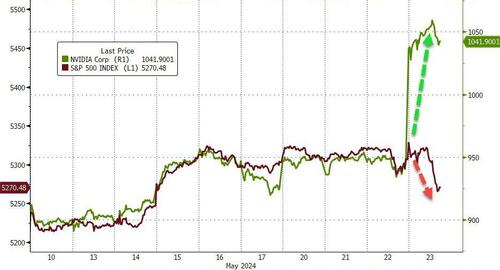

NVDA smashed earnings and guidance out of the park and shares exploded over 10% higher...

... to make the AI-darling above $2.5 trillion market cap for the first time...

Source: Bloomberg

With around a 1% decline in US stocks, total US market cap fell by around $500 billion, while NVDA alone added $230 billion...

Source: Bloomberg

For everyone else there was more great news about the American economy... US PMIs surged to two year highs proving Bidenomics is awesome (though input prices surged), and jobless claims remain near record lows. New home sales were weak but the market chose to ignore that.

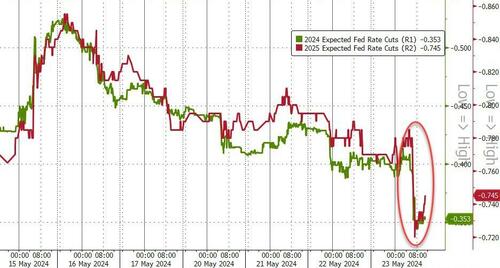

BUT... just as the dismal dump in soft data recently has prompted buying panics across stocks and commodities (on Fed cut hopes)... so the 'good news' today sparked a very bad no good response from markets with rate-cut expectations tumbling further. The market is now pricing in just chance of two rate cuts this year and has reduced 2025's expectations to three more cuts only...

Source: Bloomberg

And so while NVDA was charging to ever more impressive highs, everything else shit the bed with stocks down hard, oil & gold tanking, crypto clubbed like a baby seal, bonds battered, and only the USDollar managed gains, recovering from overnight weakness.

Small Caps and The Dow were the biggest losers on the day with the latter hit by Boeing's breakdown. Despite NVDA's surge, Nasdaq and S&P were down significantly too...

Small Caps fell back to (and found support at) the 50-DMA today (all the other majors are extended well above their 50DMAs)...

Boeing shaved almost 100pts off The Dow today but all 30 components were red...

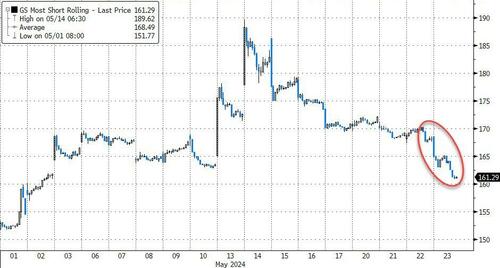

'Most Shorted' stocks continue to trend lower as short-squeezes have run out of ammo...

Source: Bloomberg

Magnificent 7 stocks ripped higher out of the gate (thanks to NVDA) but by the close had given it all back...

Source: Bloomberg

Treasury yields were up across the board with the short-end a slight laggard (2Y +6bps, 30Y +4bps)...

Source: Bloomberg

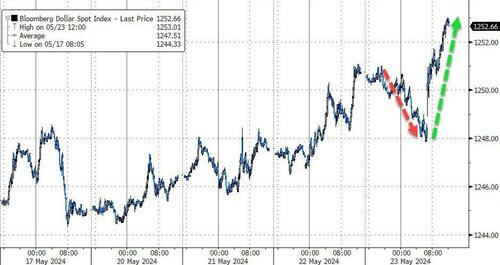

The dollar rebounded off overnight lows to end higher...

Source: Bloomberg

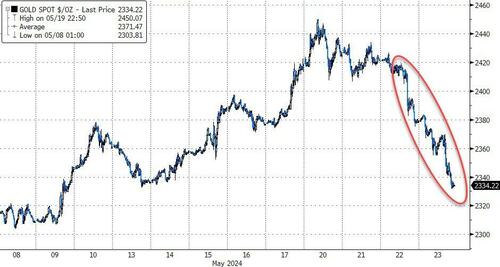

But gold was slammed lower once again...

Source: Bloomberg

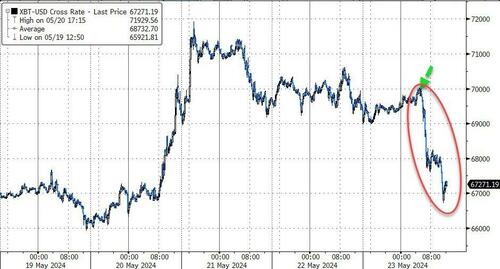

Bitcoin hit $70,000 and was immediately dumped...

Source: Bloomberg

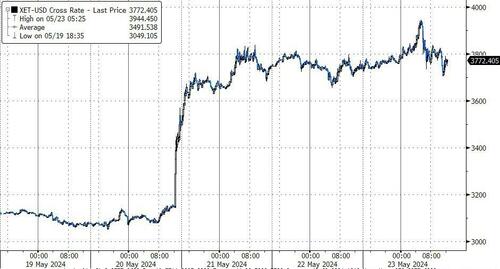

But, Ethereum held on to gains as hopes for approval of the ETH ETFs rises...

Source: Bloomberg

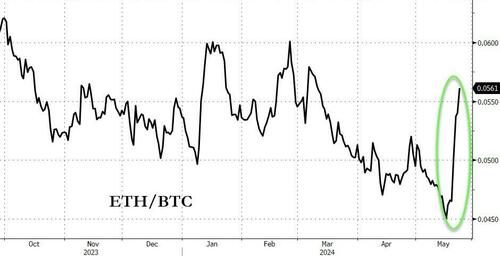

With ETH/BTC soaring...

Source: Bloomberg

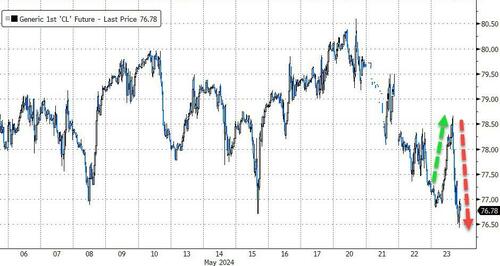

Oil prices flip-flopped to end at three-month lows...

Source: Bloomberg

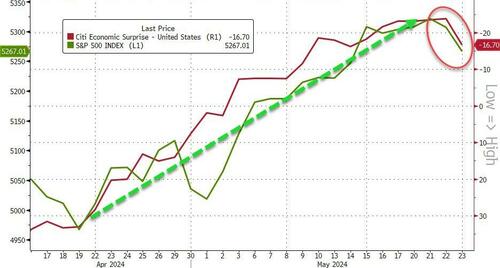

Finally, to clarify, the market is in 'Upside-Down World' still where good (macro) news is bad (market) news and vice versa...

Source: Bloomberg

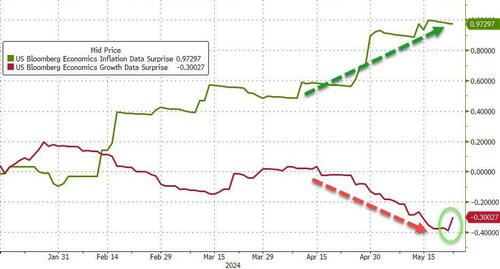

But don't forget that inflation indicators just keep surprising to the upside (and now growth is getting a pump)...

Source: Bloomberg

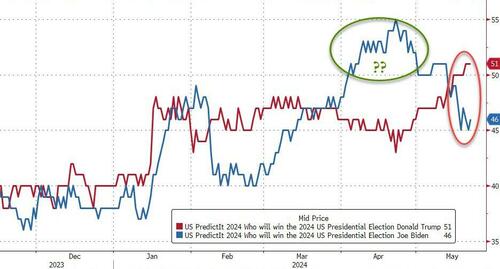

Hardly an obvious scenario for rate-cutting... but then again, it is an election year and Biden is down bigly...

Source: Bloomberg

...so anything goes for the apolitical Fed.

NVDA smashed earnings and guidance out of the park and shares exploded over 10% higher…

… to make the AI-darling above $2.5 trillion market cap for the first time…

Source: Bloomberg

With around a 1% decline in US stocks, total US market cap fell by around $500 billion, while NVDA alone added $230 billion…

Source: Bloomberg

For everyone else there was more great news about the American economy… US PMIs surged to two year highs proving Bidenomics is awesome (though input prices surged), and jobless claims remain near record lows. New home sales were weak but the market chose to ignore that.

BUT… just as the dismal dump in soft data recently has prompted buying panics across stocks and commodities (on Fed cut hopes)… so the ‘good news’ today sparked a very bad no good response from markets with rate-cut expectations tumbling further. The market is now pricing in just chance of two rate cuts this year and has reduced 2025’s expectations to three more cuts only…

Source: Bloomberg

And so while NVDA was charging to ever more impressive highs, everything else shit the bed with stocks down hard, oil & gold tanking, crypto clubbed like a baby seal, bonds battered, and only the USDollar managed gains, recovering from overnight weakness.

Small Caps and The Dow were the biggest losers on the day with the latter hit by Boeing’s breakdown. Despite NVDA’s surge, Nasdaq and S&P were down significantly too…

Small Caps fell back to (and found support at) the 50-DMA today (all the other majors are extended well above their 50DMAs)…

Boeing shaved almost 100pts off The Dow today but all 30 components were red…

‘Most Shorted’ stocks continue to trend lower as short-squeezes have run out of ammo…

Source: Bloomberg

Magnificent 7 stocks ripped higher out of the gate (thanks to NVDA) but by the close had given it all back…

Source: Bloomberg

Treasury yields were up across the board with the short-end a slight laggard (2Y +6bps, 30Y +4bps)…

Source: Bloomberg

The dollar rebounded off overnight lows to end higher…

Source: Bloomberg

But gold was slammed lower once again…

Source: Bloomberg

Bitcoin hit $70,000 and was immediately dumped…

Source: Bloomberg

But, Ethereum held on to gains as hopes for approval of the ETH ETFs rises…

Source: Bloomberg

With ETH/BTC soaring…

Source: Bloomberg

Oil prices flip-flopped to end at three-month lows…

Source: Bloomberg

Finally, to clarify, the market is in ‘Upside-Down World’ still where good (macro) news is bad (market) news and vice versa…

Source: Bloomberg

But don’t forget that inflation indicators just keep surprising to the upside (and now growth is getting a pump)…

Source: Bloomberg

Hardly an obvious scenario for rate-cutting… but then again, it is an election year and Biden is down bigly…

Source: Bloomberg

…so anything goes for the apolitical Fed.

Loading…