Early this morning, Saudi Arabia announced it will extend its voluntary, unilateral oil production cut by one month, at least through August (the output cut can and likely will be extended further), keeping a ceiling on supply even as the market is expected to tighten further.

Moments later, its OPEC+ ally Russia announced it will "voluntarily" extend a reduction of its oil exports in August by 500K bbl/day to ensure the oil market remains balanced, Deputy Prime Minister Alexander Novak says in statement.

The Saudi output reduction of 1 million barrels a day that started this month — which comes in addition to existing curbs agreed by OPEC+ — will continue into August and could be extended further, according to a statement published by state-run Saudi Press Agency.

The cuts will take the kingdom’s production to about 9 million barrels a day, the lowest level in several years.

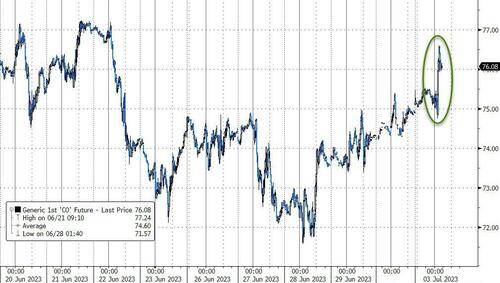

The news sent the oil and energy complex to the highest level in at least a week: Brent rose 1.5% to $76.50 a barrel; WTI for August delivery advanced 1.4% to $71.60. The Stoxx 600 Energy subsector outperformed the broader European benchmark on Monday. The energy sub-index rises as much as 1.9%, the most in a month; Shell (+2%) was the biggest contributor to the gains by index points. Other movers are Harbour Energy +4.7%, Galp +3.1%, Aker BP +2.7%, BP +2.7%, TotalEnergies +2.6%.

Early this morning, Saudi Arabia announced it will extend its voluntary, unilateral oil production cut by one month, at least through August (the output cut can and likely will be extended further), keeping a ceiling on supply even as the market is expected to tighten further.

Moments later, its OPEC+ ally Russia announced it will “voluntarily” extend a reduction of its oil exports in August by 500K bbl/day to ensure the oil market remains balanced, Deputy Prime Minister Alexander Novak says in statement.

The Saudi output reduction of 1 million barrels a day that started this month — which comes in addition to existing curbs agreed by OPEC+ — will continue into August and could be extended further, according to a statement published by state-run Saudi Press Agency.

The cuts will take the kingdom’s production to about 9 million barrels a day, the lowest level in several years.

The news sent the oil and energy complex to the highest level in at least a week: Brent rose 1.5% to $76.50 a barrel; WTI for August delivery advanced 1.4% to $71.60. The Stoxx 600 Energy subsector outperformed the broader European benchmark on Monday. The energy sub-index rises as much as 1.9%, the most in a month; Shell (+2%) was the biggest contributor to the gains by index points. Other movers are Harbour Energy +4.7%, Galp +3.1%, Aker BP +2.7%, BP +2.7%, TotalEnergies +2.6%.

Loading…