By Tsvetana Paraskova of OilPrice.com

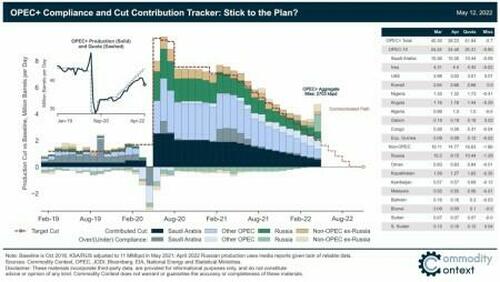

OPEC continues to undershoot its oil production target in the OPEC+ deal, failing in April to boost output as much as required by the agreement.

All 13 members of OPEC – including Iran, Libya, and Venezuela exempted from the OPEC+ deal – saw their production rise by just 153,000 barrels per day (bpd) collectively, to 28.648 million bpd in April, the organization’s Monthly Oil Market Report (MOMR) showed on Thursday.

The top three OPEC producers, Saudi Arabia, Iraq and the UAE, saw the highest increases in their respective oil production last month, while output in Libya plunged by 161,000 bpd to below 1 million bpd, at 913,000 bpd, according to OPEC’s secondary sources.

Libyan oilfields and terminals have again been under blockade in recent weeks amid protests, clashes, and disputes over the distribution of oil revenues in the country with two rival governments, with incumbent Prime Minister Abdul Hamid Dbeibah refusing to step down for newly sworn-in eastern Prime Minister Fathi Bashaga.

Excluding Libya and the other two producers exempted from the OPEC+ deal, the ten OPEC members bound by the agreement saw their collective production at 24.464 million bpd in April, OPEC’s figures showed. This compares with a collective quota for OPEC-10 of 25.315 million bpd for last month.

The gap is more than 800,000 bpd, mostly due to severe underperformance from African members Angola and Nigeria, which have been pumping 300,000 bpd-400,000 bpd below quotas each, for months, due to a lack of investment and capacity.

Per OPEC’s secondary sources, the biggest OPEC producer, Saudi Arabia, raised its production by 127,000 bpd to 10.346 million bpd in April, versus a quota nearly 100,000 bpd higher – 10.436 million bpd. The Kingdom, however, self-reported to OPEC higher production, one of 10.441 million bpd.

Secondary sources showed that OPEC’s second-largest producer, Iraq, boosted production by 103,000 bpd to 4.405 million bpd, nearly reaching its April quota of 4.414 million bpd.

Last week, the wider OPEC+ group agreed to leave its production plan unchanged, aiming to boost crude oil production in June by 432,000 bpd, in a move widely expected by the market. While OPEC+ is sticking to its policy of modest monthly increases, many of its members are not pumping to their quotas and the group is estimated to be around 1.5 million bpd below its quota.

By Tsvetana Paraskova of OilPrice.com

OPEC continues to undershoot its oil production target in the OPEC+ deal, failing in April to boost output as much as required by the agreement.

All 13 members of OPEC – including Iran, Libya, and Venezuela exempted from the OPEC+ deal – saw their production rise by just 153,000 barrels per day (bpd) collectively, to 28.648 million bpd in April, the organization’s Monthly Oil Market Report (MOMR) showed on Thursday.

The top three OPEC producers, Saudi Arabia, Iraq and the UAE, saw the highest increases in their respective oil production last month, while output in Libya plunged by 161,000 bpd to below 1 million bpd, at 913,000 bpd, according to OPEC’s secondary sources.

Libyan oilfields and terminals have again been under blockade in recent weeks amid protests, clashes, and disputes over the distribution of oil revenues in the country with two rival governments, with incumbent Prime Minister Abdul Hamid Dbeibah refusing to step down for newly sworn-in eastern Prime Minister Fathi Bashaga.

Excluding Libya and the other two producers exempted from the OPEC+ deal, the ten OPEC members bound by the agreement saw their collective production at 24.464 million bpd in April, OPEC’s figures showed. This compares with a collective quota for OPEC-10 of 25.315 million bpd for last month.

The gap is more than 800,000 bpd, mostly due to severe underperformance from African members Angola and Nigeria, which have been pumping 300,000 bpd-400,000 bpd below quotas each, for months, due to a lack of investment and capacity.

Per OPEC’s secondary sources, the biggest OPEC producer, Saudi Arabia, raised its production by 127,000 bpd to 10.346 million bpd in April, versus a quota nearly 100,000 bpd higher – 10.436 million bpd. The Kingdom, however, self-reported to OPEC higher production, one of 10.441 million bpd.

Secondary sources showed that OPEC’s second-largest producer, Iraq, boosted production by 103,000 bpd to 4.405 million bpd, nearly reaching its April quota of 4.414 million bpd.

Last week, the wider OPEC+ group agreed to leave its production plan unchanged, aiming to boost crude oil production in June by 432,000 bpd, in a move widely expected by the market. While OPEC+ is sticking to its policy of modest monthly increases, many of its members are not pumping to their quotas and the group is estimated to be around 1.5 million bpd below its quota.