Update (1410ET): Having seen shares collapse over 40% before being halted for 'news pending', we have the news...

Bloomberg reports that New York Community Bancorp plans to announce an equity investment of more than $1 billion led by Steven Mnuchin’s Liberty Strategic Capital, Hudson Bay Capital and Reverence Capital Partners, according to a spokesperson for the bank.

Liberty will invest $450 million, Hudson Bay $250 million and Reverence $200 million as part of the transaction, the spokesperson said.

In connection with the deal, NYCB will reduce the board to nine members, adding new directors, including Mnuchin and Joseph Otting, former comptroller of the currency.

Secretary Steven Mnuchin stated:

"In evaluating this investment, we were mindful of the Bank's credit risk profile. With the over $1 billion of capital invested in the Bank, we believe we now have sufficient capital should reserves need to be increased in the future to be consistent with or above the coverage ratio of NYCB's large bank peers."

Non-Executive Chairman Sandro DiNello stated,

"We welcome the approach that Liberty and its partners took in its evaluation of the Bank and look forward to incorporating their insights going forward. The strategic investment involving former Secretary Steven Mnuchin, former Comptroller Joseph Otting and Milton Berlinski, along with the other institutional investors is a positive endorsement of the turnaround that is underway and allows us to execute on our strategy from a position of strength. We enter this next chapter with a strong balance sheet and liquidity position supported by a diversified and retail focused deposit base. Our new leadership team, with the support of the reconstituted Board, will continue to take the actions that are necessary to improve earnings, profitability and drive enhanced value for shareholders."

Secretary Mnuchin stated,

"We decided to make this investment because we believe Sandro, alongside new management, has taken the appropriate actions to stabilize the Company and to position NYCB to become a best-in-class $100+ billion national bank with a diversified and de-risked business model that supports long term profitability. We are delighted that former Comptroller Otting will be NYCB's new CEO and believe that the actions taken by NYCB establish a strong foundation for future growth through our new relationship with other new Board members and investors. We are confident that NYCB is poised to generate sustainable shareholder value."

The question, of course, is just how diluted the current equity holders just got...

* * *

And the hits just keep coming...

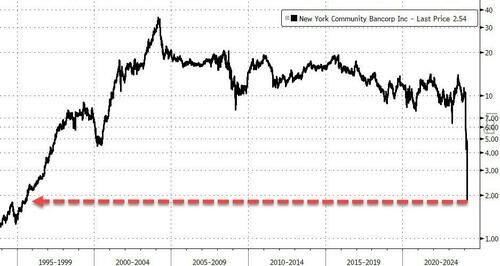

Once the darling of the small banking crisis comeback, New York Community Bancorp has crashed 45% to fresh 30 year lows after The Wall Street Journal reports the bank is seeking to raise equity capital in a bid to shore up confidence in the troubled regional lender.

According to people familiar with the matter, NYCB has dispatched bankers to gauge investors’ interest in buying stock in the company.

There’s no guarantee there will be a deal, or that one would succeed in addressing the bank’s challenges, which as of Wednesday morning had led to a roughly 80% decline in its stock price since January.

This is not a good picture for a bank... Would you hold your deposits there?

Last month, DiNello laid out a series of options the bank could explore to bolster its balance sheet, including selling assets from certain non-core businesses. The bank has also considered turning to newfangled financial instruments that would share the risks of those loans with outside investors, people familiar with the matter said.

As WSJ reports, finding takers for those assets, at least at prices that would make a deal worthwhile, has been challenging and U.S. officials have expressed reservations with banks pursuing credit-risk transfers that would shift the burden of potential losses to entities outside of the regulated banking system.

Finally, as a reminder, NYCB is not alone. The red line below shows 'small banks' are in trouble absent The Fed's BTFP facility...

Oh, and this is fine...

The delinquency rate among large banks hits 3%, the highest in 11 years.

— zerohedge (@zerohedge) March 2, 2024

The delinquency rate among small banks hits 7.80%, the highest on record. pic.twitter.com/oVWuj2doBl

And perhaps that's why the broad regional bank index is also getting hit today...

Beware the Ides of March as RRP liquidity evaporates.

Think this is isolated?

Think again.

Dear @federalreserve maybe allowing Countrwide Financial And WaMu to buy the assets of insolvent NYCB which bought the assets of insolvent Signature Bank is not the best idea.

— zerohedge (@zerohedge) March 6, 2024

As Chris Whalen details below via The Institutional Risk Analyst, the short answer as to what happens next is that we think that the bank may be sold, one way or another. The profitable Flagstar residential servicing business could be offered for sale in order to make a downpayment for the cleanup of the NYCB legacy multifamily portfolio. But in the wake of credit downgrades, NYCB itself may need to be acquired by another bank.

KBW said in a research note that NYCB could tap into its $78 billion in unpaid balances of mortgage-servicing rights to raise capital through a potential sale. The portfolio has a carrying value of $1.1 billion, analysts said. That is a mere downpayment, however, on a larger mess emanating from the bank's impaired multifamily assets.

Without an investment grade credit rating, banks cannot hold escrow balances for conventional or government loans. We cannot see how NYCB keeps the billions in conventional and government escrow deposits long-term. The whole Flagstar servicing platform and more than $300 billion in residential loan servicing, mostly for third parties like nonbank mortgage issuers, needs a new home.

Obviously the shareholders of Flagstar are coming to rue the decision to join forces with NYCB, an under-managed community bank with a portfolio of performing but ultimately unsalable multifamily assets. Thanks to the New York State legislature’s 2019 rent control law, which was supported by Governor Kathy Hochul, all banks in New York City that hold rent stabilized assets on the books are now capital impaired. Several of these banks in New York City may fail as a result of Albany's actions.

So who might acquire NYCB?

First, we take JPMorgan (JPM) and Wells Fargo (WFC) off the table. The former is already the largest residential mortgage servicer in the US and the latter is exiting the residential mortgage business with finality. The departure of Wells from residential mortgages is bad news for consumers and cause for glee among progressive cadres in the Biden Administration. In any event, neither bank wants any part of the Ginnie Mae sub-servicing book inside Flagstar.

Next is Citigroup (C), an intriguing possibility for a bank that badly needs new ideas and revenue streams. Citi has been in and out of residential mortgages for the past 50 years. In the 1980s, Citi introduced the first no-doc mortgage in the US market.

Since subprime consumer credit is a big part of Citi’s business, why not add a good sized residential mortgage business and get back into the housing finance game? There are few other industry segments that have enough size to matter to Citi. Flagstar is the number two warehouse lender after JPM. Overnight, Citi becomes the top bank servicer in the Ginnie Mae market and a significant issuer of MBS.

After Citi the obvious candidate for NYCB is U.S. Bancorp (USB), which is now the second largest residential bank loan producer after Chase. Although USB is still digesting the acquisition of Union Bank of California, they are a player in residential servicing and loan administration. USB could easily acquire the NYCB mortgage platform and billions in escrow deposits.

The idea of NYCB losing stable escrow deposits argues against the sale of the Flagstar mortgage platform and in favor of selling or recapitalizing the whole bank. But is this possible short of an FDIC intervention? Again, the actions taken by Albany in 2019 make NYCB and other New York banks unsalable short of an FDIC takeover.

If you are an investor looking at NYCB, the big question is the 40% of total loans and leases in multifamily assets. If NYCB were to either sell or risk-share a substantial portion of the rent stabilized multifamily assets, then the prospects for the business improve significantly. But given the disclosures about weak controls over loan underwriting, investors are going to be very cautious about making any assumptions on valuation. And risk-sharing is not yet broadly relevant for commercial assets.

Looking at the volume of risk-sharing deals done by banks so far, virtually all of the transactions are for consumer facing assets. Banco Santander (SAN) leads the pack on risk sharing auto and consumer loans. Commercial loans are far more difficult. Western Alliance (WAL) and Texas Capital Bank (TCBI) have done risk sharing deals in prime RMBS and warehouse loans, but commercial mortgages will likely be handled as customized, bespoke arrangements done on single loans. Selling the loans outright to hard money investors may be easier.

NYCB might want to consider creating a separate “bad bank” containing rent stabilized assets from the legacy NYCB to put pressure on Governor Hochul and the New York legislature to come and clean up their mess. Indeed, FDIC Chairman Martin Gruenberg ought to lead that discussion with Governor Hochul. His agency – and all the FDIC insured banks he represents – now hold the bag on billions in eventual losses on rent-stabilized Signature Bank commercial mortgage loans as well as loans held by other banks. The intemperate actions of the State of New York caused these losses.

We expect to see a number of creative structures being rolled out to address the impairment of multifamily commercial mortgages on the books of US banks. Risk-sharing is useful and can actually reduce the risk weighted assets of a bank and improve capital ratios, but at a cost to the bank in terms of income. Other techniques involve selling the low-coupon mortgage and replacing it with risk-free collateral that generates a similar cash flow, but frees up regulatory capital for other purposes.

Despite the promise of risk-sharing transactions, at the end of the day raising new capital and managing the delinquency may be a better approach. In the case of NYCB, raising new equity is not feasible. Indeed, any prospective buyer may demand some form of loss sharing from the FDIC on the multifamily book. If, for example, we assume a conservative 20% haircut on rent-stabilized buildings in NYC, many of the smaller institutions are insolvent.

That said, we would not be surprised to see an arranged marriage involving NYCB and a larger player that wants a bigger role in aggregating, selling and servicing residential mortgages. Even the likes of Goldman Sachs (GS), which has a significant presence in lending on residential warehouse loans and mortgage servicing rights, might find NYCB a compelling opportunity -- given the proper incentives from FDIC, of course.

Bloomberg columnist Max Abelson wrote an epitaph of sorts for NYCB this week:

"How NYCB got here is a tale of percolating financial risks, changing rules and shifting regulators. New rent restrictions became law in 2019, but instead of acknowledging a hit to its loan book, the bank got bigger. Back-to-back acquisitions, first Flagstar and then parts of Signature Bank, almost doubled the firm's size and set it on a collision course with new rules for banks holding more than $100 billion of assets."

We still own NYCB, but we strongly recommend that our readers stand clear until management gives shareholders a very specific roadmap to recovery. The economics of the bank's multifamily book are gnarly at best. Does the FDIC want to resolve another $100 plus billion asset regional bank? Hell no. Because the mess flows downhill, it may be time for creativity on the part of the FDIC and the State of New York.

FDIC Chairman Gruenberg ought to tell Governor Hochul and New York State to take over the rent stabilized loans from Signature, NYCB and other lenders or face an old fashioned FDIC liquidation as and when any banks fail. The number of public housing units in New York City will soar, placing enormous pressure on the city's finances. If the multifamily building cannot be financed by a bank, then the City of New York likely will end up as the owner.

Imagine if FDIC went "by the book" and next week sold all of the rent stabilized Signature Bank multifamily assets for whatever hard money bid is available. New York would face a political crisis. Governor Hochul and progressives in Albany caused this mess, which now threatens the solvency of a number of New York banks. The State of New York should take ownership of its fine work and repeal the 2019 rent control legislation.

Update (1410ET): Having seen shares collapse over 40% before being halted for ‘news pending’, we have the news…

Bloomberg reports that New York Community Bancorp plans to announce an equity investment of more than $1 billion led by Steven Mnuchin’s Liberty Strategic Capital, Hudson Bay Capital and Reverence Capital Partners, according to a spokesperson for the bank.

Liberty will invest $450 million, Hudson Bay $250 million and Reverence $200 million as part of the transaction, the spokesperson said.

In connection with the deal, NYCB will reduce the board to nine members, adding new directors, including Mnuchin and Joseph Otting, former comptroller of the currency.

Secretary Steven Mnuchin stated:

“In evaluating this investment, we were mindful of the Bank’s credit risk profile. With the over $1 billion of capital invested in the Bank, we believe we now have sufficient capital should reserves need to be increased in the future to be consistent with or above the coverage ratio of NYCB’s large bank peers.”

Non-Executive Chairman Sandro DiNello stated,

“We welcome the approach that Liberty and its partners took in its evaluation of the Bank and look forward to incorporating their insights going forward. The strategic investment involving former Secretary Steven Mnuchin, former Comptroller Joseph Otting and Milton Berlinski, along with the other institutional investors is a positive endorsement of the turnaround that is underway and allows us to execute on our strategy from a position of strength. We enter this next chapter with a strong balance sheet and liquidity position supported by a diversified and retail focused deposit base. Our new leadership team, with the support of the reconstituted Board, will continue to take the actions that are necessary to improve earnings, profitability and drive enhanced value for shareholders.”

Secretary Mnuchin stated,

“We decided to make this investment because we believe Sandro, alongside new management, has taken the appropriate actions to stabilize the Company and to position NYCB to become a best-in-class $100+ billion national bank with a diversified and de-risked business model that supports long term profitability. We are delighted that former Comptroller Otting will be NYCB’s new CEO and believe that the actions taken by NYCB establish a strong foundation for future growth through our new relationship with other new Board members and investors. We are confident that NYCB is poised to generate sustainable shareholder value.”

The question, of course, is just how diluted the current equity holders just got…

In connection with the equity capital raise transaction, NYCB will sell and issue, in the aggregate, to the Investors shares of common stock of the Company at a price per share of $2.00 and a series of convertible preferred stock with a conversion price of $2.00, for an aggregate investment amount of $1.05 billion.

In addition, investors will receive 60% warrant coverage to purchase non-voting, common-equivalent stock with an exercise price of $2.50 per share, a 25% premium to the price paid on common stock.

NYCB was trading at $1.86 before the halt (but that sounds like a lot of dilution above).

* * *

And the hits just keep coming…

Once the darling of the small banking crisis comeback, New York Community Bancorp has crashed 45% to fresh 30 year lows after The Wall Street Journal reports the bank is seeking to raise equity capital in a bid to shore up confidence in the troubled regional lender.

According to people familiar with the matter, NYCB has dispatched bankers to gauge investors’ interest in buying stock in the company.

There’s no guarantee there will be a deal, or that one would succeed in addressing the bank’s challenges, which as of Wednesday morning had led to a roughly 80% decline in its stock price since January.

This is not a good picture for a bank… Would you hold your deposits there?

Last month, DiNello laid out a series of options the bank could explore to bolster its balance sheet, including selling assets from certain non-core businesses. The bank has also considered turning to newfangled financial instruments that would share the risks of those loans with outside investors, people familiar with the matter said.

As WSJ reports, finding takers for those assets, at least at prices that would make a deal worthwhile, has been challenging and U.S. officials have expressed reservations with banks pursuing credit-risk transfers that would shift the burden of potential losses to entities outside of the regulated banking system.

Finally, as a reminder, NYCB is not alone. The red line below shows ‘small banks’ are in trouble absent The Fed’s BTFP facility…

Oh, and this is fine…

The delinquency rate among large banks hits 3%, the highest in 11 years.

The delinquency rate among small banks hits 7.80%, the highest on record. pic.twitter.com/oVWuj2doBl

— zerohedge (@zerohedge) March 2, 2024

And perhaps that’s why the broad regional bank index is also getting hit today…

Beware the Ides of March as RRP liquidity evaporates.

Think this is isolated?

Think again.

Dear @federalreserve maybe allowing Countrwide Financial And WaMu to buy the assets of insolvent NYCB which bought the assets of insolvent Signature Bank is not the best idea.

— zerohedge (@zerohedge) March 6, 2024

As Chris Whalen details below via The Institutional Risk Analyst, the short answer as to what happens next is that we think that the bank may be sold, one way or another. The profitable Flagstar residential servicing business could be offered for sale in order to make a downpayment for the cleanup of the NYCB legacy multifamily portfolio. But in the wake of credit downgrades, NYCB itself may need to be acquired by another bank.

KBW said in a research note that NYCB could tap into its $78 billion in unpaid balances of mortgage-servicing rights to raise capital through a potential sale. The portfolio has a carrying value of $1.1 billion, analysts said. That is a mere downpayment, however, on a larger mess emanating from the bank’s impaired multifamily assets.

Without an investment grade credit rating, banks cannot hold escrow balances for conventional or government loans. We cannot see how NYCB keeps the billions in conventional and government escrow deposits long-term. The whole Flagstar servicing platform and more than $300 billion in residential loan servicing, mostly for third parties like nonbank mortgage issuers, needs a new home.

Obviously the shareholders of Flagstar are coming to rue the decision to join forces with NYCB, an under-managed community bank with a portfolio of performing but ultimately unsalable multifamily assets. Thanks to the New York State legislature’s 2019 rent control law, which was supported by Governor Kathy Hochul, all banks in New York City that hold rent stabilized assets on the books are now capital impaired. Several of these banks in New York City may fail as a result of Albany’s actions.

So who might acquire NYCB?

First, we take JPMorgan (JPM) and Wells Fargo (WFC) off the table. The former is already the largest residential mortgage servicer in the US and the latter is exiting the residential mortgage business with finality. The departure of Wells from residential mortgages is bad news for consumers and cause for glee among progressive cadres in the Biden Administration. In any event, neither bank wants any part of the Ginnie Mae sub-servicing book inside Flagstar.

Next is Citigroup (C), an intriguing possibility for a bank that badly needs new ideas and revenue streams. Citi has been in and out of residential mortgages for the past 50 years. In the 1980s, Citi introduced the first no-doc mortgage in the US market.

Since subprime consumer credit is a big part of Citi’s business, why not add a good sized residential mortgage business and get back into the housing finance game? There are few other industry segments that have enough size to matter to Citi. Flagstar is the number two warehouse lender after JPM. Overnight, Citi becomes the top bank servicer in the Ginnie Mae market and a significant issuer of MBS.

After Citi the obvious candidate for NYCB is U.S. Bancorp (USB), which is now the second largest residential bank loan producer after Chase. Although USB is still digesting the acquisition of Union Bank of California, they are a player in residential servicing and loan administration. USB could easily acquire the NYCB mortgage platform and billions in escrow deposits.

The idea of NYCB losing stable escrow deposits argues against the sale of the Flagstar mortgage platform and in favor of selling or recapitalizing the whole bank. But is this possible short of an FDIC intervention? Again, the actions taken by Albany in 2019 make NYCB and other New York banks unsalable short of an FDIC takeover.

If you are an investor looking at NYCB, the big question is the 40% of total loans and leases in multifamily assets. If NYCB were to either sell or risk-share a substantial portion of the rent stabilized multifamily assets, then the prospects for the business improve significantly. But given the disclosures about weak controls over loan underwriting, investors are going to be very cautious about making any assumptions on valuation. And risk-sharing is not yet broadly relevant for commercial assets.

Looking at the volume of risk-sharing deals done by banks so far, virtually all of the transactions are for consumer facing assets. Banco Santander (SAN) leads the pack on risk sharing auto and consumer loans. Commercial loans are far more difficult. Western Alliance (WAL) and Texas Capital Bank (TCBI) have done risk sharing deals in prime RMBS and warehouse loans, but commercial mortgages will likely be handled as customized, bespoke arrangements done on single loans. Selling the loans outright to hard money investors may be easier.

NYCB might want to consider creating a separate “bad bank” containing rent stabilized assets from the legacy NYCB to put pressure on Governor Hochul and the New York legislature to come and clean up their mess. Indeed, FDIC Chairman Martin Gruenberg ought to lead that discussion with Governor Hochul. His agency – and all the FDIC insured banks he represents – now hold the bag on billions in eventual losses on rent-stabilized Signature Bank commercial mortgage loans as well as loans held by other banks. The intemperate actions of the State of New York caused these losses.

We expect to see a number of creative structures being rolled out to address the impairment of multifamily commercial mortgages on the books of US banks. Risk-sharing is useful and can actually reduce the risk weighted assets of a bank and improve capital ratios, but at a cost to the bank in terms of income. Other techniques involve selling the low-coupon mortgage and replacing it with risk-free collateral that generates a similar cash flow, but frees up regulatory capital for other purposes.

Despite the promise of risk-sharing transactions, at the end of the day raising new capital and managing the delinquency may be a better approach. In the case of NYCB, raising new equity is not feasible. Indeed, any prospective buyer may demand some form of loss sharing from the FDIC on the multifamily book. If, for example, we assume a conservative 20% haircut on rent-stabilized buildings in NYC, many of the smaller institutions are insolvent.

That said, we would not be surprised to see an arranged marriage involving NYCB and a larger player that wants a bigger role in aggregating, selling and servicing residential mortgages. Even the likes of Goldman Sachs (GS), which has a significant presence in lending on residential warehouse loans and mortgage servicing rights, might find NYCB a compelling opportunity — given the proper incentives from FDIC, of course.

Bloomberg columnist Max Abelson wrote an epitaph of sorts for NYCB this week:

“How NYCB got here is a tale of percolating financial risks, changing rules and shifting regulators. New rent restrictions became law in 2019, but instead of acknowledging a hit to its loan book, the bank got bigger. Back-to-back acquisitions, first Flagstar and then parts of Signature Bank, almost doubled the firm’s size and set it on a collision course with new rules for banks holding more than $100 billion of assets.”

We still own NYCB, but we strongly recommend that our readers stand clear until management gives shareholders a very specific roadmap to recovery. The economics of the bank’s multifamily book are gnarly at best. Does the FDIC want to resolve another $100 plus billion asset regional bank? Hell no. Because the mess flows downhill, it may be time for creativity on the part of the FDIC and the State of New York.

FDIC Chairman Gruenberg ought to tell Governor Hochul and New York State to take over the rent stabilized loans from Signature, NYCB and other lenders or face an old fashioned FDIC liquidation as and when any banks fail. The number of public housing units in New York City will soar, placing enormous pressure on the city’s finances. If the multifamily building cannot be financed by a bank, then the City of New York likely will end up as the owner.

Imagine if FDIC went “by the book” and next week sold all of the rent stabilized Signature Bank multifamily assets for whatever hard money bid is available. New York would face a political crisis. Governor Hochul and progressives in Albany caused this mess, which now threatens the solvency of a number of New York banks. The State of New York should take ownership of its fine work and repeal the 2019 rent control legislation.

Loading…