By Jan Nieuwenhuijs of Gainesville Coins

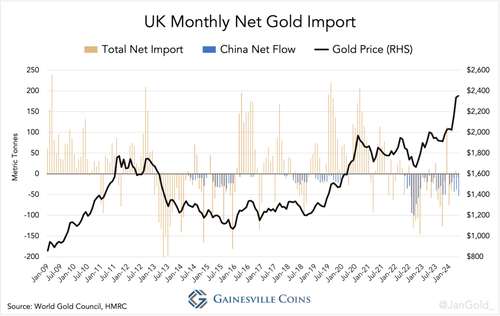

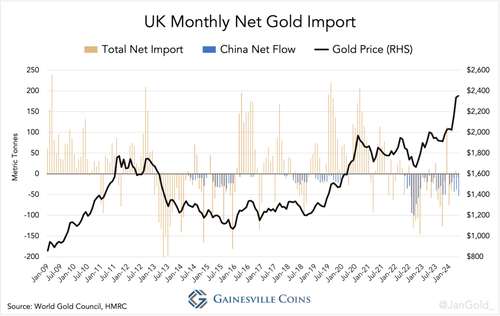

This article is an analysis of how the Chinese central bank (PBoC) buys gold in London from Western bullion banks. Because the bullion banks take care of the gold transport for the PBoC, the shipments from London to Beijing are disclosed in UK customs data. The customs data reveals that the PBoC continued to buy gold in May — when it communicated to the market it discontinued buying — at a rate of 53 tonnes. The PBoC stated it stopped buying to dampen the gold price so it could acquire more gold.

Several months ago, I discovered that supply in the Chinese gold market was outstripping demand. During my investigation of this anomaly, I found circumstantial evidence that led me to conclude the surplus is imported in 400-ounce bars from the United Kingdom, and surreptitiously procured by the PBoC.

Let’s go through some of the mechanics of the global gold market before we can stitch it all together.

PBoC Gold Buying Hidden in Plain Sight

In global customs data — officially called International Merchandise Trade Statistics (IMTS) — all gold disclosed is “non-monetary,” meaning not owned by a monetary authority such as a central bank. In the United Nations IMTS rulebook it reads that customs data excludes monetary gold:

Since monetary gold is treated as a financial asset rather than a good, transactions pertaining to it should be excluded from international merchandise trade statistics.

Though, someone familiar with the matter but who prefers to stay anonymous, shared with me that gold import and export data can relate to monetary gold. Commonly, central banks will buy gold from Western bullion banks that arrange transportation and insurance of the metal. The moment these banks ship the gold from the UK it is thus non-monetary bullion, but when it arrives in China it is monetized (changes ownership) and brought to vaults of the central bank, supposedly in Beijing.

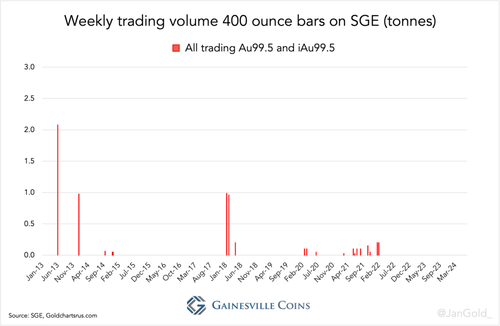

Exports from the UK are mainly from the wholesale gold market in London where virtually all bars traded weigh 400 ounces. The retail market in Britain dealing in smaller bars pales in comparison, and the refining industry in the UK is relatively small.

In turn, at the core of the Chinese domestic gold market, which excludes Free Trade Zones (FTZs), is the Shanghai Gold Exchange (SGE) where predominantly 1Kg gold bars are traded.

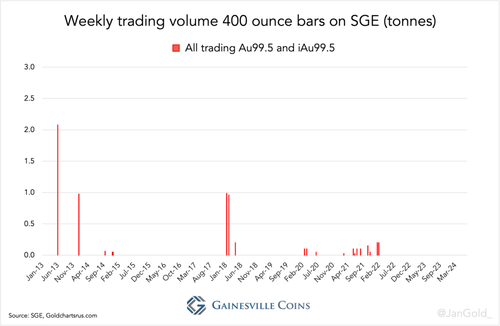

The private sector in China trades 1Kg bars through SGE, while the central bank buys “large bars” (400-ounce bars) abroad. As all gold on the SGE is traded in yuan, the PBoC can only diversify its international reserves by buying gold overseas with dollars or other foreign exchange. Aside from logic, there are multiple sources that have made clear the PBoC doesn’t purchase gold on the SGE. For example, the World Gold Council (WGC, page 9), the SGE (page 4), and it was confirmed to me personally by an ex-gold trader from a Chinese state-owned bank.

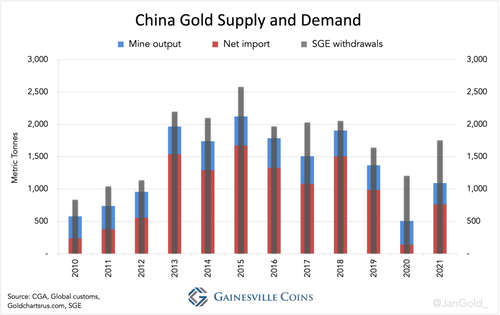

The SGE captures the lion share of all gold trading in the Chinese private market. There are rules and incentives that steer most supply—imports, domestic mine production, and recycled metal—towards the SGE, which for liquidity reasons attracts most demand. Hence, the gold withdrawn from the SGE vaults is often used as a proxy for Chinese wholesale demand. In a formula:

SGE withdrawals = net import + domestic mine output + recycled metal

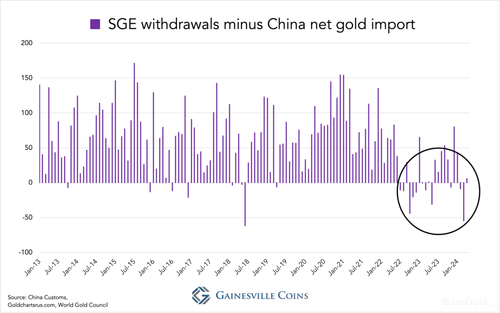

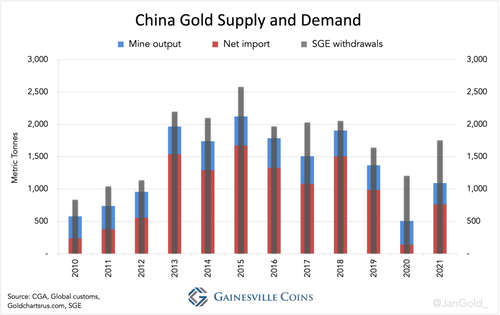

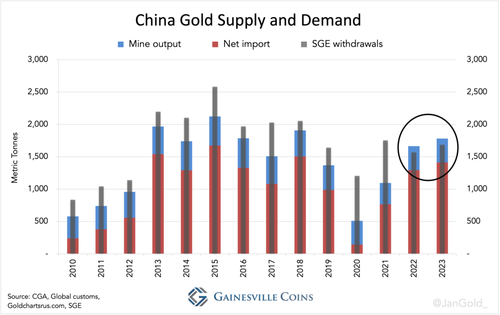

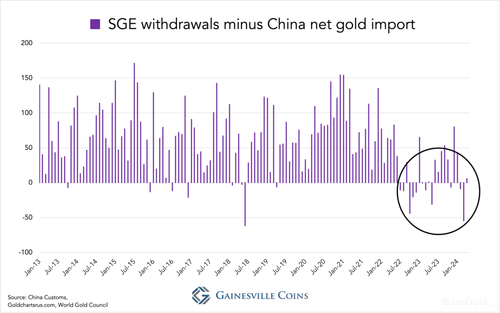

Before 2022, gold supply and demand in the Chinese market matched. SGE withdrawals were always higher, to varying degrees, than net import plus domestic mine output, the difference being gold recycled through the central bourse.

If it were true that bullion banks ship gold to China, as non-monetary gold visible in customs data, that doesn’t flow into the SGE system, we would see a discrepancy between apparent Chinese gold supply and SGE withdrawals. As more gold would be supplied to China than sold through the SGE. In a formula:

SGE withdrawals < net import + domestic mine output + recycled metal

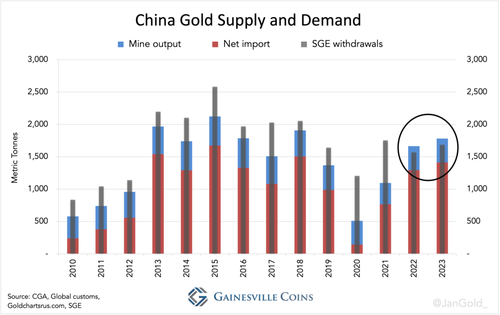

Indeed, both in 2022 and 2023 China’s net import plus mine output transcended SGE withdrawals (let alone if we would add recycled gold).

As we shall see, the surplus in the Chinese gold market—imports that are not sold through the SGE—is being absorbed by the PBoC.

Readers with deep knowledge of the Chinese gold market might think: “what if the large bars are refined in FTZs and loaded into SGE vaults without being withdrawn?” I checked with a source that has connections to refineries in China, and according to this person the refineries don’t use any large bars as feedstock for producing 1kg bars for the SGE*. Another contact I have, close to the SGE, shared with me that SGE inventory in April 2024 accounted for about 300 tonnes. Inventory had gone up recently together with a rise in the price of gold, this person said. However, the increase in SGE inventory can’t make up for the surplus in the market, which is at least 400 tonnes according to my calculations.

More Data Supporting the Thesis

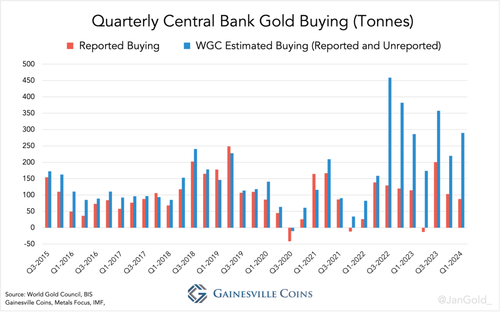

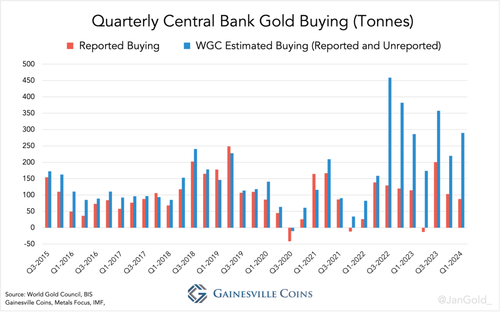

By comparing estimated central bank purchases by the WGC, based on field research, to official statistics regarding gold buying by central banks, we know that since the start of the Ukraine war, in February 2022, monetary authorities in aggregate are secretly buying much more than they report. I have written before that these covert purchases can be attributed for roughly eighty percent to the PBoC.

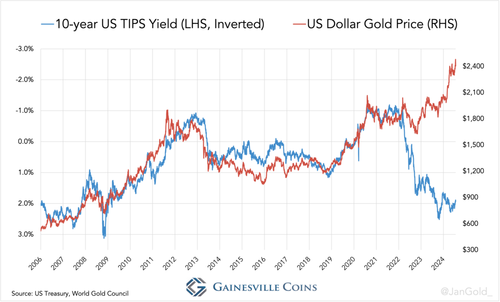

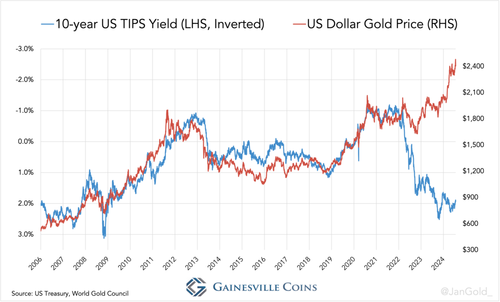

“Unreported” PBoC gold purchases exploded when $300 billion in foreign exchange reserves from the Russian central bank were frozen by the West early 2022 due to the war. Notably, the UK began exporting 400-ounce bars to China in huge tonnages at the same time. Coincidence? I think not. Ever since, China has taken over gold price control from the West and broke the gold price’s correlation with “real rates” (10-year TIPS yield).

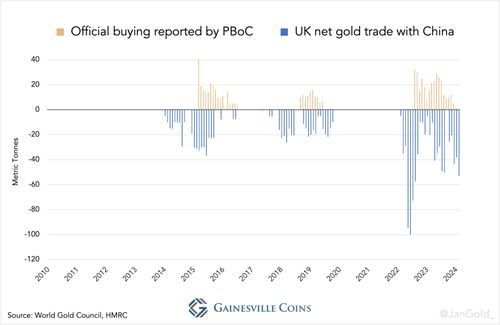

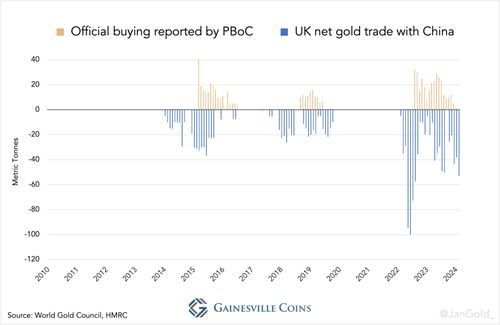

The final clue is that there is a relationship between what the Chinese central bank officially reports to be accumulating, and gold exports from the UK to China. What frequently happens, exposed by comparing these numbers, is that the PBoC starts buying gold a few months before it tells the world about it, and severely underreports its additions. This was the case in 2015, 2019, and 2022.

Conclusion

It all fits and makes sense: the motive, the data, and the anecdotal evidence. Let’s summarize our key findings:

- The Chinese central bank desperately needs to diversify its foreign exchange reserves since the beginning of 2022. Since then, the PBoC secretly buys large amounts of gold.

- At the same time, export of large gold bars from the UK to China explodes.

- A “surplus” in the Chinese market appears, while the bullion is not to be found in SGE vaults. As if it has gone up in smoke.

- A source indicates that gold shipments for central banks are often included in customs data.

- There is a correlation between PBoC official buying and UK exports to China, suggesting the Chinese central bank buys gold in England’s capital and lets banks supervise transport (maybe because the PBoC reaches the limits of its own capacity to ship gold when volumes are sizable).

It all points towards UK gold exports to China are destined for the PBoC—although probably not every ounce of these flows is for the Chinese central bank. Clearly, the PBoC is accumulating more gold than it wants to disclose.

When the PBoC stated it had stopped buying gold in May 2024, after continuous purchases for 18 months, I didn’t believe it. The PBoC has few reasons to cease growing its gold reserves in the current geo-political and monetary landscape with a plethora of challenges.

Probably, the PBoC wants the most gold for its dollars, so when the price rises fast it will signal it stopped buying, trying to cool the market. In the meantime, the United Kingdom exported 53 tonnes to China in May, of which likely most found its way to Beijing.

Note, the PBoC also buys in Switzerland and other countries, flows that can be included or excluded in customs reports, but it’s impossible, from where I stand now, to measure all these separately.

Finally, some of my previous analyses have been skewed by the above. Private demand in China has been lower because some (“non-monetary”) imports were taken by the central bank.

By Jan Nieuwenhuijs of Gainesville Coins

This article is an analysis of how the Chinese central bank (PBoC) buys gold in London from Western bullion banks. Because the bullion banks take care of the gold transport for the PBoC, the shipments from London to Beijing are disclosed in UK customs data. The customs data reveals that the PBoC continued to buy gold in May — when it communicated to the market it discontinued buying — at a rate of 53 tonnes. The PBoC stated it stopped buying to dampen the gold price so it could acquire more gold.

Several months ago, I discovered that supply in the Chinese gold market was outstripping demand. During my investigation of this anomaly, I found circumstantial evidence that led me to conclude the surplus is imported in 400-ounce bars from the United Kingdom, and surreptitiously procured by the PBoC.

Let’s go through some of the mechanics of the global gold market before we can stitch it all together.

PBoC Gold Buying Hidden in Plain Sight

In global customs data — officially called International Merchandise Trade Statistics (IMTS) — all gold disclosed is “non-monetary,” meaning not owned by a monetary authority such as a central bank. In the United Nations IMTS rulebook it reads that customs data excludes monetary gold:

Since monetary gold is treated as a financial asset rather than a good, transactions pertaining to it should be excluded from international merchandise trade statistics.

Though, someone familiar with the matter but who prefers to stay anonymous, shared with me that gold import and export data can relate to monetary gold. Commonly, central banks will buy gold from Western bullion banks that arrange transportation and insurance of the metal. The moment these banks ship the gold from the UK it is thus non-monetary bullion, but when it arrives in China it is monetized (changes ownership) and brought to vaults of the central bank, supposedly in Beijing.

Exports from the UK are mainly from the wholesale gold market in London where virtually all bars traded weigh 400 ounces. The retail market in Britain dealing in smaller bars pales in comparison, and the refining industry in the UK is relatively small.

In turn, at the core of the Chinese domestic gold market, which excludes Free Trade Zones (FTZs), is the Shanghai Gold Exchange (SGE) where predominantly 1Kg gold bars are traded.

The private sector in China trades 1Kg bars through SGE, while the central bank buys “large bars” (400-ounce bars) abroad. As all gold on the SGE is traded in yuan, the PBoC can only diversify its international reserves by buying gold overseas with dollars or other foreign exchange. Aside from logic, there are multiple sources that have made clear the PBoC doesn’t purchase gold on the SGE. For example, the World Gold Council (WGC, page 9), the SGE (page 4), and it was confirmed to me personally by an ex-gold trader from a Chinese state-owned bank.

The SGE captures the lion share of all gold trading in the Chinese private market. There are rules and incentives that steer most supply—imports, domestic mine production, and recycled metal—towards the SGE, which for liquidity reasons attracts most demand. Hence, the gold withdrawn from the SGE vaults is often used as a proxy for Chinese wholesale demand. In a formula:

SGE withdrawals = net import + domestic mine output + recycled metal

Before 2022, gold supply and demand in the Chinese market matched. SGE withdrawals were always higher, to varying degrees, than net import plus domestic mine output, the difference being gold recycled through the central bourse.

If it were true that bullion banks ship gold to China, as non-monetary gold visible in customs data, that doesn’t flow into the SGE system, we would see a discrepancy between apparent Chinese gold supply and SGE withdrawals. As more gold would be supplied to China than sold through the SGE. In a formula:

SGE withdrawals < net import + domestic mine output + recycled metal

Indeed, both in 2022 and 2023 China’s net import plus mine output transcended SGE withdrawals (let alone if we would add recycled gold).

As we shall see, the surplus in the Chinese gold market—imports that are not sold through the SGE—is being absorbed by the PBoC.

Readers with deep knowledge of the Chinese gold market might think: “what if the large bars are refined in FTZs and loaded into SGE vaults without being withdrawn?” I checked with a source that has connections to refineries in China, and according to this person the refineries don’t use any large bars as feedstock for producing 1kg bars for the SGE*. Another contact I have, close to the SGE, shared with me that SGE inventory in April 2024 accounted for about 300 tonnes. Inventory had gone up recently together with a rise in the price of gold, this person said. However, the increase in SGE inventory can’t make up for the surplus in the market, which is at least 400 tonnes according to my calculations.

More Data Supporting the Thesis

By comparing estimated central bank purchases by the WGC, based on field research, to official statistics regarding gold buying by central banks, we know that since the start of the Ukraine war, in February 2022, monetary authorities in aggregate are secretly buying much more than they report. I have written before that these covert purchases can be attributed for roughly eighty percent to the PBoC.

“Unreported” PBoC gold purchases exploded when $300 billion in foreign exchange reserves from the Russian central bank were frozen by the West early 2022 due to the war. Notably, the UK began exporting 400-ounce bars to China in huge tonnages at the same time. Coincidence? I think not. Ever since, China has taken over gold price control from the West and broke the gold price’s correlation with “real rates” (10-year TIPS yield).

The final clue is that there is a relationship between what the Chinese central bank officially reports to be accumulating, and gold exports from the UK to China. What frequently happens, exposed by comparing these numbers, is that the PBoC starts buying gold a few months before it tells the world about it, and severely underreports its additions. This was the case in 2015, 2019, and 2022.

Conclusion

It all fits and makes sense: the motive, the data, and the anecdotal evidence. Let’s summarize our key findings:

- The Chinese central bank desperately needs to diversify its foreign exchange reserves since the beginning of 2022. Since then, the PBoC secretly buys large amounts of gold.

- At the same time, export of large gold bars from the UK to China explodes.

- A “surplus” in the Chinese market appears, while the bullion is not to be found in SGE vaults. As if it has gone up in smoke.

- A source indicates that gold shipments for central banks are often included in customs data.

- There is a correlation between PBoC official buying and UK exports to China, suggesting the Chinese central bank buys gold in England’s capital and lets banks supervise transport (maybe because the PBoC reaches the limits of its own capacity to ship gold when volumes are sizable).

It all points towards UK gold exports to China are destined for the PBoC—although probably not every ounce of these flows is for the Chinese central bank. Clearly, the PBoC is accumulating more gold than it wants to disclose.

When the PBoC stated it had stopped buying gold in May 2024, after continuous purchases for 18 months, I didn’t believe it. The PBoC has few reasons to cease growing its gold reserves in the current geo-political and monetary landscape with a plethora of challenges.

Probably, the PBoC wants the most gold for its dollars, so when the price rises fast it will signal it stopped buying, trying to cool the market. In the meantime, the United Kingdom exported 53 tonnes to China in May, of which likely most found its way to Beijing.

Note, the PBoC also buys in Switzerland and other countries, flows that can be included or excluded in customs reports, but it’s impossible, from where I stand now, to measure all these separately.

Finally, some of my previous analyses have been skewed by the above. Private demand in China has been lower because some (“non-monetary”) imports were taken by the central bank.

Loading…