Just when you thought it was safe to go back in the regional bank waters...

Remember New York Community Bank - the embattled bank that made the surprise decision to slash its dividend to stockpile cash (in case commercial real estate loans go bad) amid mounting pressure from a top US watchdog (read here, here, and here)?

Well theeeyyyy're back!

According to a regulatory filing this evening, NYCB disclosed that it identified material weaknesses in its internal controls related to internal loan review as part of an assessment.

“Management identified material weaknesses in the company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities,” the bank said in the filing.

Due to this, the bank will delay its annual report.

"'NYCB' has determined that it is unable to file, without unreasonable effort or expense, its Annual Report on Form 10-K for the fiscal year ended December 31, 2023

NYCB also took a $2.4 BN hit to 4Q and annual net (loss) income, as GAAP accounting required a "goodwill impairment" charge for the quarter and fiscal year ended Dec. 31, 2023.

Additionally, Alessandro DiNello will be chief executive officer, succeeding Thomas Cangemi, it said in a statement late Thursday.

DiNello was appointed as executive chairman earlier this month to help the bank improve its operations. He joined the company following its acquisition of Flagstar Bancorp Inc. in December 2022. He had been Flagstar’s president and CEO.

Cangemi remains on the board.

NYCB Shares are down over 10% in the after-market, having stabilized (albeit at lower levels) after early Feb's debacle (that wiped over 50% of the bank's value away)...

Full filing details below:

On January 31, 2024, NYCB filed a Current Report on Form 8-K furnishing under Items 2.02 and 9.01 the Company’s press release announcing its unaudited financial results for the fourth quarter and fiscal year ended December 31, 2023 (the “Original Filing”). The full text of the press release was included as Exhibit 99.1 to the Original Filing.

On February 29, 2024, NYCB filed with the Securities and Exchange Commission (the “SEC”) an Amendment (the “Amendment”) to the Original Filing to reflect, among other things, (a) an adjustment related to a goodwill impairment with respect to 2007 and prior transactions, as more fully described therein, (b) certain measurement period adjustments impacting the Company’s bargain purchase gain from the Company’s acquisition of certain assets and liabilities of the former Signature Bank through a Federal Deposit Insurance Corporation facilitated transaction and (c) an adjustment for a type 1 subsequent event (as more fully described in the Amendment). Each of these adjustments were identified by NYCB’s management after the date of the Original Filing and as part of the Company’s customary procedures to finalize its financial statements for inclusion in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”).

Separately, as part of management’s assessment of the Company’s internal controls, management identified material weaknesses in the Company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities. Although assessment of the Company’s internal controls is not yet complete, the Company expects to disclose in the 2023 Form 10-K that its disclosure controls and procedures and internal control over financial reporting were not effective as of December 31, 2023. The Company’s remediation plan with respect to such material weaknesses is expected to be described in the 2023 Form 10-K.

The Company has been working diligently to finalize the 2023 Form 10-K; however, the Company must complete its work related to the evaluation and planning for remediation of the material weaknesses described above and other items included in the Amendment. Accordingly, the Company has determined that it is unable to file, without unreasonable effort or expense, the 2023 Form 10-K by the prescribed due date.

The Company expects to file its 2023 Form 10-K within the fifteen calendar day grace period provided by Form 12b-25. The Company does not currently anticipate that its statement of operations contained in the 2023 Form 10-K will differ materially from those reported for the full fiscal year ended December 31, 2023, in the Amendment dated February 29, 2024.

Does anyone trust any of the valuations in the loan book after this?

Just when you thought it was safe to go back in the regional bank waters…

Remember New York Community Bank – the embattled bank that made the surprise decision to slash its dividend to stockpile cash (in case commercial real estate loans go bad) amid mounting pressure from a top US watchdog (read here, here, and here)?

Well theeeyyyy’re back!

According to a regulatory filing this evening, NYCB disclosed that it identified material weaknesses in its internal controls related to internal loan review as part of an assessment.

“Management identified material weaknesses in the company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities,” the bank said in the filing.

Due to this, the bank will delay its annual report.

“‘NYCB’ has determined that it is unable to file, without unreasonable effort or expense, its Annual Report on Form 10-K for the fiscal year ended December 31, 2023

NYCB also took a $2.4 BN hit to 4Q and annual net (loss) income, as GAAP accounting required a “goodwill impairment” charge for the quarter and fiscal year ended Dec. 31, 2023.

Separately, New York Community Bancorp said it appointed executive chairman Alessandro (Sandro) DiNello as president and CEO, effective immediately.

Thomas Cangemi has stepped down from this role, but will remain a member of the board.

“It is my mandate as president and CEO, alongside our Board, to continue our transformation into a larger, more diversified commercial bank,” DiNello said.

“While we’ve faced recent challenges, we are confident in the direction of our bank and our ability to deliver for our customers, employees and shareholders in the long term.”

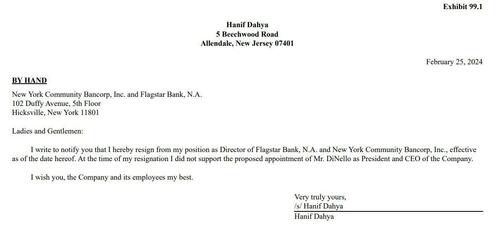

The company also named Marshall Lux presiding director of the board, effective immediately, after Hanif Dahya stepped down from the role (in opposition to DiNello’s appointment).

NYCB Shares are down over 10% in the after-market, having stabilized (albeit at lower levels) after early Feb’s debacle (that wiped over 50% of the bank’s value away)…

Full filing details below:

On January 31, 2024, NYCB filed a Current Report on Form 8-K furnishing under Items 2.02 and 9.01 the Company’s press release announcing its unaudited financial results for the fourth quarter and fiscal year ended December 31, 2023 (the “Original Filing”). The full text of the press release was included as Exhibit 99.1 to the Original Filing.

On February 29, 2024, NYCB filed with the Securities and Exchange Commission (the “SEC”) an Amendment (the “Amendment”) to the Original Filing to reflect, among other things, (a) an adjustment related to a goodwill impairment with respect to 2007 and prior transactions, as more fully described therein, (b) certain measurement period adjustments impacting the Company’s bargain purchase gain from the Company’s acquisition of certain assets and liabilities of the former Signature Bank through a Federal Deposit Insurance Corporation facilitated transaction and (c) an adjustment for a type 1 subsequent event (as more fully described in the Amendment). Each of these adjustments were identified by NYCB’s management after the date of the Original Filing and as part of the Company’s customary procedures to finalize its financial statements for inclusion in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”).

Separately, as part of management’s assessment of the Company’s internal controls, management identified material weaknesses in the Company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities. Although assessment of the Company’s internal controls is not yet complete, the Company expects to disclose in the 2023 Form 10-K that its disclosure controls and procedures and internal control over financial reporting were not effective as of December 31, 2023. The Company’s remediation plan with respect to such material weaknesses is expected to be described in the 2023 Form 10-K.

The Company has been working diligently to finalize the 2023 Form 10-K; however, the Company must complete its work related to the evaluation and planning for remediation of the material weaknesses described above and other items included in the Amendment. Accordingly, the Company has determined that it is unable to file, without unreasonable effort or expense, the 2023 Form 10-K by the prescribed due date.

The Company expects to file its 2023 Form 10-K within the fifteen calendar day grace period provided by Form 12b-25. The Company does not currently anticipate that its statement of operations contained in the 2023 Form 10-K will differ materially from those reported for the full fiscal year ended December 31, 2023, in the Amendment dated February 29, 2024.

Does anyone trust any of the valuations in the loan book after this?

Loading…