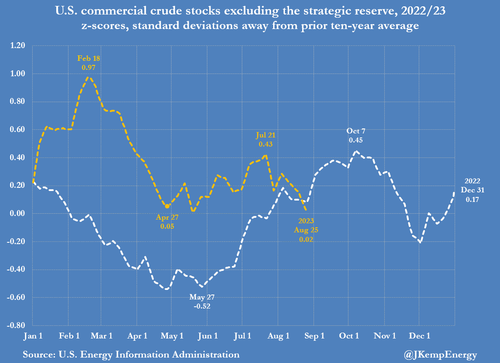

Yesterday we reported that the price of oil jumped to the second highest level of 2023 amid plunging US inventories...

... and news that Russia had agreed to further oil export cuts.

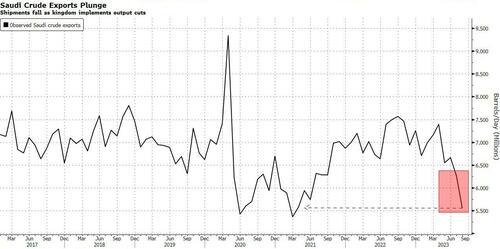

Today, West Texas Intermediate extended its gain, surging another $2 to $85.55 and hitting the highest level of 2023 - just in time for headline inflation to surge again - amid a barrage of favorable news including the latest drip-drop of Chinese micro stimuli, all of which are useless in isolation yet which guarantee that Beijing will have to pull out a bazooka, but more importantly, that observed crude shipments from Saudi Arabia plunged in August, with flows to most major destinations slumping to multiyear lows as the kingdom limits output.

According to Bloomberg which parsed tanker-tracking data, total exports were about 5.6mm b/d in August, the lowest observed since March 2021, and compared with a revised 6.3mm b/d in July.

For comparison, Vortexa data show Saudi crude exports last month at 5.58m b/d; Kpler estimates flows of 5.22m b/d.

The move should not be a surprise: when Saudi Arabia and its partners in the OPEC+ group met in Vienna in early June, the kingdom said it would make an additional unilateral production cut of 1m b/d in July; the reduction was subsequently extended to August and September. And it is now finally flowing through.

Some more details on the supply crunch:

- Exports to primary destination China fell to the lowest since June 2020

- Based on current vessel destinations, shipments to both Japan and South Korea declined to the lowest since Bloomberg began tracking Saudi exports at the start of 2017

- Cargoes to the US and Egypt — the latter home to a storage hub and transit point for flows westward — also plunged to the lowest observed levels in Bloomberg tracking

- Observed exports to India edged higher

Key crude flows to selected destinations from Saudi Arabia (’000s of b/d):

Translation: Saudi Arabia is quietly squeezing global supply and is about to sent oil back to triple digits; it already started by issuing big price increases for its crude to Europe and the Mediterranean in August, while also unexpectedly lifting the cost of supplies to Asia. The kingdom further raised almost all prices for September to Asia and Europe.

Why is Saudi Arabia chosing price over volume? Simple: earlier today the WSJ reported that Saudi Aramco, the world’s largest oil company, is considering the world’s largest offering.

According to Saudi officials and “other people familiar with the plan,” Saudi Aramco is considering selling off as much as $50 billion in shares. If The Kingdom goes through with the share sale, it would be the largest share sale in history.

The share sales will be hosted on the Riyadh exchange, Tadawul. That decision was reached after a series of advisor consultations that spanned months, in order to insulate Aramco from possible legal challenges that could arise from listing on a foreign exchange.

A few of the sources suggested that The Kingdom could host the sale before the end of the year, although the final decision about the offering has not yet been made.

This isn’t the first time the oil giant has made plans to offer shares on an exchange, only to renege later, or at least downsize its offering from ambitious plans. Saudi Arabia’s Crown Prince Mohammed bin Salman (MbS) staked his reputation on a huge IPO of Aramco years ago, including a possible share sale on the NYSE—but valuation skepticism and risks associated with 9/11 terror atttacks, the Justice Against Sponsors of Terrorism Act, and Saudi Arabia’s reluctance to be transparent about Aramco’s production, exports, reserves, capacity, and the like prevented Saudi Arabia’s national oil company from following through with such a big offering, opting to list on the Tadwul only on December 11, 2019, when 1.5% of Aramco’s value began trading on the exchange. While shy of the 5% promised by MbS, the sale was still huge, generating $25.6 billion for the Kingdom and setting a record.

Of course, if MbS hopes to float a whopping $50 billion, he will only do it if the price of oil is high enough...

Oil is going higher https://t.co/34CQ08p6uU

— zerohedge (@zerohedge) September 1, 2023

... think triple digits. Which will come just in time for the Fed to reel in shock as the reality of the second coming of the Arthuer Burns Fed makes its grand appearance.

Yesterday we reported that the price of oil jumped to the second highest level of 2023 amid plunging US inventories…

… and news that Russia had agreed to further oil export cuts.

Today, West Texas Intermediate extended its gain, surging another $2 to $85.55 and hitting the highest level of 2023 – just in time for headline inflation to surge again – amid a barrage of favorable news including the latest drip-drop of Chinese micro stimuli, all of which are useless in isolation yet which guarantee that Beijing will have to pull out a bazooka, but more importantly, that observed crude shipments from Saudi Arabia plunged in August, with flows to most major destinations slumping to multiyear lows as the kingdom limits output.

According to Bloomberg which parsed tanker-tracking data, total exports were about 5.6mm b/d in August, the lowest observed since March 2021, and compared with a revised 6.3mm b/d in July.

For comparison, Vortexa data show Saudi crude exports last month at 5.58m b/d; Kpler estimates flows of 5.22m b/d.

The move should not be a surprise: when Saudi Arabia and its partners in the OPEC+ group met in Vienna in early June, the kingdom said it would make an additional unilateral production cut of 1m b/d in July; the reduction was subsequently extended to August and September. And it is now finally flowing through.

Some more details on the supply crunch:

- Exports to primary destination China fell to the lowest since June 2020

- Based on current vessel destinations, shipments to both Japan and South Korea declined to the lowest since Bloomberg began tracking Saudi exports at the start of 2017

- Cargoes to the US and Egypt — the latter home to a storage hub and transit point for flows westward — also plunged to the lowest observed levels in Bloomberg tracking

- Observed exports to India edged higher

Key crude flows to selected destinations from Saudi Arabia (’000s of b/d):

Translation: Saudi Arabia is quietly squeezing global supply and is about to sent oil back to triple digits; it already started by issuing big price increases for its crude to Europe and the Mediterranean in August, while also unexpectedly lifting the cost of supplies to Asia. The kingdom further raised almost all prices for September to Asia and Europe.

Why is Saudi Arabia chosing price over volume? Simple: earlier today the WSJ reported that Saudi Aramco, the world’s largest oil company, is considering the world’s largest offering.

According to Saudi officials and “other people familiar with the plan,” Saudi Aramco is considering selling off as much as $50 billion in shares. If The Kingdom goes through with the share sale, it would be the largest share sale in history.

The share sales will be hosted on the Riyadh exchange, Tadawul. That decision was reached after a series of advisor consultations that spanned months, in order to insulate Aramco from possible legal challenges that could arise from listing on a foreign exchange.

A few of the sources suggested that The Kingdom could host the sale before the end of the year, although the final decision about the offering has not yet been made.

This isn’t the first time the oil giant has made plans to offer shares on an exchange, only to renege later, or at least downsize its offering from ambitious plans. Saudi Arabia’s Crown Prince Mohammed bin Salman (MbS) staked his reputation on a huge IPO of Aramco years ago, including a possible share sale on the NYSE—but valuation skepticism and risks associated with 9/11 terror atttacks, the Justice Against Sponsors of Terrorism Act, and Saudi Arabia’s reluctance to be transparent about Aramco’s production, exports, reserves, capacity, and the like prevented Saudi Arabia’s national oil company from following through with such a big offering, opting to list on the Tadwul only on December 11, 2019, when 1.5% of Aramco’s value began trading on the exchange. While shy of the 5% promised by MbS, the sale was still huge, generating $25.6 billion for the Kingdom and setting a record.

Of course, if MbS hopes to float a whopping $50 billion, he will only do it if the price of oil is high enough…

Oil is going higher https://t.co/34CQ08p6uU

— zerohedge (@zerohedge) September 1, 2023

… think triple digits. Which will come just in time for the Fed to reel in shock as the reality of the second coming of the Arthuer Burns Fed makes its grand appearance.

Loading…