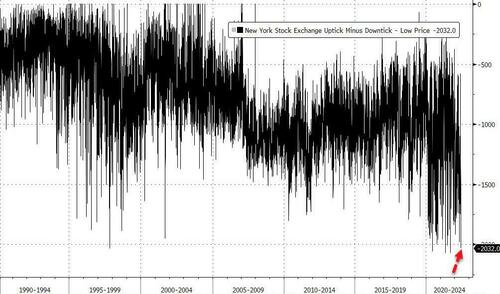

Last week, when we observed that Monday (the day the S&P finally tumbled into a bear market) saw the the fifth largest 'sell program' in history...

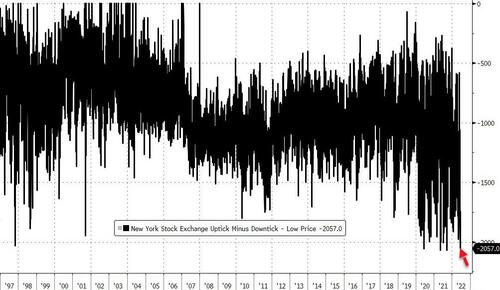

... which was promptly surpassed by even more furious selling on Thursday when the TICK hit -2,057, the 4th biggest selling program on record...

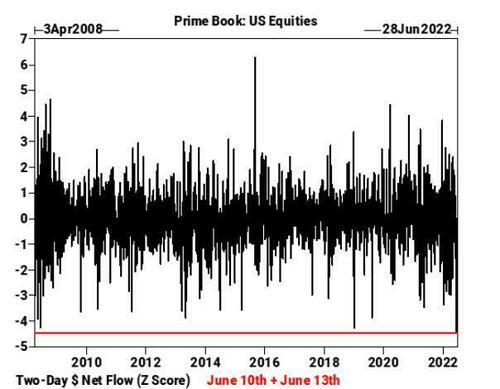

... we quoted Goldman's Prime Brokerage according to which hedge funds - the so-called "smart money" at least until Melvin Capital showed everyone just how dumb said money really was - not only sold US stocks for a seventh straight day Monday but the dollar amount of selling over the last two sessions (Friday and Monday) exploded to levels never before seen by Goldman, which is remarkable because the bank's records go back to April 2008 which means they capture the chaos from the Global Financial Crisis. In other words, we just saw a more frenzied liquidation than what took place in the immediate aftermath of Lehman!

The data also prompted us to question how much of this was actual normal selling (i.e., closing out existing positions) vs short selling (betting on more downside).

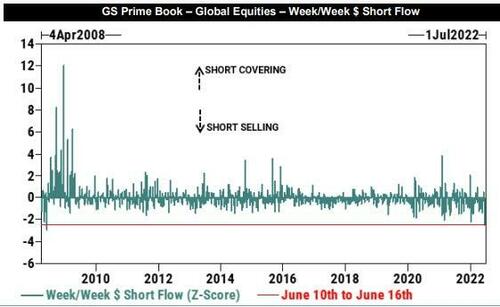

We now have the answer: according to Friday's post-mortem note by Goldman trader John Flood (available to ZH professional subs) "in notional terms, this week’s shorting activity on our PB book was the second largest ever on our record (second only to the week ending June 12, 2008)."

Here are some more details on recent hedge fund performance from Goldman's Prime Brokerage courtesy of Flood:

- The Goldman Sachs Equity Fundamental L/S Performance Estimate fell -4.61% between 6/10 and 6/16 (vs MSCI World TR -8.47%), the worst weekly returns since Jan ‘21, driven by beta of -3.99% (from market exposure and market sensitivity combined) and to a lesser extent alpha of -0.62%. L/S Equity HFs now down 19.02% on the year.

- Fundamental L/S Gross leverage -3.6 pts to 166.1% (3rd percentile one-year) and Net leverage -3.6 pts – the largest week/week decrease since early January – to 46% (lowest since Oct ‘19).

But here is the punchline: "In $ terms, this week’s shorting activity was the second largest ever on our record (behind week ending 6/12/08). Single Stocks/Macro Products were both shorted and made up 83%/17% of the $ short sales." For perspective, 9 of the 10 largest stock shorting weeks in Goldman's record occurred in 2008 (weeks ending 6/12, 5/8, 6/5), 2020 (weeks ending 4/5, 3/5, 3/12), and 2022 YTD (weeks ending 6/16,1/6, 6/9); the week ending 2/25/21 was the other one.

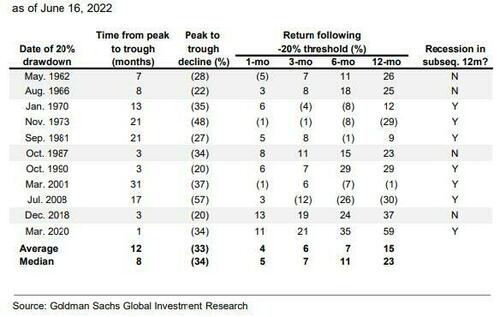

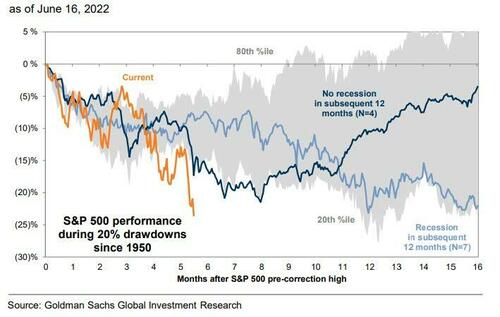

And predictably, following such massive shorting episodes, what follows traditionally has been a major squeeze: as Goldman's table below shows, returns following 20% S&P 500 declines have typically been positive

And while a squeeze now appears inevitable, the market will need much more than just technicals and positioning to recover, as the following chart shows: the current bear-market selloff has been the most violent and vicious ever!

As Flood concludes, "while it certainly feels like we are primed for a nasty squeeze early next week.... I think play book remains to sell the low quality bear mkt squeezes whenever they appear.....and I think we will see more than our fair share of them."

His full note is available to professional subs in the usual place.

Last week, when we observed that Monday (the day the S&P finally tumbled into a bear market) saw the the fifth largest ‘sell program‘ in history…

… which was promptly surpassed by even more furious selling on Thursday when the TICK hit -2,057, the 4th biggest selling program on record…

… we quoted Goldman’s Prime Brokerage according to which hedge funds – the so-called “smart money” at least until Melvin Capital showed everyone just how dumb said money really was – not only sold US stocks for a seventh straight day Monday but the dollar amount of selling over the last two sessions (Friday and Monday) exploded to levels never before seen by Goldman, which is remarkable because the bank’s records go back to April 2008 which means they capture the chaos from the Global Financial Crisis. In other words, we just saw a more frenzied liquidation than what took place in the immediate aftermath of Lehman!

The data also prompted us to question how much of this was actual normal selling (i.e., closing out existing positions) vs short selling (betting on more downside).

We now have the answer: according to Friday’s post-mortem note by Goldman trader John Flood (available to ZH professional subs) “in notional terms, this week’s shorting activity on our PB book was the second largest ever on our record (second only to the week ending June 12, 2008).”

Here are some more details on recent hedge fund performance from Goldman’s Prime Brokerage courtesy of Flood:

- The Goldman Sachs Equity Fundamental L/S Performance Estimate fell -4.61% between 6/10 and 6/16 (vs MSCI World TR -8.47%), the worst weekly returns since Jan ‘21, driven by beta of -3.99% (from market exposure and market sensitivity combined) and to a lesser extent alpha of -0.62%. L/S Equity HFs now down 19.02% on the year.

- Fundamental L/S Gross leverage -3.6 pts to 166.1% (3rd percentile one-year) and Net leverage -3.6 pts – the largest week/week decrease since early January – to 46% (lowest since Oct ‘19).

But here is the punchline: “In $ terms, this week’s shorting activity was the second largest ever on our record (behind week ending 6/12/08). Single Stocks/Macro Products were both shorted and made up 83%/17% of the $ short sales.” For perspective, 9 of the 10 largest stock shorting weeks in Goldman’s record occurred in 2008 (weeks ending 6/12, 5/8, 6/5), 2020 (weeks ending 4/5, 3/5, 3/12), and 2022 YTD (weeks ending 6/16,1/6, 6/9); the week ending 2/25/21 was the other one.

And predictably, following such massive shorting episodes, what follows traditionally has been a major squeeze: as Goldman’s table below shows, returns following 20% S&P 500 declines have typically been positive

And while a squeeze now appears inevitable, the market will need much more than just technicals and positioning to recover, as the following chart shows: the current bear-market selloff has been the most violent and vicious ever!

As Flood concludes, “while it certainly feels like we are primed for a nasty squeeze early next week…. I think play book remains to sell the low quality bear mkt squeezes whenever they appear…..and I think we will see more than our fair share of them.”

His full note is available to professional subs in the usual place.