By John Liu and Zheng Wu, Bloomberg Markets Live reporters and analysts

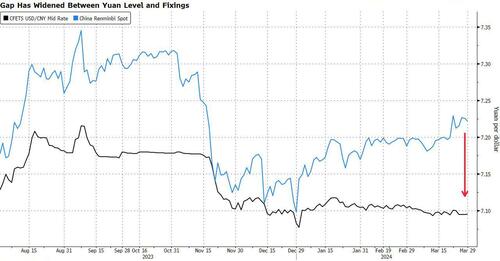

1. The use of a familiar tool to stabilize the yuan sowed confusion and touched off a debate among investors. The People’s Bank of China stepped in to halt a drop in the currency last week by strengthening the fixing, and traders said state-owned banks then proceeded to dumped dollars onshore.

The move helped to stabilize the foreign-exchange market but it also left traders wondering about the People’s Bank of China’s intentions. Investors were baffled because the yuan’s earlier selloff had been triggered by a weaker-than-expected reference rate.

Authorities have allayed fears of a steep decline in the currency for now. The yuan is trading near the weak end of the band allowed by the reference rate, and state banks are selling an undisclosed amount of dollars to prop up the Chinese currency.

But the PBOC’s mixed signals have unsettled the market and the yuan may become even more volatile if policymakers relax their grip on it again.

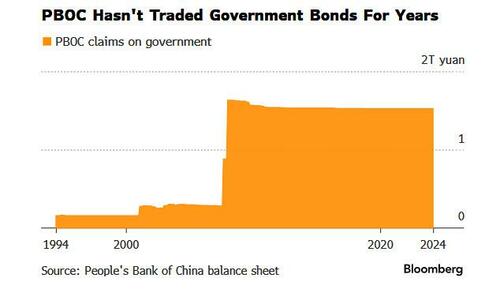

2. Xi Jinping’s remarks on monetary tools generated a buzz but they’re unlikely to signal a move toward quantitative easing. The Chinese leader was quoted in a newly published book as saying the central bank should increase the buying and selling of government bonds, fueling speculation that Beijing was planning to embark on aggressive monetary easing.

A closer examination of the context in which the comments were made suggests otherwise. Xi was probably expressing a view on how the PBOC can fine-tune its market operations, not ramp up purchases of government bonds to flood the economy with liquidity, according to Bloomberg Economics.

There is still room for the PBOC to ease policy by lowering interest rates or the required reserve ratio. On the whole, the central bank is likely to exhaust all conventional tools before resorting to QE, and any move to trade government bonds will probably be part of efforts to better manage the sovereign yield curve.

3. Xiaomi’s stock surged 12% in the US on Thursday after the Chinese smartphone and appliance maker launched its first electric vehicle. With aggressive pricing, pre-orders for the SU7 models topped 50,000 within 27 minutes of their debut.

Xiaomi’s ambitious EV bet arrives at a challenging time. Carmakers from Tesla Inc. to BYD Co. are engaging in a price war as sales growth slows, with the former recently cutting production at its plant in China. To make matters worse, trade tensions are compounding the pressure on the highly competitive sector. China’s EV exports to the European Union slumped in the first two month of the year amid a probe by Brussels into unfair subsidies.

By John Liu and Zheng Wu, Bloomberg Markets Live reporters and analysts

1. The use of a familiar tool to stabilize the yuan sowed confusion and touched off a debate among investors. The People’s Bank of China stepped in to halt a drop in the currency last week by strengthening the fixing, and traders said state-owned banks then proceeded to dumped dollars onshore.

The move helped to stabilize the foreign-exchange market but it also left traders wondering about the People’s Bank of China’s intentions. Investors were baffled because the yuan’s earlier selloff had been triggered by a weaker-than-expected reference rate.

Authorities have allayed fears of a steep decline in the currency for now. The yuan is trading near the weak end of the band allowed by the reference rate, and state banks are selling an undisclosed amount of dollars to prop up the Chinese currency.

But the PBOC’s mixed signals have unsettled the market and the yuan may become even more volatile if policymakers relax their grip on it again.

2. Xi Jinping’s remarks on monetary tools generated a buzz but they’re unlikely to signal a move toward quantitative easing. The Chinese leader was quoted in a newly published book as saying the central bank should increase the buying and selling of government bonds, fueling speculation that Beijing was planning to embark on aggressive monetary easing.

A closer examination of the context in which the comments were made suggests otherwise. Xi was probably expressing a view on how the PBOC can fine-tune its market operations, not ramp up purchases of government bonds to flood the economy with liquidity, according to Bloomberg Economics.

There is still room for the PBOC to ease policy by lowering interest rates or the required reserve ratio. On the whole, the central bank is likely to exhaust all conventional tools before resorting to QE, and any move to trade government bonds will probably be part of efforts to better manage the sovereign yield curve.

3. Xiaomi’s stock surged 12% in the US on Thursday after the Chinese smartphone and appliance maker launched its first electric vehicle. With aggressive pricing, pre-orders for the SU7 models topped 50,000 within 27 minutes of their debut.

Xiaomi’s ambitious EV bet arrives at a challenging time. Carmakers from Tesla Inc. to BYD Co. are engaging in a price war as sales growth slows, with the former recently cutting production at its plant in China. To make matters worse, trade tensions are compounding the pressure on the highly competitive sector. China’s EV exports to the European Union slumped in the first two month of the year amid a probe by Brussels into unfair subsidies.

Loading…