Authored by Mark Cudmore, Bloomberg,

The troubles of Silicon Valley Bank (SVB) have become apparent very suddenly and hence matter significantly for that precise reason.

SIVB is down another 45% overnight.

The most obvious victims will be Nasdaq and crypto, but the sentiment spillover will reach across all assets.

[ZH: For details on how we got here and where exactly we are, read here and here]

Importantly, many VC funds were only updating their advice to clients into Thursday afternoon/evening, which suggests that many more startups will be seeking to withdraw cash on Friday, perpetuating the negative news cycle on this.

Liquidity for speculative financing has been drying up for a while (note the end of the SPAC boom), but this is the first major public sudden squeeze on the sector.

Not only will the seeming bank run have direct contagion on some other small banks, but it will cause further retrenchment in the venture capital space generally for many months.

This means more startup companies won’t survive and hence there must be a write-down in values of private market portfolios. That impacts funds and banks everywhere, prompting further deleveraging.

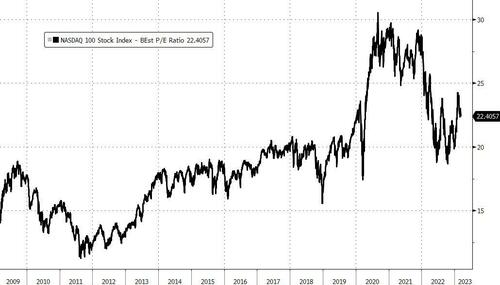

The tech-sector will be an obvious first-instinct victim of this risk-aversion. It doesn’t help that US tech stocks remain very expensive despite the backdrop of rising yields.

The Nasdaq 100’s 12-month blended-forward BEst P/E ratio stands at 22.4 versus its 10-year average of 20.4 and 20-year average of 19.2.

Albeit, after the initial stage of worry, it’ll mainly be the more speculative names that suffer.

That brings us to crypto, a sector already reeling from the shutdown of Silvergate Capital Corp.

It’s not an unreasonable jump to conclude this may herald the starting point of the next downleg in the broader US equity bear market.

Yields have slumped over the past 24 hours on the back of risk-aversion, meaning the setup for US jobs data Friday is asymmetrically skewed for yields to pop higher.

The corollary is that we’re suddenly in a regime where anything but in-line data will likely be taken negatively by the stock market.

Strong data will be bad for equities due to intensifying a liquidity crisis, and weak data is alarming for stocks as it will heighten bankruptcy and sharp slowdown concerns.

Authored by Mark Cudmore, Bloomberg,

The troubles of Silicon Valley Bank (SVB) have become apparent very suddenly and hence matter significantly for that precise reason.

SIVB is down another 45% overnight.

The most obvious victims will be Nasdaq and crypto, but the sentiment spillover will reach across all assets.

[ZH: For details on how we got here and where exactly we are, read here and here]

Importantly, many VC funds were only updating their advice to clients into Thursday afternoon/evening, which suggests that many more startups will be seeking to withdraw cash on Friday, perpetuating the negative news cycle on this.

Liquidity for speculative financing has been drying up for a while (note the end of the SPAC boom), but this is the first major public sudden squeeze on the sector.

Not only will the seeming bank run have direct contagion on some other small banks, but it will cause further retrenchment in the venture capital space generally for many months.

This means more startup companies won’t survive and hence there must be a write-down in values of private market portfolios. That impacts funds and banks everywhere, prompting further deleveraging.

The tech-sector will be an obvious first-instinct victim of this risk-aversion. It doesn’t help that US tech stocks remain very expensive despite the backdrop of rising yields.

The Nasdaq 100’s 12-month blended-forward BEst P/E ratio stands at 22.4 versus its 10-year average of 20.4 and 20-year average of 19.2.

Albeit, after the initial stage of worry, it’ll mainly be the more speculative names that suffer.

That brings us to crypto, a sector already reeling from the shutdown of Silvergate Capital Corp.

It’s not an unreasonable jump to conclude this may herald the starting point of the next downleg in the broader US equity bear market.

Yields have slumped over the past 24 hours on the back of risk-aversion, meaning the setup for US jobs data Friday is asymmetrically skewed for yields to pop higher.

The corollary is that we’re suddenly in a regime where anything but in-line data will likely be taken negatively by the stock market.

Strong data will be bad for equities due to intensifying a liquidity crisis, and weak data is alarming for stocks as it will heighten bankruptcy and sharp slowdown concerns.

Loading…