By Tsvetana Paraskova of OilPrice.com

Europe’s natural gas futures point to structurally higher prices for the rest of the year, as Europe will soon have to start filling inventories for the 2023/2024 winter.

The TTF price, Europe’s benchmark, slipped on Monday to the lowest level since September 2021, and Europe looks confident that there will not be gas shortages this winter.

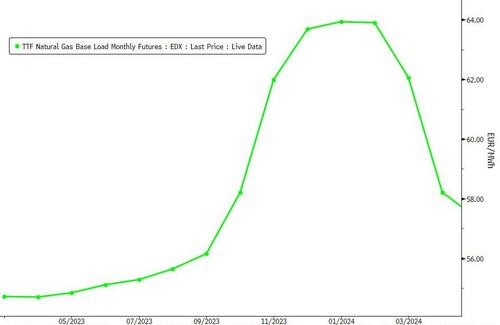

However, the race to ensure supply for next winter hasn’t even started in earnest yet. Prices are set to hold higher than before the Russian invasion of Ukraine through the summer as Europe will face stiffer competition from Asia for liquefied natural gas (LNG) supply. TTF futures for December are priced above €60 per megawatt-hour, notably higher than the €54 per megawatt-hour for March.

Last year, Asia – including China – saw lukewarm demand amid high spot prices and a slowdown in the Chinese economy. With China’s reopening, however, demand for gas and LNG is set to rebound, increasing the competition between Asia and Europe for spot supply, analysts say.

Moreover, the weather in Europe has been milder than usual for prolonged periods so far this winter, allowing for less gas consumption for heating and power generation. It is far from certain that Europe, and the northern hemisphere as a whole, will see mild temperatures next winter, too.

Governments and regulators in the EU say that while a major gas shortage crisis has been averted for this winter, next winter could be more difficult.

“Prices seem likely to remain structurally higher than they were before the Russian invasion,” Henning Gloystein, director for energy, climate and resources at Eurasia Group, said in a recent note carried by Bloomberg.

Europe continues to add new LNG import capacity, especially in Germany and the Netherlands, but if global supply is tighter, prices will spike again.

Europe’s gas prices were up by around 3% at $58 (54 euros) per megawatt-hour (MWh) around noon in Amsterdam on Wednesday.

Prices have held in the $53-64 (50-60 euros) per MWh for weeks amid higher-than-seasonal gas inventories, mild weather, and steady inflows of LNG.

By Tsvetana Paraskova of OilPrice.com

Europe’s natural gas futures point to structurally higher prices for the rest of the year, as Europe will soon have to start filling inventories for the 2023/2024 winter.

The TTF price, Europe’s benchmark, slipped on Monday to the lowest level since September 2021, and Europe looks confident that there will not be gas shortages this winter.

However, the race to ensure supply for next winter hasn’t even started in earnest yet. Prices are set to hold higher than before the Russian invasion of Ukraine through the summer as Europe will face stiffer competition from Asia for liquefied natural gas (LNG) supply. TTF futures for December are priced above €60 per megawatt-hour, notably higher than the €54 per megawatt-hour for March.

Last year, Asia – including China – saw lukewarm demand amid high spot prices and a slowdown in the Chinese economy. With China’s reopening, however, demand for gas and LNG is set to rebound, increasing the competition between Asia and Europe for spot supply, analysts say.

Moreover, the weather in Europe has been milder than usual for prolonged periods so far this winter, allowing for less gas consumption for heating and power generation. It is far from certain that Europe, and the northern hemisphere as a whole, will see mild temperatures next winter, too.

Governments and regulators in the EU say that while a major gas shortage crisis has been averted for this winter, next winter could be more difficult.

“Prices seem likely to remain structurally higher than they were before the Russian invasion,” Henning Gloystein, director for energy, climate and resources at Eurasia Group, said in a recent note carried by Bloomberg.

Europe continues to add new LNG import capacity, especially in Germany and the Netherlands, but if global supply is tighter, prices will spike again.

Europe’s gas prices were up by around 3% at $58 (54 euros) per megawatt-hour (MWh) around noon in Amsterdam on Wednesday.

Prices have held in the $53-64 (50-60 euros) per MWh for weeks amid higher-than-seasonal gas inventories, mild weather, and steady inflows of LNG.

Loading…