Crude oil prices were set for a weekly gain of about 4% after the International Energy Agency became the latest forecaster to suggest oil demand might turn out to be stronger than previously expected this year.

The IEA said Thursday that it now expects oil demand this year to grow by 1.3 million bpd, up from 1.2 million bpd last month. The agency cited maritime transport disruptions due to the Houthi attacks in the Red Sea that are adding demand for fuels.

The IEA also revised its supply forecast, but downwards, according to Irina Slav of OilPrice. It now expects additional supply this year at 800,000 bpd. As a result, the forecast, which last month said the oil market would.

The agency noted, however, that lukewarm economic growth would continue to act as a headwind for prices even as other agencies such as the IMF revised their global GDP growth outlook upwards.

A series of fresh drone attacks by Ukraine on Russian refineries also contributed to the price rally this week, especially after the energy ministry said these attacks had led to a 1.5% decline in fuel exports in February. There were drone attacks on refineries in Russia last month as well.

The latest weekly inventory figures from the United States were also bullish for prices, featuring sizeable drawdowns in fuel inventories that suggested stronger demand.

"Demand is staying high, while supplies are getting tighter, particularly on the fuel side. The refining margins are also very strong and a positive for crude demand," Reuters quoted BOK Financial senior VP of trading Dennis Kissler as saying.

As a result of the rally, which brought Brent crude to over $85 per barrel on Thursday, traders started taking profits, eventually bringing prices lower. Even so, the international benchmark was trading above $85 per barrel in midmorning trade in Asia today. West Texas Intermediate crossed the $80 threshold earlier in the week and was trading at over $81 per barrel in mid-morning trade in Asia.

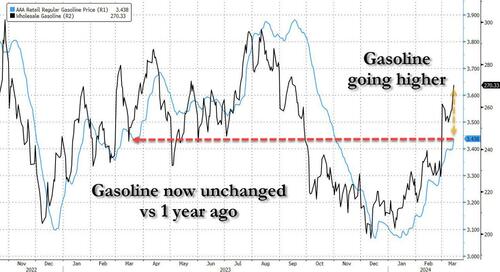

Meanwhile, gasoline is now trading at $3.44, the highest price since Octover and effectively unchanged on the year, and in the a ominous development for the Biden admin, wholesale gasoline prices suggest a big jump in retail gasoline is imminent.

Crude oil prices were set for a weekly gain of about 4% after the International Energy Agency became the latest forecaster to suggest oil demand might turn out to be stronger than previously expected this year.

The IEA said Thursday that it now expects oil demand this year to grow by 1.3 million bpd, up from 1.2 million bpd last month. The agency cited maritime transport disruptions due to the Houthi attacks in the Red Sea that are adding demand for fuels.

The IEA also revised its supply forecast, but downwards, according to Irina Slav of OilPrice. It now expects additional supply this year at 800,000 bpd. As a result, the forecast, which last month said the oil market would.

The agency noted, however, that lukewarm economic growth would continue to act as a headwind for prices even as other agencies such as the IMF revised their global GDP growth outlook upwards.

A series of fresh drone attacks by Ukraine on Russian refineries also contributed to the price rally this week, especially after the energy ministry said these attacks had led to a 1.5% decline in fuel exports in February. There were drone attacks on refineries in Russia last month as well.

The latest weekly inventory figures from the United States were also bullish for prices, featuring sizeable drawdowns in fuel inventories that suggested stronger demand.

“Demand is staying high, while supplies are getting tighter, particularly on the fuel side. The refining margins are also very strong and a positive for crude demand,” Reuters quoted BOK Financial senior VP of trading Dennis Kissler as saying.

As a result of the rally, which brought Brent crude to over $85 per barrel on Thursday, traders started taking profits, eventually bringing prices lower. Even so, the international benchmark was trading above $85 per barrel in midmorning trade in Asia today. West Texas Intermediate crossed the $80 threshold earlier in the week and was trading at over $81 per barrel in mid-morning trade in Asia.

Meanwhile, gasoline is now trading at $3.44, the highest price since Octover and effectively unchanged on the year, and in the a ominous development for the Biden admin, wholesale gasoline prices suggest a big jump in retail gasoline is imminent.

Loading…