The Northern Hemisphere winter has been mostly mild so far, driven by a weather phenomenon known as "El Niño." As a result, natural gas futures in the US have plunged to six-month lows on ample supply while the spread between March and April contracts, known as the "Widowmaker" because of its high risk and volatility, has dropped below zero.

Bloomberg pointed out, "It's the earliest in the season that the spread — which typically doesn't drop below zero until the end of January or later — has gone negative on a closing basis since 2020."

The rationale behind this trade is based on weather patterns and supply-demand dynamics. Across the Lower 48, March is still a winter month with higher demand for heating, which tends to keep natural gas prices elevated. By April, spring begins to arrive, and heating demand is reduced. Traders betting on this spread aim to profit from these predictable seasonal patterns.

But as the bet is known as Widowmaker, it's notoriously risky because weather is unpredictable and can quickly change. This bet has led to the implosion of hedge funds such as Amaranth Advisors LLC in 2006.

Since the start of November, natural gas futures have plunged 35% because the mild winter has dented gas demand.

Weather forecasting data for the Lower 48 shows temperatures for December are above 30-year, 10-year, and 5-year averages.

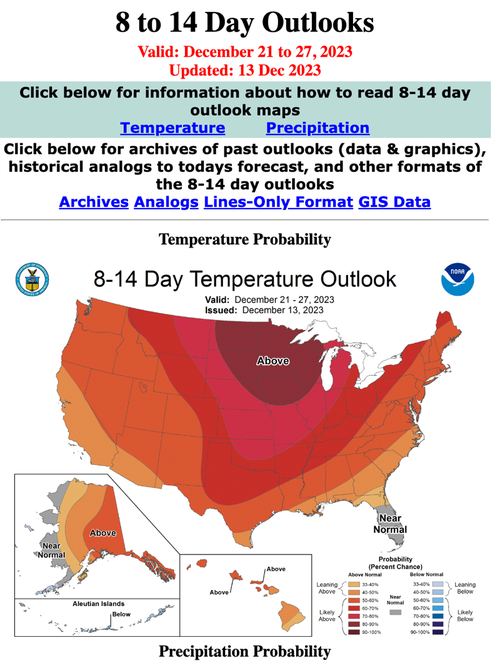

Data from the Climate Prediction Center also validates mild weather forecasts for the remainder of this month.

Some weather forecasters believe a "pattern change is still on course for January" for North America.

The influence of the El Nino continues to grow, helping to create a strong Jet Stream pattern over the Pacific Ocean, bringing warmth into North America. But a pattern change is still on course for January.https://t.co/iD0a8DTm2e

— severe-weather.EU (@severeweatherEU) December 14, 2023

And that is why this trade is known as the Widowmaker.

The Northern Hemisphere winter has been mostly mild so far, driven by a weather phenomenon known as “El Niño.” As a result, natural gas futures in the US have plunged to six-month lows on ample supply while the spread between March and April contracts, known as the “Widowmaker” because of its high risk and volatility, has dropped below zero.

Bloomberg pointed out, “It’s the earliest in the season that the spread — which typically doesn’t drop below zero until the end of January or later — has gone negative on a closing basis since 2020.”

The rationale behind this trade is based on weather patterns and supply-demand dynamics. Across the Lower 48, March is still a winter month with higher demand for heating, which tends to keep natural gas prices elevated. By April, spring begins to arrive, and heating demand is reduced. Traders betting on this spread aim to profit from these predictable seasonal patterns.

But as the bet is known as Widowmaker, it’s notoriously risky because weather is unpredictable and can quickly change. This bet has led to the implosion of hedge funds such as Amaranth Advisors LLC in 2006.

Since the start of November, natural gas futures have plunged 35% because the mild winter has dented gas demand.

Weather forecasting data for the Lower 48 shows temperatures for December are above 30-year, 10-year, and 5-year averages.

Data from the Climate Prediction Center also validates mild weather forecasts for the remainder of this month.

Some weather forecasters believe a “pattern change is still on course for January” for North America.

The influence of the El Nino continues to grow, helping to create a strong Jet Stream pattern over the Pacific Ocean, bringing warmth into North America. But a pattern change is still on course for January.https://t.co/iD0a8DTm2e

— severe-weather.EU (@severeweatherEU) December 14, 2023

And that is why this trade is known as the Widowmaker.

Loading…