The market may have been too quick to dismiss the impact of European oil price cap on Russian oil.

Assuming that the latest G-7 attempt to limit Russian oil revenues were one big nothingburger - after all, the US itself admitted that the goal of the price cap was not so much to cripple Putin's Treasury as to maintain a more stable flow of oil - the market quickly ignored the potential of lower Russian output as it continued to sell oil into year end amid fears there won't be enough demand to offset stable supply.

But in yet another case of poetic justice-cum-Murphy's law, Europe's exercise in virtue signalling optics is about to backfire and achieve precisely what it was meant to achieve, if only for virtuous public consumption.

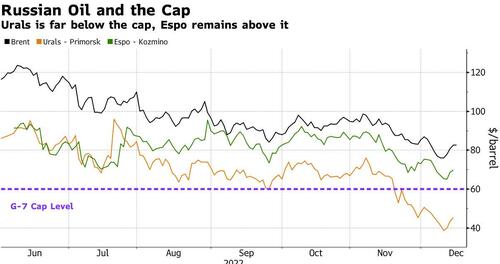

According to Bloomberg, there are signs that oil tanker companies are avoiding sending their ships to collect crude from a key Russian port in Asia following the G-7 sanctions targeting Moscow’s petroleum revenues. As has been duly documented here previously, since Dec. 5, buyers of Russian oil have only been allowed to access industry standard insurance and an array of trade-critical services if they pay $60 a barrel or less. But shipments of the key ESPO grade from the Asian port of Kozmino are about $10 above that, meaning they need to make alternative arrangements.

Since the cap began, ESPO (which stands for Eastern Siberia–Pacific Ocean, the initials of a pipeline that takes the oil from east Siberia to the Pacific) has seen loadings cut in half from a month earlier, tanker tracking compiled by Bloomberg show. By contrast Urals, a much larger grade exported from western Russia, is flowing freely to customers in Asia — aided by the fact it fell far below the $60 threshold a few weeks before it was introduced.

However, amid the latest sanctions which set the $60 price cutoff, tankers are shying away from the Asian grade, and in the 10 days since the measures began, 4.4 million barrels have been loaded onto tankers at Kozmino, Bloomberg calculates. In the same period a month earlier, there were 8.8 million barrels loaded.

While it is too soon to say if the observed drop in ESPO flows reflects something structural, weather conditions haven’t been particularly bad and there doesn’t appear to be many candidate ships in place to collect cargoes in the coming few weeks. That said, tanker tracking data is always volatile, depending on the timings of loadings, and the comings and goings of individual tankers.

Shipbrokers and traders contacted by Bloomberg also said that said there are signs that ESPO sellers are struggling to secure tankers for cargoes purchased at more than $60 a barrel. At least two large and well-known shipowners, China Cosco Shipping Corp. and Greece-based Avin International Ltd. have stepped back from moving ESPO crude since Dec. 5, according to shipbrokers. Emails sent to both companies weren’t answered.

Their absence has taken at least five tankers out of the regular pool of ships that move the grade, they said. That leaves charterers to work with smaller independent owners who’re still willing to handle the trade. If charterers continue to face headwinds with the booking of tankers, flows could be impeded, they said. ESPO and Sokol, another grade that’s exported from eastern Russia, currently trade above the $60 a barrel threshold that gives access to insurance and G-7 services.

With Urals grade Russian oil trading well below the price cap, and last fetching about $45/bbl, shipbrokers said tanker bookings for Russia’s flagship crude from western ports are proceeding more normally. Tanker tracking also suggests no obvious disruption to flows of the grade.

Of course, all of this is just a snapshot in time: once oil prices spike, as they will after the year-end selling is over, it is virtually assured that all Russian oil grades will be priced above $60, even with the deep discount to spot. At that point, traders will be watching closely to see if Russian crude exports can be maintained and how Moscow will respond if supplies do get disrupted.

As noted previously, the irony behind all this is that the stability of Russian exports is crucial as the US and rest of G-7 work on ensuring security of global oil supplies ahead of the Northern hemisphere winter while simultaneously attempting to deprive the Kremlin of funding for its war in Ukraine. A sharp loss of output could backfire on the west if it boosts wider oil prices and reignites inflation. And while the price cap wasn't really supposed to be a price cap, it just may end up being one with Russian oil exports suddenly cut off, sending all "non-Russian" oil prices explosively higher, and sparking a new energy crisis some time in early 2023.

As for Russian product just sitting there, about half the ESPO cargoes scheduled for loading in the rest of this month have yet to secure tankers, according to shipbrokers. That is slower than usual, and they attributing it to the smaller pool of willing tankers operated by a smaller number of owners. It’s possible that tankers which previously handled oil from sanctioned regimes such as Iran and Venezuela - the so-called dark fleet - would be booked, shipbrokers said.

The market may have been too quick to dismiss the impact of European oil price cap on Russian oil.

Assuming that the latest G-7 attempt to limit Russian oil revenues were one big nothingburger – after all, the US itself admitted that the goal of the price cap was not so much to cripple Putin’s Treasury as to maintain a more stable flow of oil – the market quickly ignored the potential of lower Russian output as it continued to sell oil into year end amid fears there won’t be enough demand to offset stable supply.

But in yet another case of poetic justice-cum-Murphy’s law, Europe’s exercise in virtue signalling optics is about to backfire and achieve precisely what it was meant to achieve, if only for virtuous public consumption.

According to Bloomberg, there are signs that oil tanker companies are avoiding sending their ships to collect crude from a key Russian port in Asia following the G-7 sanctions targeting Moscow’s petroleum revenues. As has been duly documented here previously, since Dec. 5, buyers of Russian oil have only been allowed to access industry standard insurance and an array of trade-critical services if they pay $60 a barrel or less. But shipments of the key ESPO grade from the Asian port of Kozmino are about $10 above that, meaning they need to make alternative arrangements.

Since the cap began, ESPO (which stands for Eastern Siberia–Pacific Ocean, the initials of a pipeline that takes the oil from east Siberia to the Pacific) has seen loadings cut in half from a month earlier, tanker tracking compiled by Bloomberg show. By contrast Urals, a much larger grade exported from western Russia, is flowing freely to customers in Asia — aided by the fact it fell far below the $60 threshold a few weeks before it was introduced.

However, amid the latest sanctions which set the $60 price cutoff, tankers are shying away from the Asian grade, and in the 10 days since the measures began, 4.4 million barrels have been loaded onto tankers at Kozmino, Bloomberg calculates. In the same period a month earlier, there were 8.8 million barrels loaded.

While it is too soon to say if the observed drop in ESPO flows reflects something structural, weather conditions haven’t been particularly bad and there doesn’t appear to be many candidate ships in place to collect cargoes in the coming few weeks. That said, tanker tracking data is always volatile, depending on the timings of loadings, and the comings and goings of individual tankers.

Shipbrokers and traders contacted by Bloomberg also said that said there are signs that ESPO sellers are struggling to secure tankers for cargoes purchased at more than $60 a barrel. At least two large and well-known shipowners, China Cosco Shipping Corp. and Greece-based Avin International Ltd. have stepped back from moving ESPO crude since Dec. 5, according to shipbrokers. Emails sent to both companies weren’t answered.

Their absence has taken at least five tankers out of the regular pool of ships that move the grade, they said. That leaves charterers to work with smaller independent owners who’re still willing to handle the trade. If charterers continue to face headwinds with the booking of tankers, flows could be impeded, they said. ESPO and Sokol, another grade that’s exported from eastern Russia, currently trade above the $60 a barrel threshold that gives access to insurance and G-7 services.

With Urals grade Russian oil trading well below the price cap, and last fetching about $45/bbl, shipbrokers said tanker bookings for Russia’s flagship crude from western ports are proceeding more normally. Tanker tracking also suggests no obvious disruption to flows of the grade.

Of course, all of this is just a snapshot in time: once oil prices spike, as they will after the year-end selling is over, it is virtually assured that all Russian oil grades will be priced above $60, even with the deep discount to spot. At that point, traders will be watching closely to see if Russian crude exports can be maintained and how Moscow will respond if supplies do get disrupted.

As noted previously, the irony behind all this is that the stability of Russian exports is crucial as the US and rest of G-7 work on ensuring security of global oil supplies ahead of the Northern hemisphere winter while simultaneously attempting to deprive the Kremlin of funding for its war in Ukraine. A sharp loss of output could backfire on the west if it boosts wider oil prices and reignites inflation. And while the price cap wasn’t really supposed to be a price cap, it just may end up being one with Russian oil exports suddenly cut off, sending all “non-Russian” oil prices explosively higher, and sparking a new energy crisis some time in early 2023.

As for Russian product just sitting there, about half the ESPO cargoes scheduled for loading in the rest of this month have yet to secure tankers, according to shipbrokers. That is slower than usual, and they attributing it to the smaller pool of willing tankers operated by a smaller number of owners. It’s possible that tankers which previously handled oil from sanctioned regimes such as Iran and Venezuela – the so-called dark fleet – would be booked, shipbrokers said.

Loading…