It took Goldman three months to slash its (widely mocked) 2022 year-end S&P price target of 5,100 published in mid-November (at the time we said it would take just a few months for the target to be cut and we were right) to 4,900 in mid-February. Back then Goldman's chief strategist David Kostin listed three scenarios, the third and most bearish of which was that if the US economy tips into a recession, "the typical 24% recession peak-to-trough price decline would reduce the S&P 500 to 3600" to which we said that's what would happen "but before we get there expect another 200 point S&P target in one month, and then another, and then another."

One month later, this is precisely what happened, when in mid-March Goldman's David Kostin again cut his year-end price target to 4,700 (from 4.900), but more importantly, Kostin grudgingly raised the odds of a recession writing that "the current S&P 500 index level of 4260 suggests roughly a 40% likelihood of a downside recessionary case." He then noted that in such a "recession" scenario, the bank expects reduced earnings and valuation multiples would cause the S&P 500 to decline by 15% to 3600, similar to the 24% drop he had warned previously (Goldman also noted that this represents a 15% drop from current levels and is probably sufficient to trigger the Fed's put).

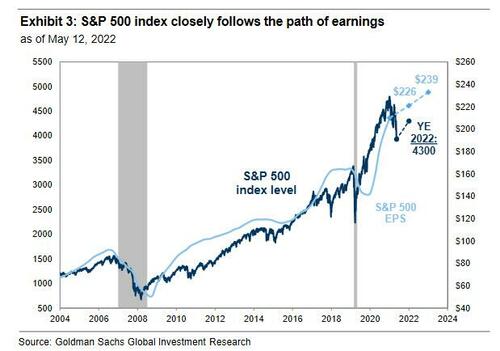

So fast forward another two months, when our prediction that Goldman would continue to slash its S&P price target by 200 points every month or so was spot on again, because as of this weekend, two months after Goldman cut its S&P target to 4,700, the bank's chief equity strategist has just published his latest forecast (full note available to professional subscribers), taking down the bank's price target to 4,300 (or 200 points per month for two months); as a reminder this was 5,100 just three months ago!

How does Kostin explain this dramatic reversal in his original cheerful forecast, which apparently could not anticipate any of the things that took place in the past few months? Here's how:

We revise our forecasts for earnings, interest rates, and the yield gap. We lower our S&P 500 year-end 2022 price target to 4300 (from 4700). Our new price target represents a 7% return from today. Our 3-month forecast equals 4000, with expected gains likely coming later in the year.

Finally admitting what we have been saying all along, Kostin concedes that "much higher equity prices in the near-term would ease financial conditions and be antithetical to the Fed’s goal of slowing economic growth", in other words, every time stocks jumped it would only prompt Powell to come out with even stronger hawkish jawboning .

That said, while Goldman expects an overshoot to 4,000 in the near-term (or undershoot since the S&P dropped as low as 3,855 on Thursday, touching the edge of a bear market), the bank remains somewhat hopeful that the worst is now behind us and "a contraction in economic growth is priced in equities and our baseline forecast suggests the worst of the decline is likely behind us assuming a recession is averted." Kostin also assumes that as the year progresses "investors will gain confidence about decelerating inflation, the path of Fed tightening, and recession risk, and equities will rise modestly driven by EPS growth."

Kostin then breaks down the revision in his forecast by factoring in for a stronger than expected Q1 earnings, offset by everything else deteriorating:

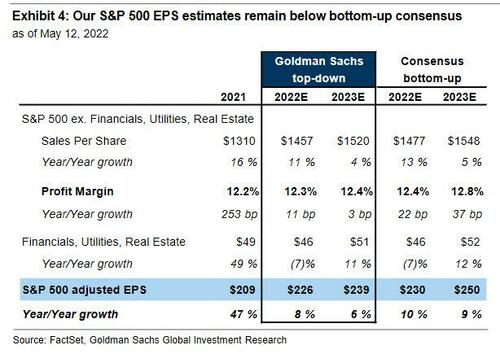

1Q earnings season was better-than-feared. Consensus expected +5% year/year growth in S&P 500 EPS, but firms realized +11%. Both sales and margins posted positive surprises. Analyst revisions to 2022 and 2023 have been slightly positive, mostly driven by Energy. We raise our 2022 S&P 500 top-down EPS growth forecast to +8% (vs. +5% previously). We maintain our 2023 EPS growth forecast of +6%. Our revised S&P 500 EPS estimates equal $226 and $239. Faster sales growth and better-than-feared Financials earnings are the primary drivers of our revision. Our net margin forecast remains unchanged. We expect margins will rise by 11 bp to 12.3% in 2022. However, excluding Energy, we forecast net profit margins will contract by 22 bp as input cost pressures weigh on companies.

Our sales, margin, and earnings forecasts remain below bottom-up consensus. Our economists’ 2022 real US GDP growth forecast is below-consensus and China’s zero COVID policy poses a clear downside risk to EPS growth. From a revenue perspective, we expect the headwind from a stronger trade-weighted dollar will need to be incorporated into analyst models. Investors have already started to reflect this risk; our domestic sales basket (GSTHAINT) has outperformed our international sales basket (GSTHINTL) by 10 pp YTD. While quarterly net profit margins have slipped modestly from their peak in 2Q 2021 to 12.1% in 1Q 2022, consensus expects an expansion during in 2H 2022, which appears too optimistic in our view. However, we believe it will take time for analysts to trim their forecasts closer to our top-down estimate. Our S&P 500 valuation and index forecasts assume that market participants price the index at year-end 2022 based on the consensus 2023E estimate of $250.

Higher interest rates. Our Rates strategists now expect the nominal 10-year US Treasury yield to rise to 3.3% at year-end 2022 (vs. 2.7% previously) driven by real yields. We assume real yields will end 2022 at 0.5% (vs. 0% previously).

Our forecast is that the P/E remains unchanged from today at 17x. Previously, we assumed the low real rate environment would support a P/E of 20x, 10% below the valuation at start of the year. But YTD the market has priced the equivalent of 8 additional 25 bp Fed hikes and real rates have risen sharply. During the last 8 weeks real rates have surged from -1.0% to +0.2%. Our revised outlook of lower growth and higher rates no longer supports meaningful P/E expansion. Our new P/E multiple forecast ranks in the 70th historical percentile and is consistent with pre-pandemic multiples, but below the past cycle’s peak of 18x in 2018. In our baseline, the relative valuation of stocks vs. real rates would rank in the 46th percentile vs history.

Lower yield gap. We expect the gap between the S&P 500 EPS yield and real 10-year US Treasury yield will narrow modestly to 530 bp (vs. 560 bp today). This yield gap would match the level experienced in April 2021 but remain above the average since 1990. We model the yield gap as a function of economic growth, policy uncertainty, the size of the Fed balance sheet, and consumer confidence. By the end of the year, our baseline assumes a slight improvement in growth expectations relative to the pessimistic outlook currently priced by cyclical vs. defensive industries. Valuation will benefit from reduced policy uncertainty and higher consumer confidence. These positive dynamics should more than offset the headwind from tightening financial conditions and allow the earnings yield gap to compress.

While Kostin tries to sound hopeful, the reality is that for the third time in a row the Goldman chief strategist not accidentally brings up that in a "downside" scenario, "a recession would push the S&P 500 11% lower to 3600", which is just slightly above the level Morgan Stanley expects stocks drop to in this bear market before they reverse. However, in a novel twist, today for the first time Kostin admits that if by year-end the economy is poised to enter a recession in 2023, "a combination of reduced EPS estimates and a wider yield gap would drive a lower index level" suggesting that the S&P may slide well below 3,600:

Earnings typically fall by 13% from peak-to-trough during recessions. However, equity prices move ahead of earnings. We assume by year-end the current 2023 EPS estimate of $250 would be cut by 7%, consistent with history. Our macro model implies the yield gap widens to 700 bp and the P/E multiple narrows to 15x.

Translation: just above 3,400.

In another downside scenario, Kostin writes that while the economy may avoid recession, real rates could continue to march higher, which would lead to a lower valuation multiple pushing the S&P 500 index down by 6% to 3800. In this scenario, if the Fed is forced to hike by more than Goldman economists expect and real rates rise to 1% - similar to the peak reached during the last cycle in 2018 - Goldman's macro model suggests that higher rates will more than offset the lower yield gap. In this scenario, the forward P/E would equal 16x, the lowest level since 2020.

Bottom line: Goldman has thrown in the towel and the bank which in early February expected stocks to hit 5,100 now says don't be surprise if they drop to 3,400. And that's why the David Kostins of the world get paid the big bucks.

But wait, there more...

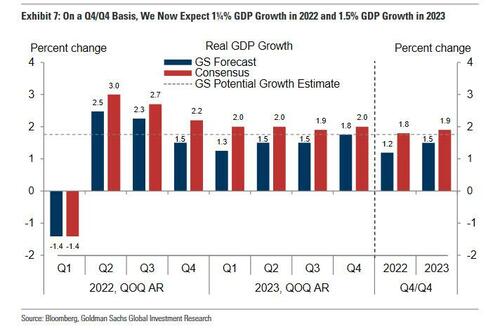

In another confirmation of our skepticism, Goldman's chief economist Jan Hatzius published a note on Sunday in which he again cut his overly optimistic GDP forecast (having done so most recently in March), and now expects GDP growth as follows:

- Q2 '22 to 2.5% from 1.5%

- Q3 '22 to 2.25% from 2.5%

- Q4 '22 to 1.5% from 2.5%

- Q1 '23 to 1.25%

- Q2 '23 to 1.5%

- Q3 '23 to 1.5%

- Q4 '23 to 1.5%

And visually:

These changes imply a downgrade in 2022 GDP growth to +2.4% on an annual basis (vs. +2.6% previously) and to +1¼% on a Q4/Q4 basis (vs. 1.6%), and a downgrade in 2023 growth to +1.6% on an annual basis (vs. +2.2%) and to +1½% on a Q4/Q4 basis (vs. +2.0%). In other words, just as we said in March, the hockeystick forecast that Goldman laughably presented two months ago has not only flattened but has inverted.

Of course, Goldman has refused to forecast a recession (yet), and instead frames the continuing slowdown (as a reminder Goldman was nowhere near the -1.4% Q1 GDP print), as a "necessary growth slowdown." According to Goldman, the slowdown is a byproduct of the Fed's tightening in financial conditions, and the bank thinks the rate hikes that are currently priced into financial conditions "are in the ballpark of what is ultimately needed to restore balance to the labor market and cool wage and price pressures. We therefore expect that the recent tightening in financial conditions will persist, in part because we think the Fed will deliver on what is priced."

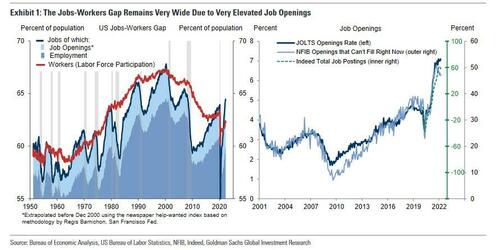

That said, not even Goldman is confident that a slowdown won't push the economy into recession, and cautions that job openings remains "extremely high (+4.5mn vs. pre-pandemic level; right chart, Exhibit 1) and less likely to moderate on their own. And the jobs-workers gap probably cannot meaningfully narrow without a moderation in job openings, and wage growth probably cannot settle back to a sustainable level while the jobs-workers gap remains very elevated. Therefore, the main challenge for the FOMC as it attempts to lower inflation is to convince companies to shelve some of their expansion plans and close enough job openings to restore balance to the labor market, a view Chair Powell endorsed at the May FOMC press conference."

It's not just GDP that will get hit: the labor market will too. As the bank concludes in its downward revision, while the slowdown in growth should help lower job openings, "it is also likely to raise the unemployment rate a bit, particularly since the job openings rate

typically only falls when unemployment spikes in recessions." Of course, Goldman remains optimistic "that a sharp rise in the unemployment rate can be avoided, especially since typically the job openings rate declines more and the unemployment rate increases less when the job openings rate is very elevated, like it is today."

Although we continue to expect that momentum in job gains will push then unemployment rate to a low of 3.4% in the next few months, we now expect that the unemployment rate will subsequently rise back to 3.5% at end-2022, and rise further to 3.7% at end-2023.

And since Goldman has been always wrong in its economic forecasts in the past year (just see the bank's horrific CPI predictions) here is our translation of the above: expect the labor market to soon enter freefall, one which will force the Fed to not only reverse its tightening and QT plans, but to go straight from rate cuts to NIRP and back to QE again.

And just to confirm that a recession is now inevitable (as is the obvious Fed response) none other than the former boss of both Kostin and Hatzius, former Goldman CEO Lloyd Blankfein, spoke on CBS’s “Face the Nation” on Sunday, and urged companies and consumers to gird for a US recession, saying it’s a “very, very high risk.”

"Do you think we're headed towards recession?" @margbrennan asks Goldman Sachs Senior Chairman Lloyd Blankfein amid U.S. inflation.

— Face The Nation (@FaceTheNation) May 15, 2022

"It's definitely a risk...If I were a consumer, I'd be prepared for it, but it's not baked in the cake." pic.twitter.com/IehxU4wSo6

“If I were running a big company, I would be very prepared for it. If I was a consumer, I’d be prepared for it.” A recession is “not baked in the cake” and there’s a “narrow path” to avoid it, said the CEO who lost his job after infamously enabling Obama golfing buddy, former Malaysia PM Najib Razak, to loot billions from 1MDB.

Blankfein noted that while some of the inflation “will go away” as supply chains unsnarl and Covid-19 lockdowns in China ease, “some of these things are a little bit stickier, like energy prices.”

“How comfortable are we now to rely on those supply chains that are not within the borders of the United States and we can’t control?” Blankfein said. “Do we feel good about getting all our semiconductors from Taiwan, which is again, an object of China.”

Bottom line: the question is not if but when the next recession hits, and not if but when the Fed responds with aggressive rates cuts and QE.

The full Goldman notes are available to professional subs in the usual place.

It took Goldman three months to slash its (widely mocked) 2022 year-end S&P price target of 5,100 published in mid-November (at the time we said it would take just a few months for the target to be cut and we were right) to 4,900 in mid-February. Back then Goldman’s chief strategist David Kostin listed three scenarios, the third and most bearish of which was that if the US economy tips into a recession, “the typical 24% recession peak-to-trough price decline would reduce the S&P 500 to 3600″ to which we said that’s what would happen “but before we get there expect another 200 point S&P target in one month, and then another, and then another.”

One month later, this is precisely what happened, when in mid-March Goldman’s David Kostin again cut his year-end price target to 4,700 (from 4.900), but more importantly, Kostin grudgingly raised the odds of a recession writing that “the current S&P 500 index level of 4260 suggests roughly a 40% likelihood of a downside recessionary case.” He then noted that in such a “recession” scenario, the bank expects reduced earnings and valuation multiples would cause the S&P 500 to decline by 15% to 3600, similar to the 24% drop he had warned previously (Goldman also noted that this represents a 15% drop from current levels and is probably sufficient to trigger the Fed’s put).

So fast forward another two months, when our prediction that Goldman would continue to slash its S&P price target by 200 points every month or so was spot on again, because as of this weekend, two months after Goldman cut its S&P target to 4,700, the bank’s chief equity strategist has just published his latest forecast (full note available to professional subscribers), taking down the bank’s price target to 4,300 (or 200 points per month for two months); as a reminder this was 5,100 just three months ago!

How does Kostin explain this dramatic reversal in his original cheerful forecast, which apparently could not anticipate any of the things that took place in the past few months? Here’s how:

We revise our forecasts for earnings, interest rates, and the yield gap. We lower our S&P 500 year-end 2022 price target to 4300 (from 4700). Our new price target represents a 7% return from today. Our 3-month forecast equals 4000, with expected gains likely coming later in the year.

Finally admitting what we have been saying all along, Kostin concedes that “much higher equity prices in the near-term would ease financial conditions and be antithetical to the Fed’s goal of slowing economic growth”, in other words, every time stocks jumped it would only prompt Powell to come out with even stronger hawkish jawboning .

That said, while Goldman expects an overshoot to 4,000 in the near-term (or undershoot since the S&P dropped as low as 3,855 on Thursday, touching the edge of a bear market), the bank remains somewhat hopeful that the worst is now behind us and “a contraction in economic growth is priced in equities and our baseline forecast suggests the worst of the decline is likely behind us assuming a recession is averted.” Kostin also assumes that as the year progresses “investors will gain confidence about decelerating inflation, the path of Fed tightening, and recession risk, and equities will rise modestly driven by EPS growth.”

Kostin then breaks down the revision in his forecast by factoring in for a stronger than expected Q1 earnings, offset by everything else deteriorating:

1Q earnings season was better-than-feared. Consensus expected +5% year/year growth in S&P 500 EPS, but firms realized +11%. Both sales and margins posted positive surprises. Analyst revisions to 2022 and 2023 have been slightly positive, mostly driven by Energy. We raise our 2022 S&P 500 top-down EPS growth forecast to +8% (vs. +5% previously). We maintain our 2023 EPS growth forecast of +6%. Our revised S&P 500 EPS estimates equal $226 and $239. Faster sales growth and better-than-feared Financials earnings are the primary drivers of our revision. Our net margin forecast remains unchanged. We expect margins will rise by 11 bp to 12.3% in 2022. However, excluding Energy, we forecast net profit margins will contract by 22 bp as input cost pressures weigh on companies.

Our sales, margin, and earnings forecasts remain below bottom-up consensus. Our economists’ 2022 real US GDP growth forecast is below-consensus and China’s zero COVID policy poses a clear downside risk to EPS growth. From a revenue perspective, we expect the headwind from a stronger trade-weighted dollar will need to be incorporated into analyst models. Investors have already started to reflect this risk; our domestic sales basket (GSTHAINT) has outperformed our international sales basket (GSTHINTL) by 10 pp YTD. While quarterly net profit margins have slipped modestly from their peak in 2Q 2021 to 12.1% in 1Q 2022, consensus expects an expansion during in 2H 2022, which appears too optimistic in our view. However, we believe it will take time for analysts to trim their forecasts closer to our top-down estimate. Our S&P 500 valuation and index forecasts assume that market participants price the index at year-end 2022 based on the consensus 2023E estimate of $250.

Higher interest rates. Our Rates strategists now expect the nominal 10-year US Treasury yield to rise to 3.3% at year-end 2022 (vs. 2.7% previously) driven by real yields. We assume real yields will end 2022 at 0.5% (vs. 0% previously).

Our forecast is that the P/E remains unchanged from today at 17x. Previously, we assumed the low real rate environment would support a P/E of 20x, 10% below the valuation at start of the year. But YTD the market has priced the equivalent of 8 additional 25 bp Fed hikes and real rates have risen sharply. During the last 8 weeks real rates have surged from -1.0% to +0.2%. Our revised outlook of lower growth and higher rates no longer supports meaningful P/E expansion. Our new P/E multiple forecast ranks in the 70th historical percentile and is consistent with pre-pandemic multiples, but below the past cycle’s peak of 18x in 2018. In our baseline, the relative valuation of stocks vs. real rates would rank in the 46th percentile vs history.

Lower yield gap. We expect the gap between the S&P 500 EPS yield and real 10-year US Treasury yield will narrow modestly to 530 bp (vs. 560 bp today). This yield gap would match the level experienced in April 2021 but remain above the average since 1990. We model the yield gap as a function of economic growth, policy uncertainty, the size of the Fed balance sheet, and consumer confidence. By the end of the year, our baseline assumes a slight improvement in growth expectations relative to the pessimistic outlook currently priced by cyclical vs. defensive industries. Valuation will benefit from reduced policy uncertainty and higher consumer confidence. These positive dynamics should more than offset the headwind from tightening financial conditions and allow the earnings yield gap to compress.

While Kostin tries to sound hopeful, the reality is that for the third time in a row the Goldman chief strategist not accidentally brings up that in a “downside” scenario, “a recession would push the S&P 500 11% lower to 3600”, which is just slightly above the level Morgan Stanley expects stocks drop to in this bear market before they reverse. However, in a novel twist, today for the first time Kostin admits that if by year-end the economy is poised to enter a recession in 2023, “a combination of reduced EPS estimates and a wider yield gap would drive a lower index level” suggesting that the S&P may slide well below 3,600:

Earnings typically fall by 13% from peak-to-trough during recessions. However, equity prices move ahead of earnings. We assume by year-end the current 2023 EPS estimate of $250 would be cut by 7%, consistent with history. Our macro model implies the yield gap widens to 700 bp and the P/E multiple narrows to 15x.

Translation: just above 3,400.

In another downside scenario, Kostin writes that while the economy may avoid recession, real rates could continue to march higher, which would lead to a lower valuation multiple pushing the S&P 500 index down by 6% to 3800. In this scenario, if the Fed is forced to hike by more than Goldman economists expect and real rates rise to 1% – similar to the peak reached during the last cycle in 2018 – Goldman’s macro model suggests that higher rates will more than offset the lower yield gap. In this scenario, the forward P/E would equal 16x, the lowest level since 2020.

Bottom line: Goldman has thrown in the towel and the bank which in early February expected stocks to hit 5,100 now says don’t be surprise if they drop to 3,400. And that’s why the David Kostins of the world get paid the big bucks.

But wait, there more…

In another confirmation of our skepticism, Goldman’s chief economist Jan Hatzius published a note on Sunday in which he again cut his overly optimistic GDP forecast (having done so most recently in March), and now expects GDP growth as follows:

- Q2 ’22 to 2.5% from 1.5%

- Q3 ’22 to 2.25% from 2.5%

- Q4 ’22 to 1.5% from 2.5%

- Q1 ’23 to 1.25%

- Q2 ’23 to 1.5%

- Q3 ’23 to 1.5%

- Q4 ’23 to 1.5%

And visually:

These changes imply a downgrade in 2022 GDP growth to +2.4% on an annual basis (vs. +2.6% previously) and to +1¼% on a Q4/Q4 basis (vs. 1.6%), and a downgrade in 2023 growth to +1.6% on an annual basis (vs. +2.2%) and to +1½% on a Q4/Q4 basis (vs. +2.0%). In other words, just as we said in March, the hockeystick forecast that Goldman laughably presented two months ago has not only flattened but has inverted.

Of course, Goldman has refused to forecast a recession (yet), and instead frames the continuing slowdown (as a reminder Goldman was nowhere near the -1.4% Q1 GDP print), as a “necessary growth slowdown.” According to Goldman, the slowdown is a byproduct of the Fed’s tightening in financial conditions, and the bank thinks the rate hikes that are currently priced into financial conditions “are in the ballpark of what is ultimately needed to restore balance to the labor market and cool wage and price pressures. We therefore expect that the recent tightening in financial conditions will persist, in part because we think the Fed will deliver on what is priced.”

That said, not even Goldman is confident that a slowdown won’t push the economy into recession, and cautions that job openings remains “extremely high (+4.5mn vs. pre-pandemic level; right chart, Exhibit 1) and less likely to moderate on their own. And the jobs-workers gap probably cannot meaningfully narrow without a moderation in job openings, and wage growth probably cannot settle back to a sustainable level while the jobs-workers gap remains very elevated. Therefore, the main challenge for the FOMC as it attempts to lower inflation is to convince companies to shelve some of their expansion plans and close enough job openings to restore balance to the labor market, a view Chair Powell endorsed at the May FOMC press conference.”

It’s not just GDP that will get hit: the labor market will too. As the bank concludes in its downward revision, while the slowdown in growth should help lower job openings, “it is also likely to raise the unemployment rate a bit, particularly since the job openings rate

typically only falls when unemployment spikes in recessions.” Of course, Goldman remains optimistic “that a sharp rise in the unemployment rate can be avoided, especially since typically the job openings rate declines more and the unemployment rate increases less when the job openings rate is very elevated, like it is today.”

Although we continue to expect that momentum in job gains will push then unemployment rate to a low of 3.4% in the next few months, we now expect that the unemployment rate will subsequently rise back to 3.5% at end-2022, and rise further to 3.7% at end-2023.

And since Goldman has been always wrong in its economic forecasts in the past year (just see the bank’s horrific CPI predictions) here is our translation of the above: expect the labor market to soon enter freefall, one which will force the Fed to not only reverse its tightening and QT plans, but to go straight from rate cuts to NIRP and back to QE again.

And just to confirm that a recession is now inevitable (as is the obvious Fed response) none other than the former boss of both Kostin and Hatzius, former Goldman CEO Lloyd Blankfein, spoke on CBS’s “Face the Nation” on Sunday, and urged companies and consumers to gird for a US recession, saying it’s a “very, very high risk.”

“Do you think we’re headed towards recession?” @margbrennan asks Goldman Sachs Senior Chairman Lloyd Blankfein amid U.S. inflation.

“It’s definitely a risk…If I were a consumer, I’d be prepared for it, but it’s not baked in the cake.” pic.twitter.com/IehxU4wSo6

— Face The Nation (@FaceTheNation) May 15, 2022

“If I were running a big company, I would be very prepared for it. If I was a consumer, I’d be prepared for it.” A recession is “not baked in the cake” and there’s a “narrow path” to avoid it, said the CEO who lost his job after infamously enabling Obama golfing buddy, former Malaysia PM Najib Razak, to loot billions from 1MDB.

Blankfein noted that while some of the inflation “will go away” as supply chains unsnarl and Covid-19 lockdowns in China ease, “some of these things are a little bit stickier, like energy prices.”

“How comfortable are we now to rely on those supply chains that are not within the borders of the United States and we can’t control?” Blankfein said. “Do we feel good about getting all our semiconductors from Taiwan, which is again, an object of China.”

Bottom line: the question is not if but when the next recession hits, and not if but when the Fed responds with aggressive rates cuts and QE.

The full Goldman notes are available to professional subs in the usual place.