By Peter Tchir of Academy Securities

Overstaying Our Welcome?

With holiday party season fast approaching (or already underway), it isn’t bad to think about overstaying our welcome at a party (I had one boss who always reminded us that no one ever got promoted based on their behavior at holiday parties…but the opposite does sometimes happen). In any case, we aren’t here to talk about parties; we’re here to talk about our positioning.

In last weekend’s What do 4.2% Treasury Yields Mean? we downgraded our “everything rally” call to:

-

Neutral to bearish on rates.

-

Neutral to mildly bullish Credit.

-

Slightly bullish equities, very bullish on the laggards!

On Friday, post-NFP, we posited that the data was Bad for Bonds, Good for Stocks. Treasuries did finish the day with higher yields, but ended the week barely changed (from 4.2% to 4.23% on the 10-year, with a dip to 4.1% on Wednesday). Stocks did rally and did finish up on the week – but barely, with no major index gaining 1% (though the Russell 2000 came darn close!).

If The Last Fed Meeting was “The Market Did Our Work for Us…”

One big takeaway from the last meeting was that the bond market had done much of the Fed’s work for it.

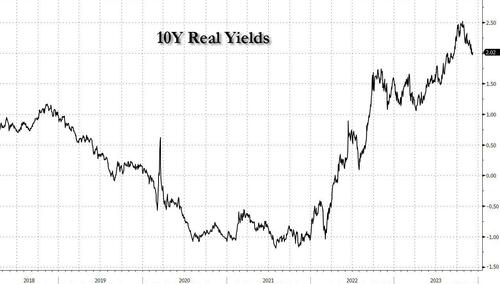

On October 31st, when the Fed started their last meeting, the 10-year real yield (using the Fed’s own “H15 Constant Maturity index”) was at 2.46%. Today it’s at 2.02% and broke below 2% during the week. The 5-year, 5-year forward breakeven yield (I’m not sure why we use that, other than it sounds so complicated that it must be useful), went from 2.48% to 2.27% – not quite as dramatic, but eye-catching nonetheless.

The June 2024 Fed fund futures contract is currently pricing in 1.8 cuts between now and then. On October 31st it was pricing in 0.5 cuts.

Without a doubt, the market undid a lot of the work that it had done!

That’s a bit concerning for bulls in any market, as there are going to be questions on this subject – and there is no way that Powell can say the market hasn’t undone some of the work.

There are two things that may let us stay at this party:

-

While the moves have been large, 2% real yields are at best “neutral” and likely still restrictive. It was as low as 1.06% in April! In fact, it wasn’t consistently above 2% until the end of September and was basically at this level when the Fed chose to do nothing at the September meeting. The Fed is likely going to view the price action in the past month as leaving things much more balanced/neutral than they were before – which, lo and behold, fits our current timid view on Treasuries.

-

The data, by and large, came in weaker this month. Not so weak that it fully offsets the change in market conditions, but pretty darn close.

Basically, market conditions have changed to tilt the Fed to be more hawkish, but the data bends the Fed the other way (more on the data in a moment).

Driving a Car with a Broken Speedometer

Would you drive a car with a broken speedometer? Or a speedometer that only has 3 measurements – slow, fast, and very fast? What’s the old adage about a broken clock being right twice a day?

Well, the Fed is trying to steer a giant, complex economy (and we’re trying to trade how we think the Fed will steer that economy), based on data which we’ve often argued is just garbage! We’d be nervous to drive a car without a speedometer, but give us a 25 TRILLION DOLLAR economy and I can steer this to the nearest ¼ point on interest rates!

-

The Household Survey had about 550,000 more jobs than the Establishment Survey! ✅

-

JOLTS had 617,000 fewer jobs in October than September ✅

-

UMich 1-year inflation expectations dropped by 1.4%, from 4.5% to 3.1% in a month! ✅

I don’t mean to pick on any of this data (well actually, I do). We’ve argued for years that it’s bizarre at best that we live with consistently wide and persistent variations in two surveys (Household and Establishment), both of which attempt to measure the same thing and don’t come close. We’ve highlighted, again and again, that the BLS publishes survey response rates; they are abysmal and getting worse! We’d be nervous driving without a speedometer, but give me two surveys (with low and declining response rates, which don’t remotely tie out) and I’m confident that we can use them! (hmmmmm….)

On JOLTS, there was a noticeable uptick years ago that seemed to coincide more with the transition to online job postings than any macro indicator. But…it couldn’t be that we’re just bad at measuring a generational shift in how people advertise for jobs? No, that wouldn’t make sense, the data must be right! (hmmmmm….)

As far as I know, CONsumer CONfidence still relies on calling people (or employing some other “state-of-the-art” technology) to get their data. So yes, it must really be that people either changed their inflation expectations, or carefully analyzed some data that might fall off, or it’s just a pseudo-random number? (hmmmmm….) You know which way I’m leaning, although the study of pseudo-random numbers (as opposed to truly random numbers) is quite fascinating.

I do look to the CITI Economic Surprise Index, and it suggests that things are still surprising to the upside, but far less so than during the summer (and that’s with expectations dropping).

So, in the real world, the economy is slowing. This gives the Fed enough ammunition to resist sounding too hawkish in the face of a market that has rallied significantly since the last FOMC announcement date press conference.

Bottom Line

-

The Fed won’t help but shouldn’t be much of a hindrance either.

-

The Middle East remains a risk, but hasn’t escalated yet (see this week’s Podcast if you missed it). I do ask a question about the global versus U.S. perception of China and Taiwan/Taipei, as well as the “one country, two systems” artifice that General Marks and Maria Donnelly handled very well. For what it’s worth, ChatGPT wasn’t very helpful in answering some simple questions on the subject. It came back on many of the queries with some version of “most people say Taiwan, but those concerned about China’s opinion of them use Taipei.”

-

China: I can’t believe that I’m almost clamoring for a pop in Chinese stocks! The negativity seems almost extreme (yes, there are many problems facing their economy), but they have options, ranging from stimulus, to “Made by China,” to some sort of deal with the U.S. to ease global tensions. All would be good for Chinese stocks and would likely propel global markets higher. Purely a trade, not a strategy, but it’s high on my list of plausible surprises that aren’t being priced in.

So, I’m going to start next week with the same views that I started this week with! (See above, or last week’s report).

The consternation that many showed on Friday, acting like it was almost mathematically impossible for bond yields to be higher and stocks to also be higher, gives me some comfort that we can see more of that this week as the data rolls in and the Fed must respect it. And (I know that I sound like a broken record) markets will have to favor variations of soft landing over hard landing scenarios until (if, I suppose, but I believe until) the data is overwhelmingly obvious!

While we can stay in this mild “risk on” positioning for a bit longer, I’m totally absorbed in trying to understand when we’ve overstayed our welcome.

By Peter Tchir of Academy Securities

Overstaying Our Welcome?

With holiday party season fast approaching (or already underway), it isn’t bad to think about overstaying our welcome at a party (I had one boss who always reminded us that no one ever got promoted based on their behavior at holiday parties…but the opposite does sometimes happen). In any case, we aren’t here to talk about parties; we’re here to talk about our positioning.

In last weekend’s What do 4.2% Treasury Yields Mean? we downgraded our “everything rally” call to:

-

Neutral to bearish on rates.

-

Neutral to mildly bullish Credit.

-

Slightly bullish equities, very bullish on the laggards!

On Friday, post-NFP, we posited that the data was Bad for Bonds, Good for Stocks. Treasuries did finish the day with higher yields, but ended the week barely changed (from 4.2% to 4.23% on the 10-year, with a dip to 4.1% on Wednesday). Stocks did rally and did finish up on the week – but barely, with no major index gaining 1% (though the Russell 2000 came darn close!).

If The Last Fed Meeting was “The Market Did Our Work for Us…”

One big takeaway from the last meeting was that the bond market had done much of the Fed’s work for it.

On October 31st, when the Fed started their last meeting, the 10-year real yield (using the Fed’s own “H15 Constant Maturity index”) was at 2.46%. Today it’s at 2.02% and broke below 2% during the week. The 5-year, 5-year forward breakeven yield (I’m not sure why we use that, other than it sounds so complicated that it must be useful), went from 2.48% to 2.27% – not quite as dramatic, but eye-catching nonetheless.

The June 2024 Fed fund futures contract is currently pricing in 1.8 cuts between now and then. On October 31st it was pricing in 0.5 cuts.

Without a doubt, the market undid a lot of the work that it had done!

That’s a bit concerning for bulls in any market, as there are going to be questions on this subject – and there is no way that Powell can say the market hasn’t undone some of the work.

There are two things that may let us stay at this party:

-

While the moves have been large, 2% real yields are at best “neutral” and likely still restrictive. It was as low as 1.06% in April! In fact, it wasn’t consistently above 2% until the end of September and was basically at this level when the Fed chose to do nothing at the September meeting. The Fed is likely going to view the price action in the past month as leaving things much more balanced/neutral than they were before – which, lo and behold, fits our current timid view on Treasuries.

-

The data, by and large, came in weaker this month. Not so weak that it fully offsets the change in market conditions, but pretty darn close.

Basically, market conditions have changed to tilt the Fed to be more hawkish, but the data bends the Fed the other way (more on the data in a moment).

Driving a Car with a Broken Speedometer

Would you drive a car with a broken speedometer? Or a speedometer that only has 3 measurements – slow, fast, and very fast? What’s the old adage about a broken clock being right twice a day?

Well, the Fed is trying to steer a giant, complex economy (and we’re trying to trade how we think the Fed will steer that economy), based on data which we’ve often argued is just garbage! We’d be nervous to drive a car without a speedometer, but give us a 25 TRILLION DOLLAR economy and I can steer this to the nearest ¼ point on interest rates!

-

The Household Survey had about 550,000 more jobs than the Establishment Survey! ✅

-

JOLTS had 617,000 fewer jobs in October than September ✅

-

UMich 1-year inflation expectations dropped by 1.4%, from 4.5% to 3.1% in a month! ✅

I don’t mean to pick on any of this data (well actually, I do). We’ve argued for years that it’s bizarre at best that we live with consistently wide and persistent variations in two surveys (Household and Establishment), both of which attempt to measure the same thing and don’t come close. We’ve highlighted, again and again, that the BLS publishes survey response rates; they are abysmal and getting worse! We’d be nervous driving without a speedometer, but give me two surveys (with low and declining response rates, which don’t remotely tie out) and I’m confident that we can use them! (hmmmmm….)

On JOLTS, there was a noticeable uptick years ago that seemed to coincide more with the transition to online job postings than any macro indicator. But…it couldn’t be that we’re just bad at measuring a generational shift in how people advertise for jobs? No, that wouldn’t make sense, the data must be right! (hmmmmm….)

As far as I know, CONsumer CONfidence still relies on calling people (or employing some other “state-of-the-art” technology) to get their data. So yes, it must really be that people either changed their inflation expectations, or carefully analyzed some data that might fall off, or it’s just a pseudo-random number? (hmmmmm….) You know which way I’m leaning, although the study of pseudo-random numbers (as opposed to truly random numbers) is quite fascinating.

I do look to the CITI Economic Surprise Index, and it suggests that things are still surprising to the upside, but far less so than during the summer (and that’s with expectations dropping).

So, in the real world, the economy is slowing. This gives the Fed enough ammunition to resist sounding too hawkish in the face of a market that has rallied significantly since the last FOMC announcement date press conference.

Bottom Line

-

The Fed won’t help but shouldn’t be much of a hindrance either.

-

The Middle East remains a risk, but hasn’t escalated yet (see this week’s Podcast if you missed it). I do ask a question about the global versus U.S. perception of China and Taiwan/Taipei, as well as the “one country, two systems” artifice that General Marks and Maria Donnelly handled very well. For what it’s worth, ChatGPT wasn’t very helpful in answering some simple questions on the subject. It came back on many of the queries with some version of “most people say Taiwan, but those concerned about China’s opinion of them use Taipei.”

-

China: I can’t believe that I’m almost clamoring for a pop in Chinese stocks! The negativity seems almost extreme (yes, there are many problems facing their economy), but they have options, ranging from stimulus, to “Made by China,” to some sort of deal with the U.S. to ease global tensions. All would be good for Chinese stocks and would likely propel global markets higher. Purely a trade, not a strategy, but it’s high on my list of plausible surprises that aren’t being priced in.

So, I’m going to start next week with the same views that I started this week with! (See above, or last week’s report).

The consternation that many showed on Friday, acting like it was almost mathematically impossible for bond yields to be higher and stocks to also be higher, gives me some comfort that we can see more of that this week as the data rolls in and the Fed must respect it. And (I know that I sound like a broken record) markets will have to favor variations of soft landing over hard landing scenarios until (if, I suppose, but I believe until) the data is overwhelmingly obvious!

While we can stay in this mild “risk on” positioning for a bit longer, I’m totally absorbed in trying to understand when we’ve overstayed our welcome.

Loading…