A stellar 3Y auction, followed by a mediocre 10Y, we conclude the refunding week's coupon offerings with an even more disappointing 30Y sale, which saw $25 billion in ultra long-dated paper sell to muted market response.

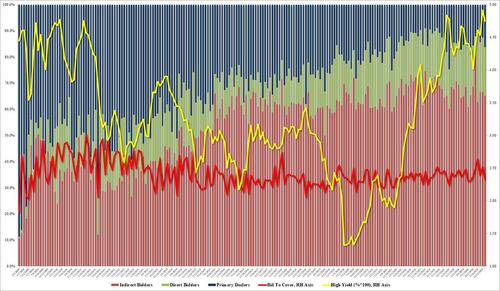

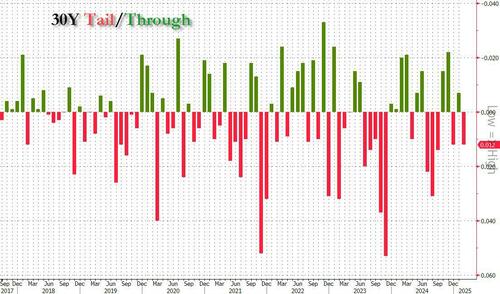

The auction stopped at a high yield of 4.748%, down from 4.913% last month, but tailing the 4.736% When Issued by 1.2bps, a reversal to last month's 0.7bps stop through and the fifth tailing 30Y auction in the past 8 months.

The bid to cover dropped to 4.748 from 4.913 in January, but this was still above the six-auction average of 4.462.

The internals were also mediocre, with Indirects awarded 65.08%, down from 66.63% and the second lowest since July (with just November's 62.7% lower); it was also notably below the 68.4% recent average. And with Directs awarded 18.6%, down from 20.7% and the lowest since October, Dealers were left with 16.3%, the highest since last August.

Overall this was a disappointing auction, although once again the market had other things to worry about (reciprocal tariffs, Ukraine ceasefire, zero liquidity) to pay too much attention to the results and 10Y yields barely budged after the 1PM break.

A stellar 3Y auction, followed by a mediocre 10Y, we conclude the refunding week’s coupon offerings with an even more disappointing 30Y sale, which saw $25 billion in ultra long-dated paper sell to muted market response.

The auction stopped at a high yield of 4.748%, down from 4.913% last month, but tailing the 4.736% When Issued by 1.2bps, a reversal to last month’s 0.7bps stop through and the fifth tailing 30Y auction in the past 8 months.

The bid to cover dropped to 4.748 from 4.913 in January, but this was still above the six-auction average of 4.462.

The internals were also mediocre, with Indirects awarded 65.08%, down from 66.63% and the second lowest since July (with just November’s 62.7% lower); it was also notably below the 68.4% recent average. And with Directs awarded 18.6%, down from 20.7% and the lowest since October, Dealers were left with 16.3%, the highest since last August.

Overall this was a disappointing auction, although once again the market had other things to worry about (reciprocal tariffs, Ukraine ceasefire, zero liquidity) to pay too much attention to the results and 10Y yields barely budged after the 1PM break.

Loading…