By John Kemp, senior market analyst

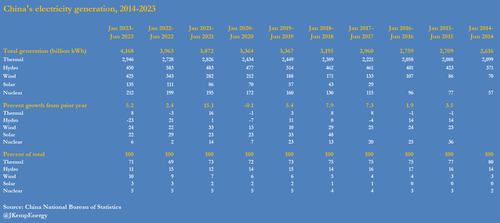

China's reliance on coal-fired power generation increased during the first half of 2023 as continued drought severely reduced hydroelectric power in the southern provinces.Total generation from all sources increased by +205 billion kilowatt-hours (kWh) in the first six months of 2023 compared with the same period in 2022 ("Output of energy products, National Bureau of Statistics, July 20").

The increase was +5.2%, which implies the government is probably on track to meet its declared target of around 5% for growth in gross domestic product this year.

But hydro generation slumped by -132 billion kWh (-23%) to its lowest level for eight years as the protracted drought hit reservoir levels.

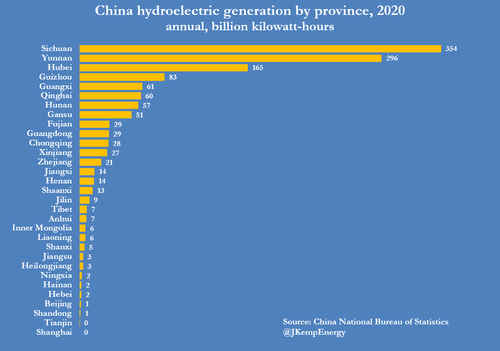

The two southwestern provinces of Sichuan and Yunnan accounted for almost half (48%) of the country's hydropower in 2020; adding the neighbouring areas of Guizhou and Guangxi takes the share to almost three-fifths (58%).

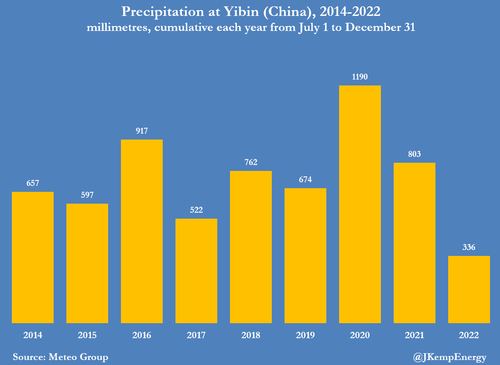

But the region experienced much lower than average precipitation over the last 12 months, forcing sharp reductions in power production.

Precipitation at the city of Yibin on the border between Sichuan and Yunnan totalled 626 millimetres in the 12 months ending in June 2023. Rainfall was just half the average over the previous eight years and down by almost 60% compared with the previous 12-month period.

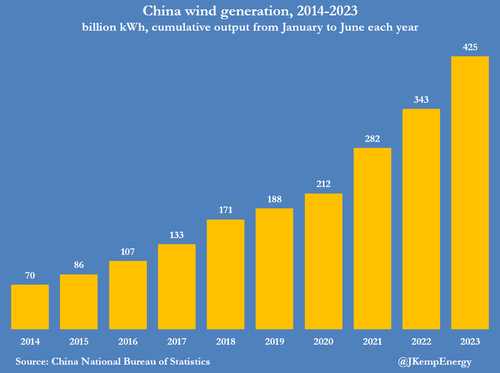

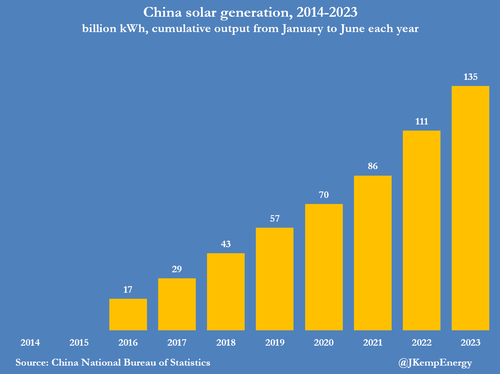

Some of the deficit caused by hydro generation was covered by increased generation from wind farms (+82 billion kWh) and solar power (+25 billion kWh).

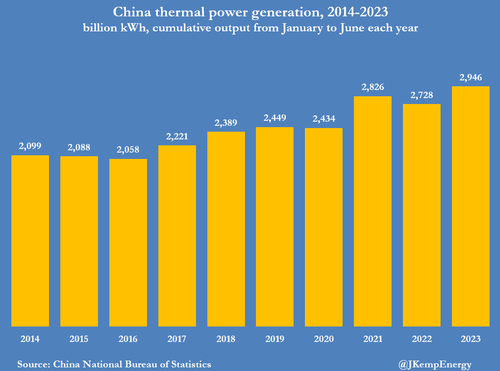

But the rest of the deficit and all the consumption growth was covered by a massive increase in thermal generation (+218 billion kWh) mostly from coal-fired units.

Thermal generation increased by +8% compared with the same period in 2022 and accounted for 71% of all electrical output, up from 69% in the previous year.

China's coal fleet kept the lights on, air conditioning working and industry operating in the drought-stricken south and more recently in the north in an unprecedented heat wave.

In response to government directives to ensure sufficient fuel stocks for generators, the country's coal mines produced a record volume in the first six months.

Domestic coal production climbed by +107 million tonnes (+5%) between January and June compared with the same period in 2022.

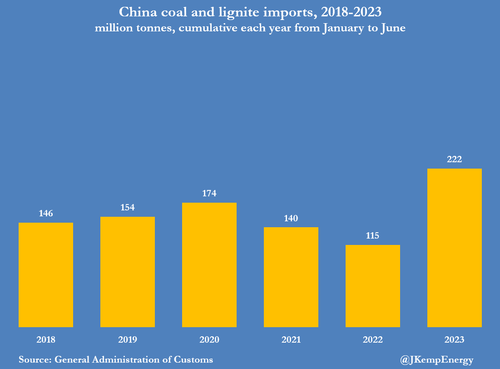

At the same time, coal imports also surged by +107 million tonnes (+92%) as power generators and steelmakers built up inventories.

In the first half of the year, wind and solar farms produced more electricity (560 billion kWh) combined than the country's hydroelectric dams (450 billion kWh) for the first time.

China's energy transition is real and is proceeding rapidly.... But coal-fired generation and production is still likely to increase for at least the next several years because of the country's inherited reliance on coal-fired units and the need to meet rapid load growth.

By John Kemp, senior market analyst

China’s reliance on coal-fired power generation increased during the first half of 2023 as continued drought severely reduced hydroelectric power in the southern provinces.Total generation from all sources increased by +205 billion kilowatt-hours (kWh) in the first six months of 2023 compared with the same period in 2022 (“Output of energy products, National Bureau of Statistics, July 20″).

The increase was +5.2%, which implies the government is probably on track to meet its declared target of around 5% for growth in gross domestic product this year.

But hydro generation slumped by -132 billion kWh (-23%) to its lowest level for eight years as the protracted drought hit reservoir levels.

The two southwestern provinces of Sichuan and Yunnan accounted for almost half (48%) of the country’s hydropower in 2020; adding the neighbouring areas of Guizhou and Guangxi takes the share to almost three-fifths (58%).

But the region experienced much lower than average precipitation over the last 12 months, forcing sharp reductions in power production.

Precipitation at the city of Yibin on the border between Sichuan and Yunnan totalled 626 millimetres in the 12 months ending in June 2023. Rainfall was just half the average over the previous eight years and down by almost 60% compared with the previous 12-month period.

Some of the deficit caused by hydro generation was covered by increased generation from wind farms (+82 billion kWh) and solar power (+25 billion kWh).

But the rest of the deficit and all the consumption growth was covered by a massive increase in thermal generation (+218 billion kWh) mostly from coal-fired units.

Thermal generation increased by +8% compared with the same period in 2022 and accounted for 71% of all electrical output, up from 69% in the previous year.

China’s coal fleet kept the lights on, air conditioning working and industry operating in the drought-stricken south and more recently in the north in an unprecedented heat wave.

In response to government directives to ensure sufficient fuel stocks for generators, the country’s coal mines produced a record volume in the first six months.

Domestic coal production climbed by +107 million tonnes (+5%) between January and June compared with the same period in 2022.

At the same time, coal imports also surged by +107 million tonnes (+92%) as power generators and steelmakers built up inventories.

In the first half of the year, wind and solar farms produced more electricity (560 billion kWh) combined than the country’s hydroelectric dams (450 billion kWh) for the first time.

China’s energy transition is real and is proceeding rapidly…. But coal-fired generation and production is still likely to increase for at least the next several years because of the country’s inherited reliance on coal-fired units and the need to meet rapid load growth.

Loading…