EV manufacturer Polestar, one of several struggling names at the bottom of the EV barrel, says that new hefty EU and US import tariffs on its Chinese-made cars are becoming an issue.

On a Tuesday call, the company said it would need to "take steps to offset" these new tariffs. The company also announced a Q1 operating loss, according to Reuters.

Polestar said it would need to introduce "mitigating measures" to achieve cashflow breakeven for 2025 and that those measures could include cost reductions across the company's supply chain or "other actions".

Despite this, the company claims there will be no further job cuts. We'll see how long that lasts.

The Swedish company, owned by China's Geely, currently makes all its EVs in China.

However, the new Polestar 3 will be produced in the U.S. starting late this summer, and the Polestar 4 in South Korea from mid-next year. Until then, it faces temporary tariffs of 20% for cars imported into the EU and over 100% for the U.S. The Polestar 2 will continue to be made in China. Despite the tariffs,

"Polestar will be constrained which cars it can sell where (US, CN, EU) until it can find a way to re-domicile production in each of the three regions - requiring more funds as well," analysts at Bernstein said.

"More than ever, the company's fortunes now hinge on the Polestar 3 and 4," they continued.

During a call with analysts and shareholders, CEO Thomas Ingenlath mentioned plans to move production to Europe but provided no further details. Polestar, like other EV makers, faces declining demand due to a price war initiated by Tesla last year, causing many to struggle with unsold inventory. In the second quarter, Polestar delivered around 13,000 cars, missing Bernstein's forecast of 15,500.

The company's quarterly report cited lower sales and increased discounts as factors impacting its results.

As we noted days ago, SAIC is being hit with a 38.1% tariff and BYD is being hit with a 17.4% tariff, the report says. Geely Auto will face a 20% tariff and all tariffs are on top of the EU's existing 10% tariff.

EV-makers that cooperated with the probe but weren’t in the three-company sample will face an additional 21% duty, while uncooperative ones will incur the full 38.1%. European brands like Mercedes-Benz, BMW, and Renault, which export China-assembled EVs, will also face extra tariffs, according to Caixin.

China’s Ministry of Commerce criticized the decision, stating the EU ignored facts, WTO rules, and objections from China and EU member states. Beijing vowed to protect Chinese companies' rights.

Tesla, importing Model 3 sedans from Shanghai, has requested the EU to impose a lower tariff, arguing it received less state support.

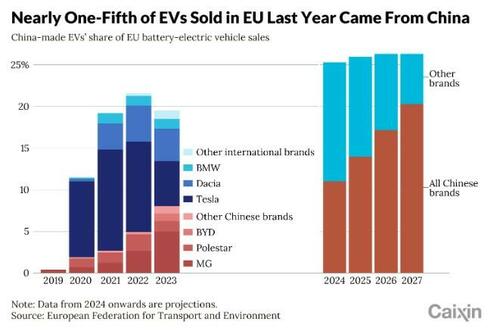

Caixin wrote that last year, nearly 20% (300,000 units) of EVs sold in the EU were made in China, according to the European Federation for Transport and Environment.

EV manufacturer Polestar, one of several struggling names at the bottom of the EV barrel, says that new hefty EU and US import tariffs on its Chinese-made cars are becoming an issue.

On a Tuesday call, the company said it would need to “take steps to offset” these new tariffs. The company also announced a Q1 operating loss, according to Reuters.

Polestar said it would need to introduce “mitigating measures” to achieve cashflow breakeven for 2025 and that those measures could include cost reductions across the company’s supply chain or “other actions”.

Despite this, the company claims there will be no further job cuts. We’ll see how long that lasts.

The Swedish company, owned by China’s Geely, currently makes all its EVs in China.

However, the new Polestar 3 will be produced in the U.S. starting late this summer, and the Polestar 4 in South Korea from mid-next year. Until then, it faces temporary tariffs of 20% for cars imported into the EU and over 100% for the U.S. The Polestar 2 will continue to be made in China. Despite the tariffs,

“Polestar will be constrained which cars it can sell where (US, CN, EU) until it can find a way to re-domicile production in each of the three regions – requiring more funds as well,” analysts at Bernstein said.

“More than ever, the company’s fortunes now hinge on the Polestar 3 and 4,” they continued.

During a call with analysts and shareholders, CEO Thomas Ingenlath mentioned plans to move production to Europe but provided no further details. Polestar, like other EV makers, faces declining demand due to a price war initiated by Tesla last year, causing many to struggle with unsold inventory. In the second quarter, Polestar delivered around 13,000 cars, missing Bernstein’s forecast of 15,500.

The company’s quarterly report cited lower sales and increased discounts as factors impacting its results.

As we noted days ago, SAIC is being hit with a 38.1% tariff and BYD is being hit with a 17.4% tariff, the report says. Geely Auto will face a 20% tariff and all tariffs are on top of the EU’s existing 10% tariff.

EV-makers that cooperated with the probe but weren’t in the three-company sample will face an additional 21% duty, while uncooperative ones will incur the full 38.1%. European brands like Mercedes-Benz, BMW, and Renault, which export China-assembled EVs, will also face extra tariffs, according to Caixin.

China’s Ministry of Commerce criticized the decision, stating the EU ignored facts, WTO rules, and objections from China and EU member states. Beijing vowed to protect Chinese companies’ rights.

Tesla, importing Model 3 sedans from Shanghai, has requested the EU to impose a lower tariff, arguing it received less state support.

Caixin wrote that last year, nearly 20% (300,000 units) of EVs sold in the EU were made in China, according to the European Federation for Transport and Environment.

Loading…