investor demand amid rising interest rates, according to Reuters sources.

Commodities

- Crude is under modest pressure as energy benchmarks generally take a breather from Monday's Red Sea related gains, Dutch TTF - 8.0%. Though, Euronav CEO announcing they will be avoiding the Red Sea has lifted WTI and Brent from their USD 71.85/bbl and USD 77.42/bbl toughs, benchmarks nearer to unchanged now.

- Spot gold unchanged despite lower global yields post-BoJ, with action in APAC hours and the European morning thus far minimal given specific/fresh drivers have been particularly light; session low of USD 2021.8/oz, above the 21- & 10-DMAs at USD 2018.45/oz & 2015.1/oz respectively.

- Base metals contained with specifics light though the slightly constructive European tone and contained USD has lent some support.

- Goldman Sachs said disruptions in the Red Sea are unlikely to have large effects on crude oil and LNG prices because vessel redirection opportunities imply that production should not be directly affected, according to Reuters.

- Maersk (MAERSKB DC) says out of safety, all vessels previously paused and due to sail through the Red Sea will be re-routed around the Cape of Good Hope.

- Euronav CEO says they will avoid the Red Sea until there are convoys to protect ships.

Geopolitics

- US and allies agreed to a Red Sea naval task force, according to the Associated Press.

- US Central Command said bulk cargo ship M/V Clara reported an explosion in water near their location; this attack is separate from the attack on Swan Atlantic, according to Reuters.

- US, Japan, and South Korea activate trilateral real-time data sharing for tracking North Korea missiles; establish a multi-year plan for trilateral exercises to begin in 2024, according to a statement.

- North Korean leader Kim said the country is ready to take swift action in the event Washington makes a misguided decision against North Korea, according to state media; nuclear force will be ready to quell any military crisis or war.

US Event Calendar

- 08:30: Nov. Building Permits, est. 1.47m, prior 1.49m, revised 1.5m

- Nov. Housing Starts, est. 1.36m, prior 1.37m

- Nov. Building Permits MoM, est. -2.2%, prior 1.1%, revised 1.8%

- Nov. Housing Starts MoM, est. -0.9%, prior 1.9%

- 6:00: Oct. Total Net TIC Flows, prior -$67.4b

DB's Henry Allen concludes the overnight wrap

As we go to press this morning, the Bank of Japan have left their policy settings unchanged overnight, and didn’t offer any guidance on when they might move away from their negative interest rate policy. Although the consensus wasn’t expecting a policy shift at this meeting, the market reaction demonstrates that the decision is being interpreted in a dovish light, which reflected some expectations that they might have signalled a shift away from the policy over the months ahead. Indeed, it was this meeting a year ago they made an unexpected adjustment to their yield curve control policy that took global markets by surprise .

Governor Ueda is hosting a press conference around the time we go to press, so keep an eye out for any further headlines and if there’s any signal about where policy is headed in 2024. And looking forward, investors are still pricing in a decent chance that the BoJ will move away from their negative interest rate policy over the months ahead, with a 45% chance of a shift priced in for the January meeting, and a 93% chance priced by April. But in the meantime, equities have rallied in response, with the Nikkei (+1.06%) outperforming other indices in Asia this morning. Sovereign bond yields have also fallen across the curve, with the 10yr yield down -2.5bps to 0.64%, whilst the Japanese Yen is the weakest-performing G10 currency this morning, and is currently down -0.45% against the US Dollar. Moreover, the continuation of low borrowing costs has meant banks have underperformed, and the TOPIX Banks Index (-0.69%) has lost ground for a 4th straight day and currently stands at a 3-month low.

Although the Bank of Japan have continued with their accommodative monetary policy, central bank officials elsewhere were mostly pushing back on all the building rate cut speculation yesterday. That meant sovereign bonds struggled on both sides of the Atlantic, with the 10yr Treasury yield ending the day up +2.1bps at 3.93%, and the 10yr bund yield was up +6.4bps. Nevertheless, several risk assets put in a stronger performance, with the S&P 500 (+0.45%) closing at a 23-month high, and the Magnificent Seven (+1.33%) reached a new all-time high .

Those remarks came from officials at multiple central banks, but the tone was consistent across the board. For instance, Cleveland Fed President Mester said that markets were “a little bit ahead” in their pricing of rate cuts, and Chicago Fed President Goolsbee said that he “was confused a bit” by the market reaction. Meanwhile at the ECB, Slovakia’s Kazimir said that the “policy mistake of premature easing would be more significant than the risk of staying tight for too long”. And similarly, Slovenia’s Vasle said that market expectations of rate cuts were “premature in my view, both with regard to the start of cuts and the totality of the moves”.

The more hawkish comments meant that investors dialled back their expectations for rate cuts next year. For instance, the chance of an ECB rate cut by March fell from 57% on Friday to 35% by yesterday’s close, and for the Fed it inched down from 77% to 75%. Now clearly, markets are pricing a lot more cuts than they were before the Fed’s decision last week, but since Friday the comments from various officials have seen investors become more sceptical about the chances of aggressive easing. In fact, at the i ntraday peak last Thursday, markets were pricing in 164bps of Fed cuts for 2024, and that’s since been dialled back to 141bps this morning, so in other words we’ve almost had an entire 25bp cut taken out of pricing for next year already.

As investors priced in fewer rate cuts, sovereign bonds lost ground on both sides of the Atlantic yesterday. In Europe, it meant yields on 10yr bunds (+6.4bps), OATs (+6.3bps) and BTPs (+3.8bps) all moved higher, whilst those on 10yr gilts (+0.9bps) saw a more modest increase. The bond selloff was milder in the US thanks to a partial reversal in the latter part of the US session, with the 10yr Treasury yield up +2.1bps to 3.93%, although overnight it’s risen a further +0.9bps to 3.94% .

However, higher rates didn’t dampen the US equity rally, which continued to power ahead. That saw the S&P 500 (+0.45%) reach a 23-month high, leaving the index now just 1.17% beneath its all-time closing high from January 2022. The advance was led by the megacap tech stocks, and the FANG+ Index (+1.40%) advanced for an 8th consecutive session. By contrast, the small-cap Russell 2000 (-0.14%) struggled after its massive surge last week, and Europe’s STOXX 600 (-0.27%) was another that put in a weaker performance. Overnight, equities outside Japan have also struggled, with losses for the Hang Seng (-0.72%), the CSI 300 (-0.15%), the Shanghai Comp (-0.20%) and the KOSPI (-0.10%).

Sentiment in Europe wasn’t helped yesterday by the Ifo’s latest business climate indicator for Germany, which posted an unexpected decline in December to 86.4 (vs. 87.7 expected). That’s the first decline since August, and the current assessment reading fell to just 88.5, which is the lowest it’s been since August 2020. Separately, European natural gas prices were up +6.72% yesterday to €35.75/MWh, which followed the news from BP that it would be pausing all shipments through the Red Sea. Moves by shippers to avoid the Red Sea after frequent recent attacks also supported oil prices, with Brent up +1.83% to $77.95/bbl and WTI up +1.46% to $72.47/bbl .

Finally on the data side, we had the NAHB’s latest housing market index from the US, which rose to 37 as expected, thus bringing an end to 4 consecutive monthly declines.

To the day ahead now, and data releases include US housing starts and building permits for November, along with Canada’s CPI for November. Central bank speakers include the Fed’s Bostic and Goolsbee, the ECB’s Simkus, Kazimir and Vujcic, and BoE Deputy Governor Breeden.

S&P futures continue their seasonal year-end meltup following 0.3% gain in Estoxx 50 where utilities and industrials outperform and a surge in Japanese stocks where the BOJ “shocked” market by doing nothing at all. As of 8:00am ET, S&P and Nasdaq 100 futures were up 0.2%, set for a third consecutive record high. Europe’s Stoxx 600 index rose 0.3%, with Switzerland’s UBS AG rising as much as 2.8% after Cevian Capital AB took a €1.2 billion ($1.3 billion) stake. The yen plunged as much as 1.5% to a one-week low against the dollar, while the Nikkei 225 equity index rallied after the BOJ held its policy rate at -0.10% denying laughable speculation of an imminent rate hike. 10-year yields slipped about two basis points, the dollar slipped and bitcoin gained, while WTI futures were little change on the day despite growing paralysis of Red Sea transit.

In premarket trading, cryptocurrency-exposed stocks rise as Bitcoin extends gains into a second session, rising above the $43,000 level. Here are some other notable movers:

- Accenture falls 1.7% after the consulting firm issued a weaker-than-expected revenue outlook for the current quarter. .

- American International Group rises 1.4% after BMO Capital Markets raises its recommendation to outperform from market perform, as lower protection limits and more reinsurance protection lift worries over reserves, analyst Michael Zaremski writes in a report.

- Chewy rises 3.8% while Bark falls 1.4% as Jefferies initiated coverage of US pet stocks, rating Chewy and PetIQ at buy, with Freshpet, Bark, and Petco at hold.

- Kenvue rises 5.1% after a court ruled in favor of the company in a class action lawsuit involving Tylenol. However, Bloomberg Intelligence notes that the company’s legal risk wouldn’t be completely gone with this update.

The big news overnight was the “shocking” lack of action by the BOJ which had ginned up tons of excitement through media leaks and jawboning that it was about to hike rates. It didn’t, and as a result the yen tumbled as much as 1.5% after policymakers did not unveil any groundwork to move away from sub-zero rates, while BOJ governor Kazuo Ueda pushed back against expectations on policy tightening as soon as January.

The BOJ has been an outlier, having failed to even start tightening policy, even as peers in the US and Europe appear set to wind down their rate-hike cycles. Its meeting follows an apparently dovish pivot from the Federal Reserve last week, which got markets wagering US and European rate cuts will start next year.

“The BOJ stance encouraged speculators to sell the yen, and there’s relief that yields in Japan aren’t likely to to to jump higher,” said Lee Hardman, a strategist at MUFG Bank Ltd. “That takes some of downside risk away for other major global bond markets as well.”

Expectation about policy easing by the FED are making investors the most optimistic since the beginning of 2022, according to a Bank of America Corp. survey. Still, several policymakers in Europe and the US have tried to push back against such bets. Chicago Fed President Austan Goolsbee and the Cleveland Fed’s Loretta Mester suggested on Monday, the expectations were premature. Atlanta Fed President Raphael Bostic will speak later Tuesday. While Treasury markets had paused Monday after the Fed officials’ comments, Hardman said “ultimately the market is looking through those comments because they only really have credibility if the data backs them up.”

Whether equities and bonds continue their rallies might be determined by near-term data readouts including durable goods orders, personal consumption expenditures — the Fed’s preferred measure of inflation — and the final third quarter gross domestic product estimate.

European stocks edged higher, with the Stoxx 600 adding 0.3%. The travel & leisure and basic resources the best-performing sub-indexes on the regional Stoxx 600 benchmark, while the automotive sector underperforms. UBS rose as much as 2.8% after activitst investor Cevian Capital AB took a €1.2 billion ($1.3 billion) stake, making it a top 10 stakeholder. Shares in shipping companies such A.P Moller-Maersk A/S and Hapag-Lloyd AG eased after surging for four sessions in a row as US Defense Secretary Lloyd Austin announced the creation of a task force to protect commercial vessels traveling through the area. Here are the biggest movers Tuesday:

- Stora Enso rises as much as 3.6% as DNB Markets upgrades its rating on the Finnish paper and packaging company to buy from hold and says it sees “good reason” to become more positive

- UBS shares climb as much as 2.7%, on track for the highest closing level since 2008, after activist investor Cevian took a €1.2 billion stake in the Swiss bank

- Thyssenkrupp Nucera rises as much as 16%, extending gains into a fourth session, as investors continued to digest the news from yesterday’s annual results, the first since its IPO

- TomTom gains as much as 5.7% after the Dutch navigation device maker announced a partnership with Microsoft to bring the benefits of generative AI to the automotive industry

- Barco rises as much as 5.2%, the most since February, after the Belgian technology company announced a program to repurchase a maximum of 2 million shares

- Duerr gains as much as 2.6% after losing its only negative analyst rating as BNP Paribas Exane upgrades the machine maker to neutral from underperform due to limited downside from here

- Superdry shares slump as much as 33%, hitting a record low, after the apparel retailer said its FY24 trading has been hit by a tough environment, with Peel Hunt slashing its price target

- Bachem falls as much as 8.6% after Citi warned its checks suggest the expansion of the firm’s Building K manufacturing facility is potentially delayed, posing a risk to consensus forecasts

- Hipgnosis Songs Fund falls as much as 3.3% delayed publishing its interim results. Jefferies said this is a setback for shareholders in attempting to resolve the fund’s “myriad of issues”

- Richemont falls as much as 1.4%, with Barclays saying the termination of the Farfetch deal, causing a €218 million writedown, may add to negative sentiment

Earlier in the session, Asian stocks were mixed, with Hong Kong-listed shares a drag while Japanese names climbed after the domestic central bank kept interest rates unchanged at its last policy meeting for 2023. The MSCI Asia Pacific Index swung between a 0.2% gain and a loss of 0.3%, with Meituan and TSMC among the main laggards. Japanese benchmarks moved sharply higher after the Bank of Japan stuck with the world’s last negative interest rate Tuesday, and left forward guidance unchanged.

“Export stocks, especially in the auto sector, which had recently been sold off, are likely to be repurchased for the time being,” said Rina Oshimo, senior strategist at Okasan Securities. Still, “there is no change in the perception that the BOJ is preparing for a modification of the easing policy,” she added. By contrast, gauges in Hong Kong were among the worst performers in the region as investors sold property shares on continued worries about the health of the sector into the next year. Country Garden Services hit a record low after it said it set aside some funds as impairment.

- Hang Seng and Shanghai Comp were softer throughout the session with the former dragged lower once again by its property sector, whilst the latter saw its losses cushioned by another sizeable liquidity injection via 7-day and 14-day reverse repos.

- Japan’s Nikkei 225 was subdued at the start of the session but later shot higher on its return from lunch break after the BoJ opted to keep all settings unchanged unanimously in what was a straightforward meeting to round off the year.

- ASX 200 was supported from the start by its Gold and Energy sectors, whilst no major move was seen on the release of the RBA minutes.

- Indian stocks rose again, resuming a rally that saw stocks climb to a new high last week, led by gains in the nation’s largest company Reliance Industries and Nestle India. The S&P BSE Sensex rose 0.2% to 71,437.19 in Mumbai, while NSE Nifty 50 Index advanced by a similar measure. Out of 30 shares in the Sensex, 15 rose, and the rest fell. Reliance Industries contributed the most to the index gain, increasing 1.5%. Zee Entertainment shares declined after Sony Pictures Networks India said it hasn’t yet agreed to the former’s request for deadline extension to close a merger

In FX, the Japanese yen was lower after the Bank of Japan stuck with negative rates and Governor Ueda played down the likelihood of any imminent policy tightening. USD/JPY rose 1.4% to ~144.80. The pound is one of the best performing G-10 currencies, rising 0.4% versus the greenback ahead of UK inflation data on Wednesday. The euro is up 0.2% after euro area CPI was confirmed at 2.4% in November.

In rates, treasuries rose alongside Japanese government bonds and bunds after Germany’s bond-sale plans for 2024 of €248b broadly meet estimates. €291b was sold this year. Treasury yields are richer by 1bp to 2bp across the curve with spreads slightly flatter, although broadly within one basis point of Monday session close; 10-year yields around 3.915% with bunds outperforming by 2bp in the sector following wider gains seen in In Asia. Treasuries were underpinned by JGBs after Bank of Japan kept monetary policy steady and Governor Kazuo Ueda said it’s difficult to lay out an exit plan from sub-zero rates. US session focus includes housing data and three Fed speakers scheduled.

In commodities, oil prices decline, with WTI falling 0.4% to trade near $72.20, just shy of the highest price in two weeks as more companies shunned the Red Sea after a spike in vessel attacks along the key shipping conduit. Bitcoin is a touch firmer and resides around the $43k mark, specifics light since Monday’s Grayscale update.

Looking to the day ahead now, and data releases include US housing starts and building permits for November, along with Canada’s CPI for November. Central bank speakers include the Fed’s Bostic and Goolsbee, the ECB’s Simkus, Kazimir and Vujcic, and BoE Deputy Governor Breeden.

Market Snapshot

- S&P 500 futures little changed at 4,797.25

- STOXX Europe 600 up 0.2% to 476.37

- MXAP down 0.1% to 164.01

- MXAPJ little changed at 513.35

- Nikkei up 1.4% to 33,219.39

- Topix up 0.7% to 2,333.81

- Hang Seng Index down 0.7% to 16,505.00

- Shanghai Composite little changed at 2,932.39

- Sensex up 0.2% to 71,436.49

- Australia S&P/ASX 200 up 0.8% to 7,489.07

- Kospi little changed at 2,568.55

- German 10Y yield little changed at 2.03%

- Euro up 0.2% to $1.0944

- Brent Futures down 0.2% to $77.81/bbl

- Gold spot down 0.0% to $2,026.47

- U.S. Dollar Index little changed at 102.51

Top Overnight News From Bloomberg

- The Japanese currency extended losses as the BOJ kept its short-term rate at -0.1% and maintained its yield curve control parameters along with its forward guidance on policy. Ueda’s ‘exit’ comments were made in a press conference after the decision

- Dollar-yen jumped as leveraged funds exited their short positions placed before the BOJ decision, according to an Asia-based FX trader

- The yields on 10-year US Treasuries fell 3 bps to 3.90%

- “The JPY reaction shows that there is some disappointment in the market that Ueda did not lay down the groundwork for a specific exit policy,” said Jane Foley, head of FX strategy at Rabobank. “There is scope for USD/JPY to edge higher near-term, but we will likely see the JPY strengthen again on rate hike hopes into the January policy meeting,” Foley added

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed after a subdued start to the session with news flow light and the BoJ failing to induce any macro price action. ASX 200 was supported from the start by its Gold and Energy sectors, whilst no major move was seen on the release of the RBA minutes. Nikkei 225 was subdued at the start of the session but later shot higher on its return from lunch break after the BoJ opted to keep all settings unchanged unanimously in what was a straightforward meeting to round off the year. Hang Seng and Shanghai Comp were softer throughout the session with the former dragged lower once again by its property sector, whilst the latter saw its losses cushioned by another sizeable liquidity injection via 7-day and 14-day reverse repos.

Top Asian News

- Japan to set FY 2024 draft budget of more than JPY 110tln, according to Asahi.

- Japan’s Economy Minister Shindo attended today’s BoJ policy meeting, according to Reuters citing the government.

- PBoC injected CNY 119bln through 7-day reverse repos at 1.80% and CNY 182bln via 14-day reverse repos at 1.95%; both rates maintained.

- China state planner spokesperson expects CPI to rise mildly next year, according to Reuters.

- China state planner said they approved 144 fixed-asset investment projects worth a total of CNY 1.28tln in January-November, according to Reuters.

- At least 118 people died after a 6.2 magnitude earthquake struck northwestern China, according to state media.

European bourses are marginally firmer with dovish BoJ not having much sway on the broader tape; Stoxx 600 +0.3%. Sectors have a slight positive bias, but with Energy names lagging as benchmarks have spent much of the morning pressured after Monday’s upside. US futures are marginally firmer but the ES is sub-4800 and yesterday’s best of 4802.25; ahead of a handful of Fed speakers and data points.

Top European News

- The EU is to suspend until the end of March 2025 retaliatory tariffs against the US regarding the steel/aluminium tariff dispute, according to an EU official journal cited by Reuters.

- German Finance Ministry says that in 2024 the government intends to issue a total of EUR 440bln in Federal securities; plans to raise a total of EUR 247.5bln vs exp. 240-250bln (prev. 291bln) on capital markets via auction.

FX

- DXY has largely been swayed by JPY fluctuations, with USD/JPY the standout outperformer after the BoJ and in reach of 145.00 at best.

- The DXY itself remains within Monday’s parameters and for the most part has been fluctuating the 102.50 mark, EUR bid but capped by 1.0950.

- GBP firmer and inching above 1.27 with specifics light ahead of potential remarks from BoE’s Breeden.

- Antipodeans are once again the best performers with the AUD benefitting from the December RBA Minutes and NZD on trade data; climbing further above 0.67 and 0.62 respectively.

- PBoC set USD/CNY mid-point at 7.0982 vs exp. 7.1347 (prev. 7.0933)

Fixed Income

- JGBs outperform post-BoJ, lifting EGBs and USTs in tandem with specifics generally light thus far.

- Bunds and Gilts remain within Monday’s range, EGBs unreactive to the German 2024 issuance remit while Gilts experienced some fleeting pressure after the last DMO outing of 2023.

- USTs moving in tandem with the above and after remarks from Fed’s Daly on Monday; US yields bull-flattening currently.

- Japan’s MOF is to reportedly front-load reduction of 20-year bonds by JPY 200bln from January, reflecting waning investor demand amid rising interest rates, according to Reuters sources.

Commodities

- Crude is under modest pressure as energy benchmarks generally take a breather from Monday’s Red Sea related gains, Dutch TTF – 8.0%. Though, Euronav CEO announcing they will be avoiding the Red Sea has lifted WTI and Brent from their USD 71.85/bbl and USD 77.42/bbl toughs, benchmarks nearer to unchanged now.

- Spot gold unchanged despite lower global yields post-BoJ, with action in APAC hours and the European morning thus far minimal given specific/fresh drivers have been particularly light; session low of USD 2021.8/oz, above the 21- & 10-DMAs at USD 2018.45/oz & 2015.1/oz respectively.

- Base metals contained with specifics light though the slightly constructive European tone and contained USD has lent some support.

- Goldman Sachs said disruptions in the Red Sea are unlikely to have large effects on crude oil and LNG prices because vessel redirection opportunities imply that production should not be directly affected, according to Reuters.

- Maersk (MAERSKB DC) says out of safety, all vessels previously paused and due to sail through the Red Sea will be re-routed around the Cape of Good Hope.

- Euronav CEO says they will avoid the Red Sea until there are convoys to protect ships.

Geopolitics

- US and allies agreed to a Red Sea naval task force, according to the Associated Press.

- US Central Command said bulk cargo ship M/V Clara reported an explosion in water near their location; this attack is separate from the attack on Swan Atlantic, according to Reuters.

- US, Japan, and South Korea activate trilateral real-time data sharing for tracking North Korea missiles; establish a multi-year plan for trilateral exercises to begin in 2024, according to a statement.

- North Korean leader Kim said the country is ready to take swift action in the event Washington makes a misguided decision against North Korea, according to state media; nuclear force will be ready to quell any military crisis or war.

US Event Calendar

- 08:30: Nov. Building Permits, est. 1.47m, prior 1.49m, revised 1.5m

- Nov. Housing Starts, est. 1.36m, prior 1.37m

- Nov. Building Permits MoM, est. -2.2%, prior 1.1%, revised 1.8%

- Nov. Housing Starts MoM, est. -0.9%, prior 1.9%

- 6:00: Oct. Total Net TIC Flows, prior -$67.4b

DB’s Henry Allen concludes the overnight wrap

As we go to press this morning, the Bank of Japan have left their policy settings unchanged overnight, and didn’t offer any guidance on when they might move away from their negative interest rate policy. Although the consensus wasn’t expecting a policy shift at this meeting, the market reaction demonstrates that the decision is being interpreted in a dovish light, which reflected some expectations that they might have signalled a shift away from the policy over the months ahead. Indeed, it was this meeting a year ago they made an unexpected adjustment to their yield curve control policy that took global markets by surprise .

Governor Ueda is hosting a press conference around the time we go to press, so keep an eye out for any further headlines and if there’s any signal about where policy is headed in 2024. And looking forward, investors are still pricing in a decent chance that the BoJ will move away from their negative interest rate policy over the months ahead, with a 45% chance of a shift priced in for the January meeting, and a 93% chance priced by April. But in the meantime, equities have rallied in response, with the Nikkei (+1.06%) outperforming other indices in Asia this morning. Sovereign bond yields have also fallen across the curve, with the 10yr yield down -2.5bps to 0.64%, whilst the Japanese Yen is the weakest-performing G10 currency this morning, and is currently down -0.45% against the US Dollar. Moreover, the continuation of low borrowing costs has meant banks have underperformed, and the TOPIX Banks Index (-0.69%) has lost ground for a 4th straight day and currently stands at a 3-month low.

Although the Bank of Japan have continued with their accommodative monetary policy, central bank officials elsewhere were mostly pushing back on all the building rate cut speculation yesterday. That meant sovereign bonds struggled on both sides of the Atlantic, with the 10yr Treasury yield ending the day up +2.1bps at 3.93%, and the 10yr bund yield was up +6.4bps. Nevertheless, several risk assets put in a stronger performance, with the S&P 500 (+0.45%) closing at a 23-month high, and the Magnificent Seven (+1.33%) reached a new all-time high .

Those remarks came from officials at multiple central banks, but the tone was consistent across the board. For instance, Cleveland Fed President Mester said that markets were “a little bit ahead” in their pricing of rate cuts, and Chicago Fed President Goolsbee said that he “was confused a bit” by the market reaction. Meanwhile at the ECB, Slovakia’s Kazimir said that the “policy mistake of premature easing would be more significant than the risk of staying tight for too long”. And similarly, Slovenia’s Vasle said that market expectations of rate cuts were “premature in my view, both with regard to the start of cuts and the totality of the moves”.

The more hawkish comments meant that investors dialled back their expectations for rate cuts next year. For instance, the chance of an ECB rate cut by March fell from 57% on Friday to 35% by yesterday’s close, and for the Fed it inched down from 77% to 75%. Now clearly, markets are pricing a lot more cuts than they were before the Fed’s decision last week, but since Friday the comments from various officials have seen investors become more sceptical about the chances of aggressive easing. In fact, at the i ntraday peak last Thursday, markets were pricing in 164bps of Fed cuts for 2024, and that’s since been dialled back to 141bps this morning, so in other words we’ve almost had an entire 25bp cut taken out of pricing for next year already.

As investors priced in fewer rate cuts, sovereign bonds lost ground on both sides of the Atlantic yesterday. In Europe, it meant yields on 10yr bunds (+6.4bps), OATs (+6.3bps) and BTPs (+3.8bps) all moved higher, whilst those on 10yr gilts (+0.9bps) saw a more modest increase. The bond selloff was milder in the US thanks to a partial reversal in the latter part of the US session, with the 10yr Treasury yield up +2.1bps to 3.93%, although overnight it’s risen a further +0.9bps to 3.94% .

However, higher rates didn’t dampen the US equity rally, which continued to power ahead. That saw the S&P 500 (+0.45%) reach a 23-month high, leaving the index now just 1.17% beneath its all-time closing high from January 2022. The advance was led by the megacap tech stocks, and the FANG+ Index (+1.40%) advanced for an 8th consecutive session. By contrast, the small-cap Russell 2000 (-0.14%) struggled after its massive surge last week, and Europe’s STOXX 600 (-0.27%) was another that put in a weaker performance. Overnight, equities outside Japan have also struggled, with losses for the Hang Seng (-0.72%), the CSI 300 (-0.15%), the Shanghai Comp (-0.20%) and the KOSPI (-0.10%).

Sentiment in Europe wasn’t helped yesterday by the Ifo’s latest business climate indicator for Germany, which posted an unexpected decline in December to 86.4 (vs. 87.7 expected). That’s the first decline since August, and the current assessment reading fell to just 88.5, which is the lowest it’s been since August 2020. Separately, European natural gas prices were up +6.72% yesterday to €35.75/MWh, which followed the news from BP that it would be pausing all shipments through the Red Sea. Moves by shippers to avoid the Red Sea after frequent recent attacks also supported oil prices, with Brent up +1.83% to $77.95/bbl and WTI up +1.46% to $72.47/bbl .

Finally on the data side, we had the NAHB’s latest housing market index from the US, which rose to 37 as expected, thus bringing an end to 4 consecutive monthly declines.

To the day ahead now, and data releases include US housing starts and building permits for November, along with Canada’s CPI for November. Central bank speakers include the Fed’s Bostic and Goolsbee, the ECB’s Simkus, Kazimir and Vujcic, and BoE Deputy Governor Breeden.

Loading…