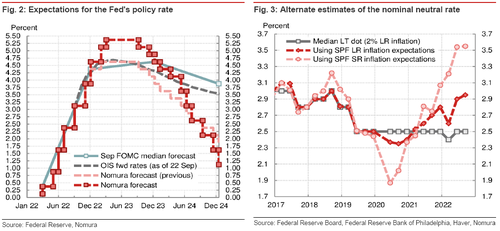

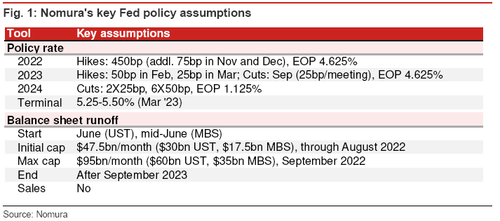

On Friday night, the Nomura US Econ Research Team revised up their Federal Reserve 'Terminal Rate' forecast to 5.25-5.50% - which they then believe will be followed by a faster pace of CUTS in 2024:

Growing evidence that the short-term “Neutral Rate” has increased on 1) looser than expected financial conditions, 2) resilient labor markets and 3) still-elevated inflation suggesting that the Nominal “Neutral Rate” is likely higher than 2-2.5%, implying any given level of Fed policy will thus be more accomodative than previously believed.

Consequently, we have revised up our “Terminal Rate” forecast by 75bps to 5.25-5.50% and now expect rate hikes of 75bps in Nov and Dec ‘22, followed by 50bps in Feb and 25bps in Mar ‘23.

We maintain our below-consensus growth outlook, including our expectations of a recession starting in Q4 2022 and peak unemployment rate of around 6% in 2024.

That said, a higher neutral rate implies the current monetary policy stance is more accommodative than we had thought previously, suggesting greater risk the recession start is delayed to Q1 2023. While we continue to expect cuts starting in September 2023 at an initial pace of 25bp per meeting, we believe the pace will accelerate to 50bp per meeting in Q2 2024.

We continue to expect cuts to start in Sep ’23, at an initial pace of 25bps per meeting; however, after five 25bps cuts (three in ’23, two in ’24), we now expect the Fed to accelerate the pace in Q2 2023 to 50bps / meeting as the risk of inflation rebounding diminishes, resulting in an end-2024 policy rate of 1.125%

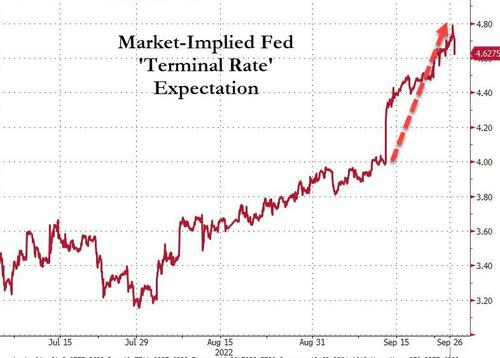

And as Nomura's Charlie McElligott notes, the market continues resetting the Fed’s “Terminal Rate” higher (Apr23 Fed Funds now implying ~4.80)...

...and with it, US Real Rates alongside US Dollar are both pushing to new multi-year highs, in what is a pure “financial conditions tightening” impulse that is poison for Risk-Assets.

And adding to the collective macro mess, there is the additional calamity emanating out of both the UK and Europe as well, as collapsing Currencies create a doom-loop of hastened / escalated Central Bank Rate hike projections, with both governments pursuing looser Fiscal policy to offset the (negative) Energy- and Growth- shocks.

The last month's FX performance against the dollar - amid widening rate-differentials and soaring current account deficits in the rest of the world on "exported inflation" and the energy crisis - McElligott risibly comments that "everything else is an emerging market."

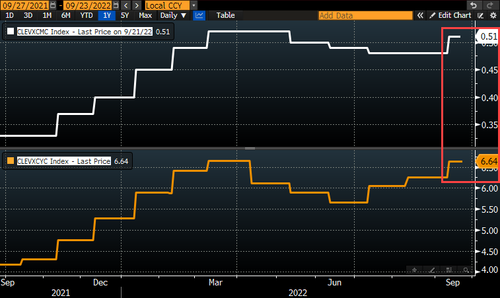

And if you thought - well it can't get any worse, surely The Fed will stop now... - think again as Cleveland Fed Inflation Nowcasting Core CPI just ticked higher vs the last reading on 9/13/22 for MoM (0.51) and YoY (6.64) - offering another catalyst for further extension of the USD rates move...

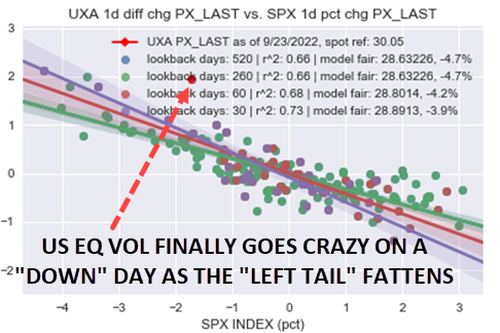

And finally, as macro condition continues to destabilize, the Nomura strategist notes that we have seen US Equities Vol / Skew / Put Skew / Crash finally go “bid” after 6+ months in the wilderness as the probability of the “Left Tail” scenario has fattened, with “Vol of Vol” VVIX seeing its second-largest 1d move (higher) since Nov ‘21...

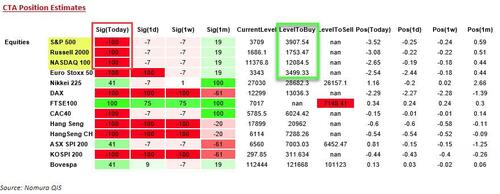

Which has pushed Nomura's CTA Trend model to '100% Short' across all the US majors...

And as the green box shows above, the 'levels to buy' will need a serious squeeze before any flip is realized.

On Friday night, the Nomura US Econ Research Team revised up their Federal Reserve ‘Terminal Rate’ forecast to 5.25-5.50% – which they then believe will be followed by a faster pace of CUTS in 2024:

Growing evidence that the short-term “Neutral Rate” has increased on 1) looser than expected financial conditions, 2) resilient labor markets and 3) still-elevated inflation suggesting that the Nominal “Neutral Rate” is likely higher than 2-2.5%, implying any given level of Fed policy will thus be more accomodative than previously believed.

Consequently, we have revised up our “Terminal Rate” forecast by 75bps to 5.25-5.50% and now expect rate hikes of 75bps in Nov and Dec ‘22, followed by 50bps in Feb and 25bps in Mar ‘23.

We maintain our below-consensus growth outlook, including our expectations of a recession starting in Q4 2022 and peak unemployment rate of around 6% in 2024.

That said, a higher neutral rate implies the current monetary policy stance is more accommodative than we had thought previously, suggesting greater risk the recession start is delayed to Q1 2023. While we continue to expect cuts starting in September 2023 at an initial pace of 25bp per meeting, we believe the pace will accelerate to 50bp per meeting in Q2 2024.

We continue to expect cuts to start in Sep ’23, at an initial pace of 25bps per meeting; however, after five 25bps cuts (three in ’23, two in ’24), we now expect the Fed to accelerate the pace in Q2 2023 to 50bps / meeting as the risk of inflation rebounding diminishes, resulting in an end-2024 policy rate of 1.125%

And as Nomura’s Charlie McElligott notes, the market continues resetting the Fed’s “Terminal Rate” higher (Apr23 Fed Funds now implying ~4.80)…

…and with it, US Real Rates alongside US Dollar are both pushing to new multi-year highs, in what is a pure “financial conditions tightening” impulse that is poison for Risk-Assets.

And adding to the collective macro mess, there is the additional calamity emanating out of both the UK and Europe as well, as collapsing Currencies create a doom-loop of hastened / escalated Central Bank Rate hike projections, with both governments pursuing looser Fiscal policy to offset the (negative) Energy- and Growth- shocks.

The last month’s FX performance against the dollar – amid widening rate-differentials and soaring current account deficits in the rest of the world on “exported inflation” and the energy crisis – McElligott risibly comments that “everything else is an emerging market.”

And if you thought – well it can’t get any worse, surely The Fed will stop now… – think again as Cleveland Fed Inflation Nowcasting Core CPI just ticked higher vs the last reading on 9/13/22 for MoM (0.51) and YoY (6.64) – offering another catalyst for further extension of the USD rates move…

And finally, as macro condition continues to destabilize, the Nomura strategist notes that we have seen US Equities Vol / Skew / Put Skew / Crash finally go “bid” after 6+ months in the wilderness as the probability of the “Left Tail” scenario has fattened, with “Vol of Vol” VVIX seeing its second-largest 1d move (higher) since Nov ‘21…

Which has pushed Nomura’s CTA Trend model to ‘100% Short’ across all the US majors…

And as the green box shows above, the ‘levels to buy’ will need a serious squeeze before any flip is realized.