At a Saturday rally in Las Vegas just three weeks into her campaign, Kamala Harris "stole" one of Donald Trump's defining policy stances - promising to abolish federal income taxes on tips if elected. While right-wing social media reacted by vaulting #CopyCatKamala to the top of Twitter's politics trending list, tax-savvy observers sighed, knowing the policy is riddled with drawbacks.

Harris didn't just steal the idea, she even copied Trump's choice of where to announce it, as the former president also unveiled the idea in Vegas on June 9th. That makes sense, given the hospitality-heavy city's high proportion of voters working in tipped jobs.

Kamala's first major policy proposal was plagiarized directly from Trump pic.twitter.com/8OgpBGA627

— End Wokeness (@EndWokeness) August 11, 2024

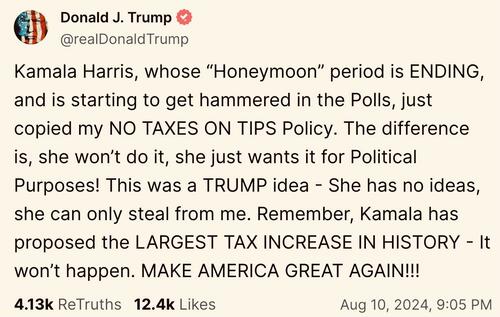

Trump quickly took to Truth Social to ridicule Harris for parroting his proposal and cast doubt on whether she's serious about it:

From a pure retail-politics point of view, Trump's proposal was brilliant, as it outflanked the Democrats in appealing directly to low-income, working class people. Rather than contest the position, Team Harris decided to simply neutralize its benefit to Trump by removing it as a voting-booth differentiator.

Yet, as tech entrepreneur and investor David Sacks noted on X: "The entire narrative of the Harris campaign is that she represents something fresh and new. She just shattered that by blatantly copying Trump’s “no tax on tips."

The entire narrative of the Harris campaign is that she represents something fresh and new. She just shattered that by blatantly copying Trump’s “no tax on tips.”

— David Sacks (@DavidSacks) August 11, 2024

And with no accomplishments from the Biden-Harris administration to ride on, Harris and her handlers have resorted to plagiarism. At the same time, corporate media is turning a blind eye to the fact that she hasn't given a single unscripted interview since announcing her run.

Prior to Harris jumping on the bandwagon, Nevada's two senators -- both Democrats -- voiced their own support for the concept. Texas Republican Sen. Ted Cruz introduced a "No Tax On Tips Act" to make the idea a reality, and Florida GOP Rep. Byron Donalds offered a companion House bill, while Reps. Thomas Massie and Matt Gaetz offered a “Tax Free Tips Act of 2024” with different specifics.

— The Right To Bear Memes (@grandoldmemes) August 11, 2024

While the concept has a great ring to it, its actual application could have an underwhelming effect on the working class and some unintended consequences for many others. As Tax Foundation senior policy analyst Alex Muresianu wrote in July:

"The policy would be poorly targeted at low- and middle-income earners, given the relatively small share of the population working in tipped occupations. Worse, the exemption itself, and any safeguards added, would add to the complexity of the tax code overall."

Only 2.5% of American workers earn tips, and just 5% of the bottom quartile of earners, Muresianu noted, citing the work of the Yale Budget Lab. Then there's the fact that many tip-income workers pay little or no federal income taxes as it is, thanks to the standard deduction and credits like the child tax credit and earned income tax credit (EITC).

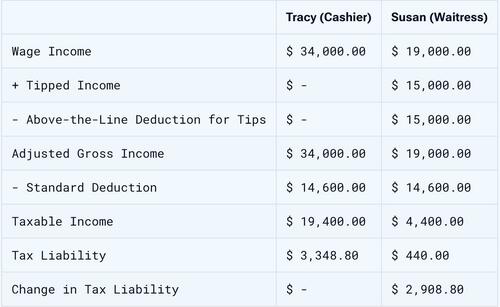

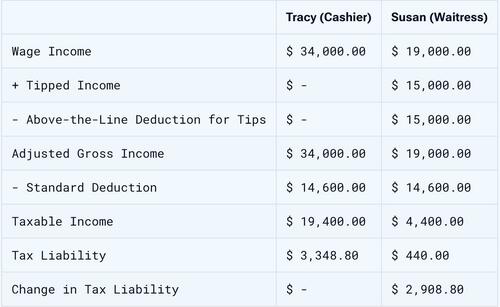

For those who do make enough to pay federal income tax, the "no tax on tips" idea is another example of politicians picking winners and losers, with a waitress making $34,000 getting a huge break while a cashier with the same total earnings getting left out.

That brings us to an important question about policy specifics -- just which taxes would tips be exempt from? Under the Cruz-Donalds "No Tax On Tips Act," tips would be spared from federal income tax, but remain subject to the payroll tax that purportedly funds Social Security and Medicare. The Massie-Gaetz offering would exempt tips from both flavors of government theft.

On the knowingly false assumption that tax-free tips wouldn't alter behavior of labor market participants, the cost of the proposal might be around $107 billion over 10 years. However, making a certain kind of income at least income-tax-free will offer a powerful incentive to shift compensation in that direction, including many occupations where tips are currently nonexistent.

Just last year the IRS under Biden-Harris made plans to crack down on tips.

— Libs of TikTok (@libsoftiktok) August 11, 2024

Now Kamala is stealing Trump’s policy of “no tax on tips.”#CopyCatKamala pic.twitter.com/63aiLioajY

"One could imagine a scenario in which, say, highly compensated lawyers or accountants begin to receive some of their income as voluntary tips," cautioned Muresianu. Congress could try heading that off by imposing income limits and other restrictions on the exemption, but that would only further complicate an already Byzantine tax code. An increase to the standard deduction would offer a simpler and more even-handed avenue for easing tax pressure on the working class.

Kamala Harris, who now claims to be against taxing tips, was the tie-breaking vote on the Inflation Reduction Act, which expanded the IRS so it could go after people not paying taxes on tips.

— Bonchie (@bonchieredstate) August 11, 2024

Incredible stuff. The most inauthentic, astro-turfed campaign in history. pic.twitter.com/9Nne61oJPi

If all that isn't enough to give you pause about "no taxes on tips," consider how many more places -- dentist offices, auto shops, florists, groceries -- where you might have a cashier spinning one of those touch-screens around and asking you to choose how much you want to tip.

Pathetic! https://t.co/3PE9NF964b pic.twitter.com/g4Hsj7Ftlp

— Captain Sou (@SouSanDiego) August 11, 2024

Fresh and newly borrowed.

— Town Square (@XTownSquareX) August 11, 2024

It seems this is who she is.

Fake and unoriginal.

People are so gullible, they’ll willingly sign up for it.

Sad for the country if she wins.

This race will boil down to one issue…The Real Kamala Harris.

— Johnny (@JohnBrdln) August 11, 2024

If Trump can expose it, he wins.

If the Democrats/media can keep it hidden, she wins.

Prediction: when she announces her “policies” they’re going to be basically identical to Trump.

— Drew (@tallRevere) August 11, 2024

A few will stray, which will separate her, but she doesn’t have time for new policy. This is going to be a copy/paste job with 2 months to pitch what Trump’s been pitching for years.

Good point...

Her first official policy is steal Trumps. Also, why wait. You’re VP now.

— MERICA MEMED (@Mericamemed) August 11, 2024

Another zinger.

Next thing you'll know...

What else will Harris plagiarize before the September 10th debate with Trump?

At a Saturday rally in Las Vegas just three weeks into her campaign, Kamala Harris “stole” one of Donald Trump’s defining policy stances – promising to abolish federal income taxes on tips if elected. While right-wing social media reacted by vaulting #CopyCatKamala to the top of Twitter’s politics trending list, tax-savvy observers sighed, knowing the policy is riddled with drawbacks.

Harris didn’t just steal the idea, she even copied Trump’s choice of where to announce it, as the former president also unveiled the idea in Vegas on June 9th. That makes sense, given the hospitality-heavy city’s high proportion of voters working in tipped jobs.

Kamala’s first major policy proposal was plagiarized directly from Trump pic.twitter.com/8OgpBGA627

— End Wokeness (@EndWokeness) August 11, 2024

Trump quickly took to Truth Social to ridicule Harris for parroting his proposal and cast doubt on whether she’s serious about it:

From a pure retail-politics point of view, Trump’s proposal was brilliant, as it outflanked the Democrats in appealing directly to low-income, working class people. Rather than contest the position, Team Harris decided to simply neutralize its benefit to Trump by removing it as a voting-booth differentiator.

Yet, as tech entrepreneur and investor David Sacks noted on X: “The entire narrative of the Harris campaign is that she represents something fresh and new. She just shattered that by blatantly copying Trump’s “no tax on tips.”

The entire narrative of the Harris campaign is that she represents something fresh and new. She just shattered that by blatantly copying Trump’s “no tax on tips.”

— David Sacks (@DavidSacks) August 11, 2024

And with no accomplishments from the Biden-Harris administration to ride on, Harris and her handlers have resorted to plagiarism. At the same time, corporate media is turning a blind eye to the fact that she hasn’t given a single unscripted interview since announcing her run.

Prior to Harris jumping on the bandwagon, Nevada’s two senators — both Democrats — voiced their own support for the concept. Texas Republican Sen. Ted Cruz introduced a “No Tax On Tips Act” to make the idea a reality, and Florida GOP Rep. Byron Donalds offered a companion House bill, while Reps. Thomas Massie and Matt Gaetz offered a “Tax Free Tips Act of 2024” with different specifics.

— The Right To Bear Memes (@grandoldmemes) August 11, 2024

While the concept has a great ring to it, its actual application could have an underwhelming effect on the working class and some unintended consequences for many others. As Tax Foundation senior policy analyst Alex Muresianu wrote in July:

“The policy would be poorly targeted at low- and middle-income earners, given the relatively small share of the population working in tipped occupations. Worse, the exemption itself, and any safeguards added, would add to the complexity of the tax code overall.”

Only 2.5% of American workers earn tips, and just 5% of the bottom quartile of earners, Muresianu noted, citing the work of the Yale Budget Lab. Then there’s the fact that many tip-income workers pay little or no federal income taxes as it is, thanks to the standard deduction and credits like the child tax credit and earned income tax credit (EITC).

For those who do make enough to pay federal income tax, the “no tax on tips” idea is another example of politicians picking winners and losers, with a waitress making $34,000 getting a huge break while a cashier with the same total earnings getting left out.

That brings us to an important question about policy specifics — just which taxes would tips be exempt from? Under the Cruz-Donalds “No Tax On Tips Act,” tips would be spared from federal income tax, but remain subject to the payroll tax that purportedly funds Social Security and Medicare. The Massie-Gaetz offering would exempt tips from both flavors of government theft.

On the knowingly false assumption that tax-free tips wouldn’t alter behavior of labor market participants, the cost of the proposal might be around $107 billion over 10 years. However, making a certain kind of income at least income-tax-free will offer a powerful incentive to shift compensation in that direction, including many occupations where tips are currently nonexistent.

Just last year the IRS under Biden-Harris made plans to crack down on tips.

Now Kamala is stealing Trump’s policy of “no tax on tips.”#CopyCatKamala pic.twitter.com/63aiLioajY

— Libs of TikTok (@libsoftiktok) August 11, 2024

“One could imagine a scenario in which, say, highly compensated lawyers or accountants begin to receive some of their income as voluntary tips,” cautioned Muresianu. Congress could try heading that off by imposing income limits and other restrictions on the exemption, but that would only further complicate an already Byzantine tax code. An increase to the standard deduction would offer a simpler and more even-handed avenue for easing tax pressure on the working class.

Kamala Harris, who now claims to be against taxing tips, was the tie-breaking vote on the Inflation Reduction Act, which expanded the IRS so it could go after people not paying taxes on tips.

Incredible stuff. The most inauthentic, astro-turfed campaign in history. pic.twitter.com/9Nne61oJPi

— Bonchie (@bonchieredstate) August 11, 2024

If all that isn’t enough to give you pause about “no taxes on tips,” consider how many more places — dentist offices, auto shops, florists, groceries — where you might have a cashier spinning one of those touch-screens around and asking you to choose how much you want to tip.

Pathetic! https://t.co/3PE9NF964b pic.twitter.com/g4Hsj7Ftlp

— Captain Sou (@SouSanDiego) August 11, 2024

Fresh and newly borrowed.

It seems this is who she is.

Fake and unoriginal.

People are so gullible, they’ll willingly sign up for it.

Sad for the country if she wins.

— Town Square (@XTownSquareX) August 11, 2024

This race will boil down to one issue…The Real Kamala Harris.

If Trump can expose it, he wins.

If the Democrats/media can keep it hidden, she wins.

— Johnny (@JohnBrdln) August 11, 2024

Prediction: when she announces her “policies” they’re going to be basically identical to Trump.

A few will stray, which will separate her, but she doesn’t have time for new policy. This is going to be a copy/paste job with 2 months to pitch what Trump’s been pitching for years.

— Drew (@tallRevere) August 11, 2024

Good point…

Her first official policy is steal Trumps. Also, why wait. You’re VP now.

— MERICA MEMED (@Mericamemed) August 11, 2024

Another zinger.

Next thing you’ll know…

What else will Harris plagiarize before the September 10th debate with Trump?

Loading…