Authored by Simon White, Bloomberg macro strategist,

Trading in option markets is likely making it easier to get bank credit, but it’s too early to say whether this will be enough to arrest the downswing in the credit cycle.

The SLOOS survey for the quarter to the end of January was released on Monday, and it showed a further easing in bank-lending standards.

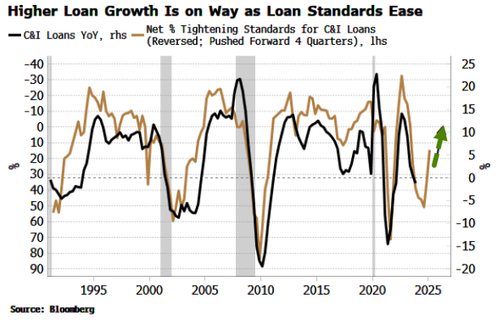

This is potentially positive, as when banks make it easier to get a loan, it typically leads to rising loan growth over the next year or so.

The easing in standards was not just confined to commercial and industrial (C&I) loans; loans for residential and commercial real-estate also eased.

On the surface, this is an upbeat development for the credit cycle. But some caution is required. In a column from two weeks ago, I discussed how the stock-market is behaving like a perpetual motion machine.

Dispersion selling mainly by banks (i.e. selling index volatility versus single-name volatility) is creating a feedback loop, keeping index volatility repressed.

Heavy vol selling on the index means that when the market darlings - that everybody seemingly wants to own (or has to own to not trail the index) - rise, other stocks have to fall, as the vol selling pins the index.

This dampens index correlation and in turn leads to lower index volatility.

Wash, rinse, repeat.

Credit and equity vol are indirectly linked, but the latter is also a direct input to many credit pricing models via the Merton distance-to-default model.

In the model, the equity of a firm is taken to be a perpetual call option on its solvency. Thus, the observable implied volatility of a company can be used to infer the unobservable volatility of the company’s asset base, and thus the implied probability of default – the basis of the value of the credit spread - can be calculated via Black-Scholes.

Action in option pricing is therefore repressing credit spreads.

Whether they are a true reflection of underlying credit conditions is a moot point – it’s possible tighter credit spreads can create their own reality.

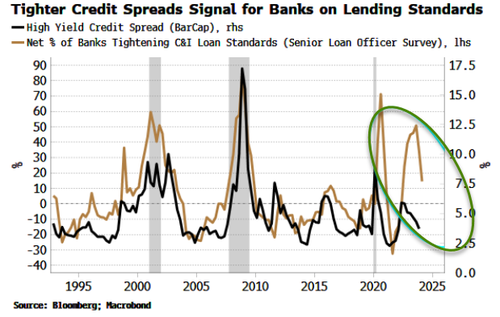

One way is by encouraging banks to ease credit. As the chart below shows, there is a close relationship between net percent of banks tightening commercial and industrial (C&I) loan standards and credit spreads. The first is quarterly data, but credit spreads are real-time. Banks are likely influenced on how easy they want to make it to get a loan by looking at credit markets.

In markets, greed typically ensures trades blow up rather than fading noiselessly from view.

Perhaps the easing of bank credit will mean a credit crisis is ultimately averted.

But it’s hard to be confident of that call when vol-selling could go belly up, as it has several occasions before.

Authored by Simon White, Bloomberg macro strategist,

Trading in option markets is likely making it easier to get bank credit, but it’s too early to say whether this will be enough to arrest the downswing in the credit cycle.

The SLOOS survey for the quarter to the end of January was released on Monday, and it showed a further easing in bank-lending standards.

This is potentially positive, as when banks make it easier to get a loan, it typically leads to rising loan growth over the next year or so.

The easing in standards was not just confined to commercial and industrial (C&I) loans; loans for residential and commercial real-estate also eased.

On the surface, this is an upbeat development for the credit cycle. But some caution is required. In a column from two weeks ago, I discussed how the stock-market is behaving like a perpetual motion machine.

Dispersion selling mainly by banks (i.e. selling index volatility versus single-name volatility) is creating a feedback loop, keeping index volatility repressed.

Heavy vol selling on the index means that when the market darlings – that everybody seemingly wants to own (or has to own to not trail the index) – rise, other stocks have to fall, as the vol selling pins the index.

This dampens index correlation and in turn leads to lower index volatility.

Wash, rinse, repeat.

Credit and equity vol are indirectly linked, but the latter is also a direct input to many credit pricing models via the Merton distance-to-default model.

In the model, the equity of a firm is taken to be a perpetual call option on its solvency. Thus, the observable implied volatility of a company can be used to infer the unobservable volatility of the company’s asset base, and thus the implied probability of default – the basis of the value of the credit spread – can be calculated via Black-Scholes.

Action in option pricing is therefore repressing credit spreads.

Whether they are a true reflection of underlying credit conditions is a moot point – it’s possible tighter credit spreads can create their own reality.

One way is by encouraging banks to ease credit. As the chart below shows, there is a close relationship between net percent of banks tightening commercial and industrial (C&I) loan standards and credit spreads. The first is quarterly data, but credit spreads are real-time. Banks are likely influenced on how easy they want to make it to get a loan by looking at credit markets.

In markets, greed typically ensures trades blow up rather than fading noiselessly from view.

Perhaps the easing of bank credit will mean a credit crisis is ultimately averted.

But it’s hard to be confident of that call when vol-selling could go belly up, as it has several occasions before.

Loading…