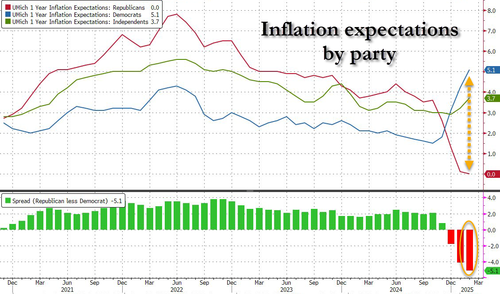

In a surprising twist, last Friday's disappointing - and massively revised - jobs data was unexpectedly upstaged by the inflation expectation prints in the February UMichigan consumer sentiment survey (where the presence of socialist "economist" Justin Wolfers seems to be increasingly skewing the numbers) and which indicated an absolutely ridiculous surge in 1Yr inflation expectations (from 3.3% to 4.3%), but not because everyone expects more inflation but because Democrats now expect something approaching hyperinflation at 5.1%, even as Republicans expect 0.0% inflation in 1 year (and how the average of these two adds up to 4.3%, maybe Justin Wolfers can tell us). Yet despite the clearly political, and thus unreliable, nature of the print the market moved dramatically, and hundreds of billions of market cap was wiped out as stocks sold off on fear of more Fed tightening in coming months.

And just because the number was so galactically stupid, we said that when the NY Fed's inflation expectations print at 11am ET today, they would show an unchanged print and "dunk on the UMich idiocy."

Watch as NY Fed 1Yr inflation expectations are flat and dunk on the Umich idiocy.

— zerohedge (@zerohedge) February 10, 2025

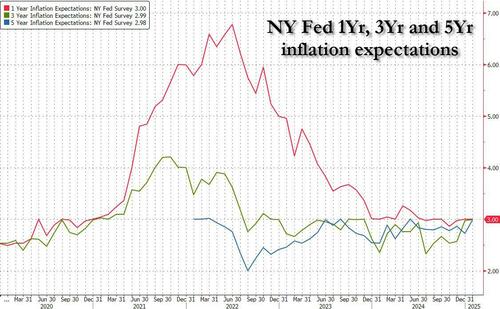

And that's precisely what the Fed revealed moments ago, when it confirmed that far from soaring, 1-Year inflation expectations were not only unchanged at 3.00% - as we said they would be - but they came in below the median analyst estimate of 3.1%.

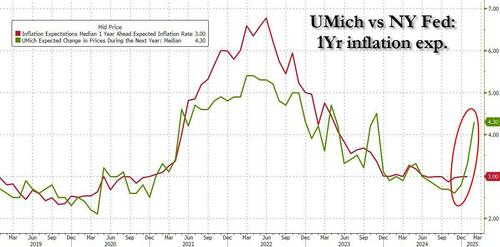

As a result, the gap in 1 Year inflation expectations between the NY Fed survey and the UMich survey, has exploded so wide...

... even WSJ Fed mouthpiece Nikileaks Timiraos was compelled to comment on it.

In the NY Fed's consumer survey, inflation expectations at the 1- and 3-year horizons were unchanged in January, opening up a notable gap with the University of Michigan surveys (which showed big increases in January and February) pic.twitter.com/wIkQOEH582

— Nick Timiraos (@NickTimiraos) February 10, 2025

3 year ahead inflation expectations were also unchanged at 3%, while the longer-dated, 5 Year, bucket rose to 3%, the highest since May 2024, although this is a series that has been capped at 3% for the past three years and which tend to track 5Yr breakevens closely.

And for those who claim that this is all due to confusion by the respondents, the NY Fed dunked on that as well, reporting that the median inflation uncertainty was unchanged at the one-year horizon, declined at the three-year horizon, and increased at the five-year horizon.

As Bloomberg notes, inflation expectations have taken on a new importance in the debate over next steps for monetary policy amid President Donald Trump’s moves to impose tariffs on the country’s biggest trading partners. On Feb. 1, Trump announced tariffs against goods imported from China, Mexico and Canada, though he subsequently delayed the Mexico and Canada decisions.

Several Fed officials have said in recent weeks that the central bank’s response to higher prices resulting from tariffs will depend on whether inflation expectations remain well anchored, and this is where Democrats are doing everything in their power to indicate that at least their expectations are becoming unanchored to the upside, while Republicans are seeing deflation!

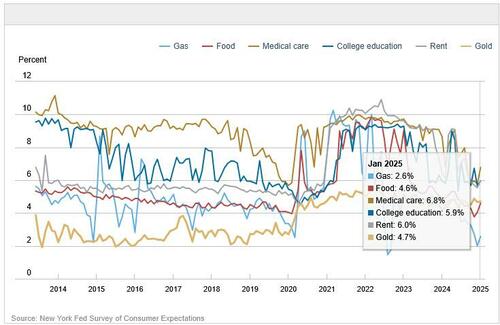

The New York Fed survey showed a rise in inflation expectations for various items over the next year, including gas, food, medical care, college tuition and rent. It also revealed a growing divergence among respondents over estimated inflation in the year ahead, with the gap between the 25th- and 75th-percentile respondents widening to the largest since mid-2023.

Median home price growth expectations rose by 0.1 percentage point to 3.2%. This increase was driven by respondents in the West census region. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023.

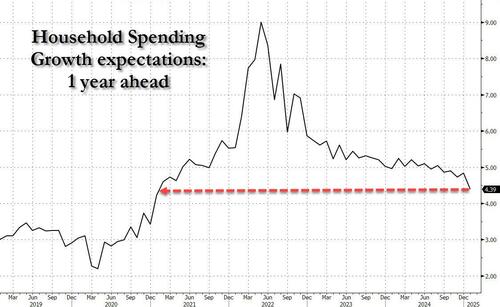

Other indicators in the New York Fed survey were more mixed. Expectations for growth in household spending fell in January to a four-year low and respondents reported more pessimism about their financial situations (which is hardly inflationary).

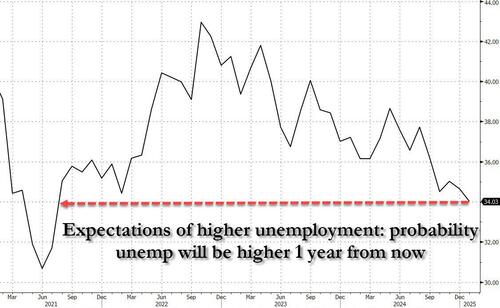

Paradoxically, the perceived probability that the unemployment rate would be higher a year from now also fell, to the lowest level since July 2021.

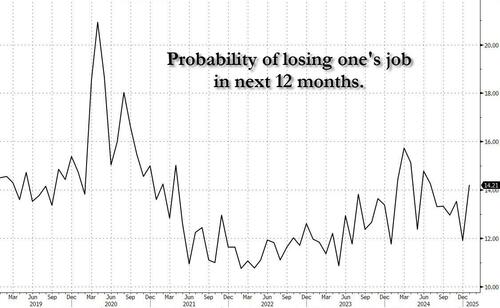

And if that wasn't confusing enough, the survey found that the mean perceived probability of losing one’s job in the next 12 months increased by 2.3% to 14.2%, the highest since July

Meanwhile, adding to the confusion, results from a separate survey published Monday by the Cleveland Fed indicated chief executives and other business leaders polled in January said they expect the consumer price index to rise 3.2% over the next 12 months, down from 3.8% in October.

- Here are some more observations from the latest survey, first looking at the Labor Market:

- Median one-year-ahead earnings growth expectations increased by 0.2 percentage point to 3.0% in January. This series has been moving within a narrow range between 2.7% and 3.0% since January 2024.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—decreased by 0.6 percentage point to 34.0%, the measure’s lowest reading since July 2021. The decline was driven by respondents with no college degree, those with an annual income below $100,000, and those above age 40.

- The mean perceived probability of losing one’s job in the next 12 months increased by 2.3 percentage points to 14.2%. This increase was broad based across demographic groups, but most pronounced for those over the age of 60. The mean probability of leaving one’s job voluntarily in the next 12 months also increased by 1.7 percentage points to 19.9%. This increase was most pronounced for those with an annual household income below $50,000.

- The mean perceived probability of finding a job in the next three months if one’s current job was lost increased by 1.3 percentage points to 51.5%. This increase was driven by those with an annual household income below $100,000.

... and Household Finance

- The median expected growth in household income increased by 0.2 percentage point to 3.0% in January. The series has been moving in a narrow range between 2.8% and 3.1% since August 2023.

- Median household spending growth expectations declined by 0.4 percentage point to 4.4%, its lowest reading since January 2021, but remains above pre-pandemic levels. The decline was broad-based across age, income, and education groups.

- Perceptions of credit access compared to a year ago improved in January, with the net share of households reporting it is easier versus harder to obtain credit than one year ago increasing. Expectations for future credit availability also improved.

- The average perceived probability of missing a minimum debt payment over the next three months decreased by 0.9 percentage point to 13.3%. This series remains above its 12-month trailing average of 13.0%.

- The median expected year-ahead change in taxes at current income level increased by 0.2 percentage point to 3.2%, but remains well below its 12-month trailing average of 3.9%.

- Median year-ahead expected growth in government debt increased by 0.1 percentage point to 6.0%. This reading is well below the series 12-month trailing average of 8.6%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 0.2 percentage point to 25.0%.

- Perceptions about households’ current financial situations compared to a year ago deteriorated in January, with the net share of households reporting a worse versus better situation compared to a year ago rising. Similarly, year-ahead expectations about households’ financial situations also deteriorated in January.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 0.5 percentage point to 40.3%.

More in the full survey available here.

In a surprising twist, last Friday’s disappointing – and massively revised – jobs data was unexpectedly upstaged by the inflation expectation prints in the February UMichigan consumer sentiment survey (where the presence of socialist “economist” Justin Wolfers seems to be increasingly skewing the numbers) and which indicated an absolutely ridiculous surge in 1Yr inflation expectations (from 3.3% to 4.3%), but not because everyone expects more inflation but because Democrats now expect something approaching hyperinflation at 5.1%, even as Republicans expect 0.0% inflation in 1 year (and how the average of these two adds up to 4.3%, maybe Justin Wolfers can tell us). Yet despite the clearly political, and thus unreliable, nature of the print the market moved dramatically, and hundreds of billions of market cap was wiped out as stocks sold off on fear of more Fed tightening in coming months.

And just because the number was so galactically stupid, we said that when the NY Fed’s inflation expectations print at 11am ET today, they would show an unchanged print and “dunk on the UMich idiocy.”

Watch as NY Fed 1Yr inflation expectations are flat and dunk on the Umich idiocy.

— zerohedge (@zerohedge) February 10, 2025

And that’s precisely what the Fed revealed moments ago, when it confirmed that far from soaring, 1-Year inflation expectations were not only unchanged at 3.00% – as we said they would be – but they came in below the median analyst estimate of 3.1%.

As a result, the gap in 1 Year inflation expectations between the NY Fed survey and the UMich survey, has exploded so wide…

… even WSJ Fed mouthpiece Nikileaks Timiraos was compelled to comment on it.

In the NY Fed’s consumer survey, inflation expectations at the 1- and 3-year horizons were unchanged in January, opening up a notable gap with the University of Michigan surveys (which showed big increases in January and February) pic.twitter.com/wIkQOEH582

— Nick Timiraos (@NickTimiraos) February 10, 2025

3 year ahead inflation expectations were also unchanged at 3%, while the longer-dated, 5 Year, bucket rose to 3%, the highest since May 2024, although this is a series that has been capped at 3% for the past three years and which tend to track 5Yr breakevens closely.

And for those who claim that this is all due to confusion by the respondents, the NY Fed dunked on that as well, reporting that the median inflation uncertainty was unchanged at the one-year horizon, declined at the three-year horizon, and increased at the five-year horizon.

As Bloomberg notes, inflation expectations have taken on a new importance in the debate over next steps for monetary policy amid President Donald Trump’s moves to impose tariffs on the country’s biggest trading partners. On Feb. 1, Trump announced tariffs against goods imported from China, Mexico and Canada, though he subsequently delayed the Mexico and Canada decisions.

Several Fed officials have said in recent weeks that the central bank’s response to higher prices resulting from tariffs will depend on whether inflation expectations remain well anchored, and this is where Democrats are doing everything in their power to indicate that at least their expectations are becoming unanchored to the upside, while Republicans are seeing deflation!

The New York Fed survey showed a rise in inflation expectations for various items over the next year, including gas, food, medical care, college tuition and rent. It also revealed a growing divergence among respondents over estimated inflation in the year ahead, with the gap between the 25th- and 75th-percentile respondents widening to the largest since mid-2023.

Median home price growth expectations rose by 0.1 percentage point to 3.2%. This increase was driven by respondents in the West census region. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023.

Other indicators in the New York Fed survey were more mixed. Expectations for growth in household spending fell in January to a four-year low and respondents reported more pessimism about their financial situations (which is hardly inflationary).

Paradoxically, the perceived probability that the unemployment rate would be higher a year from now also fell, to the lowest level since July 2021.

And if that wasn’t confusing enough, the survey found that the mean perceived probability of losing one’s job in the next 12 months increased by 2.3% to 14.2%, the highest since July

Meanwhile, adding to the confusion, results from a separate survey published Monday by the Cleveland Fed indicated chief executives and other business leaders polled in January said they expect the consumer price index to rise 3.2% over the next 12 months, down from 3.8% in October.

- Here are some more observations from the latest survey, first looking at the Labor Market:

- Median one-year-ahead earnings growth expectations increased by 0.2 percentage point to 3.0% in January. This series has been moving within a narrow range between 2.7% and 3.0% since January 2024.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—decreased by 0.6 percentage point to 34.0%, the measure’s lowest reading since July 2021. The decline was driven by respondents with no college degree, those with an annual income below $100,000, and those above age 40.

- The mean perceived probability of losing one’s job in the next 12 months increased by 2.3 percentage points to 14.2%. This increase was broad based across demographic groups, but most pronounced for those over the age of 60. The mean probability of leaving one’s job voluntarily in the next 12 months also increased by 1.7 percentage points to 19.9%. This increase was most pronounced for those with an annual household income below $50,000.

- The mean perceived probability of finding a job in the next three months if one’s current job was lost increased by 1.3 percentage points to 51.5%. This increase was driven by those with an annual household income below $100,000.

… and Household Finance

- The median expected growth in household income increased by 0.2 percentage point to 3.0% in January. The series has been moving in a narrow range between 2.8% and 3.1% since August 2023.

- Median household spending growth expectations declined by 0.4 percentage point to 4.4%, its lowest reading since January 2021, but remains above pre-pandemic levels. The decline was broad-based across age, income, and education groups.

- Perceptions of credit access compared to a year ago improved in January, with the net share of households reporting it is easier versus harder to obtain credit than one year ago increasing. Expectations for future credit availability also improved.

- The average perceived probability of missing a minimum debt payment over the next three months decreased by 0.9 percentage point to 13.3%. This series remains above its 12-month trailing average of 13.0%.

- The median expected year-ahead change in taxes at current income level increased by 0.2 percentage point to 3.2%, but remains well below its 12-month trailing average of 3.9%.

- Median year-ahead expected growth in government debt increased by 0.1 percentage point to 6.0%. This reading is well below the series 12-month trailing average of 8.6%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 0.2 percentage point to 25.0%.

- Perceptions about households’ current financial situations compared to a year ago deteriorated in January, with the net share of households reporting a worse versus better situation compared to a year ago rising. Similarly, year-ahead expectations about households’ financial situations also deteriorated in January.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 0.5 percentage point to 40.3%.

More in the full survey available here.

Loading…