Last week saw more "disinflationary" US data (misses in CPI, PPI and Friday's U Mich 1Y Inflation Expectations vs prior “peak inflation” highs and Street estimates) 'light the match' for yet another squeeze-driven rip higher in stocks prompted by an improvement in the odds of sticking a “goldilocks” soft-landing, via a perceived lowering the risk of further Fed “hawkish overshoot” / policy-error.

Friday saw further extension of the recently noted “un-stable” speculative behavior seen previously at peaks of the “Retail / WSB YOLO frenzy” in 2021, evidenced by ongoing aggressive short-dated Upside Call option buying in Meme stocks.

And as Nomura's Charlie McElligott warns, the aggressive “Spot Up, Vol Up” push in the “high spec” names has tended to preempt the potential for said Meme stocks to then collapse under the weight of their own “extended” implied expectations (and prior “Gamma squeezes” then turn the opposite direction)...so this area is worth keeping one eye on.

Over the weekend, the market awoke to yet another global growth headwind, after miserable Chinese activity data for July necessitates a PBoC easing, sending Crude Oil sharply lower again prompting another “disinflationary impulse” for global inflation and policy-makers.

All of which means - perversely for Equities Bears - “recession,” “slowing global growth” and “past peak inflation” continue to act as a large part of the “BULL-case” for Stocks, as the implication is an acceleration of the eventual pivot back into “easier” policy, after the spastic “catch up” from global central banks to tighten policy caused so much “multiple” destruction, which was effectively the entirety of the Equities downside since the highs in Nov ’21 .

Since mid-June, McElligott points out that this “Spot explosion / Vol implosion” then mechanically-dictated an enormous cover in legacy “Shorts” across global Equities futures from CTA Trend and Vol Control funds now estimated to have re-allocated back +$27.6B of Equities buying off the low exposure there as well, as trailing realized Vol crashed-down.

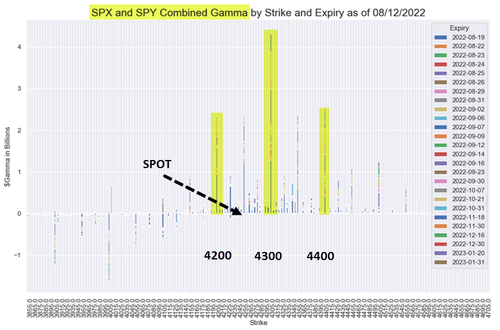

All of which sets the scene for this week's OpEx, which the Nomura strategist describes simply as “real,” because as shown above, there is a MASSIVE amount of + $Delta out there, and there are some decisions to be made on those options with a lot of it expiring which could act as a “de-risking” flow.

McElligott estimates

-

30% of SPX / SPY consolidated (and currently “Long”) $Gamma set to drop,

-

40% of QQQ $Gamma to drop; and

-

27% of IWM $Gamma set to run-off.

Key big $Gamma strikes for SPX are 4300 ($4.7B), 4200 ($3.4B) and current Spot at 4250 ($3.1B).

This means the potential for a “Gamma Unclenching” on the Index level, which could then open the window for “Volatility expansion” as the Dealer hedging buffers are reduced, allowing us to make bigger moves again in both directions (say a clear of the 200dma which would align with next CTA “buy to go +100% Long” triggers to the upside, or a big Delta de-risking purge to the downside).

Last week saw more “disinflationary” US data (misses in CPI, PPI and Friday’s U Mich 1Y Inflation Expectations vs prior “peak inflation” highs and Street estimates) ‘light the match’ for yet another squeeze-driven rip higher in stocks prompted by an improvement in the odds of sticking a “goldilocks” soft-landing, via a perceived lowering the risk of further Fed “hawkish overshoot” / policy-error.

Friday saw further extension of the recently noted “un-stable” speculative behavior seen previously at peaks of the “Retail / WSB YOLO frenzy” in 2021, evidenced by ongoing aggressive short-dated Upside Call option buying in Meme stocks.

And as Nomura’s Charlie McElligott warns, the aggressive “Spot Up, Vol Up” push in the “high spec” names has tended to preempt the potential for said Meme stocks to then collapse under the weight of their own “extended” implied expectations (and prior “Gamma squeezes” then turn the opposite direction)…so this area is worth keeping one eye on.

Over the weekend, the market awoke to yet another global growth headwind, after miserable Chinese activity data for July necessitates a PBoC easing, sending Crude Oil sharply lower again prompting another “disinflationary impulse” for global inflation and policy-makers.

All of which means – perversely for Equities Bears – “recession,” “slowing global growth” and “past peak inflation” continue to act as a large part of the “BULL-case” for Stocks, as the implication is an acceleration of the eventual pivot back into “easier” policy, after the spastic “catch up” from global central banks to tighten policy caused so much “multiple” destruction, which was effectively the entirety of the Equities downside since the highs in Nov ’21 .

Since mid-June, McElligott points out that this “Spot explosion / Vol implosion” then mechanically-dictated an enormous cover in legacy “Shorts” across global Equities futures from CTA Trend and Vol Control funds now estimated to have re-allocated back +$27.6B of Equities buying off the low exposure there as well, as trailing realized Vol crashed-down.

All of which sets the scene for this week’s OpEx, which the Nomura strategist describes simply as “real,” because as shown above, there is a MASSIVE amount of + $Delta out there, and there are some decisions to be made on those options with a lot of it expiring which could act as a “de-risking” flow.

McElligott estimates

Key big $Gamma strikes for SPX are 4300 ($4.7B), 4200 ($3.4B) and current Spot at 4250 ($3.1B).

This means the potential for a “Gamma Unclenching” on the Index level, which could then open the window for “Volatility expansion” as the Dealer hedging buffers are reduced, allowing us to make bigger moves again in both directions (say a clear of the 200dma which would align with next CTA “buy to go +100% Long” triggers to the upside, or a big Delta de-risking purge to the downside).