In case there was still any doubt if the Fed will again slash its next rate hike increment - this time from 50bps to 25bps at the Feb 1 FOMC meeting - moments ago the Fed's WSJ mouthpiece, Nick Timiraos, aka Nikileaks, made sure everyone knows that in three weeks the Fed will hike 25bps in what may well me its last hike of this cycle. Excerpted from an article he just published on the WSJ:

Inflation Report Tees Up Likely Quarter-Point Fed Rate Rise in February

Improving inflation data suggest officials will consider a smaller increase than in recent months

Fresh data showing inflation eased in December are likely to keep the Fed on track to reduce the size of interest-rate increases to a quarter-percentage-point at their meeting that concludes on Feb. 1.

Fed officials have kept their options open on whether to raise rates by either a quarter percentage point or a half percentage point at their next meeting, saying that the decision would be strongly guided by the latest data about the state of the economy.

But the improving inflation data suggest officials will strongly consider the smaller increase of a more traditional quarter point, or 25 basis points. It takes time for them to see the full effects of their policy actions, and they are trying to avoid causing unnecessary declines in employment and growth.

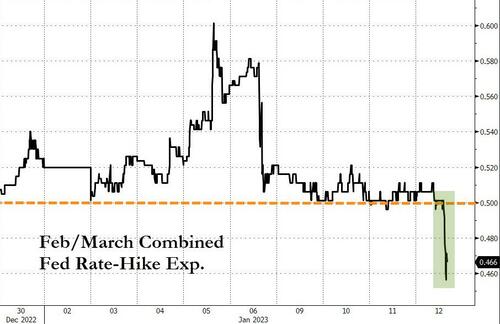

More in the full WSJ report here, but the market already got the message, as not only did odds of a 50bps Feb hike tumble to 9% from 26% pre-CPI, but as the next chart shows, the combined expectations for Feb/March are now below 50bps for the first time, suggesting that the market is now pricing in a "one more and done scenario."

In case there was still any doubt if the Fed will again slash its next rate hike increment – this time from 50bps to 25bps at the Feb 1 FOMC meeting – moments ago the Fed’s WSJ mouthpiece, Nick Timiraos, aka Nikileaks, made sure everyone knows that in three weeks the Fed will hike 25bps in what may well me its last hike of this cycle. Excerpted from an article he just published on the WSJ:

Inflation Report Tees Up Likely Quarter-Point Fed Rate Rise in February

Improving inflation data suggest officials will consider a smaller increase than in recent months

Fresh data showing inflation eased in December are likely to keep the Fed on track to reduce the size of interest-rate increases to a quarter-percentage-point at their meeting that concludes on Feb. 1.

Fed officials have kept their options open on whether to raise rates by either a quarter percentage point or a half percentage point at their next meeting, saying that the decision would be strongly guided by the latest data about the state of the economy.

But the improving inflation data suggest officials will strongly consider the smaller increase of a more traditional quarter point, or 25 basis points. It takes time for them to see the full effects of their policy actions, and they are trying to avoid causing unnecessary declines in employment and growth.

More in the full WSJ report here, but the market already got the message, as not only did odds of a 50bps Feb hike tumble to 9% from 26% pre-CPI, but as the next chart shows, the combined expectations for Feb/March are now below 50bps for the first time, suggesting that the market is now pricing in a “one more and done scenario.“

Loading…