For almost a year now, we have been dutifully tracking several key datasets within the auto sector to find the critical inflection point in this perhaps most leading of economic indicators which will presage not only a crushing auto loan crisis, but also signal the arrival of a full-blown recession, one which even the NBER won't be able to ignore, as the US consumers are once again tapped out. We believe that moment has now arrived.

But first, for those readers who are unfamiliar with the space, we urge you to read some of our recent articles on the topic of car prices - which alongside housing, has been the biggest driver of inflation in the past 18 months - and more specifically how these are funded my the US middle class, i.e., car loans, and last but not least, the interest rate paid for said loans. Here are a few places to start:

- Are We Headed For An "Auto Loan Crisis" As Delinquencies Begin To Rise? - July 7

- A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market - July 25

- American Drivers Go Deeper Into Debt As Inflation Pushes Car Loans To Record Highs - Aug 29

- Credit Card Rates Just Hit A Record As The Average Car Loan Rises To Fresh All Time High - Oct 9

- New-Car Loan-Rates Set To Hit 14-Year High As Affordability Crisis Worsens - Nov 3

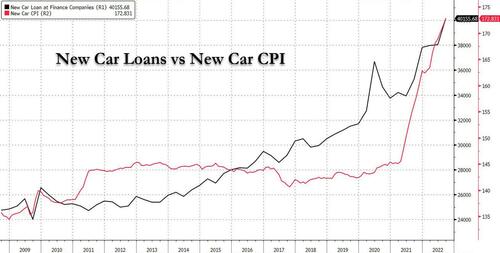

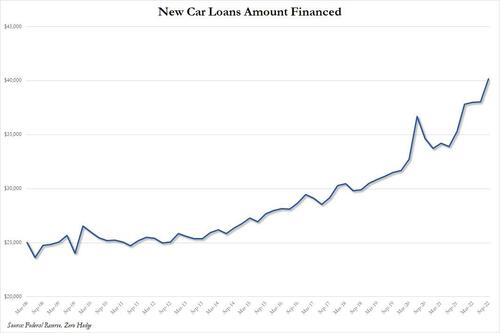

So while the big picture is clear - Americans are using ever more debt to fund record new car prices - fast-forwarding to today, we have observed two ominous new developments: the latest consumer credit report from the Fed revealed a dramatic spike in the amount of new car loans, which increased by more than $2,000 in one quarter, from just over $38,000 (a record), to $40,155 (a new record).

Now this shouldn't come as a shock: a simple reason why new car loans have hit record highs is simply because new car prices have also soared to all time highs, as the next chart shows.

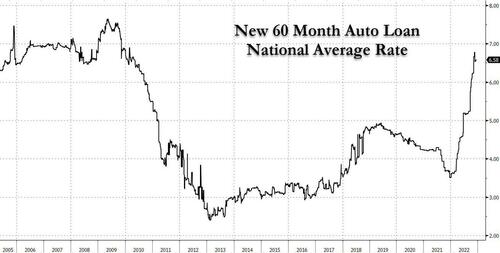

Here we will ignore for the time being cause and effect, or "chicken or egg" questions - i.e., whether record new car prices are the result of easy record credit, or whether record new car loans are simply tracking the explosive surge in car prices, and instead focus on something even more ominous: the explosion in the average interest rate on a new 60 month auto loans: according to Bankrate, as of Dec 16, the number is just over 6.50%, almost doubling since the start of the year, and the highest in 12 years.

It is this surge in nominal auto debt as well as the unprecedented spike in new auto loan rates, that we believe has finally pushed the US car sector to the infamous Wile Coyote point of no return.

Consider the following: according to various recent financial analysts, a growing number of consumers are falling behind on their car payments - a trend which will only accelerate - in a sign of the strain soaring car prices and prolonged inflation are having on household budgets.

As NBC reports, whereas repossessions tumbled at the start of the pandemic when Americans got a boost from stimulus checks and lenders were more willing to accommodate those behind on their payments, in recent months, the number of people behind on their car payments has been approaching prepandemic levels, and for the lowest-income consumers, the rate of loan defaults is now exceeding where it was in 2019, according to a recent report from Fitch.

Naturally, with the economy set to slump into a Fed-induced recession, the trend will only get much worse into 2023 with economists expecting unemployment to rise, inflation to remain relatively high (at least until the economy crashes) and household savings - already at record lows - set to dwindle. At the same time, a growing number of consumers are having to stretch their budgets to afford a vehicle; the average monthly payment for a new car is up 26% since 2019 to $718 a month, and nearly one in six new car buyers is spending more than $1,000 a month on vehicles. Other costs associated with owning a car have also shot up, including insurance, gas and repairs.

“These repossessions are occurring on people who could afford that $500 or $600 a month payment two years ago, but now everything else in their life is more expensive,” said Ivan Drury, director of insights at car buying website Edmunds. “That’s where we’re starting to see the repossessions happen because it’s just everything else starting to pin you down.”

The silver lining is that while the US auto sector faces unmitigated disaster in 2023, for those in the repossession business, it’s been difficult to keep up. Jeremy Cross, the president of International Recovery Systems in Pennsylvania, said he can’t find enough repo men to meet the demand or space to hold all the cars his company has been tasked with repossessing. With the holidays approaching, he’s been particularly busy as people prioritize spending elsewhere, and he’s expecting business to keep up throughout next year and 2024.

“Right now, it’s really the perfect storm,” said Cross. “Over the last two years, vehicle prices were inflated because there was no new car supply, people were still buying like crazy because they had a lot of stay-at-home cash, they had inflated credit scores, so it was like a recipe for disaster.”

Ironically, at the same time, the number of repossession companies has shrunk by 30% as many firms closed up shop and the workers found jobs in other industries when repossessions tumbled during 2020, Cross said. Now, he told NBC, lenders are paying him premiums to repossess their cars first in anticipation of a continued increase in loan defaults (read: plunging prices).

“The volume is picking up, and the remaining companies that are still performing repossessions are very busy,” Cross said. “The overall numbers are still not prepandemic numbers, but we will see a big change coming in ‘23 and ‘24 that I think the lenders are starting to recognize because they are offering financial incentives that they never had to do in the past. They’re jockeying for position knowing that there’s only a certain amount of bandwidth available.”

Predictably, the coming auto crisis is an issue that’s raised concern among officials at the Consumer Financial Protection Bureau, who say they are seeing troubling signs in the auto market, particularly among so-called subprime borrowers, who have below-average credit scores, and those with loans taken out in 2021 and 2022 when auto prices were particularly high.

Yes: that 2008 deja vu feeling is back front and center....and so are the defaults.

“Loans taken out in those years are performing worse than prior years just because those consumers had to finance cars once the supply chains were jammed and the prices started to go up,” said Ryan Kelly, acting auto finance program manager for the CFPB. “Those consumers got hit with inflation twice. First, when they had to finance a car after the prices went up, and then when they had to put gas in the car after the Russia-Ukraine conflict started. So there’s just a lot of consumer stress.”

What happens next?

Well, as the economy continues to deteriorate in 2023, the number of those falling behind on their car payments will continue to rise, even as consumers tend to give priority to their car payment ahead of most bills because of the importance a car plays in getting to work or potentially providing shelter, industry analysts said.

For now, the rate of defaults and repossessions isn’t expected to reach 2008 and 2009 levels, when there was a spike caused by the financial crisis. The percentage of auto loans that were 30 days delinquent was at 2.2% in the third quarter compared with 2.35% delinquent over the same period in 2019, according to data from Experian. By contrast, just over 4% of auto loans went into default in 2009. However, that could quickly change once the 2023 economy unleashes the final whammy of mass layoffs (which have already slammed the tech sector).

“We’re expecting it to continue to increase and maybe even breach prepandemic levels because of the macroeconomic headwinds of higher interest rates, higher cost of borrowing and expectations for unemployment to continue to increase,” said Margaret Rowe, the lead auto analyst at Fitch. “I think our expectation is that we’re going to continue to see it go up, but it’s just been so low that even going up isn’t like what we saw in the Great Financial Crisis.”

Some, like Cox Automotive, remain optimistic: their analysts (who just may be a little conflicted) forecast that while loan defaults and repossessions will increase from their pandemic lows, long-term through 2025 they predict overall defaults and repossessions will remain at or below historic norms.

Still, the financial squeeze has been particularly difficult for lower-income consumers looking for budget vehicles, which have been particularly hard to find. While in the past, those car buyers would have purchased a used car for $7,000 to $15,000 they are now having to spend $20,000 to $25,000 for the same type of vehicle. Among dealers that cater to subprime and deep subprime consumers, the average listing price on their cars has almost doubled since the beginning of the pandemic, according to the CFPB.

“That near prime and subprime group of consumers, they’re getting hit very, very hard by inflation. That group of people did not have much disposable income. They had to finance a more expensive car and then they got hit with prices going up overall. There’s just a lot of stress,” said Kelly.

Ally Financial, which has a significant share of loans to subprime borrowers, said in its October earnings report that it expects delinquencies to increase to as much as 3.8% compared with 3.1% in 2019. That estimate will prove to be overly optimistic.

Another risk to car buyers’ finances is the growing length of auto loans, many of which now exceed seven years. While those longer term loans can lower the monthly payments amid higher prices, consumers risk paying off the loan much more slowly than the car is depreciating, leaving them underwater if they need to sell the vehicle. It can also mean higher interest costs over the life of the loan on top of already inflated vehicle prices.

And speaking of interest rates, they have not been this high since 2009 and will stay at their current levels until the Fed finally pivots. As NBC notes, "for consumers, there is unlikely to be any relief over the next year. Interest rates are expected to remain high for those needing to borrow to buy a vehicle, and Covid-related plant closures and material shortages are continuing to ripple through the car manufacturing supply chain, limiting the number of new vehicles."

“I dare think what happens to people who are signing up for new loans today,” said Drury. “It’s not going to be better when we see these payments so high.”

But wait, there's more.

As twitter's CarDealershipGuy - who claims to be an anonymous auto-industry CEO and whose analysis has been featured in places like the NY Post and who frequently Tweets about the state of the auto market - laid out a long thread on Thursday, all of the above may end up being an overly optimistic assessment of the perfect storm that's about to hit the auto sector:

"This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending. I'm now convinced that there is a massive wave of car repossessions coming in 2023," he wrote.

Recapping much of what we said above, he noted that over the past 2 years, many people took out exorbitant loans on cars and while car values were inflated (and still are) but many people simply had no choice and bought an overpriced a car. Then, echoing the Fitch assessment, he notes how those buyers are underwater: "Car valuations are now plummeting. Some cars have declined in value as much as 30% y/y. And these same people that took out these big loans are now 'underwater'. Basically, they owe banks more on these cars than they are worth. And the banks are well-aware of this."

The punchline is his personal experience from late last week. "This morning, one of our General Managers opened up DealerTrack — a portal that dealers use to communicate with auto lenders — and highlighted something very concerning. 9 of our lending partners have started WAIVING 'open auto stipulations' for consumers."

What this means, he explained, is that once consumers are stuck with a vehicle they paid too much for, they can't trade it in without putting some money up front to cover the difference of what is owed on it versus what it is worth. At that point, he notes, "Dealer can't sell consumer a car, Consumer can't buy a car, And, you guessed it, lender can't finance a car!"

The lender then knows that most consumers are stuck and waives the open auto stipulation - meaning they allow the consumer to buy the new car with a second loan knowing they already have a first one. But the lender does it because they know that the buyer will default on the old, other car.

Cue default avalanche: "This is NOT normal. But it's the only way lenders can finance cars and dealers can put cars on the road. And the implications of this will be tons of repossessions," the CEO wrote.

He concluded: "I've been a doubter, but after what I saw this morning, I'm now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we're in trouble."

Here is a snapshot of his entire thread:

This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending. I'm now convinced that there is a massive wave of car repossessions coming in 2023.

Here's what I discovered (and what no one knows):

Background:

Over the past 2 years, many people took out exorbitant loans on cars. Car values were inflated (and frankly, still are to some extent). But many people simply had no choice and bought an overpriced a car.

Well...

Car valuations are now plummeting. Some cars have declined in value as much as 30% y/y. And these same people that took out these big loans are now "underwater".

Basically, they owe banks more on these cars than they are worth. And the banks are well-aware of this...

But there is no easy solution. You can't just put the genie back in the bottle. This brings me to what happened this morning:

Every Friday I conduct a team meeting to recap our week.

This morning, one of our General Managers opened up DealerTrack — a portal that dealers use to communicate with auto lenders — and highlighted something very concerning:

9 of our lending partners have started WAIVING "open auto stipulations" for consumers.

Wait, wtf does that even mean?

Let me explain using a simple, hypothetical scenario:

1) Consumer takes out an auto loan in 2020/2021 on an overvalued car

2) 2022 comes around and that overvalued car is now rapidly declining in value

3) With the car declining in value, consumer now owes more on the car than it is worth

4) Consumer no longer wants the car. Maybe they outgrew it. Or maybe it keeps breaking. So consumer wants to trade it in.

5) But dealer can't trade the car in because the consumer owes WAY too much on it. So dealer asks consumer for lots of money down to cover the difference.

6) But of course, the consumer doesn't have $1,000s to cover the difference between what they owe on the car and what it's worth. And here comes the perfect storm...

7) Dealer can't sell consumer a car, Consumer can't buy a car, And, you guessed it, lender can't finance a car! Everybody loses! Oh no. So what happens next?

8) Lender knows that most consumers are stuck in this situation, and does the following:

WAIVES THE OPEN AUTO STIPULATION.

Meaning, the lender lets the consumer buy the car KNOWING that they already have an open auto loan with another bank!

Why the f*ck would they do this?

Surely the lender knows that consumers that take out a 2nd auto loan are MUCH riskier and have a MUCH high risk of default? Right? RIGHT?

Yes, but the lender does it because they know that the consumer will default on the other car !!!!

Dog eat dog style.

Let me be clear: This is NOT normal.

But it's the only way lenders can finance cars and dealers can put cars on the road.

And the implications of this will be tons of repossessions.

I've been a doubter, but after what I saw this morning, I'm now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we're in trouble.

This will not end pretty.

What does this mean in simple terms: well, besides the imminent devastation across the auto sector, including a surge in defaults and car repossessions, we are about to witness a historic collapse in car prices. In fact, in a subsequent tweet, the CarDealershipGuy noted the plunge in prices at troubled used-car dealer Carvana which will be the first domino to fall and be forced to liquidate much if not all of its inventory to stay afloat:

These are all retail-ready cars being advertised to other dealers - likely at a big loss.

— CarDealershipGuy (@GuyDealership) December 17, 2022

(h/t RayMF for submission) pic.twitter.com/f8xb2oSnyU

Translation: just as soaring car prices were the leading indicator for red-hot, runaway inflation in 2021 and 2022 (followed by housing, food, goods and finally services) so the plunge in car prices - first used, then new - is the canary in the recessionary coal mine of deflation that will send all prices - cars, houses, and everything else - sharply lower in the coming months.

For almost a year now, we have been dutifully tracking several key datasets within the auto sector to find the critical inflection point in this perhaps most leading of economic indicators which will presage not only a crushing auto loan crisis, but also signal the arrival of a full-blown recession, one which even the NBER won’t be able to ignore, as the US consumers are once again tapped out. We believe that moment has now arrived.

But first, for those readers who are unfamiliar with the space, we urge you to read some of our recent articles on the topic of car prices – which alongside housing, has been the biggest driver of inflation in the past 18 months – and more specifically how these are funded my the US middle class, i.e., car loans, and last but not least, the interest rate paid for said loans. Here are a few places to start:

So while the big picture is clear – Americans are using ever more debt to fund record new car prices – fast-forwarding to today, we have observed two ominous new developments: the latest consumer credit report from the Fed revealed a dramatic spike in the amount of new car loans, which increased by more than $2,000 in one quarter, from just over $38,000 (a record), to $40,155 (a new record).

Now this shouldn’t come as a shock: a simple reason why new car loans have hit record highs is simply because new car prices have also soared to all time highs, as the next chart shows.

Here we will ignore for the time being cause and effect, or “chicken or egg” questions – i.e., whether record new car prices are the result of easy record credit, or whether record new car loans are simply tracking the explosive surge in car prices, and instead focus on something even more ominous: the explosion in the average interest rate on a new 60 month auto loans: according to Bankrate, as of Dec 16, the number is just over 6.50%, almost doubling since the start of the year, and the highest in 12 years.

It is this surge in nominal auto debt as well as the unprecedented spike in new auto loan rates, that we believe has finally pushed the US car sector to the infamous Wile Coyote point of no return.

Consider the following: according to various recent financial analysts, a growing number of consumers are falling behind on their car payments – a trend which will only accelerate – in a sign of the strain soaring car prices and prolonged inflation are having on household budgets.

As NBC reports, whereas repossessions tumbled at the start of the pandemic when Americans got a boost from stimulus checks and lenders were more willing to accommodate those behind on their payments, in recent months, the number of people behind on their car payments has been approaching prepandemic levels, and for the lowest-income consumers, the rate of loan defaults is now exceeding where it was in 2019, according to a recent report from Fitch.

Naturally, with the economy set to slump into a Fed-induced recession, the trend will only get much worse into 2023 with economists expecting unemployment to rise, inflation to remain relatively high (at least until the economy crashes) and household savings – already at record lows – set to dwindle. At the same time, a growing number of consumers are having to stretch their budgets to afford a vehicle; the average monthly payment for a new car is up 26% since 2019 to $718 a month, and nearly one in six new car buyers is spending more than $1,000 a month on vehicles. Other costs associated with owning a car have also shot up, including insurance, gas and repairs.

“These repossessions are occurring on people who could afford that $500 or $600 a month payment two years ago, but now everything else in their life is more expensive,” said Ivan Drury, director of insights at car buying website Edmunds. “That’s where we’re starting to see the repossessions happen because it’s just everything else starting to pin you down.”

The silver lining is that while the US auto sector faces unmitigated disaster in 2023, for those in the repossession business, it’s been difficult to keep up. Jeremy Cross, the president of International Recovery Systems in Pennsylvania, said he can’t find enough repo men to meet the demand or space to hold all the cars his company has been tasked with repossessing. With the holidays approaching, he’s been particularly busy as people prioritize spending elsewhere, and he’s expecting business to keep up throughout next year and 2024.

“Right now, it’s really the perfect storm,” said Cross. “Over the last two years, vehicle prices were inflated because there was no new car supply, people were still buying like crazy because they had a lot of stay-at-home cash, they had inflated credit scores, so it was like a recipe for disaster.”

Ironically, at the same time, the number of repossession companies has shrunk by 30% as many firms closed up shop and the workers found jobs in other industries when repossessions tumbled during 2020, Cross said. Now, he told NBC, lenders are paying him premiums to repossess their cars first in anticipation of a continued increase in loan defaults (read: plunging prices).

“The volume is picking up, and the remaining companies that are still performing repossessions are very busy,” Cross said. “The overall numbers are still not prepandemic numbers, but we will see a big change coming in ‘23 and ‘24 that I think the lenders are starting to recognize because they are offering financial incentives that they never had to do in the past. They’re jockeying for position knowing that there’s only a certain amount of bandwidth available.”

Predictably, the coming auto crisis is an issue that’s raised concern among officials at the Consumer Financial Protection Bureau, who say they are seeing troubling signs in the auto market, particularly among so-called subprime borrowers, who have below-average credit scores, and those with loans taken out in 2021 and 2022 when auto prices were particularly high.

Yes: that 2008 deja vu feeling is back front and center….and so are the defaults.

“Loans taken out in those years are performing worse than prior years just because those consumers had to finance cars once the supply chains were jammed and the prices started to go up,” said Ryan Kelly, acting auto finance program manager for the CFPB. “Those consumers got hit with inflation twice. First, when they had to finance a car after the prices went up, and then when they had to put gas in the car after the Russia-Ukraine conflict started. So there’s just a lot of consumer stress.”

What happens next?

Well, as the economy continues to deteriorate in 2023, the number of those falling behind on their car payments will continue to rise, even as consumers tend to give priority to their car payment ahead of most bills because of the importance a car plays in getting to work or potentially providing shelter, industry analysts said.

For now, the rate of defaults and repossessions isn’t expected to reach 2008 and 2009 levels, when there was a spike caused by the financial crisis. The percentage of auto loans that were 30 days delinquent was at 2.2% in the third quarter compared with 2.35% delinquent over the same period in 2019, according to data from Experian. By contrast, just over 4% of auto loans went into default in 2009. However, that could quickly change once the 2023 economy unleashes the final whammy of mass layoffs (which have already slammed the tech sector).

“We’re expecting it to continue to increase and maybe even breach prepandemic levels because of the macroeconomic headwinds of higher interest rates, higher cost of borrowing and expectations for unemployment to continue to increase,” said Margaret Rowe, the lead auto analyst at Fitch. “I think our expectation is that we’re going to continue to see it go up, but it’s just been so low that even going up isn’t like what we saw in the Great Financial Crisis.”

Some, like Cox Automotive, remain optimistic: their analysts (who just may be a little conflicted) forecast that while loan defaults and repossessions will increase from their pandemic lows, long-term through 2025 they predict overall defaults and repossessions will remain at or below historic norms.

Still, the financial squeeze has been particularly difficult for lower-income consumers looking for budget vehicles, which have been particularly hard to find. While in the past, those car buyers would have purchased a used car for $7,000 to $15,000 they are now having to spend $20,000 to $25,000 for the same type of vehicle. Among dealers that cater to subprime and deep subprime consumers, the average listing price on their cars has almost doubled since the beginning of the pandemic, according to the CFPB.

“That near prime and subprime group of consumers, they’re getting hit very, very hard by inflation. That group of people did not have much disposable income. They had to finance a more expensive car and then they got hit with prices going up overall. There’s just a lot of stress,” said Kelly.

Ally Financial, which has a significant share of loans to subprime borrowers, said in its October earnings report that it expects delinquencies to increase to as much as 3.8% compared with 3.1% in 2019. That estimate will prove to be overly optimistic.

Another risk to car buyers’ finances is the growing length of auto loans, many of which now exceed seven years. While those longer term loans can lower the monthly payments amid higher prices, consumers risk paying off the loan much more slowly than the car is depreciating, leaving them underwater if they need to sell the vehicle. It can also mean higher interest costs over the life of the loan on top of already inflated vehicle prices.

And speaking of interest rates, they have not been this high since 2009 and will stay at their current levels until the Fed finally pivots. As NBC notes, “for consumers, there is unlikely to be any relief over the next year. Interest rates are expected to remain high for those needing to borrow to buy a vehicle, and Covid-related plant closures and material shortages are continuing to ripple through the car manufacturing supply chain, limiting the number of new vehicles.”

“I dare think what happens to people who are signing up for new loans today,” said Drury. “It’s not going to be better when we see these payments so high.”

But wait, there’s more.

As twitter’s CarDealershipGuy – who claims to be an anonymous auto-industry CEO and whose analysis has been featured in places like the NY Post and who frequently Tweets about the state of the auto market – laid out a long thread on Thursday, all of the above may end up being an overly optimistic assessment of the perfect storm that’s about to hit the auto sector:

“This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending. I’m now convinced that there is a massive wave of car repossessions coming in 2023,” he wrote.

Recapping much of what we said above, he noted that over the past 2 years, many people took out exorbitant loans on cars and while car values were inflated (and still are) but many people simply had no choice and bought an overpriced a car. Then, echoing the Fitch assessment, he notes how those buyers are underwater: “Car valuations are now plummeting. Some cars have declined in value as much as 30% y/y. And these same people that took out these big loans are now ‘underwater’. Basically, they owe banks more on these cars than they are worth. And the banks are well-aware of this.”

The punchline is his personal experience from late last week. “This morning, one of our General Managers opened up DealerTrack — a portal that dealers use to communicate with auto lenders — and highlighted something very concerning. 9 of our lending partners have started WAIVING ‘open auto stipulations’ for consumers.”

What this means, he explained, is that once consumers are stuck with a vehicle they paid too much for, they can’t trade it in without putting some money up front to cover the difference of what is owed on it versus what it is worth. At that point, he notes, “Dealer can’t sell consumer a car, Consumer can’t buy a car, And, you guessed it, lender can’t finance a car!”

The lender then knows that most consumers are stuck and waives the open auto stipulation – meaning they allow the consumer to buy the new car with a second loan knowing they already have a first one. But the lender does it because they know that the buyer will default on the old, other car.

Cue default avalanche: “This is NOT normal. But it’s the only way lenders can finance cars and dealers can put cars on the road. And the implications of this will be tons of repossessions,” the CEO wrote.

He concluded: “I’ve been a doubter, but after what I saw this morning, I’m now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we’re in trouble.”

Here is a snapshot of his entire thread:

This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending. I’m now convinced that there is a massive wave of car repossessions coming in 2023.

Here’s what I discovered (and what no one knows):

Background:

Over the past 2 years, many people took out exorbitant loans on cars. Car values were inflated (and frankly, still are to some extent). But many people simply had no choice and bought an overpriced a car.

Well…

Car valuations are now plummeting. Some cars have declined in value as much as 30% y/y. And these same people that took out these big loans are now “underwater”.

Basically, they owe banks more on these cars than they are worth. And the banks are well-aware of this…

But there is no easy solution. You can’t just put the genie back in the bottle. This brings me to what happened this morning:

Every Friday I conduct a team meeting to recap our week.

This morning, one of our General Managers opened up DealerTrack — a portal that dealers use to communicate with auto lenders — and highlighted something very concerning:

9 of our lending partners have started WAIVING “open auto stipulations” for consumers.

Wait, wtf does that even mean?

Let me explain using a simple, hypothetical scenario:

1) Consumer takes out an auto loan in 2020/2021 on an overvalued car

2) 2022 comes around and that overvalued car is now rapidly declining in value

3) With the car declining in value, consumer now owes more on the car than it is worth

4) Consumer no longer wants the car. Maybe they outgrew it. Or maybe it keeps breaking. So consumer wants to trade it in.

5) But dealer can’t trade the car in because the consumer owes WAY too much on it. So dealer asks consumer for lots of money down to cover the difference.

6) But of course, the consumer doesn’t have $1,000s to cover the difference between what they owe on the car and what it’s worth. And here comes the perfect storm…

7) Dealer can’t sell consumer a car, Consumer can’t buy a car, And, you guessed it, lender can’t finance a car! Everybody loses! Oh no. So what happens next?

8) Lender knows that most consumers are stuck in this situation, and does the following:

WAIVES THE OPEN AUTO STIPULATION.

Meaning, the lender lets the consumer buy the car KNOWING that they already have an open auto loan with another bank!

Why the f*ck would they do this?

Surely the lender knows that consumers that take out a 2nd auto loan are MUCH riskier and have a MUCH high risk of default? Right? RIGHT?

Yes, but the lender does it because they know that the consumer will default on the other car !!!!

Dog eat dog style.

Let me be clear: This is NOT normal.

But it’s the only way lenders can finance cars and dealers can put cars on the road.

And the implications of this will be tons of repossessions.

I’ve been a doubter, but after what I saw this morning, I’m now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we’re in trouble.

This will not end pretty.

What does this mean in simple terms: well, besides the imminent devastation across the auto sector, including a surge in defaults and car repossessions, we are about to witness a historic collapse in car prices. In fact, in a subsequent tweet, the CarDealershipGuy noted the plunge in prices at troubled used-car dealer Carvana which will be the first domino to fall and be forced to liquidate much if not all of its inventory to stay afloat:

These are all retail-ready cars being advertised to other dealers – likely at a big loss.

(h/t RayMF for submission) pic.twitter.com/f8xb2oSnyU

— CarDealershipGuy (@GuyDealership) December 17, 2022

Translation: just as soaring car prices were the leading indicator for red-hot, runaway inflation in 2021 and 2022 (followed by housing, food, goods and finally services) so the plunge in car prices – first used, then new – is the canary in the recessionary coal mine of deflation that will send all prices – cars, houses, and everything else – sharply lower in the coming months.

Loading…