By George Lei, Bloomberg Markets Live reporter and analyst

Equity markets in both mainland China and Hong Kong have stalled in April after two straight quarters of stellar rallies. Asia-focused money managers appear to have maxed out their China stock exposure, and the next leg in the reopening trade will depend a lot on institutional investors elsewhere shifting their allocations as the latest data revived fears that a US recession could be in store.

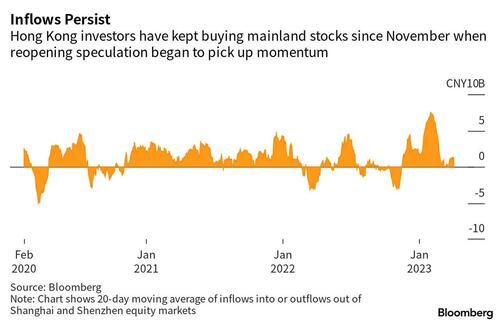

Equity inflows into onshore markets from Hong Kong via the stock connect program slowed last month after reaching a post-pandemic high in January and February. Meanwhile, aggregated net inflows from active long-only managers into China/Hong Kong stocks moderated from $5.2 billion in January to $1.2 billion the following month and $330 million in March, according to EPFR data.

Purchases in 1Q were largely driven by portfolio rebalancing as money managers in Asia ex-Japan added China/HK stocks to their equity holdings, according to a research report from Morgan Stanley. Current allocation by Asia ex-Japan portfolios is at the top quintile versus history, a level that appears to be “enough to capture market upside,” according to the US bank.

On the other hand, active weights from global equity managers have remained mostly unchanged, wrote analysts led by Gilbert Wong, Morgan Stanley’s head of Asia quantitative research. Investors outside the region are unlikely to boost their allocation unless relations between Beijing and Washington warm up, China’s long-term growth prospects meaningfully improve or a “black swan” event hits the outlook for developed markets.

Ironically, the black swan scenario might be the most likely catalyst at this point that could tip portfolio reallocation in favor of China. China’s domestic growth recovery is real but will be gradual, largely due to weak confidence that prevents corporates from hiring and consumers from spending, according to Macquarie.

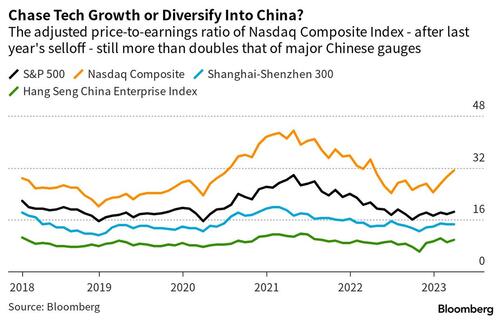

It’s unwise for US investors to chase mega-cap growth stocks that contributed to over 80% of S&P 500 gains in 1Q, UBS Global Wealth Management said in a client note on Wednesday. With tech expensive and the latest data flashing recession risks, the Swiss bank recommends diversifying beyond the US and growth in global equity portfolios, favoring China and other emerging markets.

By George Lei, Bloomberg Markets Live reporter and analyst

Equity markets in both mainland China and Hong Kong have stalled in April after two straight quarters of stellar rallies. Asia-focused money managers appear to have maxed out their China stock exposure, and the next leg in the reopening trade will depend a lot on institutional investors elsewhere shifting their allocations as the latest data revived fears that a US recession could be in store.

Equity inflows into onshore markets from Hong Kong via the stock connect program slowed last month after reaching a post-pandemic high in January and February. Meanwhile, aggregated net inflows from active long-only managers into China/Hong Kong stocks moderated from $5.2 billion in January to $1.2 billion the following month and $330 million in March, according to EPFR data.

Purchases in 1Q were largely driven by portfolio rebalancing as money managers in Asia ex-Japan added China/HK stocks to their equity holdings, according to a research report from Morgan Stanley. Current allocation by Asia ex-Japan portfolios is at the top quintile versus history, a level that appears to be “enough to capture market upside,” according to the US bank.

On the other hand, active weights from global equity managers have remained mostly unchanged, wrote analysts led by Gilbert Wong, Morgan Stanley’s head of Asia quantitative research. Investors outside the region are unlikely to boost their allocation unless relations between Beijing and Washington warm up, China’s long-term growth prospects meaningfully improve or a “black swan” event hits the outlook for developed markets.

Ironically, the black swan scenario might be the most likely catalyst at this point that could tip portfolio reallocation in favor of China. China’s domestic growth recovery is real but will be gradual, largely due to weak confidence that prevents corporates from hiring and consumers from spending, according to Macquarie.

It’s unwise for US investors to chase mega-cap growth stocks that contributed to over 80% of S&P 500 gains in 1Q, UBS Global Wealth Management said in a client note on Wednesday. With tech expensive and the latest data flashing recession risks, the Swiss bank recommends diversifying beyond the US and growth in global equity portfolios, favoring China and other emerging markets.

Loading…