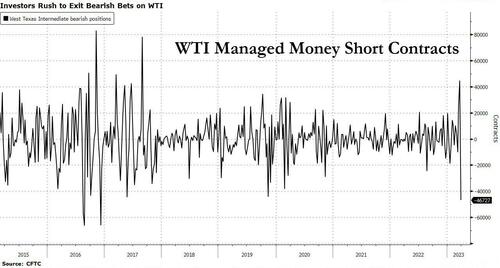

Over the weekend, and ahead of the OPEC+ output cut shocker, we first reported that short WTI bets had already collapsed by the most in 7 years following last week's sharp spike in oil prices.

Now, it's energy guru John Kemp's turn to report that investors started to pair back short positions in petroleum even before Saudi Arabia and its OPEC+ allies surprised the market by announcing production cuts totalling more than 1 million barrels per day.

As Kemp notes, "the scale of the cuts and the element of surprise is likely to have been intended to intensify the rush of short-covering as well as boost confidence and draw more bullish investors back into the market."

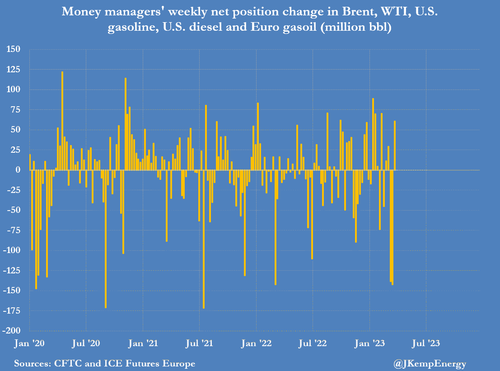

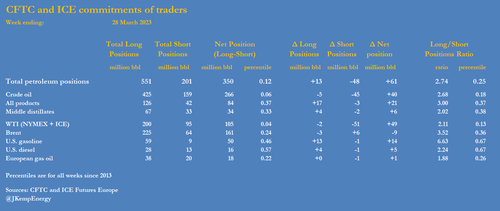

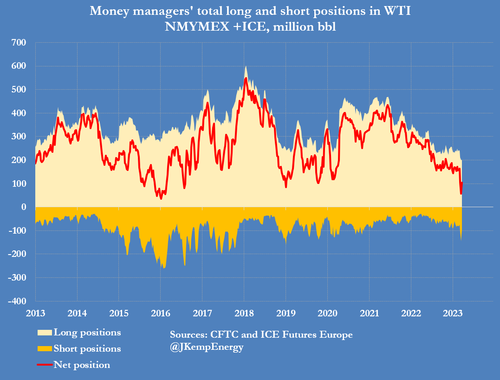

Hedge funds and other money managers purchased the equivalent of 61 million barrels in the six most important petroleum futures and options contracts over the seven days ending March 28.

This marked a sharp turnaround after fund managers sold a total of 281 million barrels over the two preceding weeks, the fastest rate of selling for almost six years.

Most of the buying came from the closure of previous bearish short positions (-48 million barrels) rather than initiation of new bullish longs (+13 million).

Buying was concentrated in NYMEX and ICE WTI (+49 million barrels), U.S. gasoline (+14 million), U.S. diesel (+5 million) and European gas oil (+1 million) with sales of Brent (-9 million).

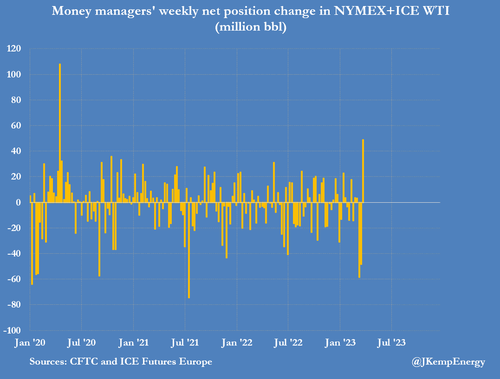

As we also noted over the weekend, while short positions in NYMEX and ICE WTI were slashed (-51 million barrels), no new bullish positions were established and in fact long positions were trimmed marginally (-2 million).

Fund managers seem to have concluded WTI prices had found a floor after touching a 15-month low of less than $67 per barrel on March 17 and were unlikely to fall further in the short term.

Positions were all reported at the close of business on March 28, ahead of the decision by Saudi Arabia and its allies in the OPEC⁺ producer group to cut their output targets by more than 1 million barrels per day on April 2.

WTI Rally Primed

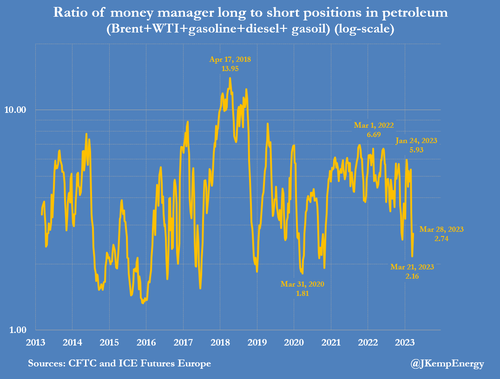

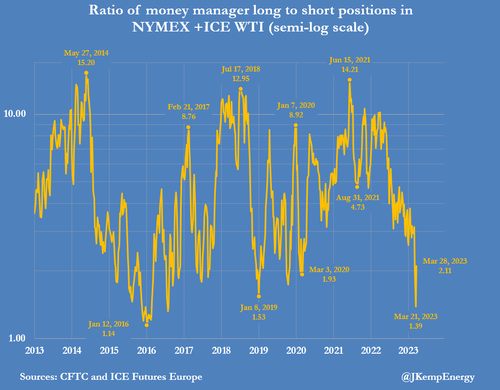

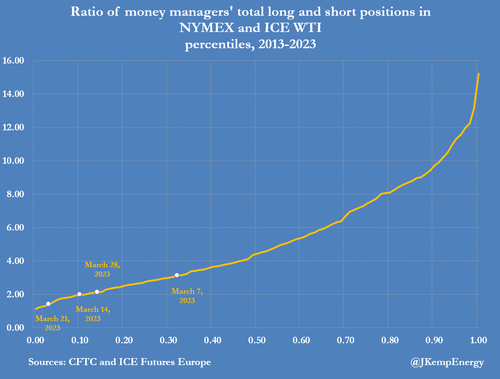

Prior to the most recent week, positioning in WTI had become especially bearish, leaving the market primed for a sharp short-covering rally. Hedge funds had reduced their net position in WTI to just 56 million barrels by March 21, the lowest since February 2016 and in only the 1st percentile for all weeks since 2013.

Funds’ bullish long positions outnumbered bearish short ones by a ratio of just 1.39:1 on March 21...

... the lowest since August 2016 and in only the 2nd percentile.

Positions had become so stretched towards the downside creating conditions for a sharp rebound if and when the news flow become more bullish or at least less bearish.

Even before the OPEC+ announcement, the concentration of bearish shorts and absence of bullish longs seems to have encouraged at least some fund managers to realise profits ahead of the expected recoil.

The announcement will likely fuel even more short covering in the near future, which was probably one of the motivations for the decision, announced on a Sunday to maximise its impact when trading resumed on Monday.

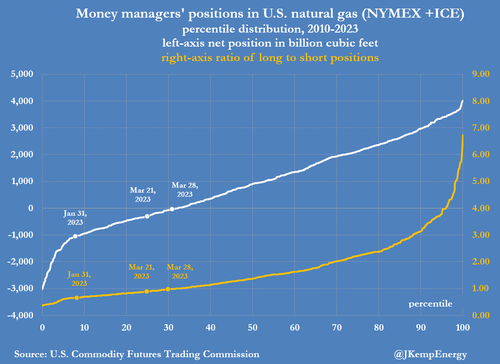

US Gas Positions

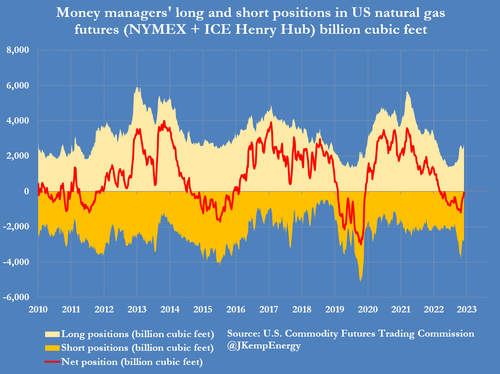

Fund managers are becoming less bearish about the outlook for U.S. gas prices following the full re-opening of Freeport LNG’s export terminal.

Hedge funds and other money managers increased their net position in Henry Hub futures and options for the seventh time in eight weeks.

Funds purchased the equivalent of 237 billion cubic feet of gas over the seven days ending March 28 taking total purchases to 1,011 billion cubic feet since January 31.

Portfolio managers still have a small overall short position of 50 billion cubic feet (30th percentile since 2010) but it has been sharply pared back from 1,061 billion cubic feet (7th percentile) at the end of January.

Over the weekend, and ahead of the OPEC+ output cut shocker, we first reported that short WTI bets had already collapsed by the most in 7 years following last week’s sharp spike in oil prices.

Now, it’s energy guru John Kemp’s turn to report that investors started to pair back short positions in petroleum even before Saudi Arabia and its OPEC+ allies surprised the market by announcing production cuts totalling more than 1 million barrels per day.

As Kemp notes, “the scale of the cuts and the element of surprise is likely to have been intended to intensify the rush of short-covering as well as boost confidence and draw more bullish investors back into the market.“

Hedge funds and other money managers purchased the equivalent of 61 million barrels in the six most important petroleum futures and options contracts over the seven days ending March 28.

This marked a sharp turnaround after fund managers sold a total of 281 million barrels over the two preceding weeks, the fastest rate of selling for almost six years.

Most of the buying came from the closure of previous bearish short positions (-48 million barrels) rather than initiation of new bullish longs (+13 million).

Buying was concentrated in NYMEX and ICE WTI (+49 million barrels), U.S. gasoline (+14 million), U.S. diesel (+5 million) and European gas oil (+1 million) with sales of Brent (-9 million).

As we also noted over the weekend, while short positions in NYMEX and ICE WTI were slashed (-51 million barrels), no new bullish positions were established and in fact long positions were trimmed marginally (-2 million).

Fund managers seem to have concluded WTI prices had found a floor after touching a 15-month low of less than $67 per barrel on March 17 and were unlikely to fall further in the short term.

Positions were all reported at the close of business on March 28, ahead of the decision by Saudi Arabia and its allies in the OPEC⁺ producer group to cut their output targets by more than 1 million barrels per day on April 2.

WTI Rally Primed

Prior to the most recent week, positioning in WTI had become especially bearish, leaving the market primed for a sharp short-covering rally. Hedge funds had reduced their net position in WTI to just 56 million barrels by March 21, the lowest since February 2016 and in only the 1st percentile for all weeks since 2013.

Funds’ bullish long positions outnumbered bearish short ones by a ratio of just 1.39:1 on March 21…

… the lowest since August 2016 and in only the 2nd percentile.

Positions had become so stretched towards the downside creating conditions for a sharp rebound if and when the news flow become more bullish or at least less bearish.

Even before the OPEC+ announcement, the concentration of bearish shorts and absence of bullish longs seems to have encouraged at least some fund managers to realise profits ahead of the expected recoil.

The announcement will likely fuel even more short covering in the near future, which was probably one of the motivations for the decision, announced on a Sunday to maximise its impact when trading resumed on Monday.

US Gas Positions

Fund managers are becoming less bearish about the outlook for U.S. gas prices following the full re-opening of Freeport LNG’s export terminal.

Hedge funds and other money managers increased their net position in Henry Hub futures and options for the seventh time in eight weeks.

Funds purchased the equivalent of 237 billion cubic feet of gas over the seven days ending March 28 taking total purchases to 1,011 billion cubic feet since January 31.

Portfolio managers still have a small overall short position of 50 billion cubic feet (30th percentile since 2010) but it has been sharply pared back from 1,061 billion cubic feet (7th percentile) at the end of January.

Loading…