By Michael Msika, Bloomberg Markets live reporter and analyst

A crunch week lies ahead for stock markets and with the fourth-quarter rally having already lost some momentum, the asymmetry of potential returns is likely skewed to the downside.

With the year-end holidays coming into sight, risk appetite is lower than it has been ahead of events including US inflation data, and rate decisions from the Federal Reserve, European Central Bank and Bank of England. With investors looking to protect their returns, the Stoxx 600 just snapped a seven-week winning streak.

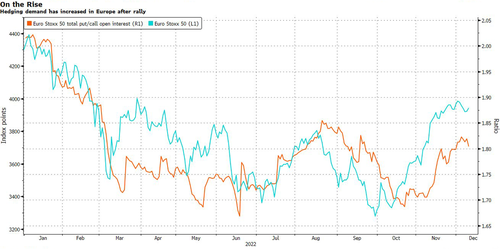

At the same time, hedging demand has increased, with total put/call open interest at its highest in three months on the Euro Stoxx 50 Index. That said, it remains below August’s peak, even with the market now much higher than it was back then.

“It’s time to hedge,” according to Vincent Rennella, head of equity strategy at asset management firm Silex, who says the “bear squeeze” has run its course, and sees the tactical risk-reward for equities as being less attractive.

The strategist expects stocks to be in for a bumpy ride in the next few months, with markets unlikely to find a lasting bottom until the macro-economic trough is reached. The recent pressure on short sellers to reduce or exit positions has also changed how hedge funds and commodity trading advisers (CTAs) are positioned, and light volumes have exacerbated price action across assets, he says.

With gauges for equity volatility plunging below 20, it’s no surprise investors took advantage of a cheap hedging opportunity, especially as a decline below that level has been a signal to sell stocks over the course of the year.

For sure, equities already look to be pricing in a lot of good news, including further Chinese reopening and lower US inflation, expectations for which were dented by Friday’s hotter-than-expected producer prices reading. And while a recession is widely anticipated next year, it’s less aggressively priced after the recent rebound, according to Barclays strategist Emmanuel Cau.

Cau says European equities should be in “a better place” by the end of 2023 as an easing in interest rates, the dollar and growth strains “open the door to a new cycle.” However, the path there is a tricky one and following the rally of recent months, “the tactical risk-reward feels more neutral,” he says.

Technically, the bullish trend remains strong above the 436.4 level for the Stoxx 600, according to DayByDay technical analyst Valerie Gastaldy. Should the index break below this support, it would likely accelerate the downside toward supports at 425.8 and 418.5, triggering a “fake sell signal, that will provide the best long entry point for 2023,” possibly this month, or in January, she says.

For Michele Morganti, senior equity strategist at Generali Investments, the rally could be prolonged due to “depressed positioning, resilient macro momentum, peaking US inflation plus low relative equity volatility.” Still, Morganti remains cautious, saying valuations are in “an uncomfortable zone,” while monetary tightening “will continue to hurt over the next months.”

By Michael Msika, Bloomberg Markets live reporter and analyst

A crunch week lies ahead for stock markets and with the fourth-quarter rally having already lost some momentum, the asymmetry of potential returns is likely skewed to the downside.

With the year-end holidays coming into sight, risk appetite is lower than it has been ahead of events including US inflation data, and rate decisions from the Federal Reserve, European Central Bank and Bank of England. With investors looking to protect their returns, the Stoxx 600 just snapped a seven-week winning streak.

At the same time, hedging demand has increased, with total put/call open interest at its highest in three months on the Euro Stoxx 50 Index. That said, it remains below August’s peak, even with the market now much higher than it was back then.

“It’s time to hedge,” according to Vincent Rennella, head of equity strategy at asset management firm Silex, who says the “bear squeeze” has run its course, and sees the tactical risk-reward for equities as being less attractive.

The strategist expects stocks to be in for a bumpy ride in the next few months, with markets unlikely to find a lasting bottom until the macro-economic trough is reached. The recent pressure on short sellers to reduce or exit positions has also changed how hedge funds and commodity trading advisers (CTAs) are positioned, and light volumes have exacerbated price action across assets, he says.

With gauges for equity volatility plunging below 20, it’s no surprise investors took advantage of a cheap hedging opportunity, especially as a decline below that level has been a signal to sell stocks over the course of the year.

For sure, equities already look to be pricing in a lot of good news, including further Chinese reopening and lower US inflation, expectations for which were dented by Friday’s hotter-than-expected producer prices reading. And while a recession is widely anticipated next year, it’s less aggressively priced after the recent rebound, according to Barclays strategist Emmanuel Cau.

Cau says European equities should be in “a better place” by the end of 2023 as an easing in interest rates, the dollar and growth strains “open the door to a new cycle.” However, the path there is a tricky one and following the rally of recent months, “the tactical risk-reward feels more neutral,” he says.

Technically, the bullish trend remains strong above the 436.4 level for the Stoxx 600, according to DayByDay technical analyst Valerie Gastaldy. Should the index break below this support, it would likely accelerate the downside toward supports at 425.8 and 418.5, triggering a “fake sell signal, that will provide the best long entry point for 2023,” possibly this month, or in January, she says.

For Michele Morganti, senior equity strategist at Generali Investments, the rally could be prolonged due to “depressed positioning, resilient macro momentum, peaking US inflation plus low relative equity volatility.” Still, Morganti remains cautious, saying valuations are in “an uncomfortable zone,” while monetary tightening “will continue to hurt over the next months.”

Loading…